No mercy for (central) banks

Silicon Valley Bank was irresponsible but the Fed is still responsible.

Inside this issue:

No mercy for (central) banks

The quiet death of Signature Bank

No mercy for (central) banks

A number of readers suggested that I was being overly kind to Silicon Valley Bank (SVB) in my last post blaming the Fed for SVB’s failure. Here’s what I said:

That meant those rapid hikes were very bad news for Silicon Valley Bank … rising rates meant their portfolio of ~$80B of long-dated (>10 year) bonds were plummeting in value. That wasn’t an issue of solvency because those assets were still an extremely safe bet to pay out at maturity. But it was a liquidity issue, because maturity was still a decade away and people are allowed to withdraw their deposits anytime they felt like it.

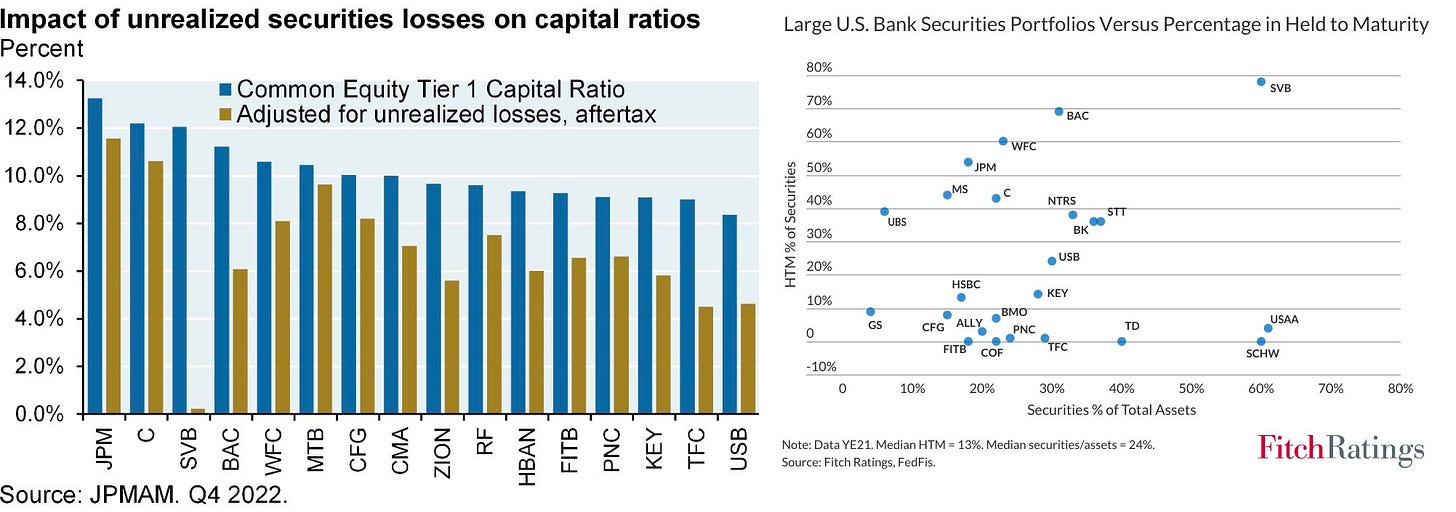

Is that too generous? Perhaps! It is certainly true that SVB was a significant outlier among the major banks in terms of how exposed it was to this category of risk. For more than a year they didn’t even have a Chief Risk Officer. They were clearly being reckless, which is pretty easy to see by comparing them to their peers:

So are the managers and directors of SVB responsible for its untimely demise? Yes, absolutely. Does that mean we should let the Fed off the hook? I don’t see why. If the gym teacher takes a nap during class the most reckless children will injure themselves first, but it is still largely the teacher’s fault. The Fed created the environment that created SVB and then they created the environment that killed it. I am not willing to forgive them just because SVB was a naughty child.

SVB was not a fraud like FTX or Celsius, it was not wildly overextended trying to manipulate exotic assets like 3AC or making absurdly under-collateralized loans like BlockFi or Voyager. They were just taking customer deposits and buying government bonds. That turned out to be unacceptably risky — but at the time SVB was buying those bonds (2021) most Fed presidents were predicting <0.75% rates and all of them were predicting <1%. Rates are now 4.75%.

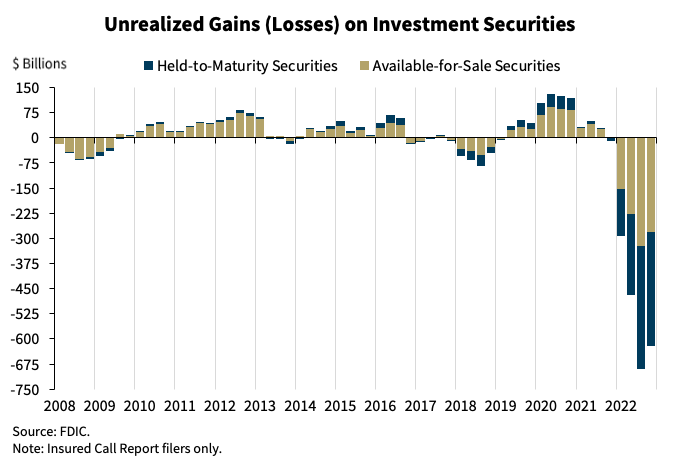

This is what that did to the bond market:

It is also hard to take criticisms of SVB’s risk strategy too seriously given that one of the key government responses to this particular crisis was setting up a lending facility that would allow banks to borrow against their hold-to-maturity assets at par. Imagine if our hypothetical gym teacher handled a student breaking both legs by handing out knee pads to everyone else. That’s not the same as teaching kids to be careful!

