Central African Republic adopts Bitcoin

Plus Bitcoiners are psychopaths and the worst trade in the history of NFTs

Hey Something Interesting friends -

I’m still re-adjusting to the arrival of my second daughter at the end of March! In spite of my clear and I think perfectly reasonable request that we all refrain from doing anything newsworthy for a few weeks the market is still generating far more news than I feel like we agreed to. I’ll do my best to touch on some of the stories I missed but let me know if there is anything you want more/deeper coverage on. I’m also planning longer upcoming posts on Lido and BIP119. The goal is to start building back up to my previous posting frequency, but that might be ambitious still. We’ll see how it goes. :)

Cheers,

KF

Inside this issue:

Elon Musk buys the Marketplace of Ideas

Central African Republic adopts Bitcoin

Lightning is electric

The worst trade in the history of NFTs

Bitcoiners are psychopaths

Elon Musk buys the Marketplace of Ideas

Tesla CEO and petty troll Elon Musk has agreed to buy Twitter for ~$44B.1 His stated reason for doing that is to defend free speech but I think a simpler explanation is just that he likes Twitter a lot and wants to own it. I do think he wants looser moderation and maybe to reinstate Trump’s account, but as I wrote about at the time free speech is not a useful way to characterize the issue of Twitter moderation. Even Musk doesn’t actually want free speech — he’s already promising to kill the spambots:

The idea of a neutral "free speech" policy is a fiction that lets the powerful disguise their preferences as the emergent will of the people. That was true before Musk bought Twitter and it will be true afterwards. The problem was never that Twitter had the "wrong" policies, the problem is that it lacks competitors who could provide meaningful alternative approaches. We shouldn’t make Twitter a better town square we should make the town square better than Twitter.

The interesting / alarming thing about all this is not that Musk might misuse Twitter but rather that he could afford it at all. If Twitter was as valuable (as a business) as it is important (to society) it would have been too expensive for even Musk to purchase. But Twitter’s revenue has always been anemic relative to its prominence. Musk buying Twitter is just proof of what everyone already knew: Twitter is more valuable as a tool to manipulate society than as a traditional business.2

Personally that alarms me more than the specifics of who happens to own it.

Central African Republic adopts Bitcoin

On Wednesday Faustin-Archange Touadéra, the president of the Central African Republic signed a law formally making the C.A.R. the second country in the world (and the first in Africa) to formally adopt Bitcoin as legal tender. Like El Salvador (the first country to formally adopt Bitcoin) the C.A.R. economy was already built on an foreign currency — but where El Salvador used USD the C.A.R. used the French controlled CFA franc. So El Salvador drafts off of US monetary stability, but the C.A.R (and other CFA franc countries) are under French monetary control.

As is the case in El Salvador the effect of the law is mostly symbolic. The C.A.R. is incredibly poor and most of the population does not have internet access. This is probably not a transformative market event. Still, it is the second nation state to formally recognize Bitcoin as a superior form of money.

