CBDCs are only useful for dictatorships

Plus the SEC thinks Ethereum is in the US and what we know about Satoshi from his mining habits.

In this issue:

CBDCs are only useful for dictatorships

The SEC thinks Ethereum is in the United States

What we know about Satoshi from his mining habits

CBDCs are only useful for dictatorships

Back in March we talked about the Biden executive order directing various government agencies to develop formal policy recommendations for cryptocurrency and we talked earlier this month about the embarrassingly misinformed report about cryptocurrency mining the Office of Science & Technology Policy produced in response to that order.1 In total there were nine reports from as many different agencies, the White House summarized the findings here.

There isn’t a ton of new policy or perspective in this summary. There is a lot of airtime devoted to the importance of regulation and enforcement, some discussion of tools and data across agencies, a token acknowledgement of the value of financial education and accessibility and a stated commitment to applying bank secrecy and money laundering laws to digital assets.

Most of the content is so broad and uncontroversial it borders on banal: keep studying the tech, work together across agencies, balance risks and opportunity, etc etc. There were predictable notes about fighting terrorist financing and the systemic risks of collapses like Terra/Luna, but nothing that was a significant break from past government statements or reports — with one major exception:

"[A U.S. Central Bank Digital Currency (CBDC)] … has the potential to offer significant benefits … the Administration has developed Policy Objectives … for a potential U.S. CBDC … the Administration encourages the Federal Reserve to continue its ongoing CBDC research, experimentation, and evaluation." — White House Fact Sheet

A central bank digital currency (or CBDC) is basically a stablecoin where instead of the token representing dollars stored in a bank somewhere the token is issued by the Federal Reserve directly and therefore actually *is* dollars. Where digital dollars today represent a claim on an account at a consumer bank, CBDCs would represent a claim on an account held directly with the Central Bank. The FED releasing a CBDC is functionally equivalent to them releasing a consumer banking product and competing with retail banks directly.

The White House report claims a CBDC would be more efficient, more innovative, enable faster cross-border transactions, be more environmentally sustainable and promote financial inclusion while fostering economic growth, improving both data privacy and operational security. CBDCs can also get rid of stubborn carpet stains and take two strokes off your golf game. It even comes with a free frogurt!

That’s a pretty striking contrast from the hostility in recent remarks by Minneapolis Fed President Neel Kashkari about CBDCs:

"I can see why China would do it. If they want to monitor every single one of your transactions you could do that with a Central Bank Digital Currency — you can’t do that with Venmo. If you want to impose negative interest rates — you could do that with a Central Bank Digital Currency — you can’t do that with Venmo. And if you want to directly tax customer accounts you could do that with a Central Bank Digital Currency — you can’t do that with Venmo. So I get why China would be interested. Why would the American people be for that?" — Minneapolis Fed President Neel Kashkari

As Kashkari observes CBDCs don’t actually do any of the things promised in the White House 'fact' sheet. The vast majority of dollars are already digital — changing them into CBDCs would not make them faster, more efficient or more environmentally sustainable. That’s like saying CBDCs would be made using faster and more streamlined electrons. Venmo can do anything a CBDC can do. The only things CBDCs enable are things that Venmo would refuse to do.

CBDCs do not (and are not meant to) improve financial inclusion, technical innovation or personal privacy. They are tools for surveillance and seizure. They are only useful for giving the governments that run them greater access to and control over the economic lives of their citizens. The pro-CBDC propaganda in the White House report is deeply chilling and un-American.

There is a kind of poetic symmetry to the government’s stance here. Most of the crypto industry is just centralized businesses using pointless blockchains to disguise noncompliance as innovation. One of the blockchain’s most proven use cases is making ignoring the rules look like inventing something new. Why wouldn’t the government adopt such a promising and useful technology?

Other things happening right now:

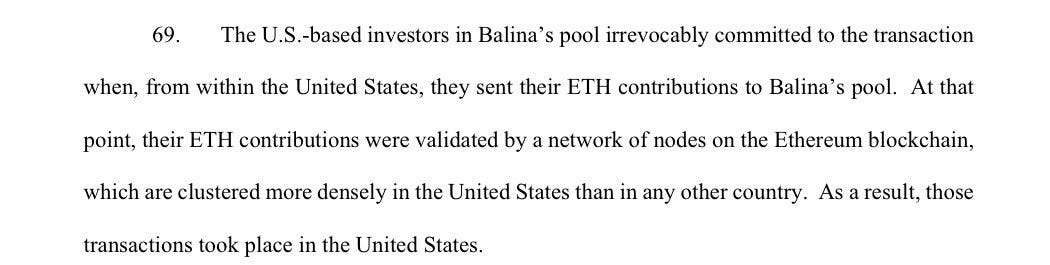

On Monday the SEC charged Ian Balina with an unregistered security offering for his role in promoting the (now defunct) Sparkster (SPRK) token in 2018. Sparkster and the associated charges are not themselves that noteworthy but buried in the court documents is an argument by the SEC that because the majority of ETH nodes are run from the United States that Ethereum transactions should be considered within U.S. jurisdiction. That claim isn’t strictly necessary to the charges they have made against Balina, so it seems like this is a forward-looking attempt to establish court precedent.

Here’s a very interesting statistical analysis from Jameson Lopp of the mining patterns of early Satoshi blocks. Lopp documented significant evidence that Satoshi was deliberately throttling his mining efforts, turning off his rig for five minutes every time he found a block. That makes it pretty clear that Satoshi was mining not to maximize his rewards but to support the network — in other words, he was mining altruistically not greedily. Satoshi spent virtually none of the ~1.1M BTC he accumulated.

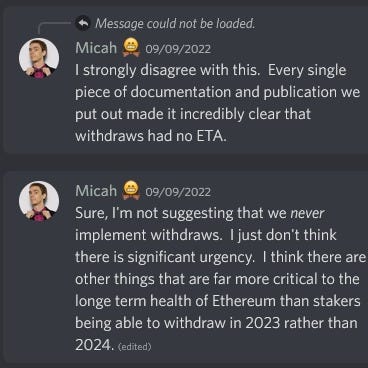

Less than one week after the Merge lands and discussion has already started about delaying the logic to allow staked ETH to withdraw. The Micah quoted below is Micah Zoltu, who we talked about before when he raised concerns about OFAC censorship before the Merge. He is not an official leader but he is an active Ethereum core developer.

Presented without comment:

If you want an in-depth exploration of why this report was an embarrassment Nic Carter released an incredibly thorough annotated response. We can’t have a grown up conversation about cryptocurrency until the crypto skeptics start actually doing their homework.