Who owns the monkey?

Plus SBTs still make no sense and Christine Lagarde has no answers

In this issue:

Who owns the monkey?

Nope, still not buying SBTs (reader submitted)

Christine Lagarde has no answers

Live footage of the Terra 2 launch

Who owns the monkey?

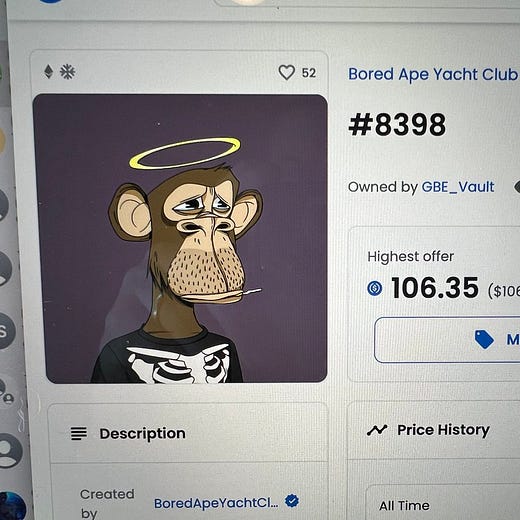

Actor and creator of animated series Robot Chicken Seth Green has been developing a TV show called White Horse Tavern. The show is a series of urban vignettes that mixes live action and animation — most notably the protagonist (played by Seth Green) has been animated into Bored Ape #8398. The Bored Ape Yacht Club (BAYC) NFT collection famously pioneered a licensing arrangement that grants owners of Bored Apes the commercial rights to use them.1

There’s only one small problem: Green no longer has the ape.

Phishing attacks meant to steal people’s NFTs are rampant in the space. In this case Green clicked a link to an attackers website and was tricked into signing a transaction that gave the attacker control of his NFTs. The hacker immediately listed them for sale very cheaply and then ran off into the sunset with the money. BAYC #8398 was sold to a user named Darkwing84 and is now sitting in an address marked GBE_Vault. Whoever owns BAYC #8398 owns the commercial rights needed for White Horse Tavern. But who owns the monkey?

The actual license from Yuga Labs is not great. It reads:

You Own the NFT. Each Bored Ape is an NFT on the Ethereum blockchain. When you purchase an NFT, you own the underlying Bored Ape, the Art, completely. Ownership of the NFT is mediated entirely by the Smart Contract and the Ethereum Network: at no point may we seize, freeze, or otherwise modify the ownership of any Bored Ape.

The line about "ownership of the NFT is mediated entirely by the Smart Contract" seems to imply that the thief is the new owner — the smart contract certainly thinks they are. But the smart contract only governs the movement of the token — the actual IP rights are enforced and protected by traditional courts, and the law here is actually pretty clear: If you steal something it isn’t yours. If you bought something from someone who stole it, sucks for you — it still isn’t yours. Since the ape left Green’s control under fraudulent pretenses, it was stolen and it still belongs to him — at least according to American legal traditions.

In practice nothing is really stopping Green from moving forward with his show — the thief would have to doxx themselves to a court in order to sue, then they would lose because the law does not recognize their claim and then they would be arrested. But that puts everyone involved in an awkward position. If Green can make the show without the token, what does the token actually mean?

Discussions around NFTs are often murky because it is hard to distinguish the map from the territory. The rights are not the same thing as the token which is not the same thing as the image which is not the same thing as the art. Green holds the rights, GBE_vault holds the token, we can all access the image and who owns the art is a matter of interpretation.

Crypto enthusiasts like to say that "code is law" but of course that is naive. Law is law. Cryptographic systems may not be aware of the Law but they still exist within its framework, as all human activity does. But the Law is definitely still coming to terms with disputes about smart contracts. Most contract disputes are about how the contract was executed, but smart contract execution is automatically enforced by the network. Disputes about smart contracts aren’t about whether the contract was followed but whether it was legitimate in the first place.

Seth Green didn’t intend to give away his NFTs but that is what the contract he signed was programmed to do. If he had been able to read the contract he likely would never have signed — but skilled developers can hide exploits in smart contracts that even expert security researchers might miss. There is no way to be completely certain what a smart contract someone else wrote might do. You can’t even be completely certain about the behavior of a smart contract that you wrote yourself. That leaves a lot of ambiguities for the courts to sort through.

In Singapore for example a man used BAYC #2162 as collateral for a loan and it was confiscated when he didn’t pay back the loan on time. He sued for an injunction claiming that he was entitled to a refinancing option and the court agreed. BAYC #2162 is now flagged for "suspicious activity" on OpenSea. No one disputes that the smart contracts all operated as intended.

NFT cynics point to stories like this and conclude that NFTs must be pointless because centralized authorities like OpenSea and the government are still able to intervene. I get where that intuition comes from but I think it is oversimplifying. I’ve written before about how most NFTs are centralized and that doesn’t interfere with their value proposition. Smart contracts only eliminate disputes around execution not validity — but there are a lot of contract disputes around execution and a lot of contracts never get written to avoid them! Eliminating execution disputes would be really valuable.

Traditional IP agreements using existing systems are extremely cumbersome. NFTs show real promise in creating greater efficiency and liquidity in IP markets, even if they are still ultimately backstopped by the rule of law. The map is not the territory. But the map is still useful!

