A graph of Greed and Virtue

Plus the zen riddle of decentralization and why not to weaponize the dollar.

In this issue:

A graph of Greed and Virtue

The dollar is a double-edged sword

The zen riddle of decentralization

A graph of Greed and Virtue

I alluded briefly in the last post to how Ukraine’s official Twitter account posted donation addresses for both Bitcoin and Ethereum donations. At time of writing they have received ~$38.4M worth of Ethereum, ~$9.9M worth of Bitcoin and ~$12M worth of other crypto assets including Polkadot, Solana and a Crypto Punk. There have been ~115k total donations in total, averaging ~$500 each.

I stand with the people of Ukraine and I hope they are able to put those funds to good use defending themselves against Russian forces, but I do think the ethics of private citizens directly funding foreign war efforts is pretty murky. It gets especially murky when it starts to blend with marketing, such as with Polkadot founder Gavin Wood:

I’m not sure if that was a cost-efficient advertisement but I do know he over-payed because Justin Sun (founder of Tron) made the same bargain at an 80% discount:

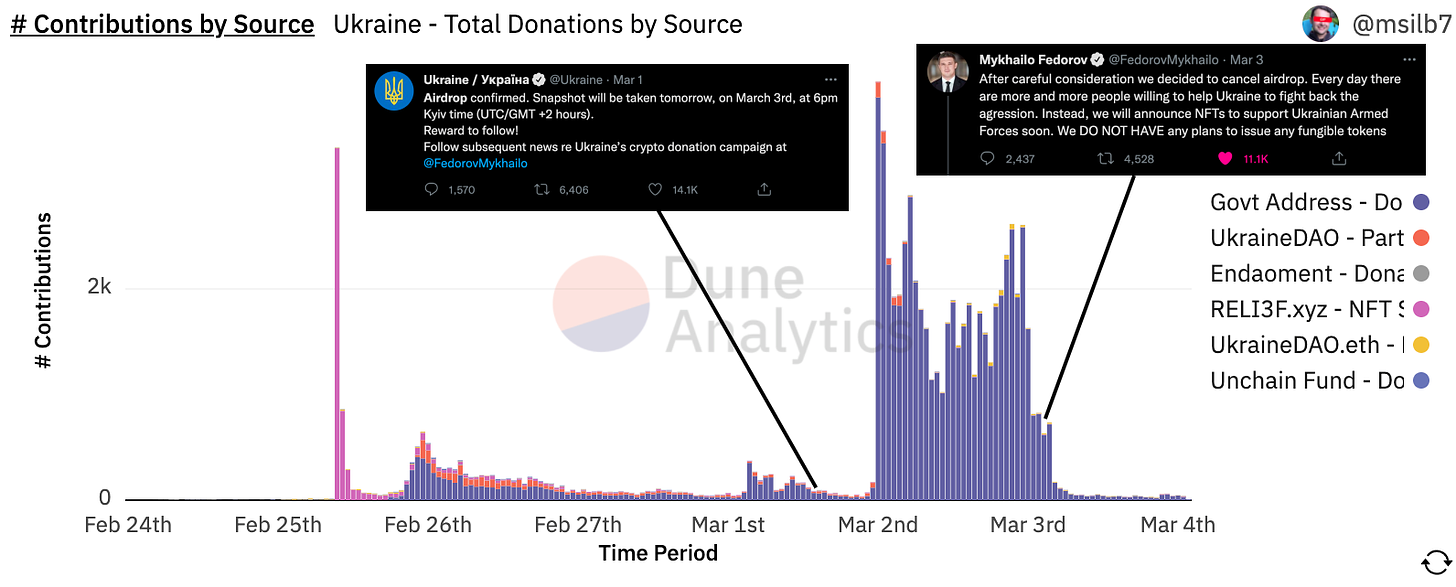

As you can see from the graph at the top of the section donations to the government (the blue bars) tapered off relatively quickly after tweeting the address but then ticked back up again on March 1st when rumors started circulating that Ukraine was going to airdrop a token of some kind (akin to the PEOPLE, ENS or LOOKS tokens). Late that evening Ukraine confirmed the rumors were true — an airdrop was coming:

Suddenly spurred on by the prospects of free money, "donations" surged. More genuine donors appeared, but also a host of exploiters donating a tiny amount from dozens of different addresses to farm the airdrop — ultimately paying more to miners than they donated to Ukraine. The airdrop was planned for Ethereum, which gave Justin Sun of Tron the opportunity for a breathtakingly bad tweet:

The whole thing was a bit of a mess though. Ethereum was only ~1/3rd of the total crypto donations and newer donors were fairly obviously trying to game the system. It wasn’t clear what the token would be for or how it should be distributed. Fake Ukrainian tokens were already launching to take advantage of the confusion. So rather than inventing a new kind of money to give donors Ukraine decided to continue focusing on ways that donors could give money to them:

For some reason after that announcement donations to the Ethereum address dried back up again. Perhaps it is because people are saving their money for the big upcoming NFT sale.

