In this issue:

NFTs are centralized and nobody cares

A blockchain was mean to Stephen once (reader submitted)

Two short stories about cryptocurrency crime

NFTs are centralized and nobody cares

On Friday January 7th Moxie Marlinspike (CEO of encrypted messaging platform Signal) published a blog post laying out his impression/critique of web3 and especially of NFTs within web3.1 Signal is one of the most successful mainstream applications of cryptography, so Marlinspike is an important thought leader in the space. The post is short, cogent and worth your time to read, but statistically only ~10-15% of you click on links so I’ll do my best to summarize it here:

In Marlinspike’s estimation web3 is not delivering on its promise because no one is actually using it in a decentralized way. To benefit from decentralization you actually have to run your own server/node and in practice no one wants to do that. Instead everyone is relying on a daisy chain of trusted, third party services to tell them what the blockchain says. Since everyone is relying on [OpenSea, Infura, Etherscan] anyway these users must not actually care about decentralization and so could probably be better served by web2 architecture.2

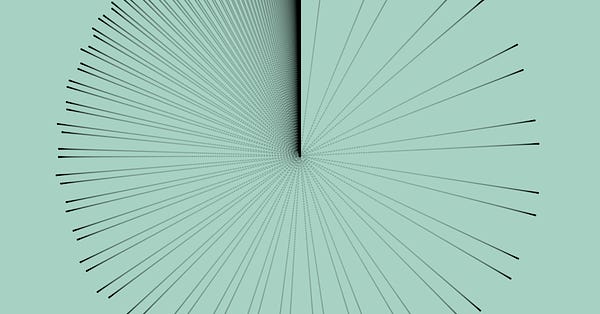

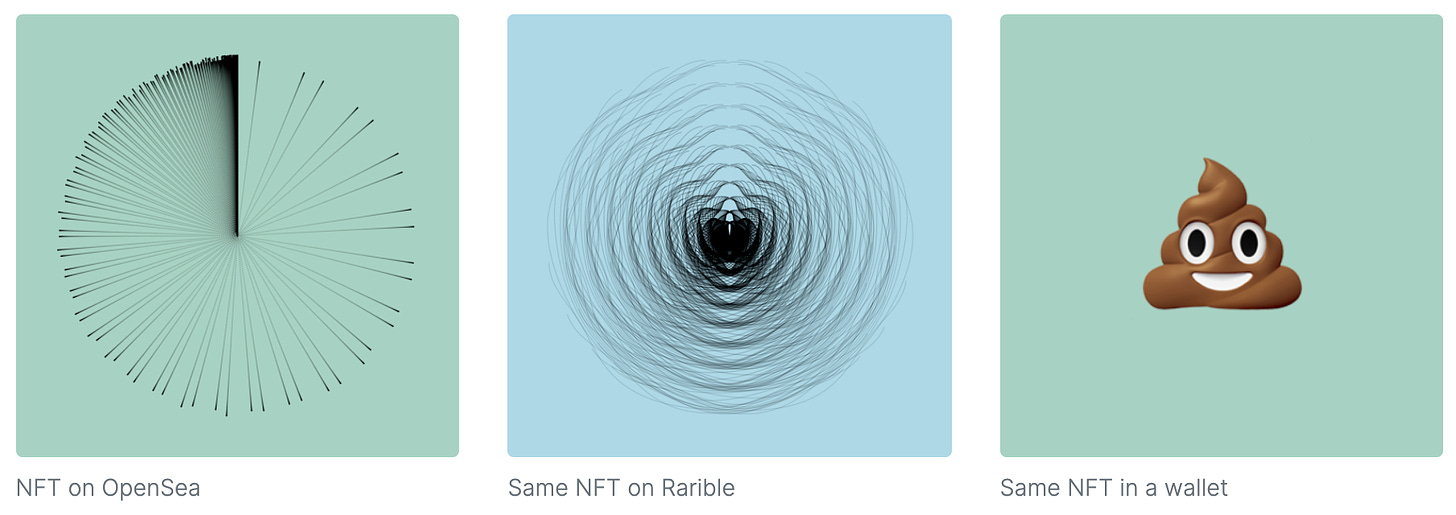

Marlinspike observes (correctly) that many NFTs are not actually untrusted or decentralized in any meaningful sense. A great many (though not all) NFTs are simply receipts that point to a URL meant to house the art. To demonstrate the weaknesses of that approach Marlinspike designed an NFT that looked good in storefronts but looked like a poop emoji when viewed from inside a wallet:

His point was that since a lot of NFTs are just pointers they inherently trust the owners of those servers not to just change the art to a poop emoji whenever they feel like it. OpenSea then helpfully underlined his point by banning the NFT from their platform (presumably because some users complained) causing it to disappear from his wallet (MetaMask), which relies on OpenSea APIs to display NFTs. No one is running their own infrastructure — but if everything is centralized and users don’t mind, why is anyone paying for an expensive blockchain?

