Wait, was that illegal?

Plus the Council of Concern Trolls is concerned and the ineffable priorities of the SEC

In this issue:

Wait, was that illegal?

Lido and the threat of Liquid Staking

The Council of Concern Trolls is concerned

The ineffable priorities of the SEC

Wait, was that illegal?

Back in September of 2021 we talked about the firing of Nate Chastain from OpenSea. Chastain admitted to secretly buying NFTs from collections just before they were promoted on the front page and then selling them shortly after, essentially trading on his inside knowledge about what collections were about to be promoted. Here’s what I wrote at the time:

While it’s fairly obvious that what Chastain did was both wrong and ill-advised, it’s not at all clear that it was illegal. It feels like insider trading but insider trading rules apply to securities, not fine art. Pretty much everyone in the entire NFT world would prefer that NFTs remain oddities rather than securities. So a very obvious problem that looks awfully similar to very familiar problems in securities is awkward.

Turns out it was definitely super illegal. On Wednesday Chastain was charged with wire fraud and money laundering, each with a maximum sentence of 20 years in prison. Chastain sold 45 NFTs over the course of several months for ~2-5x what he paid for them, netting a total of ~19 ETH (~$60k at the time).

The charges are notable for a couple of reasons. One reason is that in spite of the prominent framing of "insider trading" the SEC did not co-announce the indictment and the charges do not mention securities at all. That means it probably isn’t a sign that NFTs are about to be reclassified as securities — but it is probably a sign that authorities are preparing an enforcement crackdown.

Another reason the charges are notable is that by the standards of market abuses in cryptocurrency, ~$60k barely merits a participation trophy let alone 40 years in prison. There are countless similar market abuses in the crypto market — and most of them are dramatically larger in scope and consumer harm than Chastain flipping NFTs before they are featured in a homepage promotion.

For example someone (or someones) traded hundreds of thousands of USD worth of tokens right before they were featured in a Coinbase Asset Listing announcement. Two friends from Utah bought ~$100k worth of CloneX NFTs the day before they were acquired by Nike and bragged about it on Twitter. Madison Cawthorn made $150k pumping and dumping the "Let’s go Brandon!" coin. ZachXBT and Coffeezilla have made entire brands out of exposing these kinds of abuse.

If Chastain’s actions have him facing down 40 years in prison there are probably a lot of people in the NFT markets who are freaking out right now.

Lido and the threat of Liquid Staking

Ethereum devs are now predicting the upcoming migration to proof-of-stake (PoS) will land sometime in August — although the Merge has been "almost ready" for literally years now so feel free to apply a healthy dose of skepticism. In fairness, some major milestones have recently been reached (the beacon chain, live testnet merge, etc) so perhaps we finally are nearing the moment of truth.

I have written before about how I am deeply bearish on proof-of-stake. Advocates usually market proof-of-stake as environmentally friendly because it uses less electricity, but that comparison is misguided and deceptive. The environmental costs of proof-of-stake are more obfuscated than the environmental costs of proof of work, but they are very real and ultimately larger. The intuitive shortcut "less electricity means environmentally friendlier" is very appealing but also completely wrong.

Another entirely different problem with proof-of-stake is that it doesn’t actually work. Remember the point of a blockchain is to make sure no one can control access to the network. If any authority can control access to the network they can just replace the blockchain with a traditional centralized database. It would be able to do all the same things much faster and more cheaply. The problem is that proof-of-stake just ends up rebuilding that central authority but with extra steps.

In a proof-of-work (PoW) network miners demonstrate their loyalty to the network by sacrificing electricity and computing power. In a proof-of-stake network validators demonstrate their loyalty to the network by staking capital. Validators like the part where they are paid for their services! But they are less fond of the part where their money is locked in place while it is staking. If your money is locked up you can’t do any of the interesting money things with it.

So instead of staking their own capital directly a lot of ETH validators choose to use a staking service where they deposit ETH to be staked on their behalf and get back a tradable receipt for their share of the staked ETH. The largest staking service like this is a DAO called Lido Finance. They control about ~1/3 of the ETH currently staked on the Ethereum beacon chain.

Investors in Lido deposit ETH to be staked and receive stETH and LDO (a governance token for the Lido protocol). stETH isn’t quite the same thing as ETH (it generally trades at a discount) but you can use it in a lot of the same ways, such as providing liquidity to DeFi protocols to earn fees or as collateral for a loan. Staking through Lido is more profitable than staking directly with the network because you can still use that capital to do other things.

The problem is that this is a self-reinforcing loop: the more people who use stETH the more useful stETH will be. Deeper and more liquid markets will make the stETH/ETH discount smaller and more services will accept stETH as payment. Liquid staking services have a natural network effect: they are most efficient when everyone is using the same one. But if a majority1 of validators are staking via the same service that service has become a de facto authority.2 The blockchain is vestigial.

