The Secret to Infinite Pizza

Why are Bitcoin skeptics satisfied with bad arguments?

Inside this issue:

The Secret to Infinite Pizza

A seat at the big kids table

Food for bulls

The Secret to Infinite Pizza

Over the last week or so Samantha LaDuc (founder and CEO of LaDuc Capital) has been arguing with the major accounts of Bitcoin Twitter about the value and purpose of Bitcoin. The conversation started with LaDuc retweeting Caitlin Long of Custodia Bank to ask why anyone would ever save in Bitcoin and it culminated in this long, meandering tweet in which she declared that since Bitcoin is not sanctioned by the state it is ROGUE MONEY. Bitcoiners obviously fell in love with that branding and immediately co-opted it.

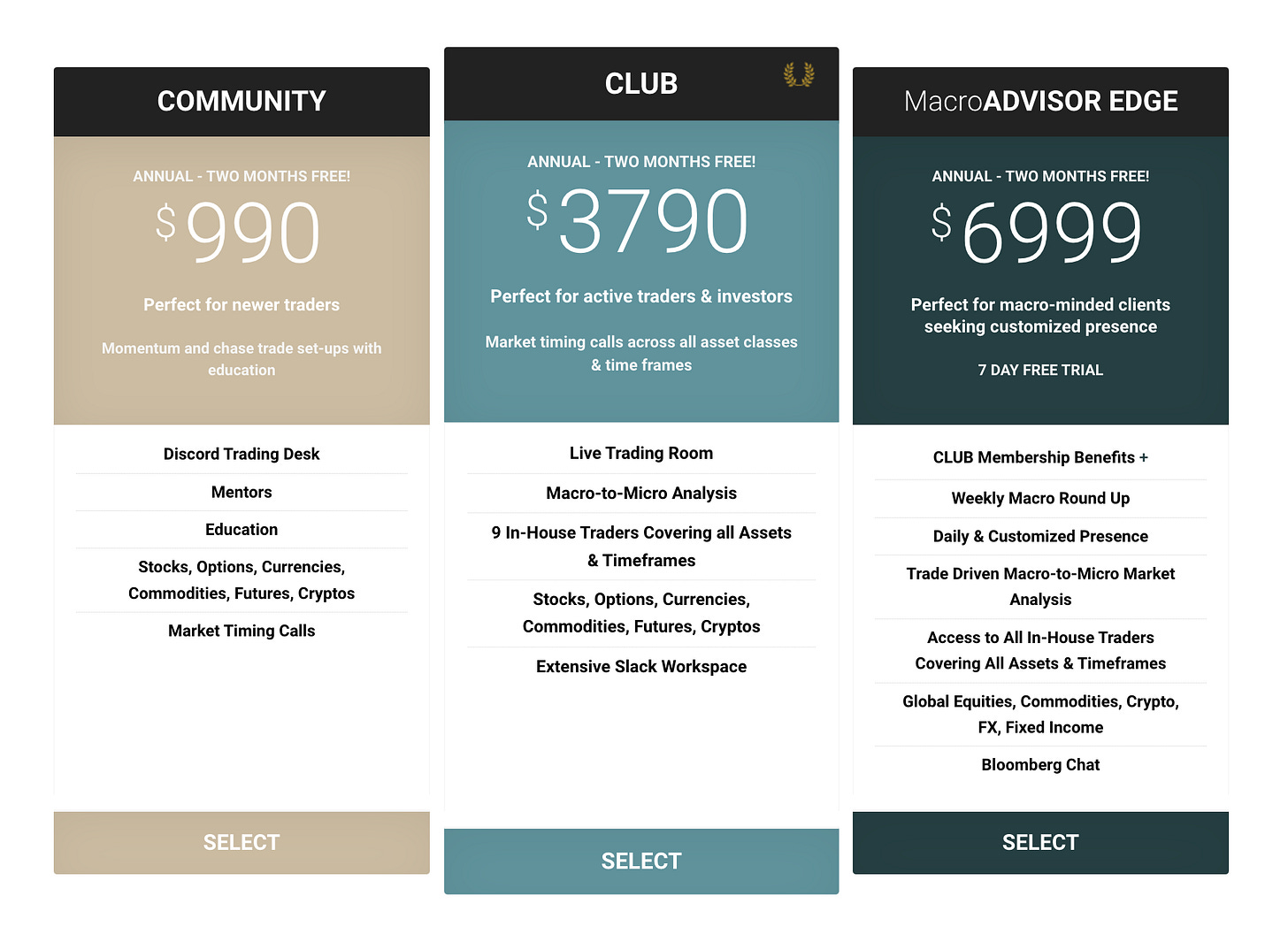

LaDuc would very much like you to believe that she makes her money by trading, but as a general rule the people who make money from trading do not sell trading advice. LaDuc’s actual job is not to predict the market, it is to convince a certain segment of investors that she is good at predicting the market. She is engaging with the Bitcoin community largely to market her subscription trading advice service:

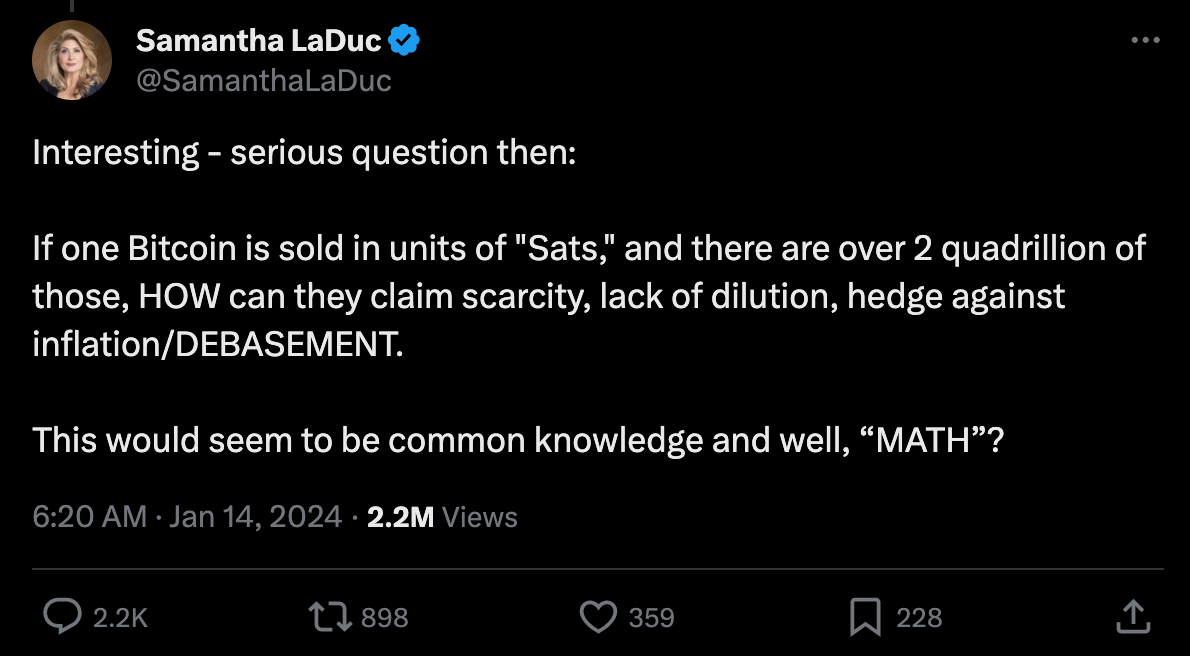

I don’t think LaDuc’s arguments are all that interesting and I don’t feel like rehashing them here. The market decides what is money, not the state. But one thing she said did strike me as interesting:

Sit with this argument for a moment. It’s wrong, obviously — the fact that you can divide Bitcoin into smaller pieces doesn’t make it less scarce for the same reason that cutting more slices into a pizza doesn’t give you infinite pizza. A child could tell you why this argument doesn’t make sense. In fact, child psychologists have studied this exact concept (it’s called Piaget conservation) and most children master it somewhere between 6 and 11 years old.

My point is not that I think LaDuc is stupid — I don’t have that impression. I think she is engaging in a deliberate (and probably effective) organic marketing campaign for her business. So I am less curious "Why does Samantha LaDuc believe this obviously bad argument?" then I am curious "Why does Samantha LaDuc believe this obviously bad argument will appeal to her target audience?"

"Bitcoin isn’t really scarce because it can be divided" has been a mainstay of Bitcoin skeptics for a long time. Here’s Frances Coppola making a variation of that argument back in December of 2020:

There are plenty of legitimate arguments to be made against Bitcoin: both practical arguments about whether it works and moral arguments about whether we should want it to. So it is interesting that arguments built on a childish, easily debunked fallacy are so durable. What is the appeal?

Here’s another example of a surprisingly persistent bad argument, this time from Jamie Dimon of JPMorgan Chase:

"I think there’s a good chance … Satoshi is going to come on there, laugh hysterically, go quiet and all bitcoins will be erased." — Jamie Dimon

It is fascinating to me that a smart, capable individual like Jamie Dimon would go on national television and say something as nakedly dumb as "Satoshi is going to erase all the bitcoins." Dimon is plenty smart enough to understand the basic mechanics of Bitcoin and JPMorgan Chase is literally an authorized participant for several of the Bitcoin ETFs, so he has in-house experts who can explain it to him.

The easy explanation for why people say dumb thing is that they are dumb — but I don’t think that explanation fits the evidence for LaDuc or Dimon. Neither of them strike me as dumb. So why do they reach for dumb arguments?

A seat at the big kids table

Another extremely old and unconvincing argument against taking Bitcoin seriously is the idea that Bitcoin’s price is artificially propped up by Tether (USDT). The theory is that Tether prints unbacked USDT and uses it to buy Bitcoin to manipulate the price so you can’t trust the price of Bitcoin because Tether is fake.