I have written before about why I am skeptical of Ethereum as a platform and a lot of these criticisms echo my concerns. The fact that running your own Ethereum node is out of reach for so many participants in the ecosystem is a serious attack vector. I believe Ethereum is centralized and is therefore doomed to eventually fail. But I don’t find those same critiques as compelling when leveled against NFTs.

It isn’t really a problem that most NFTs are pointers to centralized servers because most NFTs are not meant to protect the collector from the creator. That’s not what they are for. Marlinspike betrayed that trust by making an NFT that trolled users who didn’t read the fine print but that isn’t important because most artists are not interested in betraying the trust of their audiences. Why would they be?

A common mistake that people make with NFTs is confusing the map for the territory. NFTs are simply a receipt — the actual thing that people are buying and selling is authenticity. It isn’t necessarily bound to the token.

Sometimes creators retain control of how authenticity is assigned — think of Taylor Swift re-releasing her music as Taylor’s version. Sometimes they don’t — Topps can’t print more rookie Mickey Mantle cards. Authenticity can be complicated and ambiguous. Different people can disagree. Art collective MSCHF mixed an original Andy Warhol drawing in with 999 counterfeits and sold them for more collectively than the original was worth. Banksy shredded a painting and collectors decided it was more valuable. Only the market can assign authenticity.

If the creators of an expensive NFT project go unexpectedly rogue the owners of a given collection can (if they choose) re-assert control of their art with wrapper contracts, as some Pudgy Penguin owners did to fire the original creators and eliminate ongoing secondary royalty payments or how the MoonCats Rescue project did to revive an abandoned early NFT project. Artists may be able to damage the value of their art by damaging their reputation or their relationship with the audience but that’s not the same as controlling the art.

It is also true that OpenSea has tremendous market dominance and network effects driven by liquidity — but that doesn’t mean it has the power of a centralized platform. Marlinspike didn’t bother to go any further than looking in his MetaMask folder, but the CryptoPhunks project was banned from OpenSea and simply built their own independent marketplace. It is more work to work around OpenSea but it is entirely doable. It’s being done already.

OpenSea is also non-custodial and transparent. That means competitors like LooksRare (which launched on Monday) can poach OpenSea’s best customers by airdropping them rewards for their past OpenSea engagement and users can migrate to LooksRare (or back to OpenSea) trivially because they hold all their assets themselves. Imagine launching a Facebook competitor that offers users a cash reward for every post they ever liked and lets them bring all their friends with them just by signing in. That’s not even close to equivalent to web2.

Vitalik Buterin (co-founder of Ethereum) argues that Marlinspike is putting too much emphasis on the status quo and not giving Ethereum enough credit for the direction of future development — but here I agree with Marlinspike. Ethereum made fundamental architectural decisions that make truly decentralized infrastructure infeasible and will be hard to undo. But I don’t see why Marlinspike concludes the sins of the platform will be visited upon the apps.

Both DeFi and NFT projects can and have migrated to other chains. They don’t have to go down with the Ethereum ship if users/collectors don’t want them to. Marlinspike knows how to build NFTs, but I’m not sure he gets them yet.

A blockchain was mean to Stephen once

“Hey Knifefight have you ever written anything about Stephen Diehl? This post of his is being shared around my work and I’d love to have something I could send back.” — BB

Stephen Diehl is the CTO and co-founder of a corporate blockchain company called Adjoint — though you have to work hard to find that information out. His main web presence is defined almost entirely by his opposition to cryptocurrency, which he tweets about several times a day in between complaining about how much he is forced to talk about cryptocurrency. I don’t usually cover Diehl because I think he is engagement farming and I don’t want to give him any more visibility. This post is a good example of why. Diehl makes four arguments:

Cryptocurrencies don’t solve a real problem

Cryptocurrencies aren’t really money

Private money is always bad

All cryptos are unregistered securities.

In section [1] Diehl doesn’t actually argue his point at all he just asserts "The crypto project has had 13 years to try and find a problem to solve. It has not found one." without discussing any of the ways people are actually using Bitcoin and other cryptocurrencies today. Reasonable people can debate whether the problems crypto solves are worth the trade-offs but asserting they have no use at all is empirically wrong. Crypto is used by activists, dissidents, international travelers, investors and others. They do not need Stephen Diehl’s blessing for their usage to be 'real.'

Section [2] is wrong in two ways: First, money is not simply a medium of exchange but has other functions as well. Bitcoin (like gold) is a poor medium of exchange but a good store of value. Diehl may not think gold is real money but central banks certainly do. Second he dismisses all of cryptocurrency as bad money but many projects in the space are no longer even attempting to be money. It is possible to think NFTs are stupid but arguing they aren’t good money is missing the point.

