How to tell when they’re faking it

Plus the "social" part of social slashing and $100T worth of Bitcoin (and why it doesn't matter)

In this issue:

The "social" part of social slashing

How to tell when they’re faking it (reader submitted)

$100T worth of Bitcoin (and why it doesn’t matter)

A central banker is extremely right about CBDCs

The "social" part of social slashing

In spite of the looming threat of OFAC, the Merge is still on track to launch to the Ethereum mainnet in mid-September. The majority of Ethereum validators are known entities in OFAC compliant nations — whether Ethereum itself will remain resistant to government censorship now rests on the decisions of those validators and of the regulators that govern them. What will the government ask of them? What will they be willing (or able) to do?

It’s not a simple question because the government has not laid out clear guidelines about what compliance with these sanctions actually means. BitMex Research identified at least 8 different potential strategies a validator can take, ranging from ignoring OFAC entirely all the way up to actively trying to reorg blocks from other validators out when they contain offending transactions. It’s not obvious what level of compliance the government is asking and it is not obvious what level of compliance should be considered an attack on the network.

Coinbase CEO Brian Armstrong pinkie-promised not to do a censorship, but that promise is inherently hollow. The Coinbase Board of Directors has a fiscal responsibility to pursue business opportunities of that size and Armstrong himself has no interest in being fired or arrested on behalf of the citizens of DeFi. The vast majority of Ethereum validators are (for better or worse) corporations. They will maximize their own interests because that is what corporations are built to do. So the focus now is on how to convince the corporations running validators that censoring transactions is not in their corporate interests.

Mainly by threatening them:

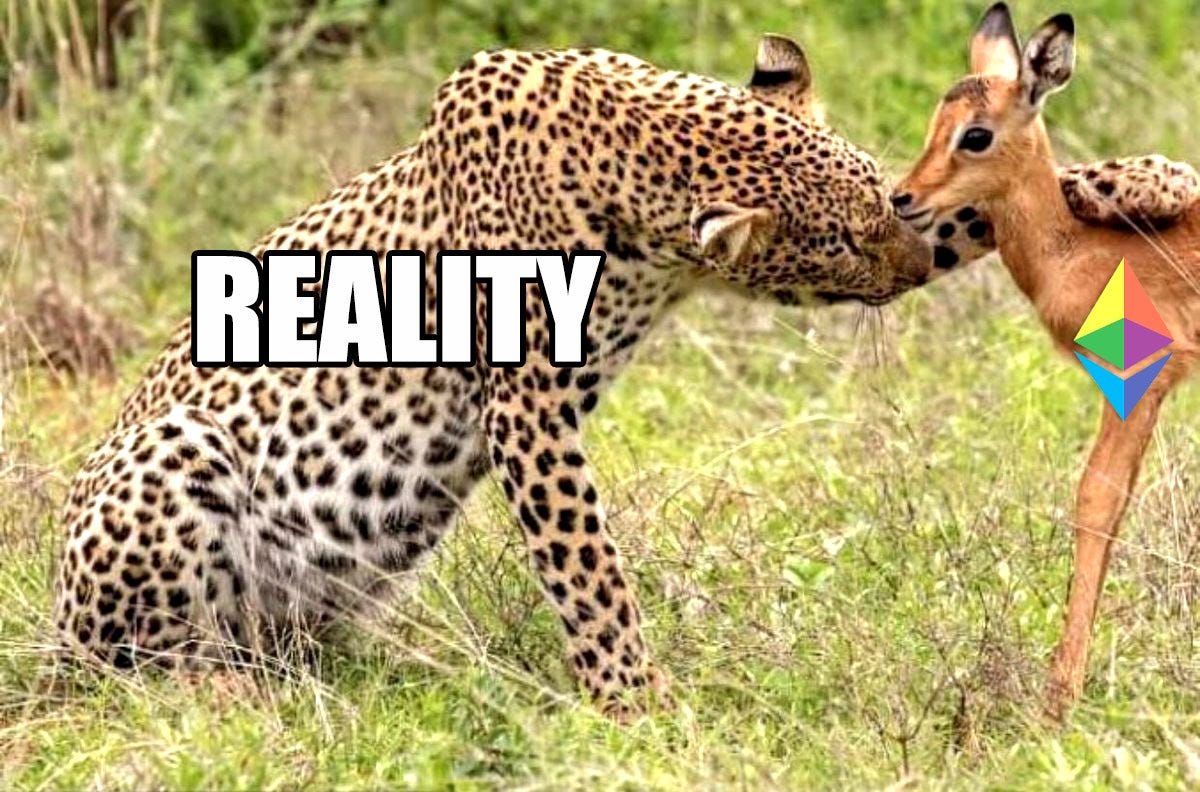

In a proof of stake system the network uses the validators' staked ETH as a hostage to ensure honesty. If validators misbehave their staked ETH is "slashed" — their wealth is erased. The 🏴 in Eric's tweet is a symbol of support for "social slashing" or coordinating across the Ethereum community to delete any ETH staked by validators that are censoring the network. The problem (as Eric alluded to in his tweet) is that the network has no built-in notion of censorship. The network does not know or care how validators choose which transactions to include.

In theory you could imagine adding a rule for detecting and punishing attempts at censorship but building new rules into the consensus layer is extremely difficult and the transition to proof-of-stake is basically already locked in. That’s the "social" part of social slashing — the rules for who gets punished this way have to be coordinated somehow outside the network. Ethereum users would have to agree somehow on a list of addresses to punish — basically censoring the censors. The OFAC sanctions against Tornado Cash are essentially symmetrical to the social slashing that the 🏴 movement is proposing in response. A fairer description would probably be political slashing, but I can see why social slashing sounds nicer.

