Not your central bank, not your foreign reserves

Plus God & Bitcoin and Panera Bread enters the Metaverse

In this issue:

Not your central bank, not your foreign reserves

God, Bitcoin and Asymmetry

Bored Ape phishing victim sues OpenSea for $1M

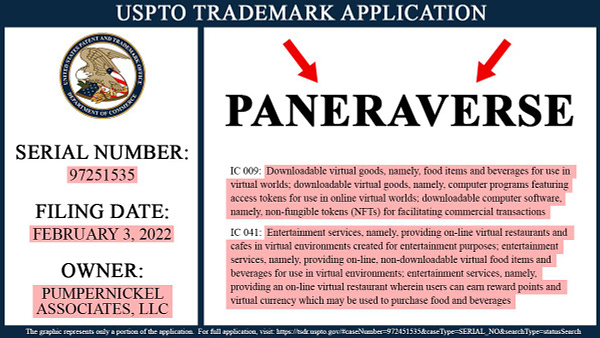

Panera Bread enters the Metaverse

As we’ve already discussed cryptocurrency is only a small element of the story of the unfolding conflict in Ukraine — but the unfolding conflict in Ukraine is easily the most important story in cryptocurrency. I will continue to do my best to provide the context here necessary to understand the role of and implications for crypto, but for actual coverage of the war please rely on journalists.

I am also going to continue normal discussion of other cryptocurrency news and events which (by definition) are less important and less serious than the events taking place in Ukraine. At times the transitions and contrast may be a bit jarring. I think there is merit in continuing to observe and interpret the things happening in crypto even (and perhaps especially) during turbulent times.

Not your central bank, not your foreign reserves

By all accounts the Russian invasion of Ukraine is not going as Putin had hoped. Ukrainian resistance has been stiff. Ukrainian President Volodymyr Zelenskyy refused an American offer to evacuate and remains in the country along with his cabinet. Russia has not (as of writing) been able to seize either Kyiv or Kharkiv. Protests opposing the war have erupted across Moscow in spite of the risks of openly protesting the government in Russia.

In parallel the world response has grown sterner. The European Commission, France, Germany, Italy, the United Kingdom, Canada, and the United States announced mutual sanctions against Russia and a plan to remove 'selected' Russian banks from the SWIFT messaging system. The international response includes dramatic exemptions and reversals in major historic policies like Swedish neutrality, German pacifism and Swiss banking non-interference.

The private sector is cutting Russia off as well. BP has announced it will exit its 20% stake in state-owned Russian oil company Rosneft, writing off a loss in the billions. Previously that was the largest Western investment into any Russian enterprise. JP Morgan is removing Russian bonds from its Environmental/Social/Governance indices. FIFA has ejected Russia from the World Cup. Canadian liquor stores are taking Russian vodka off the shelves.

Meanwhile in Russia, the local stock market has fallen ~33% so far (the largest crash in a large equity market since 1987), erasing ~$190B in wealth overall. The ruble is down ~21% in spite of the Russian Central Bank more than doubling the base interest rate. International payment systems like Google Pay and Apple Pay have stopped working. Bank runs are starting to form:

The Bitcoin community has a saying that goes back to the fall of the Mt. Gox exchange: not your keys, not your coin. The idea is that if you don’t hold your bitcoin yourself (i.e. use your own private keys) you don’t really own bitcoin what you own is an IOU from whoever has the bitcoin. Everyone who was holding IOUs when Mt. Gox collapsed learned the difference between money and IOUs the hard way. Many citizens of Russia are learning the same thing now: they do not own money, they own IOUs from Russian banks which may soon be insolvent.

