How to build a cage with money

Plus an exclusive clip from the new Coinbase documentary

Inside this issue:

How to build a cage with money

Real businesses market to customers not investors (reader submitted)

There is no “WE” in BSC

An exclusive clip from the new Coinbase documentary

How to build a cage with money

According to the New York Times prosecutors in states where abortion has recently become illegal have started subpoenaing financial companies to use their transaction data as evidence in abortion charges. Credit card records can be used to show not just literally whether a person paid for an abortion but also whether they traveled and paid for lodging out of state somewhere abortion services are available. If someone is planning to travel out-of-state in search of an abortion that would not be legal where they live, they should probably pay for everything in cash.

Meanwhile PayPal accidentally revealed their own plans to start enforcing political norms when they quietly published (and then quickly withdrew) a new set of policy terms that included the right to fine users up to $2500 for acts of "the sending, posting, or publication of any messages, content, or materials" that "promote misinformation." PayPal has claimed the policy update went out in error but these documents are drafted and reviewed by teams of lawyers. Claiming it was created by mistake is like writing up divorce papers and pretending it was a typo.

Payment technologies are being used as increasingly direct tools of political control, both against the powerful (Western nations sanctioning Russia) and against the less powerful (Trudeau freezing the bank accounts of Canadian truckers). Prosecutors using payments as a means of universal surveillance and unelected authorities fining users for promoting wrongthink is the natural (if Orwellian) consequence of centralized payment systems.

There is no “WE” in BSC

On Thursday a hacker managed to steal 2M BNB (~$566M USD) from the Binance Bridge on the Binance Smart Chain (BSC). If you are interested in the technical details here is a explainer thread and if that thread is too confusing here is another thread explaining the first one. The attacker was effectively able to trick the BNB bridge contract into creating new BNB and sending it to them.

The attacker immediately scattered their gains across into every bridge / liquidity pool in the BSC ecosystem trying to swap their way into less controlled networks like ETH. Ultimately they were able to get ~$100M worth of capital out of the BSC network before Binance announced they had paused the chain:

The money lost here is significant but not large by the scale of Binance,1 so the financial hit here is not the main consideration. It's mildly embarrassing to be caught in a technical failure but the attack here was subtle and advanced and the response was quick and effective so the PR story isn't the end of the world either. No Binance customers ultimately lost money as a result of this exploit.

The real reason this attack is damaging is because it ruined the appearance of decentralization. Rapidly freezing the BSC network in response to a hack made it pretty obvious that Binance could also enforce whatever rules the government wanted. If you can stop the network whenever someone does something you don’t like it is hard to deny you could stop the network whenever someone does something the government wouldn’t like. Binance can put [we] in the tweets but it doesn’t make it any less obvious who is in control.

Real businesses market to customers not investors

"Have you written about Novatech? I don’t know too much about it other than it’s flying around with my nanny’s immigrant crowd saying “everyone’s making so much money and the more you put in the more interest you make.” Feels like a scam but curious if you’ve heard of it." — TS

This is the first I’ve heard of Novatech but it didn’t take a lot of research for me to start finding red flags. Something Interesting does not provide financial, legal or fashion advice but if it did that advice would be to keep your money away from Novatech because that lewk does not slay.

A good rule of thumb for understanding any business is to figure out who their real customers are — not by listening to what they say but by watching what they do. Any business that is more focused on attracting investors than customers is at best an MLM and more often an outright ponzi scheme.

Novatech claims that it is a crypto exchange that happens to offer a side feature of letting you invest with them. But if you look through their website or marketing materials, almost none of it is dedicated to attracting traders or explaining their exchange features. It’s almost entirely about their investment feature, which is the only real product they are trying to sell. Novatech exists entirely to convince people to give money to Novatech. It will eventually collapse when it runs out of new investors and anyone who still has money invested will lose everything. That’s basically exactly what happened to Celsius, which I warned readers against in August of last year.

