It’s not illegal to be unconstitutional

Plus the true price of nickel and Floyd Mayweather has not learned his lesson

In this issue:

The true price of nickel (reader submitted)

It’s not illegal to be unconstitutional (reader submitted)

Star Citizen isn’t Fyre Festival (reader submitted)

The true price of nickel

Hey @Knifefight, is there any good read on nickel? Seems fascinating." — BB

Nickel is outside our usual crypto markets focus which is why I haven’t covered the story there yet — but it is definitely startling to watch the price of nickel violently whiplash around in the last week or so. The nickel story starts (as a lot of recent market stories do) with someone taking a short position and regretting it.

There are two possible reasons that you might short the price of nickel on the London Metals Exchange (LME). One reason is because you are a speculator who is betting the price of nickel will go down. Another reason is because you already own a lot of nickel (or more likely a lot of nickel mines) and you would like to hedge your risk. You are betting the price of nickel will go down but in your heart you actually are hoping it will go up.

Regardless of why you want to bet against the price of nickel, the way you do it is by borrowing someone else’s nickel and selling it. Eventually when you want to close the position you buy back the nickel you owe and return it to the lender. In the meantime you pay interest on the loan.

If the price of nickel goes up a little you are sad because you will pay more for the nickel you repay the lender than you got for the nickel you borrowed. If the price of nickel goes up a lot then you and the lender are both sad. You are sad because you are bankrupt now and the lender is sad because their nickel is gone and since you are bankrupt no one is going to buy it back for them.

To make sure that doesn’t happen the LME requires you to keep some money on the exchange as collateral (known as margin). If the price of nickel goes up too much the LME will close your position and use your margin collateral to cover your losses, leaving you with nothing. That’s called a margin call. It’s kind of like an automatic self-contained bankruptcy for that account.1

If your short position is margin called the exchange will force you to buy nickel even if you think the price growth is temporary or artificial — they won’t take the risk that you might not be able to pay back your loan. So you will become a forced buyer, which will drive the price up even further and create a feedback loop that forces other short sellers into margin calls as well. That’s called a short squeeze — it’s what Redditors were trying to do to hedge funds who shorted Gamestop.

That means a sudden rise in the price of nickel — for example, if the world’s third largest nickel producer was suddenly ejected from the world economy — can have a cascading effect where short positions are forced into buying, driving the price up and margin calling more short positions. Here’s what that looks like:

So margin calls as a system are kind of a double-edged sword. In isolation they help insure the lender and the exchange against the risk of the short seller going bankrupt — but collectively they can turn a minor shock into a major one by forcing margin traders to close their positions at the worst possible moment.

The price here was real in the sense that trades were really happening but it was also in some important sense not real. Remember a lot of the shorts being margin called were held by nickel producers — the price of nickel going up was not actually making them a worse credit risk. They actually had a lot more wealth, it was just buried in nickel mines and not easily deposited on an exchange for collateral. They had plenty of nickel to cover the short but not enough cash to cover the margin. They were being bankrupted on a technicality.

This wasn’t just a handful of producers, either — according to the LME around four or five of the brokers who trade on the exchange would have been bankrupted. That would have been bad enough but the collapse of a string of nickel producers and brokers would inevitably have sent the price even higher and potentially destabilized the entire market. Obviously you can relax margin requirements but (a) the LME already did that and (b) that doesn’t really eliminate risk it just absorbs that risk into the LME itself.

So the LME did something much more drastic. They retroactively cancelled all trades above $48k and then reopened the market very cautiously with tight bounds on how far the price was allowed to move in a day. Matt Levine has some good commentary on the strangeness of that approach. It did seem to calm the market down initially as prices returned to pre-surge levels, but on Wednesday the market surged ~15% (the daily limit) and the LME closed trading again.

I personally expect a lot of commodities markets to experience whiplash like this over the next few years. In part because Russia is a major producer of many commodities: oil, wheat, gas, rare earth metals, etc — but also in part because of the pendulum swinging back away from globalization. The move from inside money to outside money will increase demand for commodities, in particular for physically delivered assets as opposed to paper liabilities.

Lower supply, rising demand and diminished liquidity will put every major commodities market under pressure. Brace yourself.

It’s not illegal to be unconstitutional

"What chance does Bitcoin have to become legal tender in the US? Could states decide to make Bitcoin legal tender individually?” — PS

The only currency recognized federally in America as legal tender is (obviously) the U.S. Dollar, but a handful of states also recognize gold and silver as legal tender. There are no states that recognize Bitcoin as legal tender — mostly because Article 1, Section 10 of the US Constitution specifically says "No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts."

So it would be unconstitutional for a state to pass a law recognizing Bitcoin as legal tender. They can still do that, of course — it is not illegal to pass an unconstitutional law, it just won’t be impactful because it will be struck down by the courts if it ever inconveniences anyone. Even if a law like that passed and was never challenged it probably still wouldn’t actually matter though, because legal tender status is a somewhat obsolete concept.