Nope, still not buying SBTs

"One thing that SBTs have going for them is that ETH/BTC are the first widely adopted and credible forms of private-key identity. That network might create enough new demand for private-key identities to make decentralized credentials plausible." — AW

"For credentials on SBTs, here’s my counterargument: 1) blockchain costs will go down over time, 2) writing to blockchain is expensive but reads are cheap, spending $20-100 to write a Stanford degree to the blockchain isn’t unreasonable and 3) at a tipping point of web3 adoption there would be enough people with wallets used to signing things that the UX/habit benefits will make the gas fees worth it. Thoughts?" — UJ

Last week I touched on soulbound-tokens (SBTs) a proposal from Ethereum founder Vitalik Buterin for encoding degrees, credentials and other trust relationships as tokens on the blockchain. I think the proposal takes advantage of a fundamental misunderstanding people have about blockchains: a blockchain stores data but does not make it trustworthy. It just makes it impossible to copy or erase.

So if you have a cryptographically signed degree from Stanford (good for you!) you can store that cryptographic signature yourself, or Stanford could store it in a database or you could pay to have it engraved forever on the blockchain. Then when a potential future employer wanted to see that degree you could show them the copy you kept, point them at the Stanford database or have them scan it off of a blockchain. For credentials the provenance / method of delivery make no difference. Employers don’t care how the degree is stored, only how it was issued.

Even if you believe that the community of users comfortable with private key management will continue to grow (I do) and you think blockchain space will get cheaper over time (I do not) it still wouldn’t make sense to store credentials on a blockchain. It doesn’t make anything better except for people who have magical reasoning about what blockchains actually do.

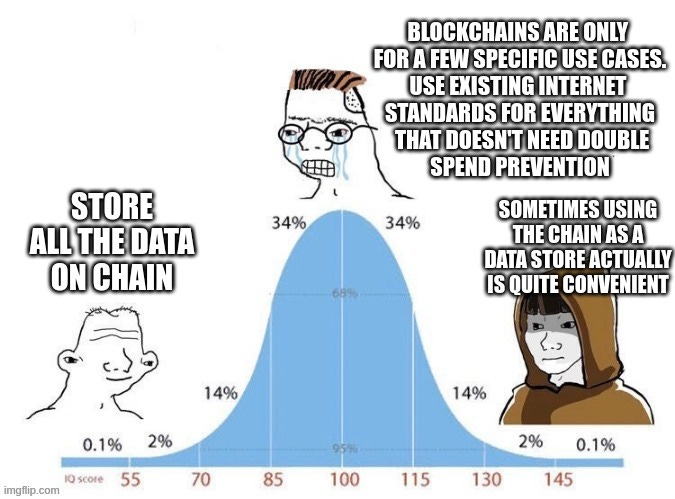

Which brings us to Vitalik’s midwit meme at the top of the section. He argues that when enough people are reading/writing to the blockchain for transactions it will be more convenient and practical to store identity information on the blockchain as well. Vitalik believes blockspace will eventually be cheap enough that the convenience will overcome the cost — but even if you stipulate that blockspace will eventually be cheap I’m still not convinced SBTs will be useful.

The underlying presumption of SBTs is that there is market demand for a shared credential protocol *and* that demand can’t be satisfied by a centralized service. I’m not sure I understand either claim. We have lots of centralized credentialing services: credit score companies, phone books, universities, Yelp. There are even credential aggregating services like RottenTomatoes or OpenCritic.

Credential aggregating services today tend to have a focus, such as aggregating movie reviews on RottenTomatoes. The aggregation there makes sense — users who want to read a movie review likely want to other movie reviews. It would make less sense to aggregate reviews across movies and books — it isn’t obvious that users looking for movie reviews are interested in book reviews and vice versa. The less tightly related the credentials are the less obviously they benefit from aggregation.

Aggregating different kinds of credentials into a common format also imposes limitations. Sharing a format across all college degrees is probably useful but a common format for all education certification may not be as useful and sharing a format with credit histories or Uber passenger reviews is probably not helpful at all. The problem isn’t centralization, its standardization. The reason there isn’t a 'universal' credential aggregator isn’t because it is impossible to build centrally. It’s because nobody actually wants that service.

I remain comfortable in my midwittery. SBTs are an unnecessarily expensive solution to a problem no one actually cares to solve. We don’t need a blockchain for that.

Other things happening right now:

The Ropsten test network is the first Ethereum test network to begin attempting the Merge — Ethereum’s planned transition from proof-of-work mining to proof-of-stake validation. The transition failed dramatically this week taking the test network down entirely for a while. The crash was the result of an "attack" apparently by a rogue testnet miner taking advantage of how cheap it is to acquire mining share on test networks to simulate extreme network conditions. This particular attack would not work on mainnet Ethereum.

Adam Neumann, co-founder of the famously disastrous co-working startup WeWork, has just raised $70M for a company called Flowcarbon that plans to sell a "Goddess Nature Token" as an on-chain carbon credit. This is textbook magical thinking about blockchains — the blockchain proves who bought and sold a credit but it doesn’t prove anything about whether carbon was sequestered or not in the real world. Carbon credits on the blockchain make even less sense than carbon credits generally. Anyone giving Adam Neumann money at this point is clearly being findom’d.

Here is Christine Lagarde, head of the European Central Bank, becoming visibly uncomfortable and refusing to answer a simple question about how the ECB balance sheet will ever be unwound.

Presented without comment:

Disclaimer: I own a Bored Ape along with several other Yuga Labs NFTs. You can learn more about my holdings on my disclosures page.