Warren Buffett can't have my Bitcoin

Plus the Madness of the Apes and the new frontiers of bling

In this issue:

Madness of the Apes

Centralized doesn’t have to mean law abiding

Warren Buffett can’t have my Bitcoin

The new frontiers of bling

Madness of the Apes

We’ve talked any number of times about the Bored Ape Yacht Club, the most expensive and prominent NFT collection in the world right now.1 On Saturday Yuga Labs (the creators of the BAYC) and their partner Animoca Brands released a collection of NFTs that represent property in their upcoming metaverse (Otherside). Some Otherdeeds were given to holders of previous Yuga collections and the rest were sold to the public at a flat rate of 305 APE, worth a little over ~$6k at the time.

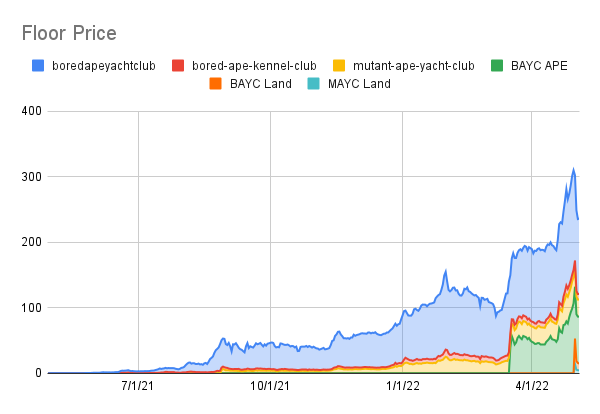

Historically participating in a Yuga Labs sale has been extremely lucrative. The original BAYC collection sold for 0.08E (~$200 at the time) and eventually turned into a collection of assets worth ~300E (~$850k) at the time of the Otherside sale. Anyone who participated in the original Mutant ape auction turned ~3E (~$10k at the time) into a collection of assets worth ~50E ($140k) by the Otherside sale. Here’s what that growth looks like over time:

There were 100k Otherdeeds released — 30k were given to BAYC/MAYC holders, 15k were held by founders and the remaining 55k were available to the public. Given the enormous profits in the graph above there were a lot more than 55k people who were excited about the chance to buy into a Yuga Labs project.

In most markets when there is more demand than supply the price will rise until a balance is reached — but NFT projects (Yuga Labs projects included) are usually deliberately underpriced at launch to create a pop in the secondary market that builds hype and attention. That’s not unlike how IPOs are usually priced — the idea is to create early gains that reward the first buyers for the risk they assumed by buying first. In traditional equity markets this strategy is common but controversial — in the NFT markets it’s just conventional wisdom.

Yuga tried to moderate the resulting demand by restricting access to the sale only to those who completed an onerous know-your-customer identification process with no explanation a few weeks before — but there were still many more people eager to buy than there were NFTs available for sale. The result was the digital equivalent of a Black Friday stampede. Collectively buyers paid Yuga ~$320M for the Otherdeeds but they paid Ethereum miners ~$172M in gas for the privilege to do so. The entire Ethereum blockchain was congested for roughly three hours.

None of this was a surprise to anyone once the mechanics of the sale were known. There are a lot of different ways to mitigate gas wars — auctions, raffles, snapshots, even a lower limit per wallet. Yuga knew how many people had gone through the registration and Yuga set the rules for how many plots people could buy. The resulting traffic was both predictable and avoidable — which makes it seem suspiciously like causing this problem might have been a calculated choice:

