There's no glory in a fraction of a bitcoin

Plus Taproot Hawks push forward and what is DOGE may never die.

In this issue:

Hawks and Doves play chicken

There's no glory in a fraction of a bitcoin

Bitcoin is for savers

Hawks and Doves play chicken

The last time we talked about the Taproot upgrade it was about how developers used the blockchain in a quirky way to resolve a technical debate by "flipping" a bitcoin. The coinflip was successful, in that it produced an outcome ("median past time") but it was unsuccessful in that it did not end the debate. Where things stand now are less of a compromise and more of a stand-off.

The Taproot update itself (an upgrade to the encryption library that makes certain transactions cheaper and more private) has broad consensus. All the debate is around how to coordinate the release of that upgrade in a decentralized way - but that debate has been going on since early 2020. Bitcoin is hard to upgrade.

Aaron van Wirdum has a terrific technical explainer if you are interested in the details of the debate. To simplify a bit here there are two main philosophical camps, now each with their own independent implementation of Bitcoin. Both sides agree that the Taproot upgrade is good but they differ in how aggressive they want to be in deploying it to the network. Bitcoin miners have until August to signal their readiness for the Taproot upgrade - after that period (dubbed the "Speedy Trial") the Taproot hawks will begin to treat any block not signaling Taproot readiness as invalid.

That means by the end of August we will either have locked in the Taproot upgrade or we will be on the brink of the first major fork in Bitcoin since 2017. There were two significant debates at that time: one over the blocksize parameter and another about an upgrade called Segregated Witness (or Segwit). The blocksize debate was resolved when the large-block community split away from Bitcoin into the Bitcoin Cash fork. The debate around Segwit ended when the users who wanted Segwit threatened a fork1 with very similar tactics to those being used by Taproot hawks now.

The activation threshold for Taproot is 90% of hashrate and at time of writing ~89% of hashrate was signaling support so everything may just roll out smoothly. But if not we may be in for a bumpy November.

There's no glory in a fraction of a bitcoin

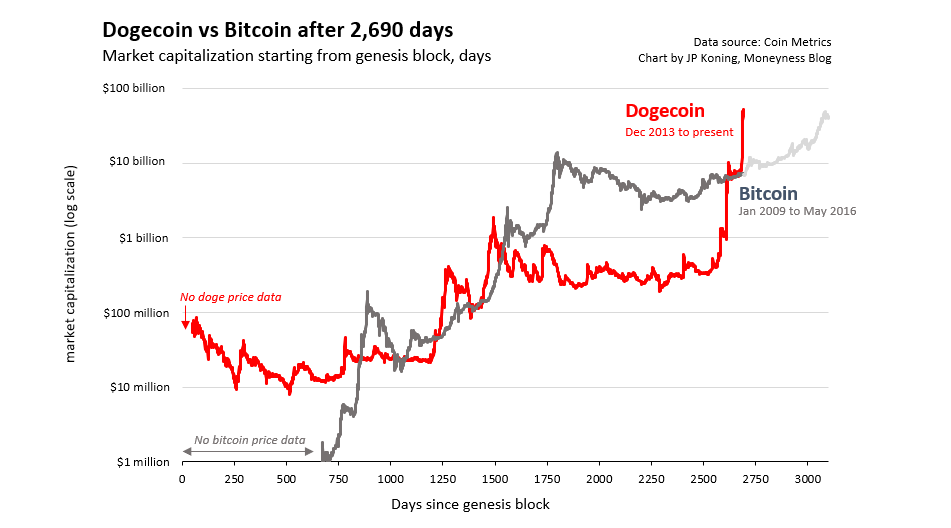

The price of DOGE has fallen off this week (to ~$0.31 at time of writing) but was still enough to make Dogecoin the 5th largest cryptocurrency by market cap (~$39B), worth slightly less than the Ford Motor Company (~$46B) but slightly more than General Mills (~$38B). It is also still trading very near its all time high against Bitcoin. I am emotionally obligated to remind you that Dogecoin is a literal joke, abandoned by its founders, unmaintained since 2018, run by only a handful of nodes, etc, etc.