That thesis has never made much sense to me. It is true that USDT hasn’t always been backed 1:1 with USD (at one point Tether admitted the backing was as low as $0.73 USD for every USDT) but the existence of a fractional reserve bank (even a sketchy one) doesn’t invalidate the prices in nearby markets. If you buy Taylor Swift tickets with counterfeit money it doesn’t mean the price you paid was fake, it just means you’re a bad fan.

Anyway, the video above is Cantor Fitzgerald CEO Howard Lutnick saying — completely unprompted and in pretty unambiguous terms: Tether has the money. That’s interesting in one sense because there is legitimate reason to wonder whether Tether has the money they claim to have — they haven’t always in the past. But even more interesting is the fact that Lutnick is going on record about it.

Testifying to the solvency of your clients on television is not a normal thing for banking CEOs to do — it incurs the risk that someone will take financial action based on your testimony and then sue you later if it doesn’t work out. I assume the reason that Lutnick is going out on a limb to defend Tether here is because he expects to make a lot of money from Tether in the future somehow.

Whether you believe Tether has the money they say they have (I do) or you believe that Tether’s solvency affects the Bitcoin market (I don’t), it does seem like a traditional finance executive like Lutnick defending Tether on Bloomberg is a pretty clear sign that Tether has a seat at the big kids table now.

That has to be disappointing for Tether truthers. The short history of crypto is littered with shady crypto companies that later turned out to be record-breaking frauds (3AC, Celsius, Terra/Luna, FTX, etc, etc) and they picked the one shady crypto company that seems to have made it through basically unscathed.

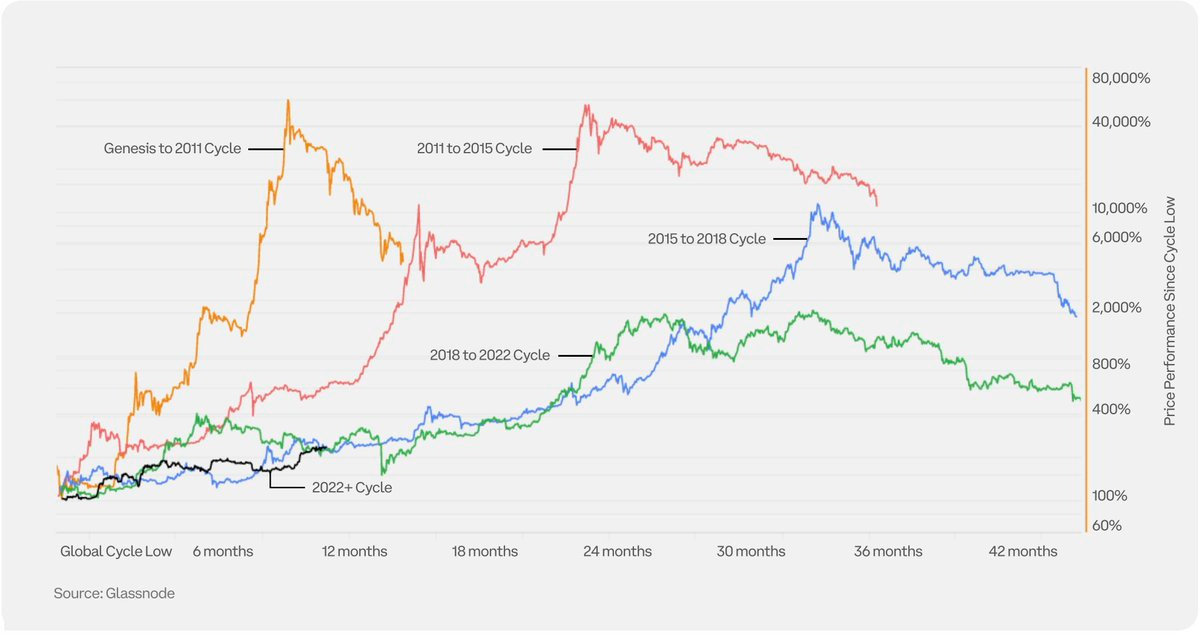

Other things happening right now:

In the first three trading days the Bitcoin ETFs had ~$10B in volume. For comparison, the ~500 ETFs that launched in 2023 had a collective $450M in

volume, the largest being ~$45M. Blackrock’s IBIT 0.00%↑ alone has more volume than every single ETF launched in 2023.

I’ve written a few times about the 6050l provision in the infrastructure bill, which introduced new (and in my opinion unreasonable) tax reporting provisions for cryptocurrency assets that went into effect on Jan 1st. The IRS just released a statement clarifying that businesses are not yet required to report anything until new regulations have been released.

Presented without comment:

Good article - its amazing how many times the divisibility gets substituted for supply. We'll just have to keep engaging with this bad faith argument to educate those who might buy into this fallacious argument.

Minor correction - JPMC is an Authorized Participant, not an "accredited partner" for multiple ETFs.