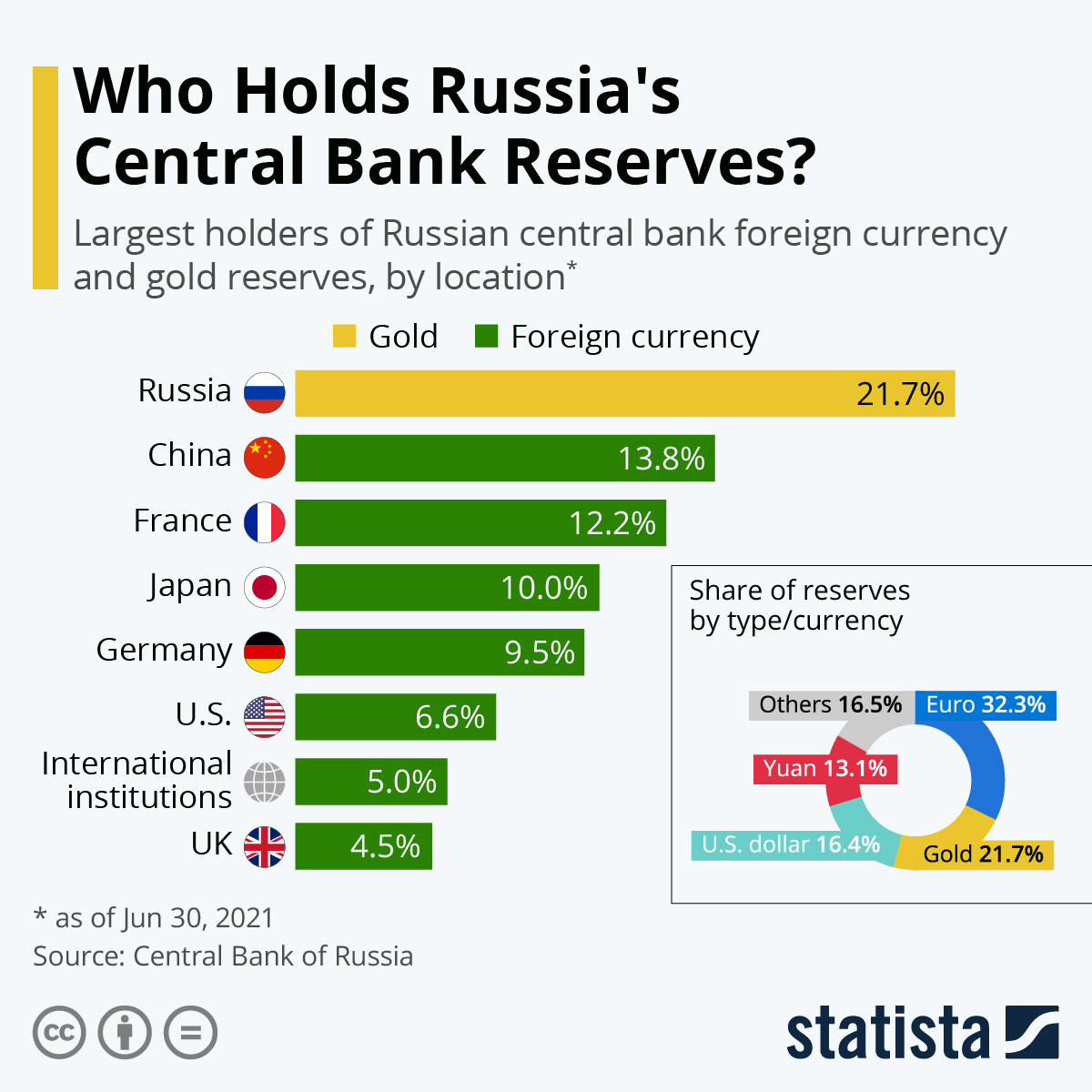

The Russian Central Bank is learning the same lesson. On Friday Russia’s Central Bank likely assumed that they had ~$630B in foreign currency reserves — but in fact what they actually had was ~$136B worth of gold and ~$494B worth of IOUs from other countries, mostly countries now actively sanctioning Russia and its central bank. That means Russia is unable to deploy those reserves to fund the war or defend the value of the ruble. Not your central bank, not your foreign currency reserves.

The first order implications of these sanctions is a lot of collateral damage both among Russian banks/businesses and among banks/businesses that do business with Russia. Some banks are already failing as a result of missed payments. Air cargo is significantly disrupted, perhaps permanently. This pales in comparison to the human suffering of war, obviously, but it will cast a long shadow on the economy.

Exiling Russia from SWIFT is a double edged sword — it weakens Russia but it also undermines the network effects of SWIFT. The larger the economy outside of SWIFT becomes, the less important SWIFT membership will be. Russia itself is presumably already grasping for ways to send/receive payments as a global financial pariah. The Biden administration and the European Central Bank both expressed concern that cryptocurrency might offer Russia a route around sanctions but honestly that seems very unlikely. Russian annual GDP in 2020 was ~$1.48T, the entire Bitcoin ecosystem has a market cap of ~$820B.

In other words Russia can use Bitcoin but they are way too large to use it discreetly. Sanctions can (and are) enforced by the banks/exchanges at the edge of the network that allow wealth to move in (and out) of the crypto economy. So Russia can send/receive crypto but not trade it for USD/EUR. In theory Russia could just buy/sell from people who also wanted to use Bitcoin and form a circular economy — but in practice their largest remaining trading partner is China and China is not very enthusiastic about Bitcoin.