Instead of "investing" in Novatech consider subscribing to Something Interesting! It’s probably a better use of your money and it’s definitely on trend this season. NFA2

Other things happening right now:

Meanwhile a 14,500 page court document from the Celsius bankruptcy filings containing the names, addresses and recent transactions of every customer leaked this week. Since it is trivial to match the transaction time/value with the time/value of transactions on the Ethereum blockchain the ETH addresses of every Celsius customer has now been publicly doxxed. Know-your-customer laws create giant honeypots of consumer data that eventually end up leaked or exploited. Privacy should be the norm for every financial service and transaction.

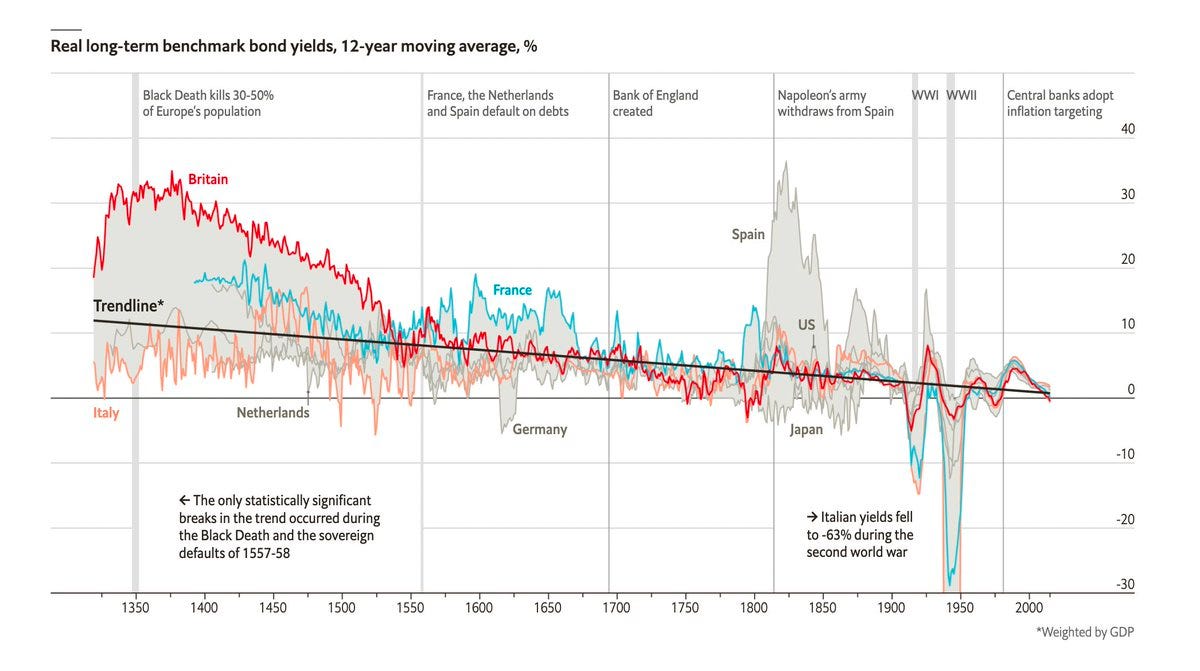

This incredible graph from The Economist shows that the long downward trend in interest rates for government debt goes back as far as 1350. In other words governments have been lowering interest rates (and hence devaluing money) since literally the Black Death. The inflection point we are hitting at zero and near zero interest rates has been building for centuries.

CEO of Coinbase Brian Armstrong has apparently decided to produce and release a hero-worshipping biopic about himself using company funds. Coinbase stock is trading ~80% below IPO price and they just finished a round of layoffs. I assume this movie was greenlit in response to a double-dog-dare that Coinbase could never make a movie so cringey it made their Bored Ape trailer look good. Check out this exclusive clip from the film:

Binance uses a portion of their profits every quarter to buy and burn BNB as a means of profit-sharing with token holders. Their last quarterly burn was ~4x larger than the total amount of BNB created by this exploit.

Not fashion advice