El Salvador is the first nation-state to buy the dip

Plus Jason Derulo sings about Bitcoin and Coinbase calls out the SEC.

In this issue:

El Salvador is the first nation-state to buy the dip

Coinbase to the SEC: be cool, bro

You say Cardano, I say Cardowno

El Salvador is the first nation-state to buy the dip

On Tuesday El Salvador’s law making Bitcoin legal tender went into effect. As part of the rollout the government established an official Bitcoin wallet and offered any El Salvadoran who set up an account $30 worth of bitcoin as an incentive. Many Bitcoiners (including myself) also bought $30 worth of bitcoin as a gesture of solidarity.1 Perhaps we all should have waited a day instead however and shown our solidarity at a discount:

Over Tuesday morning Bitcoin’s price dropped from ~$50.8k/BTC to ~$44.7k/BTC (~12%) over the course of around an hour and a half. ~$1.2B worth of leveraged Bitcoin longs were liquidated. Sell offs like these after major news events in crypto are not uncommon, but the speed at which this one played out was suspicious.

It is also suspicious that outages were happening simultaneously at Coinbase,2 Kraken, Binance and LN Strike (the exchange that powers the official El Salvadoran government wallet). Exchanges can be brought down by panic sellers but that kind of panic takes time to build momentum and doesn’t hit everywhere at the same time. That kind of speed and simultaneity implies coordination, which in turn implies a deliberate attack.

Whether the motives for such an attack are political or financial is difficult to say. If the attack was political it likely failed - the price of bitcoin has stabilized and the Bitcoin network itself never missed a beat. El Salvador is certainly showing no signs of backing down about adopting Bitcoin:

I actually think the more likely explanation is that the attack was a financially motivated, intended to manipulate the market for profit - possibly even to acquire more Bitcoin. If that is the case it was likely a success - this thread from Sam Trabucco of Alameda Research gives a good sense of how enormously profitable yesterday’s trading was for anyone who was prepared.

If it was profitable we should expect to see similar attacks happen again. Traders using leverage are like little birds pecking at spiders beneath the shadow of eagles. They think of themselves as predators but they’re actually prey.

Coinbase to the SEC: be cool, bro

On Tuesday CEO of leading cryptocurrency exchange Coinbase Brian Armstrong took some fairly direct shots at the SEC accusing them of regulatory overreach and using the threat of litigation to selectively intimidate businesses.

At issue are the increasingly popular (with businesses) and increasingly unpopular (with regulators) yield products on crypto. We’ve talked about some of the other companies that offer this kind of service like BlockFi and Celsius on Something Interesting before. The idea is that you deposit your cryptocurrency and they lend it out to others to earn interest.

Businesses and consumers have generally been treating these like bank accounts, but bank accounts have special consumer protection (FDIC insurance) that don’t apply to crypto accounts. If you are not a bank and you offer interest in exchange for a deposit what you are offering is not a bank account (because you are not a bank) it is something akin to an unsecured bond3 and therefore probably a security.

I say probably because the SEC has not chosen to be very clear about where it thinks the boundaries should be here:

Look, whatever you think of Coinbase or of retail cryptocurrency lending products, this kind of regulatory ambiguity is objectively bad. The clarity of our financial regulations and the reliability of our legal system is the main reason that America remains the financial capital of the world.

You say Cardano, I say Cardowno

Cardano (ADA) is for some reason still the #3 cryptocurrency token by volume. We last spoke about it in Something Interesting in the first 10 Cryptocurrencies you meet. Here’s how I described it then:

Cardano advocates claim that Ouroborus is as flexible as Ethereum, as secure as Bitcoin while also being more scalable and with less environmental footprint. I’m skeptical. In general in cryptocurrencies there are trade-offs worth exploring but there is no such thing as a free lunch - anytime someone tells you they have a scalable blockchain but they can’t tell you what they sacrificed to achieve it, they probably sacrificed centralization.

It turns out they didn’t even manage to build something scalable. The first decentralized application (a decentralized exchange) launched on the Cardano testnet this week and it is capable of a whopping one transaction per block. That means the DEX can process one trade every 20-40 seconds.

Don’t worry, they’re researching a solution!

My sense is that Cardano was probably a lot more valuable as the abstract idea of an academic competitor to Ethereum than it will be as an actual, concrete competitor. When holders of ADA are forced to confront realistic comparisons of developer activity, total value locked and economic throughput Cardano will likely suffer from those comparisons. Better start researching.

