¡Bitcóin tendrá validez legal!

Nation states are being forced to position themselves for the coming Bitcoin revolution.

In this issue:

El Salvador is considering legislation to declare Bitcoin legal tender. What does that mean?

President of El Salvador proposes recognizing Bitcoin as legal tender

On Saturday afternoon at the Bitcoin 2021 conference President Nayib Bukele of El Salvador announced his plans to bring a bill before the legislature designating Bitcoin legal tender and holding a portion of the treasury in bitcoin as a reserve asset. If the bill passes El Salvador will be the first country to recognize Bitcoin as legal tender.1

Legal tender means Bitcoin is considered money for the purposes of settling debt or paying taxes. It doesn’t mean that shops are obligated to accept Bitcoin as a matter of ordinary commerce. But it would mean that the government of El Salvador officially recognizes Bitcoin not just as property but specifically as money. That implies no capital gains taxes on ordinary transactions (such as remittances), which would make transacting in Bitcoin both easier and less expensive.

In some ways El Salvador is a natural fit for Bitcoin. Since the discontinuation of the Salvadoran colon in 2001 they have used the US dollar as their local currency. The population is ~70% unbanked and remittances make up ~24% of the GDP. Bitcoin use was already starting to flourish in El Salvador. Widespread adoption of Bitcoin would probably genuinely help the El Salvadoran people by giving them access to banking services and lowering the cost of remittances.

Money in El Salvador is money everywhere

All of this is all still hypothetical - the law has not yet been voted on by the El Salvadoran legislature. Initially the bill seems well positioned to pass: it has the very public endorsement of a President who has been at times criticized for autocratic tendencies - one assumes domestic power structures are lined up to support it.2 The stakes here are global though so opposition is almost certainly still on its way.

In the United States the USD is recognized as legal tender (obviously) but in a handful of states (such as Wyoming) gold and silver are considered legal tender as well. There are no states that recognize Bitcoin as legal tender because Article 1, Section 10 of the US Constitution specifically says "No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts." Making Bitcoin legal tender in America would require a constitutional amendment. But American money is not the only kind of money America legally recognizes.

According to UCC § 1-201 money is "a medium of exchange currently authorized or adopted by a domestic or foreign government." If this law passes in El Salvador, then Bitcoin will have been adopted by a foreign government and will legally become foreign money in the US (and likely many other jurisdictions). That would be a significant step forward in normalizing Bitcoin as an ordinary commercial tool.

Being a foreign currency allows much more favorable tax and accounting treatment of Bitcoin. Companies could exempt small payments from capital gains taxes, making Bitcoin much more practical for buying coffee. They could use the much more favorable accounting rules for foreign currency instead of intangible assets.3 Being a foreign currency would also make it much easier to offer Bitcoin banking services. The commercial implications are enormous!

They are also, of course, small compared to the political implications.

Slowly at first, then suddenly

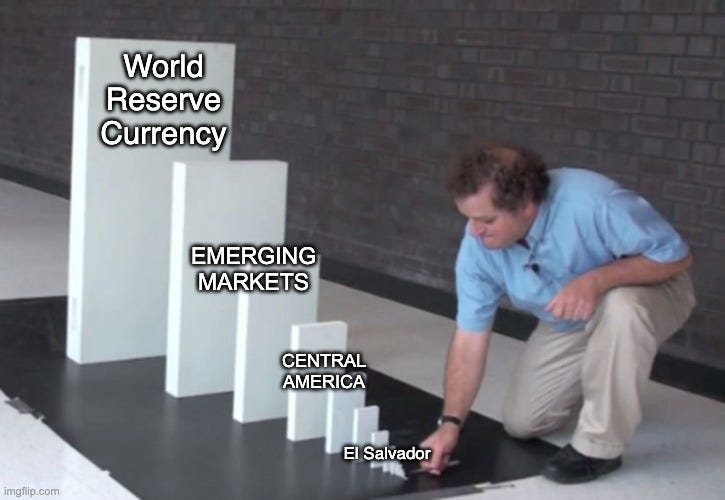

The more significant part of the announcement (though it received both less emphasis and fewer details) is the suggestion that the El Salvador treasury will start holding Bitcoin as a reserve asset. Long time readers will recall last December when Microstrategy (a publicly traded company!) openly holding Bitcoin on their balance sheet was considered quite newsworthy.4 Just as Microstrategy opened the door for a string of other companies to follow suit, we may see other countries more willing to formally adopt Bitcoin after El Salvador breaks the ice.

To be clear, El Salvador is a very small country. At ~$27B its GDP is slightly more than half the market cap of Dogecoin. We don’t know yet how much of its treasury it plans to hold in Bitcoin but the buy pressure from El Salvador probably won’t move the price all that much by itself. The real question is whether El Salvador might encourage other countries with weak or non-existent local currencies to follow their example.