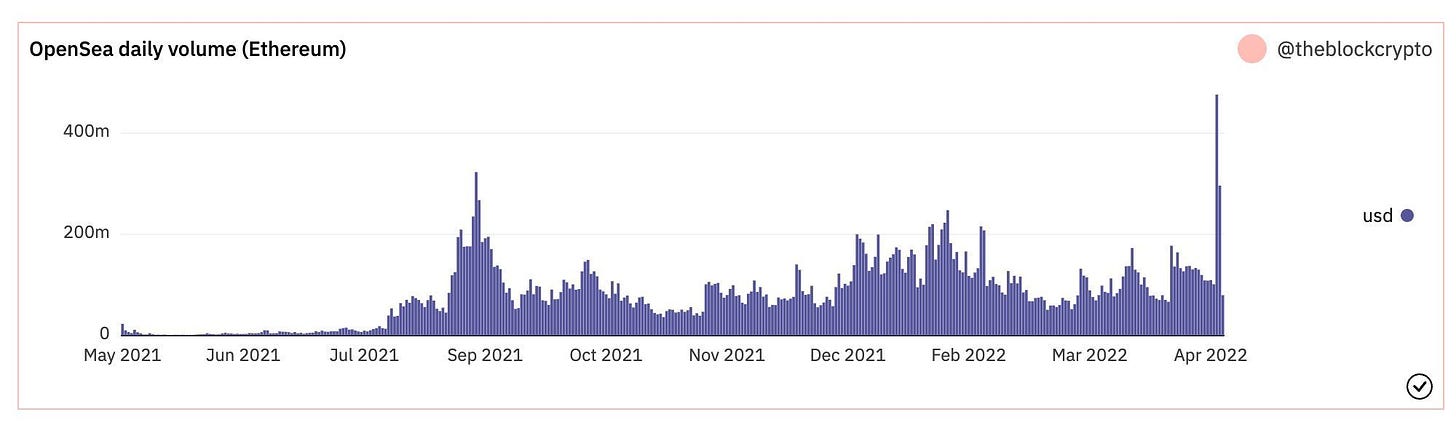

Whatever one thinks of the launch strategy it definitely did build hype. Since launch there has been ~220k ETH (~$638M) worth of volume, already making it the #5 project of all time in total volume on OpenSea. In the past seven days Bored Apes, Mutant Apes and Otherdeeds generated more than $1B in secondary sales. OpenSea broke it’s previous volume records by a wide margin:

I wonder how the Wall Street Journal will cover this explosive recent growth?

How embarrassing. Maybe someone can recommend them a good newsletter to keep them better informed. I offer gift subscriptions.

Centralized doesn’t have to mean law abiding

"One thing that I still ponder is how people tend to have their crypto in centralized exchange, which seem like they would be just as susceptible to governmental intervention as bank accounts. If the majority of people are unlikely to ever go off-exchange, is Bitcoin still providing the core value? For now it seems like exchanges are simply flying under the radar and not worth the country's efforts to freeze/limit outflows." — A.S.

From the perspective of the Bitcoin network the only users that exist are the ones that control private keys. Some of those users are individuals and some are exchanges that represent the shared interest of many individuals, but Bitcoin doesn’t care. It can only offer decentralization to the people who are actually using it.

In the long run Bitcoin transactions will become too expensive for retail individuals, so the majority of Bitcoin’s users will effectively be banks. But a world of Bitcoin banks is very different from a world of fiat banks because governments control access to the banking network but no one controls access to Bitcoin.

You can’t launch a fiat bank without government permission because you can’t access the SWIFT network without government permission. But no one can regulate access to Bitcoin or impose requirements on reselling that access to consumers. Anyone can launch a Bitcoin bank. Fiat banks serve the government — Bitcoin banks serve only their customers. As long as Bitcoin itself remains decentralized anyone can launch a centralized service on top of it that routes around whatever restrictions governments might try to impose.

It was true for a while that cryptocurrency was flying under the government’s radar but those days have long passed. The government of Nigeria has openly acknowledged that it own currency is losing the competition against Bitcoin. El Salvador and the Central African Republic adopted it as legal tender. China banned it. President Biden issued an executive order calling for American leadership in the space.

There are a thousand different ways for governments to approach the rise of crypto but pretty much no one is ignoring it anymore.

Other things happening right now:

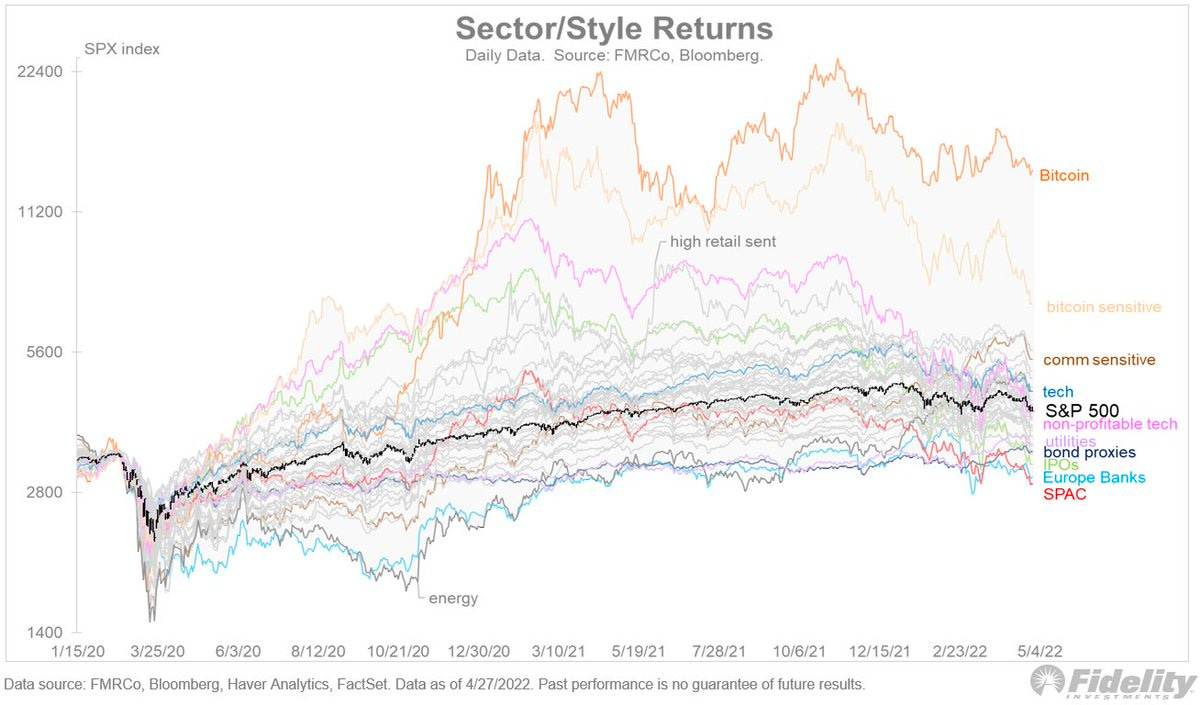

The pandemic economy in one chart:

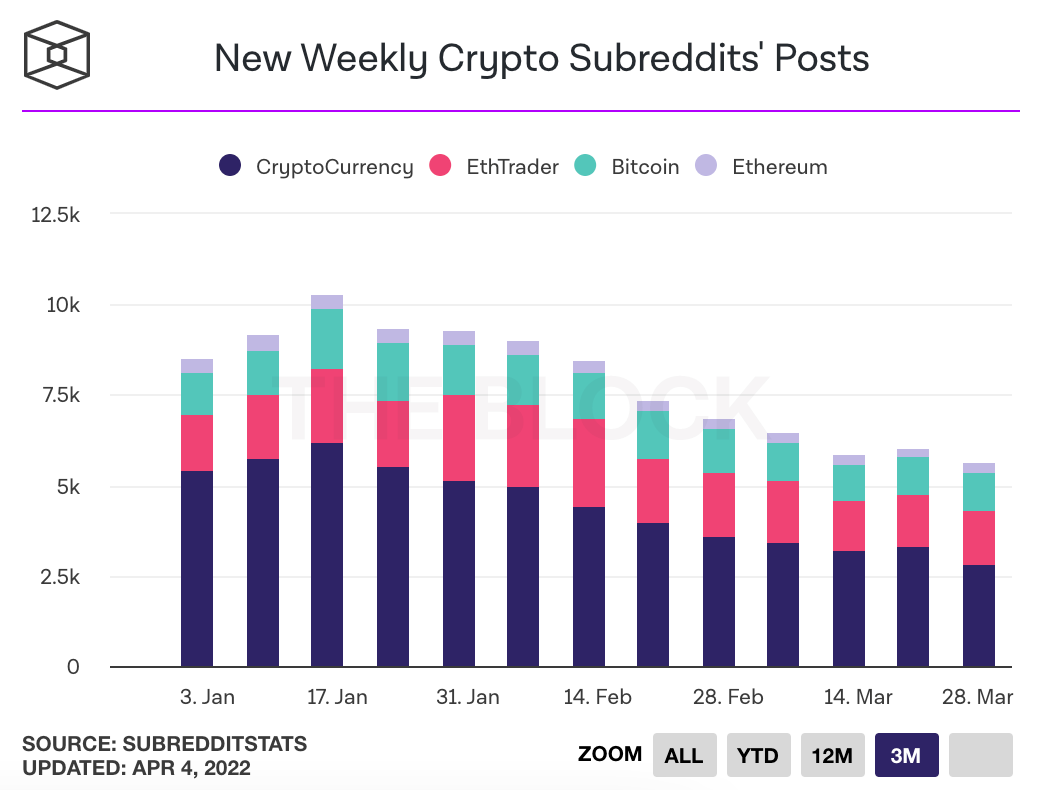

In spite of Reddit’s attempts to court the crypto community the conversation seems to be steadily migrating to other platforms, most notably Twitter.2

Over the weekend Warren Buffett once again emphasized his distaste for Bitcoin by saying he wouldn’t buy all the Bitcoin in the world for $25. Part of the reason Warren Buffett isn’t going to buy all the world’s Bitcoin for $25 is because he does not think Bitcoin is valuable — but another important reason is that I own some of the world’s Bitcoin and I’m not selling. He can still subscribe to my newsletter for free, though.

American rapper Gunna wore a diamond-encrusted Ledger hardware wallet to the Met Gala. Fashion and wealth-signaling are starting to natively incorporate cryptocurrency into the culture.

Disclaimer: I worked at Reddit from late-2017 to mid-2019. I didn’t work on crypto features.