The problem is that you can’t actually teach banks to be careful. Taking consumer deposits (instant liability) and transforming them into long dated assets like bonds and mortgages isn’t some exotic derivative cooked up by arrogant tech bros — it’s the basic model of all fractional reserve banks. SVB may have been at the far end of the spectrum, but every bank has duration risk and every bank is vulnerable to bank runs. That’s what makes bank runs so dangerous — fears about solvency are extremely contagious and often fatal to banks.

Only the thin veil of consumer confidence keeps the U.S. banking system functional and the primary role of the FDIC is to preserve that confidence. In theory ~97% of SVB’s deposits were in uninsured accounts — but in practice letting those depositors be voided out would almost certainly have caused a nationwide crisis. Depositors would have rushed to move their funds out of vulnerable institutions and into the small handful of U.S. banks officially designated too-big-to-fail. Every small to mid-sized bank in America would be brought to their knees simultaneously. The FDIC’s job is to instill confidence. That would not be confidence inducing!

Obviously they didn’t let that happen. Instead the Fed, the Treasury and the FDIC released a joint statement announcing that they had backstopped the closure of Silvergate, Signature Bank and Silicon Valley Bank (more on those other two in just a moment). Equity holders were wiped out and senior management was fired. All depositors were fully protected, even those above the FDIC limits. The announcement emphasized that neither depositors nor taxpayers would suffer any losses.

To be clear, loaning banks money by treating their held-to-maturity bonds as though they can be valued at par is just giving away money with extra steps. Reasonable people can make a reasonable case for why a bailout was necessary or worth it, but pretending that taxpayers won’t end up paying for it is disingenuous at best. They will definitely pay for it eventually and the bill will be large.

The FDIC has also tipped their hand and made it clear that the political will to enforce the $250k insurance limit does not exist and that even some "non-systemic" banks are still effectively too-big-to-fail. And while it is true that SVB shareholders and management were wiped out by the FDIC intervention, they still had literally years to profit from the risks before they were bailed out. Former SVB CEO Greg Becker sold ~$3.6M worth of SVB stock just days before the collapse. An inevitable consequence of the bailout is that banks will take on more risk (knowing they can socialize more losses) and customers will be less vigilant (knowing the FDIC will protect them even if they aren’t insured).

A more interesting and subtle consequence of the bailout is that the political appetite for Central Bank Digital Currencies (CBDCs) has probably gotten much stronger. As we’ve talked about before, one of the main arguments against CBDCs is that they are effectively competitors to retail banking accounts. But if universal federal insurance is necessary to maintain confidence in retail banks anyway, it is a lot more viable to consider disintermediating them.

Another unfortunate reality is that the common throughline in all the recent banking instability is not the risk profile of the banks but rather the sudden and unexpected volatility of the depositor base. In a world where panic can go viral on social media and banking is available online 24/7, bank runs are likely going to be fundamentally faster and more frequent going forward. It is not clear that any of our financial infrastructure (public or private) is ready to grapple with that yet.

Good thing we are all insured now! Should be fine.

The quiet deaths of Silvergate and Signature

Tucked in the Fed/FDIC announcement about SBV was a small note about another bank they were winding down, Signature Bank of New York (SBNY):

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

This was pretty surprising to a lot of people who were watching other banks more closely (most notably First Republic Bank). Apparently it was also a surprise to Signature! According to SBNY board member and former Chair of the House Finance committee Barney Frank, "We had no indication of problems until we got a deposit run late Friday, which was purely contagion from SVB … I think part of what happened was that regulators wanted to send a very strong anti-crypto message. We became the poster boy, because there was no insolvency based on the fundamentals."

Frank’s position on the board is obviously a source of bias — but he is also one of the co-authors of the the Dodd-Frank reform act and not exactly known as a champion of risky banking practices. For him to directly accuse the administration of killing SBNY as a means of unbanking the crypto industry is quite striking — particularly considering the mysterious circumstances under which Silvergate (a crypto-focused bank) recently failed. Silvergate had suffered significant losses from the fallout of the crypto collapse, but it was actually the abrupt withdrawal of line of credit from the Federal Home Loan Board that precipitated their failure.

I hope it is obvious, but no one should be allowed to use the banking system as an extra-judicial tool to achieve political aims. The government should not be allowed to execute a bank because they dislike its customers — and they definitely shouldn’t be allowed to risk inciting a bank panic to do it. If the closure of Silvergate and/or Signature was politically motivated, it was deeply reckless and unethical.

If you want to pass a law making crypto illegal, just do it. Don’t wreck the entire banking industry just so you can accuse crypto of being a bad driver.