The Council of Concern Trolls is concerned

A group of 26 self-described technologists lead by human papercut Stephen Diehl published an open letter to congress this week warning of the dangers of public blockchains, alongside a blitz of pre-arranged coverage starting with a glowing piece in the Financial Times. The letter urges Congress to "consider our objective and independent expert judgements to guide your legislative priorities" and personally I find it refreshingly candid to appeal to authority using an appeal to authority.

Other things happening right now:

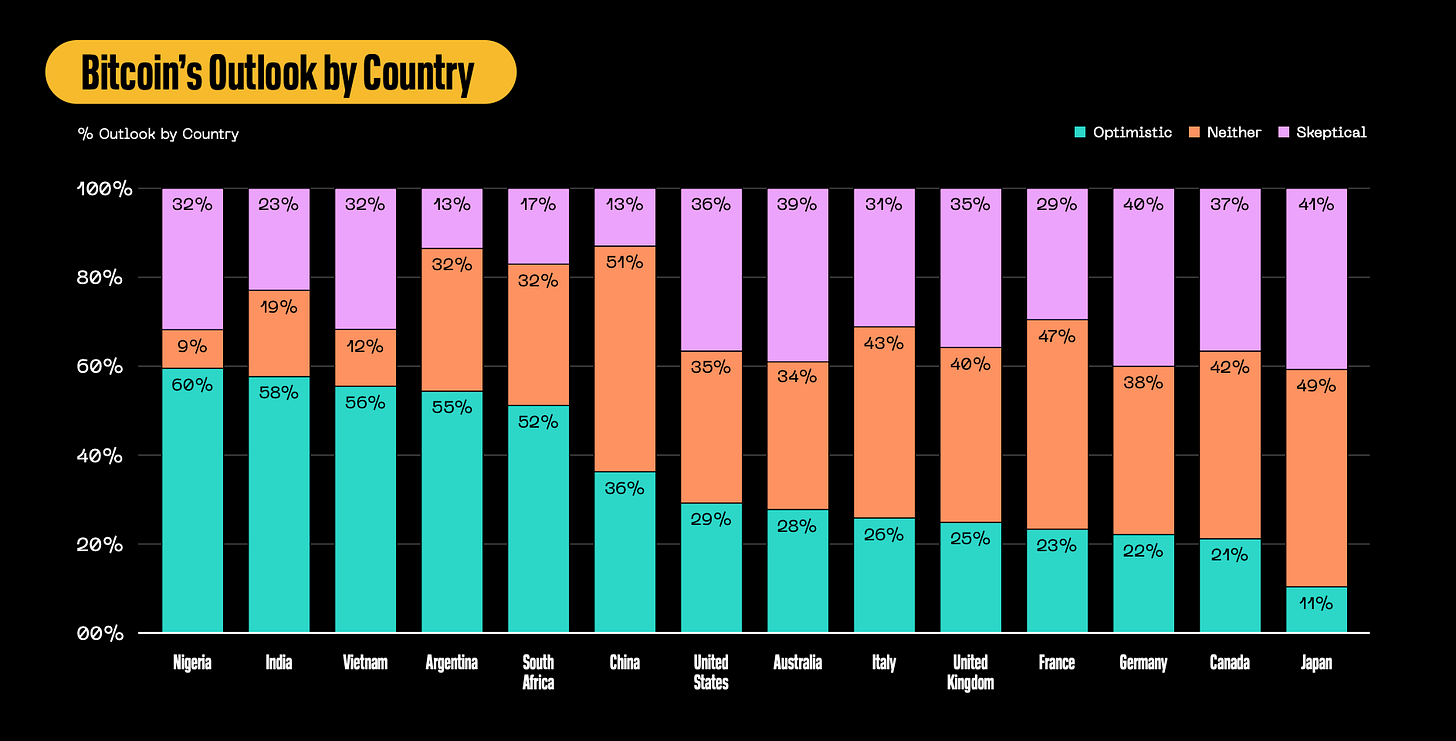

Block, Inc just released a fascinating set of survey results describing people’s knowledge and perception of Bitcoin around the world. Particularly noteworthy to me was how optimism around Bitcoin was so much stronger in countries with weaker economies and less stable currencies. The survey was of ~9500 adults worldwide inside Block Inc’s Cash App.

The SEC has yet to provide clear guidance on how to apply the Howey test to crypto assets or what the rules around stablecoin yields and disclosures should be, but they did find the time to make a series of passive aggressive video shorts making fun of retail investors who buy meme stocks and cryptocurrency. Investor protection in action!

Presented without comment:

Technically it’s even worse than that! The security guarantees of the network start to diminish once a single entity controls >1/3 of the network, which Lido already does.

Since Lido is a DAO it aspires to be decentralized itself, but that doesn’t really solve the problem it just pushes it one recursive layer deeper. Even if you are bullish on DAOs in general (I personally am not) the best case scenario is that Lido is a network-within-a-network whose attack surface is smaller and therefore more vulnerable. It’s increasingly tiny turtles the whole way down.