Presumably China is watching the Russian sanctions and considering what they might mean for their own territorial ambitions in Taiwan. China is still the second largest foreign holder of US treasuries, after Japan — but the case for owning dollars rests on the belief that you will be able spend them when you need them. The pressure being applied to Russia right now undermines that belief.

There is an unmistakeable through line in recent current events. Everyone from Canadian truckers to Russian oligarchs is learning the difference between sovereign money and accounting entries in a bank database. Bitcoiners have been trying to explain that for a while: not your keys, not your coin.

God, Bitcoin and Asymmetry

I saw a mention of Pascal’s wager re: crypto investing and it instantly brought your concept of insurance to bitcoin upside to my mind. Have you ever compared the two?" — P.S.

I have not made the explicit comparison on Something Interesting but it is a good one! Blaise Pascal was a 17th century French philosopher who proposed that every rational person ought to believe in God because being wrong about God existing has limited downsides (you don’t get to sin) but being wrong about God not existing has infinite downsides (you get sent to hell). The goal was to reduce faith to a logic puzzle and then 'prove' that one ought to be faithful.1

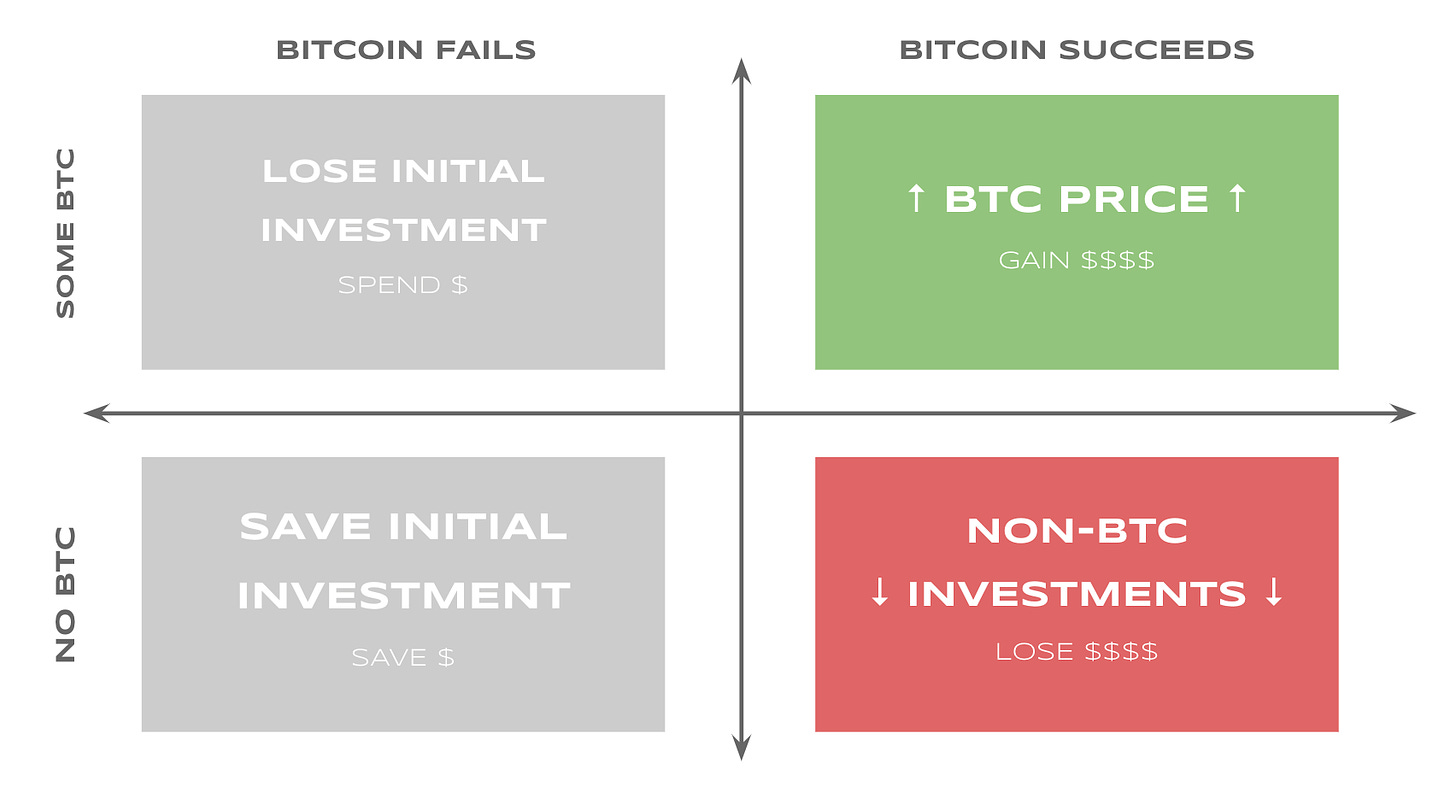

You can indeed draw parallels with the argument that I made in the post Everyone should have a Bitcoin insurance policy. If Bitcoin succeeds at becoming the universally preferred instrument for savings it will capture value away from other assets used as a vehicle for savings like equity, real estate or precious metals. In other words, if society as a whole adopts Bitcoin you wouldn’t just expect the price of Bitcoin to go up — you would expect the price of everything else to go down.

The upside for owning Bitcoin and the downsides of not holding Bitcoin are so wildly asymmetric that even if you don’t personally believe in Bitcoin you should still probably own some. Just in case.2

Other things happening right now:

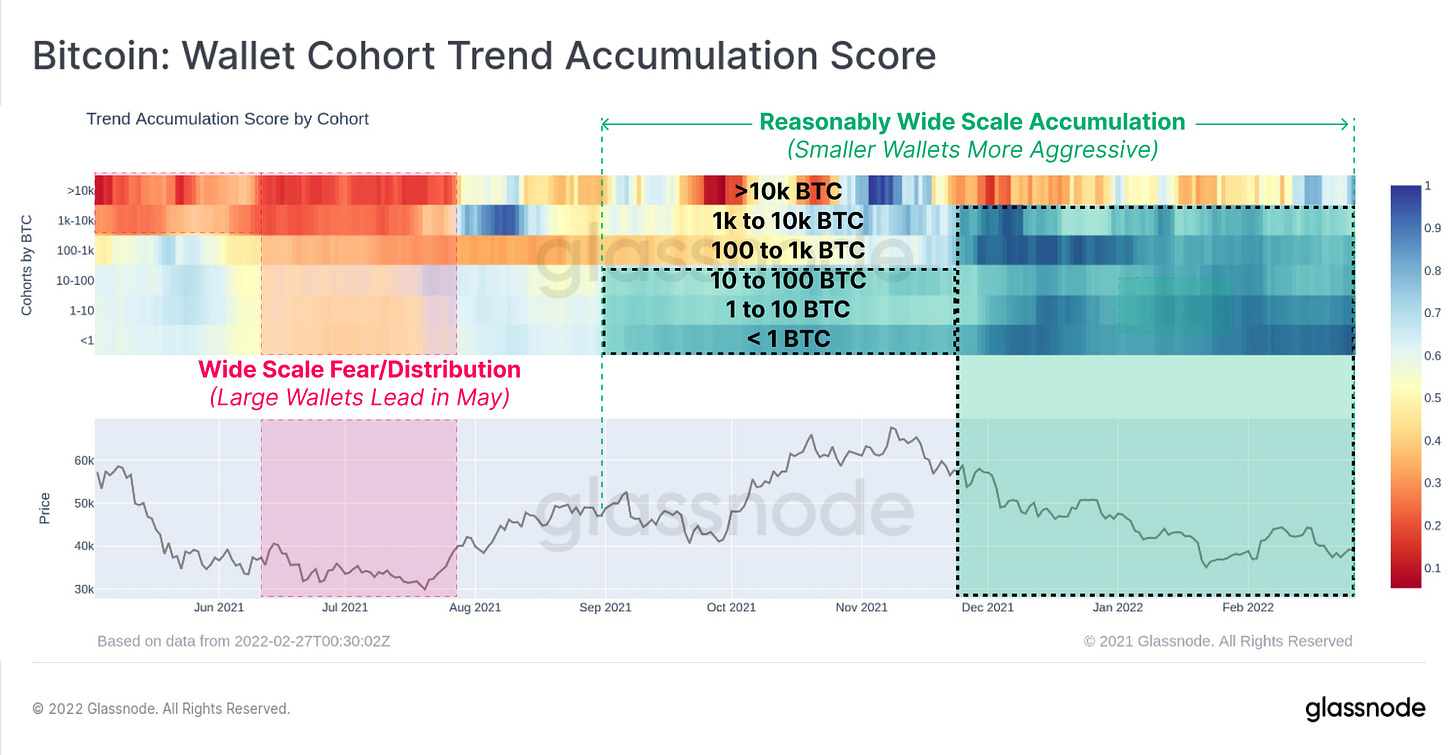

Here is a cool graph from Glassnode showing when Bitcoin addresses of various sizes were selling down their bitcoin position versus acquiring more. The top band (representing the largest wallets) includes exchange balances so accumulation there is a little more difficult to interpret — it may actually represent people sending their bitcoin to an exchange to sell.