Other things happening right now:

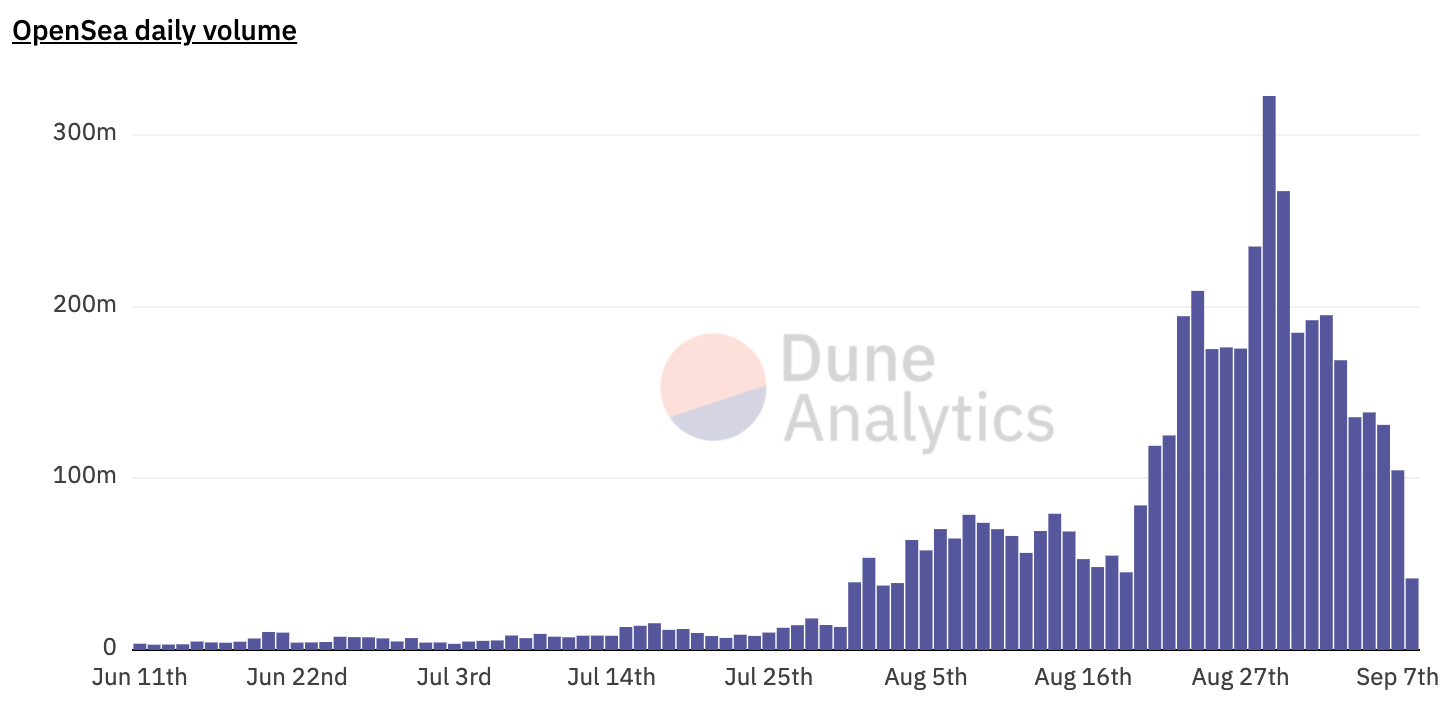

OpenSea (the largest NFT marketplace) did a staggering amount of volume over the month of August - more than the entire rest of the history of the company combined. But the volume appears to have crested and the NFT market may finally be cooling off for the moment.4

If you have been day-trading NFTs yourself make sure you are planning for the tax bill that will be coming. CoinTracker just published a nice clean guide for how to do that. They are the tax service that I personally use for crypto. If you are buying and selling NFTs there are no wash trades you are incurring a taxable event each time. If you are interested in collecting NFTs keep some liquidity available for later this year when NFT collectors realize they have huge tax bills and their whole portfolio is in illiquid JPEGs.

Presented without comment:

Quick reminder that while adoption of Bitcoin is great President Nayib Bukele is a complicated figure we should be very careful not to romanticize.

Coinbase’s stock actually dropped 6% when the market noticed you couldn’t buy or sell cryptocurrency and realized that was actually their main business.

Actually in practice it would probably sit lower than an unsecured bond on the cap table.

On the other hand on Monday a Bored Ape sold for 740 ETH (~$2.9M at the time) and Sotheby’s is auctioning off a collection of 101 of them with the bid is already at ~$19M and almost 24 hours left to go. So we may not be done with the NFT fireworks just yet.