The dollar is a double-edged sword

We also spoke last post about the difference between money (something you own) and debt (something someone owes you). Most of Russia’s wealth was stored in foreign currency reserves. Until recently most people (especially Russian government officials) thought that was basically money! It wasn’t though. Russia’s foreign currency wasn’t paper in a vault, it was numbers in a foreign bank account. It wasn’t something they had it was something they were owed. It was debt.

Debt is a liability: someone has to pay it back to you. That requires a minimum level of trust, which tends to break down in time of war. No one wants to repay you if they suspect you will use the money to kill them (or their allies). So when Western sanctions cut Russia off from the global economy it also cut off access to their foreign currency reserves. That’s obviously pretty bad for Russia but (perhaps less obviously) it is also pretty bad for the US dollar.

As the Wall Street Journal put it:

According to the IMF US dollars represent just under 60% of the world’s foreign reserves. The largest foreign holder of US dollars is China at ~$3.2T, roughly ~2.5x the next largest holder Japan (~$1.2T). The case for holding US dollars rests on the idea that you will be able to spend them when you need to — but as the sanctions against Russia make clear, dollars are really only available to spend if the US government approves of what you want to spend them on.

On Wednesday Fed Chairman Jerome Powell testified before Congress about monetary policy and Representative Carolyn Maloney (D-NY) asked him what the effect on the US economy would be if China, Russia and others stopped using the USD to settle trades between each other. His answer (embedded in the video above) was quite striking.

"Over time [countries moving away from the dollar] would diminish our status as the reserve currency. It’s also possible to have more than one large reserve currency — there have been times when that was the case."

The chair of the Federal Reserve hinting at a possible future where the US is no longer the dominant global reserve currency is a remarkable admission of the risks of weaponizing the financial system. If everyone knows that the US will use their debt against you, fewer countries will want to hold US debt.

The zen riddle of decentralization

As I’ve written about before in greater detail Ethereum is advertised as a decentralized platform but is in practice actually quite centralized. One of the ways that Ethereum is centralized is that it is quite difficult to run an Ethereum node for yourself, so most people do not. Most end users rely on free third-party services to check the state of the blockchain and most of those services pay a company called Infura to run a node for them.

Ethereum is (at least nominally) a decentralized global network — but Infura is a US based company. So Ethereum might be available for anyone but Infura blocks traffic from countries sanctioned by US law. On Thursday they were adjusting their configurations and mistakenly blocked users in Venezuela. Users were only cut off from Infura and not from Ethereum itself — but since most users don’t run their own nodes it amounts to the same thing.

In this case it was a mistake and quickly fixed, but it doesn’t really matter. If Infura can block someone’s access by mistake they can do it by government order, too — by Infura’s own description they already are. The whole point of Ethereum is that it is supposed to be unstoppable — otherwise it is just a slow, expensive database with terrible privacy defaults.

This problem isn’t specific to Infura — lots of web3 companies present themselves as stewards of decentralization while quietly enforcing government rules. Uniswap delisted slightly over 100 tokens at the request of the SEC. MetaMask and OpenSea recently banned all users from Iranian and North Korean IP addresses. Ethereum’s decentralization is like a zen riddle: if a network resists censorship but only censors can use the network, is it really decentralized?

Other things happening right now:

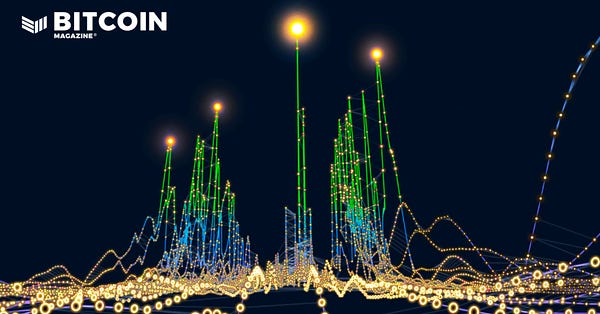

If you are wondering why Bitcoin is still falling in spite of money printers going brrrr and sanctions giving everyone a crash course in the limits of fiat money, this graph is pretty much the answer in a nutshell. Bitcoin should be a safe haven asset but since most people don’t understand it they just treat it as a kind of goofy, high-risk tech stock. So instead of trading like you might expect and going up in times of trouble, Bitcoin follows the rest of the market down.

Ryan Peterson the CEO of shipping company Flexport revealed recently that Flexport holds Bitcoin on its balance sheet as a means of keeping liquid capital available to deploy globally. Peterson did not disclose the amount held but did say "I assume all the other global logistics providers will do the same in the years to come."

The SEC has finally begun formally investigating whether some NFT projects are actually unregistered securities. Apparently fractional NFTs are getting particular scrutiny which seems a bit arbitrary to me? I would have expected more concern about the projects promising future revenue streams. It will be interesting to see how Coinbase’s upcoming NFT marketplace responds to this regulatory attention.