Still it is important to acknowledge that something about Dogecoin is legitimately unique. Of the Top 50 cryptocurrencies by marketcap in 2013 Dogecoin was #27. It was the only one outside of the top three (Bitcoin, Litecoin, XRP) to survive. It has had several bubble cycles and is one of the very few cryptocurrencies to have occasionally outperformed Bitcoin as an investment, as it is doing right now.

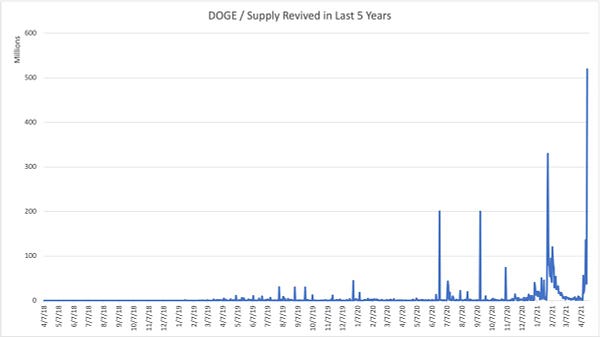

The last time Dogecoin had significant activity was during the bull market in 2017. At the time it was still widely understood to be a joke and it wasn’t very common to view it as an investment. People gave DOGE away to each other on reddit for no particular reason. The community raised funds to sponsor a Nascar driver and send the Jamaican bobsled team to the Sochi Olympics. Talk about the price was usually met with the response that 1DOGE = 1DOGE. Users of that era thought of Dogecoin as a near-worthless toy, so many of the coins of that era are probably lost.

Not all of them, though:

The longer DOGE maintains prices like this, the greater the incentive for past users to dig up their old wallets. I’ve been seeing more and more tweets like this one:

It isn’t just new supply that is drawn out by higher prices - it also increases the incentives for scams, hacks and attacks on the network. If DOGE enthusiasts can sustain these prices the same dark patterns that we see with larger cryptocurrencies will start to flourish. We probably aren’t far from Dogecoin giveaway scams and Dogecoin ransomware.

Part of the reason that people are drawn to Dogecoin is that it seems comparatively cheap: ~$0.31/DOGE versus ~$55k/BTC. But that’s a strange comparison really because there are a lot more Dogecoin (~129B compared to ~18.7M bitcoin2). It’s a bit like a real estate site listing one property priced by $/sqft and another one by $/acre. To make the percentage of ownership comparable you would either need to compare one bitcoin to ~6900 DOGE (~$2.1k) or compare one DOGE to 0.000145 BTC (~$7.8). DOGE is still cheaper than Bitcoin but it’s much closer than you might think.

Our tendency not to do this math and to just compare things directly even when they aren’t comparable is called unit bias and it’s pretty well understood. That’s why companies do stock splits - they know retail investors are most comfortable when prices per share are lower and it feels like they are getting a bargain. It’s also why some advocates of Bitcoin prefer to price by satoshis (the smallest unit in Bitcoin) rather than by full bitcoins. A satoshi currently trades for $0.00055.

Bitcoin is for savers

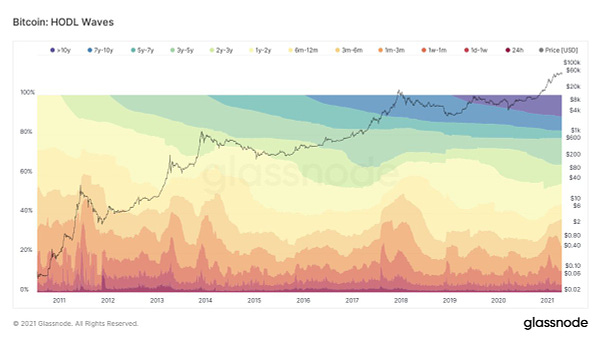

We’ve talked several times recently about how regardless of the price action supply of Bitcoin has been steadily moving off of the exchanges and into the hands of long term savers. Glassnode maintains a graphic they call the "HODL waves" that shows the age at which various bitcoin on the network last moved. Slightly more than half of all bitcoin have not moved in the last year - and most of those have not moved in the last two years. Holders of these coins are sitting on 7-10x unrealized gains and show no particular interest in selling.

