Evergrande ruins it for everyone

Why Bitcoin is falling and why Snoop Dogg is a crypto influencer now.

In this issue:

Evergrande ruins it for everyone

Probably don’t steal from the breakroom (Not financial advice)

The subtle politics of EIP-1559

Evergrande ruins it for everyone

It has been a bad week for Bitcoin. On Sunday the price slipped from ~$47k/BTC and crashed as low as ~$40.5k/BTC (~14% drop). It has twice tested support at ~$40k/BTC and rebounded, albeit weakly. At time of writing it is ~$43k/BTC.

Generally price drops are easier to explain than price rises, because investments rise individually but they tend to all fall together. As the saying goes, in a crisis all correlations go to 1. Fear is contagious! That’s not irrational by the way - all prices falling is equivalent to saying the value of money has gone up. It makes sense that in a time of crisis lots of people would want to buy dollars. Dollars are useful in a crisis.

The crisis that everyone is worried about is the collapse of Chinese property developer Evergrande, who has apparently accumulated ~$300B worth of debt and are about to run out of money. Or more realistically they long ago ran out of money and everyone kind of already knows that and what’s really happening is that everyone is getting ready to admit it.

The fear with Evergrande is two-fold. First, Evergrande owes so much to so many different groups that it’s collapse could start a chain reaction akin to the collapse of Lehman Brothers in America in 2008. More insidiously, there is no particular reason to believe that Evergrande is an outlier. Many or even most companies in Chinese property development may be similarly fragile.

Here is how the market assessed China’s overall risk of default this week:

If you were to look carefully at the dates on that graph (don’t bother I will explain them here) you would notice they go from September 17th directly to September 20th. That’s because credit default swaps don’t trade on the weekend, so they didn’t have a chance to react to the unfolding events until the explosive lurch on Monday. Bitcoin on the other hand started responding to the market movements on Sunday. So yeah, it crashed, but at least it crashed sooner.

I’m not convinced this is a crisis outside of China and it definitely isn’t a crisis for Bitcoin. The Chinese economy is (by design) very isolated from the West. Even a major debt crisis wouldn’t easily spread - and if anything a debt crisis strengthens the case for Bitcoin.1

It is interesting though that the price of Bitcoin dropped - that means for most people Bitcoin still isn’t money (something you would want in a crisis) it is a more like a weird nerdy slot machine that pays well enough but is not to be trusted. The market holds BTC when it feels confident but it is quick to drop it when spooked.

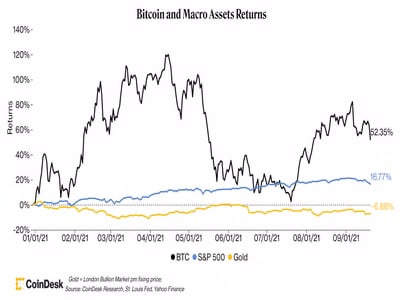

Two graphs from Coindesk tell this story really well. The first shows how well Bitcoin has performed as an investment this year:

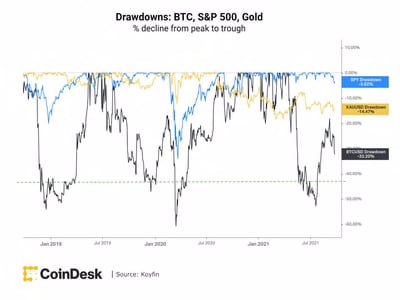

But people don’t actually experience all prices as equally salient. All time highs get much more visibility and news coverage, so they tend to be the price people remember and compare the current price against. This is what that looks like if you compare those assets not to each other but instead to their own peak price:

At any given time Bitcoin is both heavily outperforming traditional alternatives and drastically down from its own recent highs. Because we naturally use peak prices as our reference point, Bitcoin performance often feels worse than it actually is.

Probably don’t steal from the breakroom (not financial advice)

Last week Head of Product at NFT marketplace OpenSea Nate Chastain admitted to buying NFTs from collections just before they were promoted on the front page of OpenSea and selling them shortly after. He tried to hide his trading activity by using secret accounts to do the trading - but he sent the money back to his main wallet. Not a good plan.

There is a lot to unpack here. First, this is the Head of Product at a billion dollar crypto company who apparently didn’t understand the trail of evidence he was producing on the blockchain. More astonishing is the amount of money he let corrupt him - roughly 19 ETH (~$60k at the time of the trades). That’s like the manager of a McDonald’s getting caught stealing ketchup packets.

While it’s fairly obvious that what Chastain did was both wrong and ill-advised, it’s not at all clear that it was illegal. It feels like insider trading but insider trading rules apply to securities, not fine art. Pretty much everyone in the entire NFT world would prefer that NFTs remain oddities rather than securities. So a very obvious problem that looks awfully similar to very familiar problems in securities is awkward.

For their part, OpenSea fired Chastain more-or-less immediately and then published an apology along with two new policies around OpenSea employee trading. No need to call the regulators everyone! There’s a policy now.

Other things happening right now:

We’ve talked about EIP-1559 before and I’ll probably end up covering it again in follow-ups to the Ethereum Flippening essays. In the meantime here is a terrific essay from Nic Carter about the subtle politics of EIP-1559:

Pseudonymous NFT Influencer @CozomoMedici doxxed himself on Monday and I think it’s pretty much who we all expected.

I missed this somehow when it first came out so maybe you missed it, too. When I tell my family about my job, this is what they picture.

Presented without comment:

There was a rumor that Evergrande had a supply of bitcoin that they had to liquidate as they neared the end, but I sort of doubt it? Bitcoin is money and Evergrande’s whole problem was that they didn’t have any money. I find it unlikely they had a stash of bitcoin hidden between the couch cushions.