Of course I don’t actually think the USD is in any danger of losing its status as world reserve currency. But I do think El Salvador’s decision may increase the pressure on neighbors and other similar countries to consider taking a position in Bitcoin. That could in turn create more pressure on other countries - a cascading feedback loop that Bitcoiners sometimes call hyperbitcoinization.

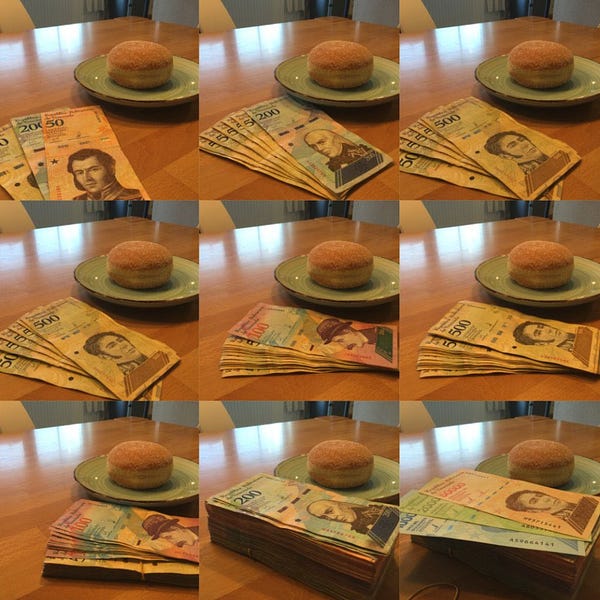

That feels far off - but then again last year a country buying Bitcoin felt far off, too. If I was a central banker responsible for historically weak currencies like the Nicaraguan Córdoba or the Venezualan Bolívar I would be paying very close attention.

The Separation of Money and State

The text of the law El Salvador is considering is explicit about the intent (emphasis mine):

IV. Central banks are increasingly taking actions that may cause harm to the economic stability of El Salvador;

V. That in order to mitigate the negative impact from central banks, it becomes necessary to authorize the circulation of a digital currency with a supply that cannot be controlled by any central bank and is only altered in accord with objective and calculable criteria;

El Salvador is very deliberately seeking to put control of the money supply beyond the reach of any government. El Salvador primarily uses the US dollar today, so the government being disenfranchised here is the US government not the government of El Salvador, but it is still a pretty bold philosophical stance. The idea that money was a tool of the government is as old as the portraits of kings stamped in our coins.

For countries that rely heavily on control of their currency Bitcoin is a competitive threat. But for smaller countries already at the mercy of foreign monetary policies, it is strictly an opportunity. By giving up monetary controls it never really had El Salvador is now free to focus on attracting Bitcoin wealth and businesses.

We usually talk about whether governments will ban or regulate Bitcoin, but President Bukele’s approach here is more similar to the mayor of Miami or the governor of Texas, both of whom are bending over backwards to make it clear to Bitcoin miners and other cryptocurrency businesses how welcoming their jurisdictions are. Some governments worry about the effects of Bitcoin on monetary policy, others are just happy about the tax revenue.

America has a strong currency and a strong tradition of personal and financial freedom, so it is unsurprising Bitcoin is unambiguously legal and cryptocurrency businesses have flourished. American Senators and Congresspeople have openly declared their support for Bitcoin and the philosophy it is based on.5 American citizens have little reason to fear their government criminalizing Bitcoin.

Globally the story is more complicated. India banned all cryptocurrencies but has recently begun walking that back. Iran publicly bans Bitcoin mining but secretly sponsors it. Russia would love to disrupt the USD but relies on the banking system to block fundraising for Alexei Navalny’s opposition party. China has had a famously ambivalent relationship with Bitcoin for years.

Ambivalence made sense when Bitcoin was small and weird and no one was sure if it was actually real, but it is an increasingly unsustainable strategy. Bitcoin no longer looks like it will go away on its own. That means Bitcoin is either a problem that needs to be contained before it grows any larger or an opportunity that should be acted on before it slips away.

The pressure is on governments to start placing their bets now.

There was some discussion online of Japan and Australia having made Bitcoin legal tender, but that does not appear to be the case. Here is a post from Australia’s Reserve Bank explicitly calling out that Bitcoin does not have legal tender status. The confusion around Japan’s legal status comes from a series of translation errors in 2017 regarding a law that established Bitcoin as legal property, but not as legal tender.

I don’t pretend to know El Salvadoran politics but putting laser eyes on your profile picture does not necessarily make you a friend to freedom. On the other hand he is by all accounts quite popular domestically. Here is a Reddit thread offering some local perspective.

At the moment bitcoin holdings are considered intangible assets and are valued using the lower of cost-basis or mark-to-market. That means companies are required to book losses when prices fall but not allowed to record gains when prices rise - so Bitcoin looks much worse on a company’s books than it would if it were treated as a foreign currency.

Back then DOGE was worth less than a penny and you could still buy a share of GME for only ~$15. It was a simpler time.

Louisiana even wrote a very nice thank you note to Satoshi which is certainly excellent manners if nothing else.