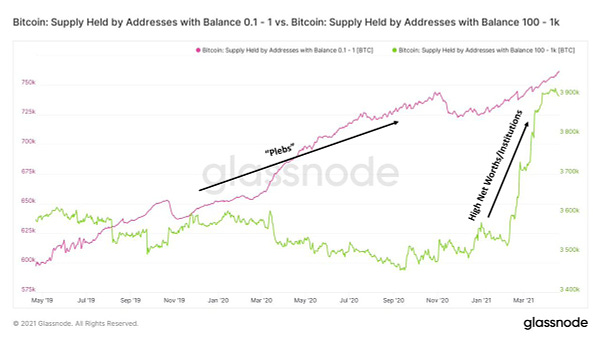

Much of the more recent demand has come in the form of institutions newly interested in acquiring large stakes in Bitcoin, but smaller investors have been steadily acquiring Bitcoin for a much longer span of time. You can see that by watching the balance of addresses on the network. Addresses with 0.1-1 BTC ($5.6k-$55.6k at time of writing) have been growing steadily for most of Bitcoin’s history. Addresses that control 100-1000 bitcoin ($5.6M-$56M) have suddenly surged in recent months.

There are ~2.37M bitcoin available for sale across every exchange. There are ~46.8M millionaires in the world. So there are enough bitcoin for sale today for every millionaire to buy ~0.05 BTC (~$2800), assuming they move quickly.

Other things happening right now:

If after 8 years the best understanding someone has of Bitcoin is techno-utopian jewelry than they are profoundly incurious. Here is a list of practical use-cases for Bitcoin if it strikes you as useful. I also really enjoy the characterization of hedging against disaster as a 'minor side use.' Other famously minor side use cases include airbags, lifeboats, parachutes, seat belts, bulletproof vests, backup plans and health insurance. Totally useless when nothing goes wrong!

JPMorgan analyst Josh Younger on why recovering from this past weekend’s unwinding may actually shore up market confidence by showing resilience, which may actually be bullish in the medium term:

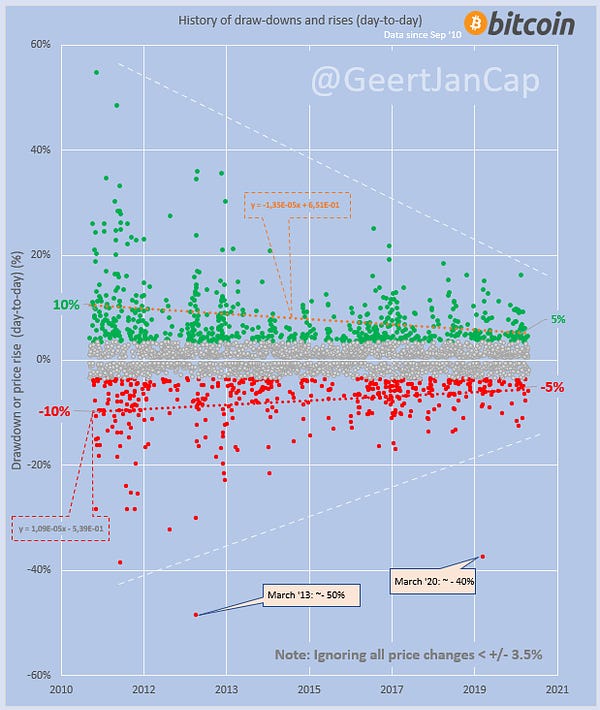

Bitcoin is getting boring:

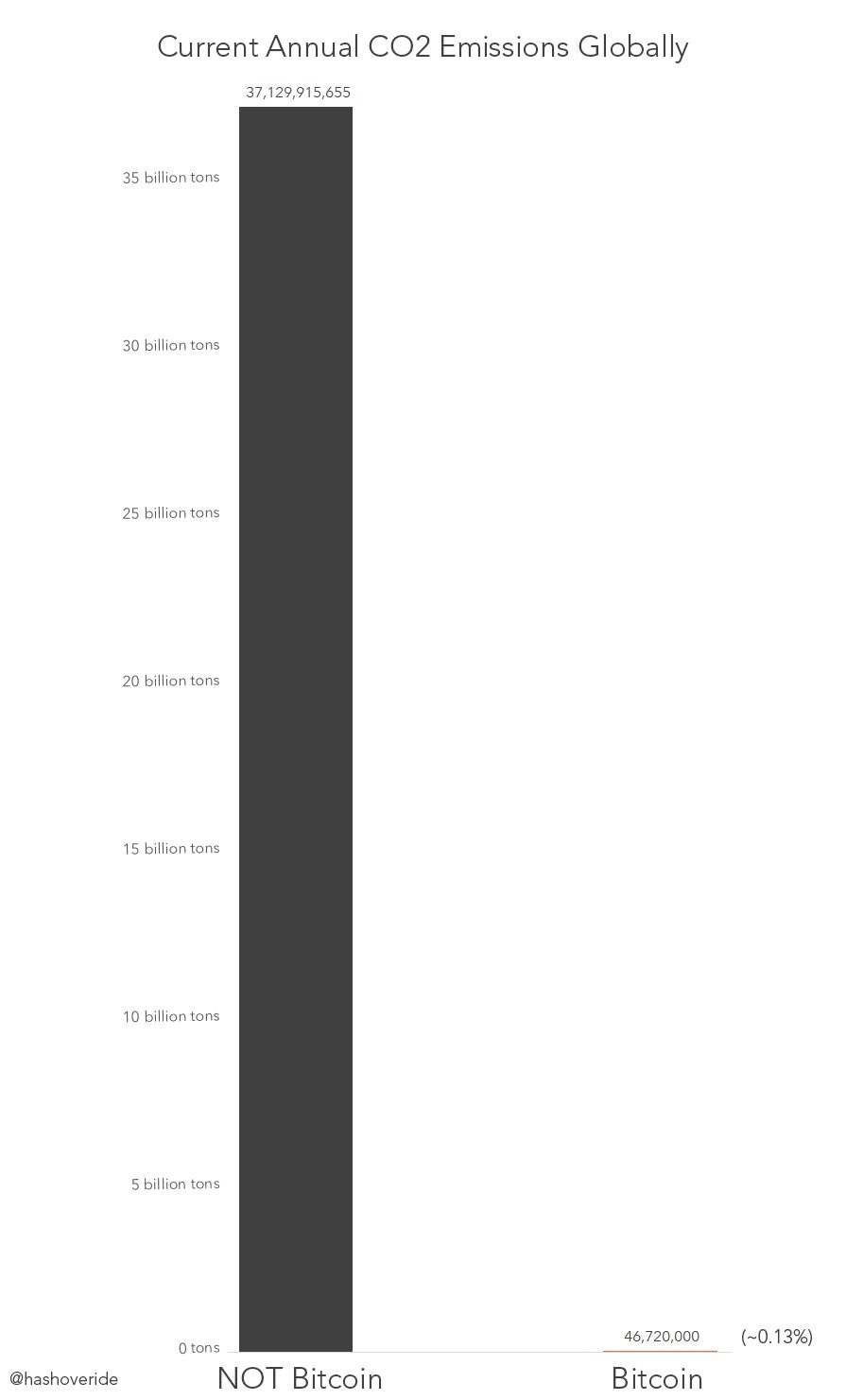

Happy Earth Day!

That threat was known as the User Activated Soft Fort or UASF. Many users ran UASF nodes and signaled support for the UASF on social media. There were even hats. Ultimately the Segwit upgrade happened before the UASF actually needed to activate.

It would be nice to compare the full 21M Bitcoin to the fully diluted supply of Dogecoin but because of an unfixed bug from years ago, Dogecoin supply is not capped and will continue to grow indefinitely.