When the constitution was written people still thought of gold as being money and paper currency as being a kind of gold-denominated debt. People did not consider $1 [of banknotes] to be worth as much as $1 [of gold]. Gold was gold, dollars were just a promise that someone, somewhere was looking after your gold for you. People were understandably skeptical of that promise and treated banknotes as worth less than their face value to discount for the risk.

Declaring the US dollar as legal tender "for all debts, public and private" was a way of enforcing the dollar’s peg to the gold standard by preventing banks from having separate debt markets for gold and dollars. You could count on the bank treating your $1 [of USD] as being worth $1 [of gold] because the law required them to accept either currency when paying off $1 [of debt].

In other words, legal tender laws are about defending the gold standard — they no longer make sense in the modern world of free-floating exchange rates. It is not possible to collapse the debt markets for USD and gold because there is no fixed ratio between gold and USD to enforce. You are legally entitled to pay your debts back with USD but USD is also what the bank wants from you. The law is redundant.

So the complete answer to your question is that making Bitcoin legal tender would be unconstitutional but also probably pointless so it’s quite possible no one would bother to stop you. State legislatures are unpredictable and there are fifty of them, so it’s easy to imagine one or two passing a law like this just for the symbolism — Louisiana recently passed a resolution formally thanking Satoshi for his work and commending him for his success. It was a thoughtful gesture! A law that made Bitcoin legal tender would probably matter about the same amount.

Star Citizen isn’t Fyre Festival

"Star citizen is not a scam! It’s fun! And beautiful! Even though there are no NFTs in it, I think it's actually an interesting example of what a good interactive-community-NFT-game thingy could look like. In a world where publishers spend hundreds of millions to develop games privately and need to ensure it sells, it's an under-appreciated experiment in having the audience pay for what it wants more directly." — DS

That is … pretty fair pushback. I didn’t actually say (or mean) that Star Citizen was a scam, but putting it on a list with Fyre Festival and WeWork does cast it in a pretty unflattering light. My point with that example was how all three were able to raise large sums of money by selling hype around a potential future — but WeWork promised something impossible and Fyre Festival promised something they were fundamentally incapable of doing. Star Citizen was just overly optimistic about how quickly they would be able to deliver. I’ve worked on enough tech projects to know that an optimistic roadmap doesn’t make you a scam. I apologize for casting inadvertent shade on the good citizens of Star Citizen.

Other things happening right now:

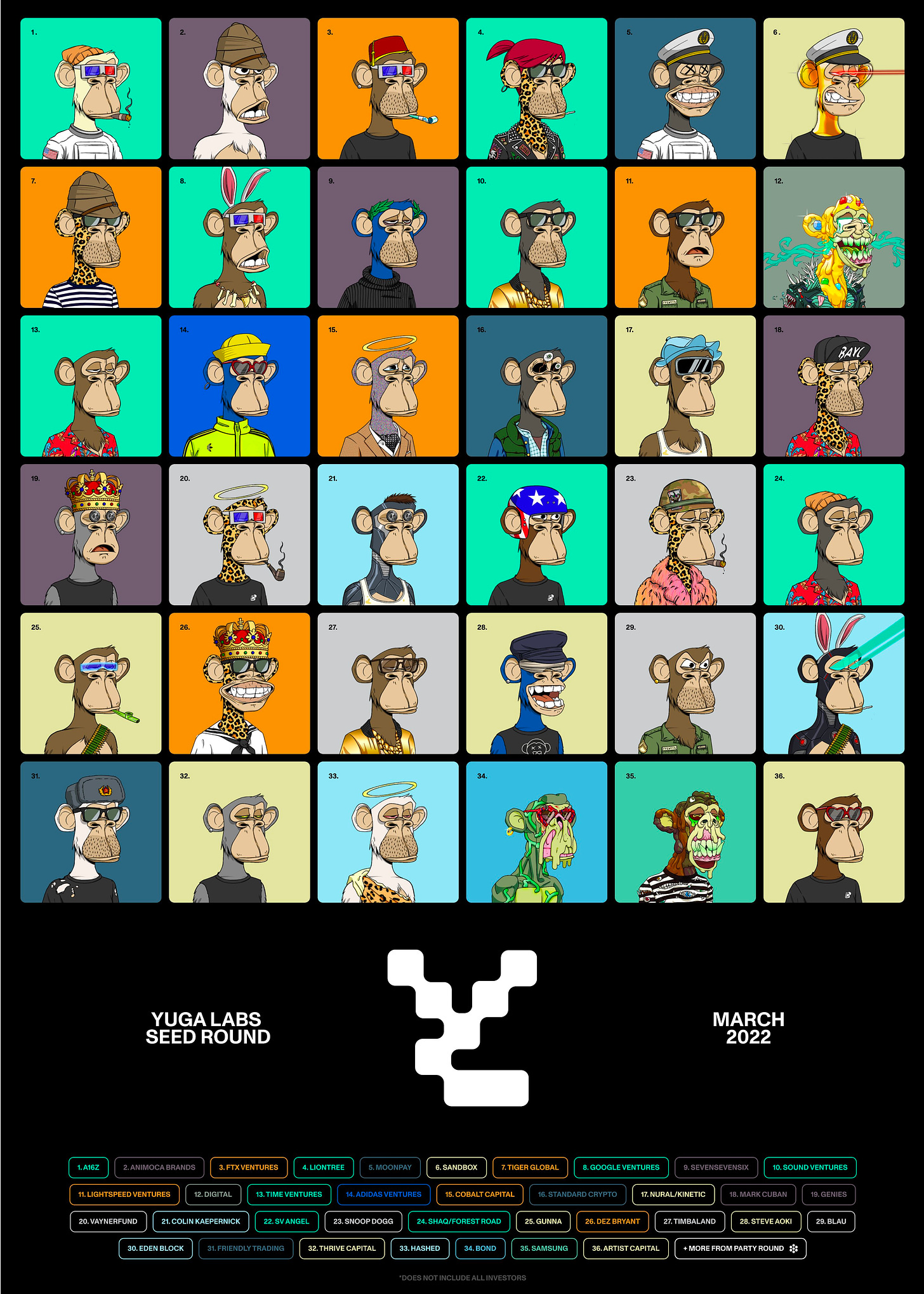

Yuga Labs (the company behind Bored Ape Yacht Club) raised ~$450M at a valuation of ~$4B. They are calling it a seed round but at those prices I think it would be fairer to call it a coco-de-mer. I’m sure it wasn’t hard to find investors, though. Traditionally start-ups lose money in their first year — Yuga Labs had a profit margin of ~92%. You can see the "seed" investors in the image below. As a show of dominance Yuga Labs made them all buy an ape and told the 37th investor they weren’t invited because it would ruin the square. (I assume.)

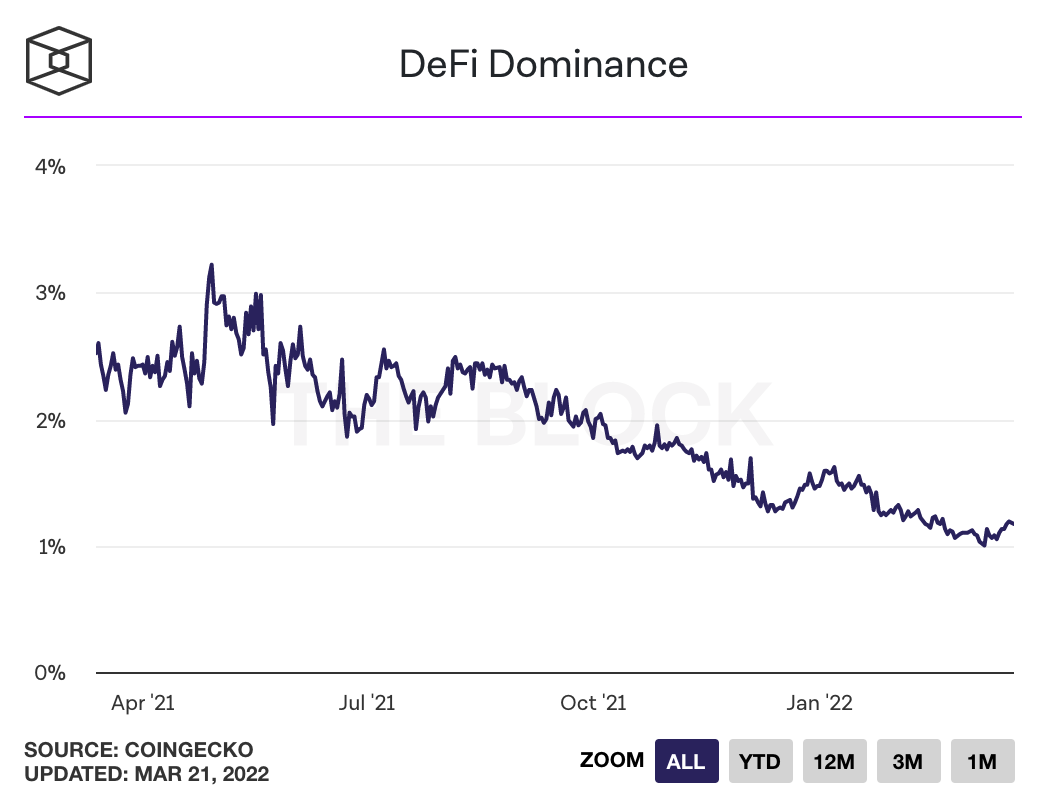

Tough times for DeFi. NFTs have captured a lot of the speculator audience and the product market fit for non-speculative usage has been pretty limited so far. If NFTs turn out to be a more fun casino the only proven use case DeFi has left is letting people borrow against their ETH. That’s not nothing but it’s a long way from the original promise of DeFi. The chart below shows the percentage of the global cryptocurrency market cap that comes from DeFi projects (colloquially known as 'dominance’).

We’ve spoken before about how former boxer Floyd Mayweather was fined ~$600k for promoting a series of shady ICOs back in 2018. Apparently he didn’t learn his lesson because he is back promoting a new NFT collection. Mayweather’s return tells you something about how effective SEC enforcement has been in discouraging bad actors.

Margin calls can happen in both directions (long and short) but for the purposes of this story we are focused on margin calls on short positions.