Section [3] claims that all private money including cryptocurrencies are equivalent to the fractional reserve wildcat banking era in the US. That’s a bizarre claim to be leveling against Bitcoin or Ethereum which are not backed by anything fractionally or otherwise. I’m guessing Diehl was thinking of this paper comparing stablecoins to wildcat banks:

The comparison is weak. Bank failures of the US wildcat era were not caused by private banking — banks of the era were forced to hold risky government bonds and prevented from diversifying risk by branching across state lines. There have been eras of successful free banking in Canada, Sweden, Scotland, Switzerland and others. But even if you are concerned about fractional reserve private banking — that’s not a criticism of cryptocurrency at all. You don’t need cryptocurrency to do it and that’s not what the majority of crypto projects are doing.

Section [4] asserts that all cryptocurrency projects are unregistered securities. That’s a bit strange, since SEC Chairman Gary Gensler has already declared that the two largest crypto projects (Bitcoin and Ethereum) are not securities — although he does think many other crypto projects are. Diehl doesn’t actually make any arguments — he doesn’t even reference the Howey test, for example. But he does congratulate himself that "The argument laid out in this article is a quite complicated edifice, and requires a large amount of knowledge at the intersection of several fields of study."

This is pretty much typical of all his writing. He makes wild assertions, misses obviously relevant context, lumps wildly different projects together without seeming to notice and then pats himself on the back for his service. Send your coworkers my list of quality skeptics. They deserve more intelligent crypto criticism.

All time high in cryptocurrency crime

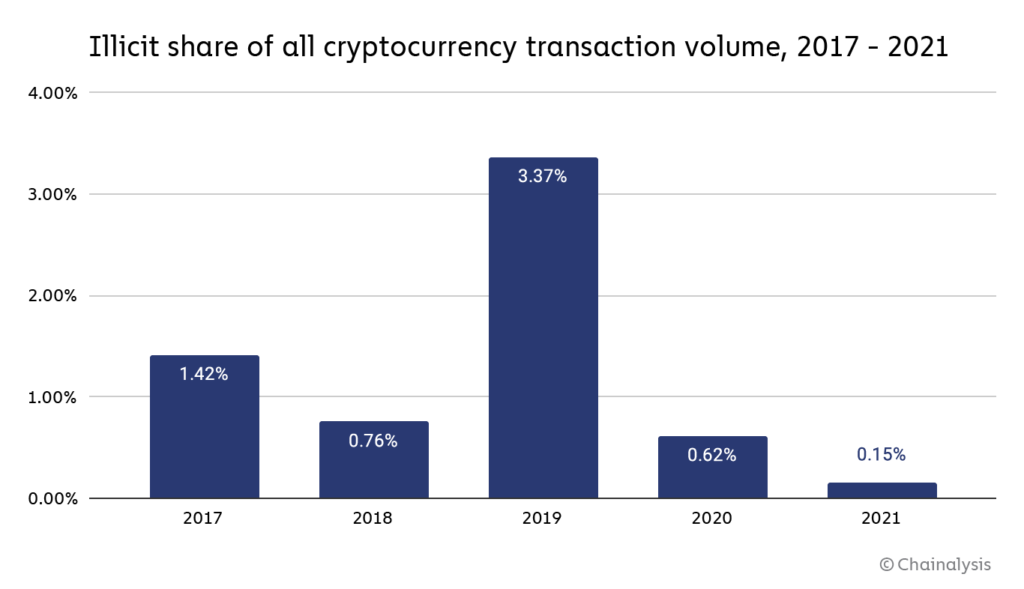

According to blockchain analysis firm Chainalysis criminal activity on cryptocurrency networks reached an all-time high of $14B in 2021, up ~79% from 2020. Top criminal use cases were theft, scams and darknet markets. Users lost ~$7.8B to scams and thefts (up ~82% from 2020, an accelerating trend). DeFi represented ~72% of those stolen funds, with ~$2.8B lost to rugpulls alone.

All time low in cryptocurrency crime

According to blockchain analysis firm Chainalysis criminal activity on cryptocurrency networks reached an all-time low of ~0.15% in 2021, down from ~0.62% in 2020. Legal cryptocurrency transactions grew more than ~7x faster than illicit transactions. Much of the criminal activity that remains came from isolated extreme outliers such as the collapse of the centralized Theodex exchange or the PlusToken ponzi scheme. The IRS seized ~$3.2B worth of cryptocurrency from non-tax criminal investigations in 2021, the FBI has taken down ransomware networks and OFAC has been sanctioning crypto money launderers. Crime is a small and diminishing share of cryptocurrency markets.

Then on Monday he announced he was stepping down as CEO of Signal. I don’t think the two were related but you never know I suppose.

c.f. satirical projects like Matt Levine’s ExcelCoin or Roy Keyes’ CSVChain.