We’ve talked a few times recently about OpenSea exploits leading to the theft of valuable NFTs. One victim has filed a lawsuit against OpenSea demanding $1M in damages for the loss of his bored ape, which was taken from him for 0.01 ETH after he was successfully tricked into signing an OpenSea sale order. The lawsuit is … not good. For example OpenSea is not a legal entity — OpenSea is owned/operated by Ozone Networks Inc. The accusation of negligence on the part of OpenSea is actually somewhat reasonable in my opinion — but the part where he values his ape by using Justin Bieber’s wildly overpriced ape as a baseline is a little optimistic, I think.

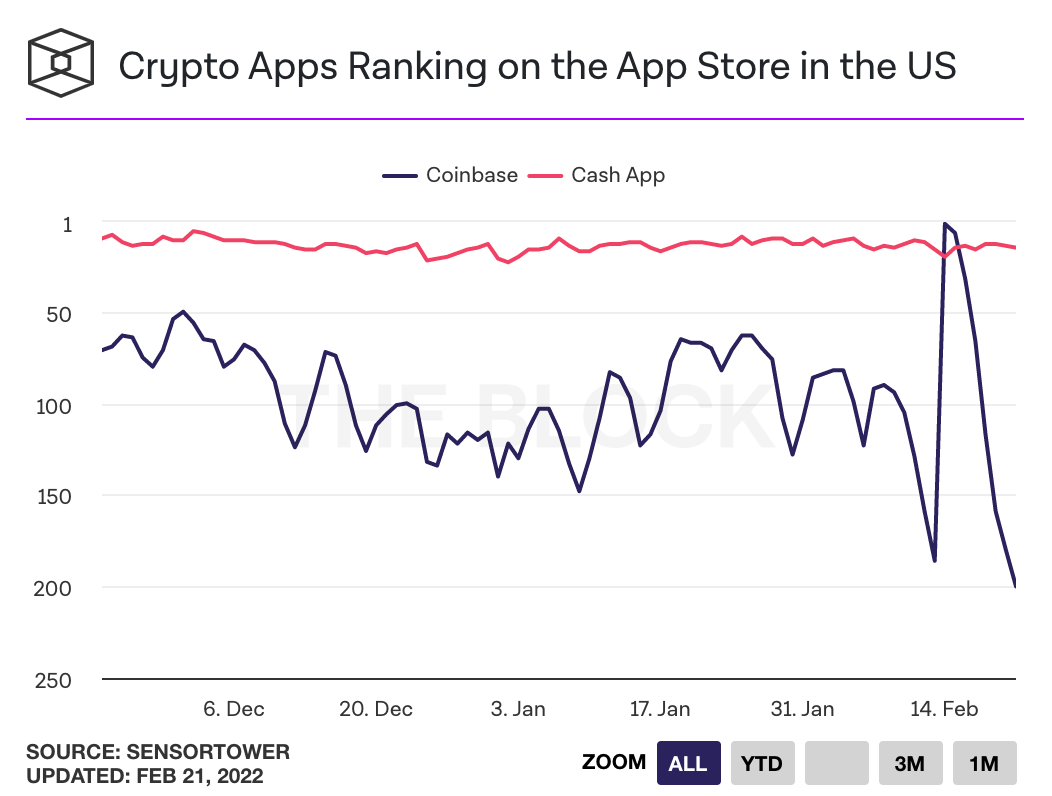

Coinbase’s Super Bowl ad definitely rocketed them to the top of the app store but it does not appear to have had lasting impact. As soon as the $15 new user promotion ran out they plummeted back down to ~200, lower than they were ranked before they started the promotion. Whoopsie-doodle.

Presented without comment:

There are flaws in this theological argument, but in fairness to Pascal his wager was a small part of an imagined dialog between two characters published posthumously from assembled fragments of his notes. He did not actually mean it to be proof of anything, it was more meant to demonstrate that the tools of logic were not helpful in matters of faith.

The post that lays this argument out in more detail also includes a tool for estimating how much Bitcoin you might want to hold for various levels of insurance.