Lightning is electric

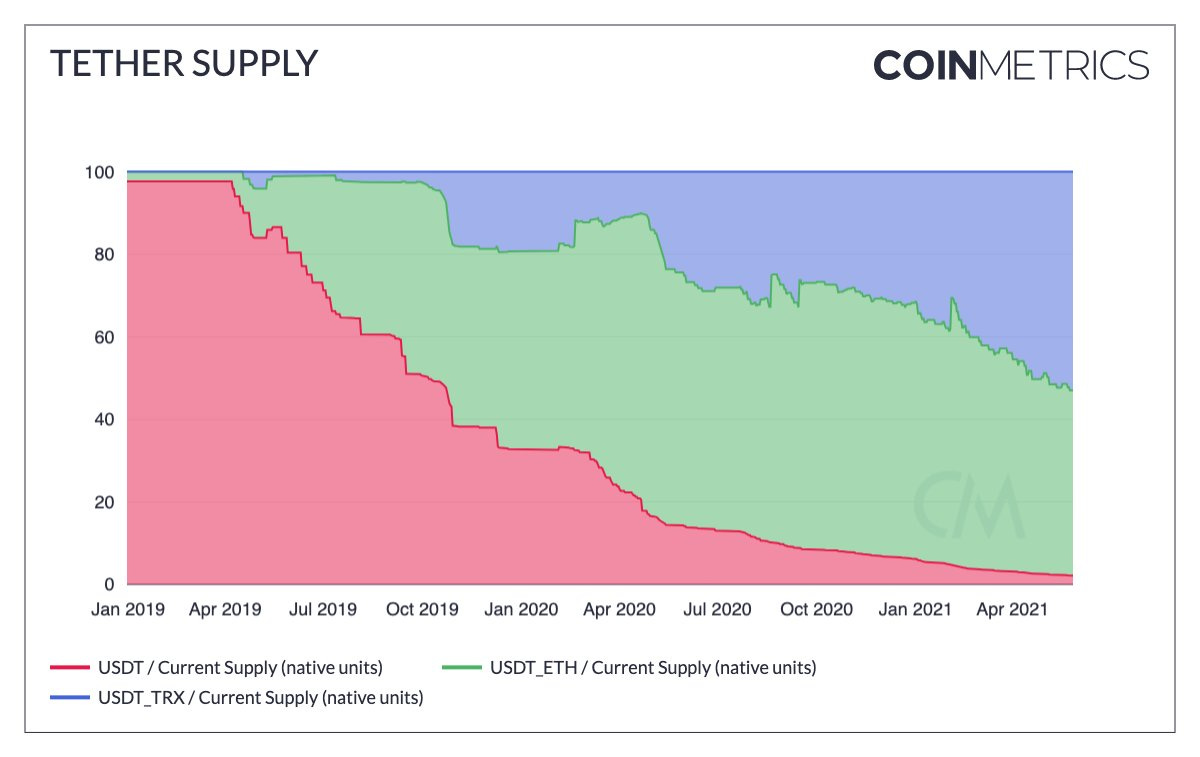

The first Tether (USDT) transaction over the Lightning Network happened at the end of March. Since payments within a Lightning channel are essentially free that means the cheapest way to transact in USDT is once again on top of Bitcoin.3 As we’ve talked about before USDT transactions naturally migrate to the cheapest compatible platform so over time Lightning will likely capture significant stablecoin share from other cryptocurrency networks like Ethereum and Tron.

Of course transaction fees aren’t the only reason to use a particular network — you might also want USDT on a network for access to the native network economy: yield farming on DeFi or buying/selling NFTs, etc. Which is what makes the new Taro protocol announcement from Lightning Labs so interesting:

Taro takes advantage of the recent Taproot upgrade to Bitcoin (which we’ve talked about before here, here and here) to allow users to create and issue private tokenized assets and NFTs on the Bitcoin network. The ledgers for those tokens are concealed within a Bitcoin Taproot transaction meaning that they are completely private and indistinguishable from any other Bitcoin Taproot transactions.

That suggests that many (or perhaps most?) of the interesting economic games currently being played on the Ethereum network can be rebuilt to run more cheaply on the Lightning Network. If the proposal is as promising as it looks at first glance it would suggest that Bitcoin will soon be stepping back into direct competition with the various DeFi platforms battling to overtake Ethereum.

Other things happening right now:

The city of Fort Worth is now mining Bitcoin:

The misguided Greenpeace campaign to change Bitcoin from proof-of-work to proof-of-stake continued with a post from the World Economic Forum. I’ve written a bit before about how Bitcoin and other proof-of-work networks actually subsidize the transition to renewable energy sources but here is an exceptionally detailed and thorough explanation of how that works from Bitcoin mining company Braiins.

Fidelity announced they would soon allow employers to add Bitcoin to the list of supported assets for employee 401ks. Interestingly this seems to be a product responding to genuine customer demand rather than a marketing/PR tactic. Unsurprisingly pile-of-bitcoins-in-an-equity-shaped-trenchcoat Microstrategy will be the first company to offer Bitcoin in employee 401ks. The US Department of Labor has "grave concerns" about Fidelity’s plans. They would much rather you lost your money responsibly using traditional assets like Netflix or Robinhood.

Ethereum launched a "shadow fork" of the network and successfully deployed the merge to proof-of-stake to the resulting testnet. That marks an important milestone on the journey to migrating Ethereum itself to proof of stake. I remain skeptical of proof of stake and Ethereum’s transition to it.

First Deputy Chairman of Bank of Russia Olga Skorobogatova says Russia will continue development of the so-called "digital ruble" which they started testing in January. The obvious implication is that it will be used to evade international sanctions but I don’t see how it would actually help with that. Central bank digital currencies (CBDCs) like the "digital ruble" are tools for monetary policy and financial surveillance. Most rubles are digital already.

On April 11th Coinbase announced a list of 52 tokens it was "considering" for listing in Q2/2022. The list is pretty inexplicable and includes some seemingly dead projects. There is also some pretty clear evidence of insider trading based on the announcement. Letting insiders pump & dump dead tokens onto naive retail investors is a pretty shit move on Coinbase’s part.

Arguably the worst single trade in the history of NFTs:

Presented without comment:

For anyone keeping score at home that’s enough money to acquire Something Interesting and all it’s associated intellectual property and still have ~$43B leftover. Hit me up, Elon.

Here is a fun post comparing Musk’s Twitter buyout to a DeFi governance attack.

Amusingly the transaction also uses the OMNI protocol, which was the way USDT transactions used the L1 Bitcoin network before being priced out by rising fees.