If it was easy to build social consensus around who should be punished how much and for what we wouldn’t need a justice system. Expecting it to be easy to build that kind of consensus around highly technical and esoteric validator behavior is naive. Even more than that it is self-defeating — the only useful thing about a blockchain is the ability to resist outside control. If a political consensus exists that can censor the network (even righteously) then the blockchain serves no purpose. Any authority that can be trusted to censor the network can be trusted to run it.

The real goal of the 🏴 movement is not to actually do any social slashing but to threaten it so loudly and convincingly that corporate validators are more intimidated by the 🏴 movement than by OFAC. I don’t think that’s very realistic. It implicitly assumes that the majority of users will run social slashing nodes but no one has even written social slashing code yet and governments have already demonstrated a willingness to jail developers over this issue. The majority of Ethereum users don’t actually run their own nodes and the majority of companies that do run their own nodes are often the same ones being targeted for social slashing.

My sense is that transaction filtering is relatively easy for validators to implement and for regulators to understand, so I suspect it will be required. Stricter rules around attestation or reorging are both more demanding to build and more technical to understand so I’m guessing validators won’t be asked to do more than that yet. The government can always tighten regulatory requirements later. But that isn’t a very strong assumption to hang the security of a network on.

How to tell when they’re faking it

"Any thoughts on this article, Knifefight?" — BB

For many years reputable companies refused to get involved in Bitcoin trading, so the demand to buy and sell Bitcoin was serviced by less reputable companies. Some of those companies were perfectly honest businesses that happened to work in a niche industry — but a lot of them were pretty shady. The history of Bitcoin exchanges is riddled with fraud, theft and collapse. There is a reason why the Bitcoin community adopted the mantra "not your keys, not your coins."

There a lot of things you might do as a dishonest entrepreneur running a Bitcoin exchange but a super obvious one is to fake volume. Everyone wants to trade on exchanges where there are lots of other traders so exaggerating the number of trades on your platform is an easy way to make it look more appealing and important. There is no way to fact check your claims and your competitors are probably doing the same thing already. Faking exchange volume was (and probably still is) widespread practice especially among smaller/less reputable exchanges.1

These days the market leading exchanges are under heavy scrutiny and are much more compliance oriented than Mt Gox and its peers were so I don’t think it is particularly likely that they are faking their volume. But real volume is challenging to build and limited by the total demand to trade Bitcoin and fake volume is effortless to create and limited only by the cumulative chutzpah of liars. It makes sense that at any given time fake volume would be the majority of volume — just as there are probably more dollar denominated lies than actual dollars in the world. Lies are cheap.

So I am overall inclined to agree with the broad assertion 'fake volume is widespread in crypto trading.' That said, this article is being surprisingly dishonest in how it goes about making an otherwise uncontroversial claim. The headline assertion is that 51% of all Bitcoin trades are fake … but as I already mentioned there is no way to prove that an exchange is lying about their reported volume, even when it is obvious. So there is no way to quantify the amount of fake volume. Forbes is just attaching numbers to a subjective assessment as a way of making it seem more scientific.

We apply volume discounts based on a proprietary methodology that relies on 10 factors such as an exchange’s home regulator if any and volume metrics based on an exchange’s web traffic and estimated workforce size. We also use the number and quality of crypto licenses as proxy to gauge the sophistication of each crypto exchange in matters pertaining to regulation and trade surveillance. If a firm shows a commitment to transparency by conducting token proofs of reserve or by participating in Forbes crypto exchange surveys, it qualifies for a “transparency credit” that lowers any discount that may otherwise apply.

In other words they gave a high score to businesses with lots of licenses and employees and a low score to businesses based in markets with the wrong kind of regulator or who weren’t willing to "show a commitment to transparency by … participating in Forbes crypto exchange surveys." Shockingly, after assigning arbitrary weights/penalties using their proprietary methodology, the volume turned out to be exactly 51% fake! Good thing too or they would have had to rewrite the headline.

This is a weird hill to be sacrificing credibility on. Forbes isn’t arguing that all major exchanges fake their volume (the analysis treats reports from 40 of the 157 exchanges as being 100% reliable) and no one has ever argued that the volume reports from the long tail of exchanges should be trusted. If anything the amount and importance of fake volume in crypto trading is going down over time. This seems like a great deal of mental gymnastics in service of a deceptive headline.

Other things happening right now:

A common complaint about centralization risks in Ethereum is how the majority (~52%) of nodes are run on Amazon Web Services — not exactly beyond the reach of government intervention. The next largest share of nodes are run on Hetzner Online GmbH, a German hosting provider. That’s a problem for Ethereum because according to Hetzner "Using our products for any application related to mining, even remotely related, is not permitted. This includes Ethereum. It includes proof of stake and proof of work and related applications … even if you just run one node, we consider it a violation of our ToS." Oops! 😬

Bitcoin recently passed the $100T total value transferred threshold but other than being a statistical amuse bouche it’s not very meaningful. When value is transacted on Bitcoin there is no way to distinguish between the amount being sent to another party and the amount being sent to a "change address" controlled by the spender. So total value transferred is about as meaningful as calculating the GDP by adding your entire total net worth to the total every time you buy a stick of gum.

Here is President of the Minneapolis Fed Neel Kashkari being extremely right about the true purpose of Central Bank Digital Currencies (CBDCs):

There are other ways to achieve the same goal. You can create real but meaningless volume for example by charging negative-fees for some trades, effectively paying traders to create artificial volume by wash trading with themselves. LooksRare did that at launch.