Contrary to the interests of civilization

Plus new Ethereum all-time-highs and the collapse of the internet.

In this issue:

Contrary to the interests of civilization

Ethereum reaches new all time (dollar) highs

Contrary to the interests of civilization

Last week at the Berkshire Hathaway annual shareholder’s meeting legendary investors Charlie Munger and Warren Buffet were once again asked their thoughts on Bitcoin and once again reaffirmed that they did not care for it. Munger called Bitcoin "disgusting and contrary to the interests of civilization" but he also said he would "leave the criticism to others" so I guess he means disgusting and contrary to the interests of civilization but not in a negative way. Here is the whole quote:

Maybe it’s just me but I feel like if your most famous investment is selling sugar water to children you probably aren’t that concerned about things that are "contrary to the interests of civilization." You can take a look at the Berkshire Hathaway portfolio for yourself and decide how committed they are to the public good.

This isn’t really news in any sense - Charlie Munger has been calling Bitcoin rat poison since at least 2013.1 It isn’t clear to me why people are still surprised to learn he feels that way. He has exactly the attitude towards Bitcoin you would expect from a 97 year old man who has been heavily invested in traditional banks for decades. It feels like asking John D. Rockefeller for his take on solar panels and antitrust legislation.

Munger and Buffet have earned their reputations as geniuses of the craft but they are not universal oracles. Bitcoin was created in part in response to the 2008 Great Financial Crash, during which Berkshire Hathaway struck a number of "sweetheart deals" to rescue struggling banks.

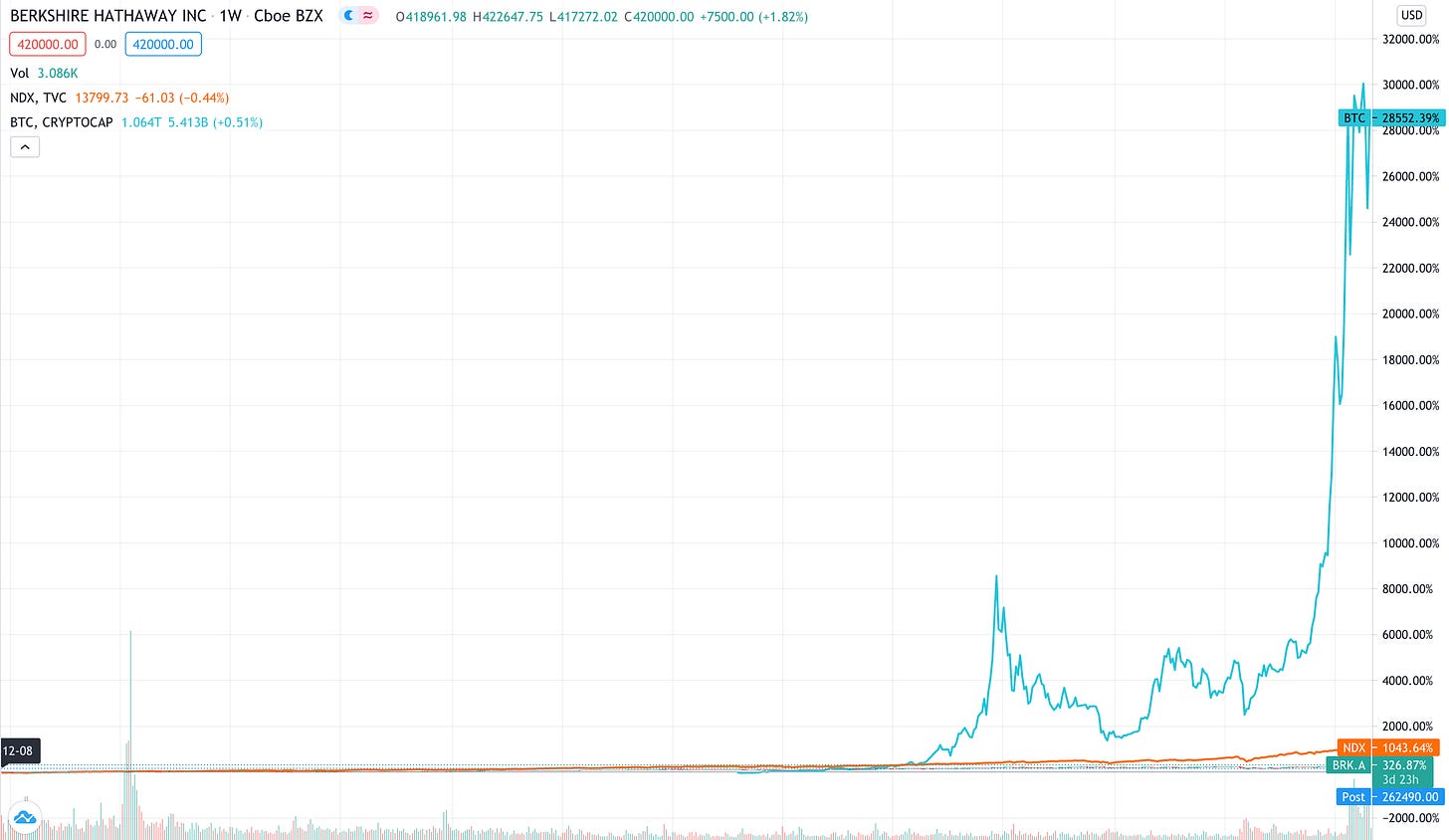

Here is the performance of Berkshire Hathaway ($BRK.A) since that time:

So if you invested $100 into $BRK.A at the beginning of 2009 you would have ~$335 in 2021, an effective annual gain of ~9.8%. Very respectable! Although you would have done somewhat better investing in the top 100 companies on the Nasdaq, where your $100 would now be ~$1045, an effective gain of ~19.8%/year:

Of course if you happen to find a way to invest backwards in time then what you should really do is invest in Bitcoin - then you could turn your $100 into ~$28,552 for an effective gain of ~55.5%/year:

Errata: This is of course quite wrong. You couldn’t buy Bitcoin in 2009. This price is anchored from 2014, and implies a ~125% annual gain. (h/t to reader KC)

Munger and Buffet have an impressive investing history - but I’m not sure they are especially well qualified to comment on investing trends in the last decade or so, especially those involving cryptocurrency. But to be honest that isn’t really what they are doing - at this point the Berkshire Hathaway shareholders calls are a very specific genre of entertainment. Charlie Munger is playing to his audience: conservative investors who are likely uncomfortable with Bitcoin and will enjoy an elegant turn of phrase that lets them comfortably dismiss it. It is not especially different from what Bill Maher is doing in this clip:

Stand for a moment in awe at the astonishing self-confidence necessary to sincerely announce "I don’t understand Bitcoin and neither do you or anyone else." Maher (like Munger and Buffet) isn’t apologetic about his ignorance because he has reinterpreted it as being too clever to get involved. The basic underlying message of both entertainers is "Don’t feel bad for not understanding this. It’s because you are smart!"

It’s a good bit, people like it. You can trot it out for years. Bill Maher has been doing his version of it since at least 20032:

Ethereum reaches new all time (dollar) highs

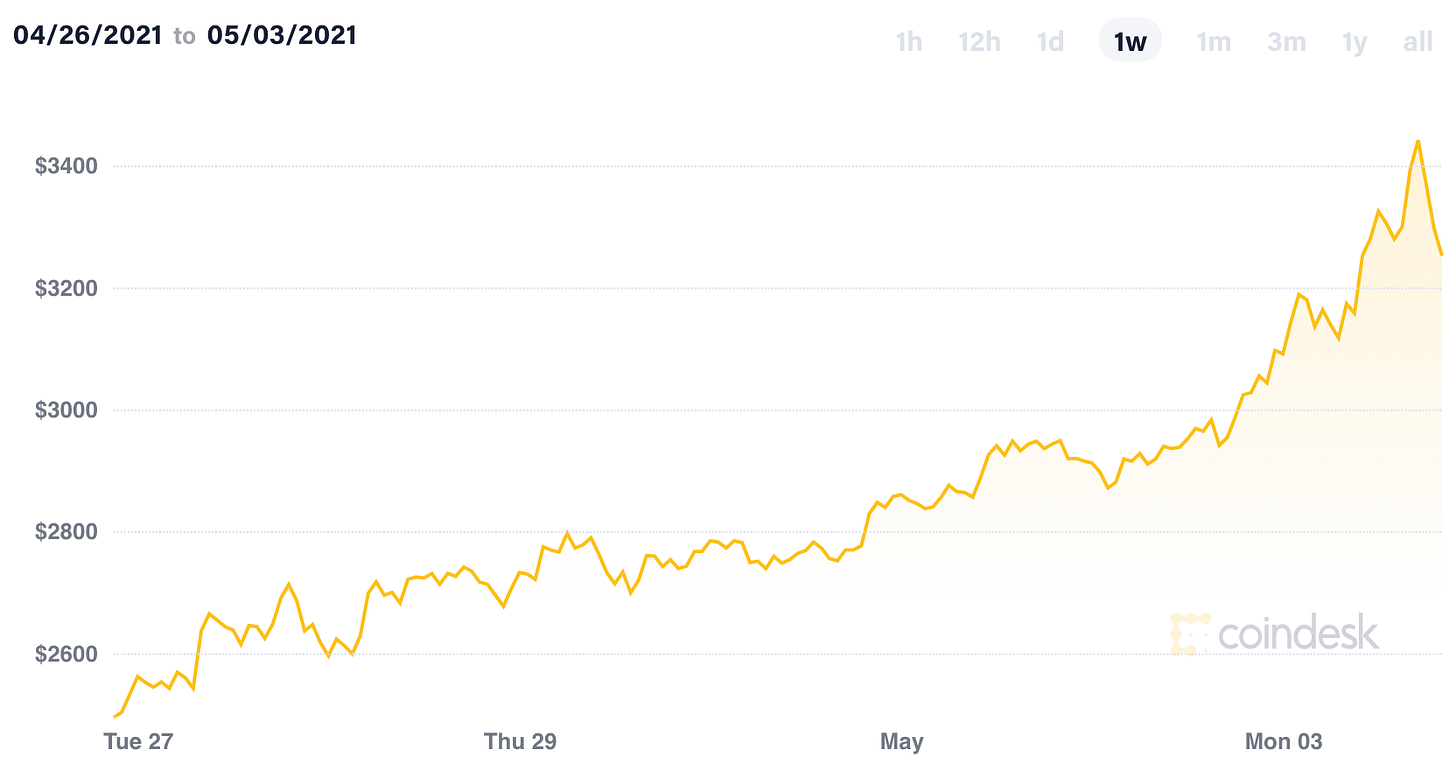

Ethereum has been on a tear recently, rising ~36% over the week to a new all time high of ~$3500/ETH before settling down to ~$3200/ETH at time of writing. As Ethereum crossed ~$2900/ETH on Sunday Vitalik Buterin became a fiat billionaire.3

I often encourage people to measure the price of coins in BTC rather than USD to distinguish between how confident the market is in a specific cryptocurrency versus how confident the market is in cryptocurrencies generally. If something is up in USD but down in BTC it means the market is becoming excited about cryptocurrencies faster than it is about that particular cryptocurrency. By that measure Ethereum is still ~66% down from its all time highs in 2017 but it is the highest it has been in years:

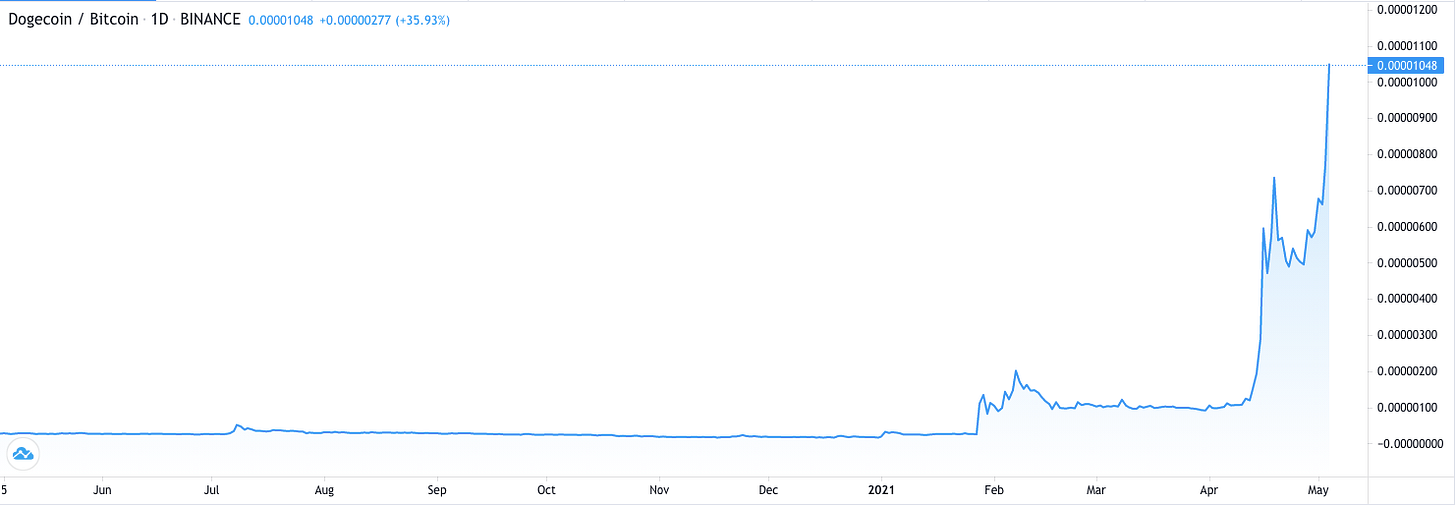

Another cryptocurrency reaching new all time highs is DOGE which spiked overnight to a new all time high of $0.59/DOGE at time of writing.4 There is no comfort for the Bitcoin maximalists in the DOGE/BTC chart - DOGE is performing even better relative to Bitcoin:

One way to measure how well that theory is playing out in practice over time is to watch what is called the Bitcoin Dominance Index - i.e. what % of the entire crypto market is just Bitcoin.5 Dominance has slipped below 50% for the first time since 2017. In other words the value of Bitcoin is at the moment slightly less than the collective value of cryptocurrencies that are not Bitcoin.

As with any price movements in crypto it is difficult to ascribe specific reasons. Maybe Ethereum benefited from the launch of Meebits? Maybe DOGE is rallying in anticipation of Elon Musk saying something irresponsible about it on SNL? We do know at least one person had a very bad night: someone lost ~$75M in a single trade as their Ethereum short was liquidated.

Other things happening right now:

We talked about the upcoming Taproot upgrade a few weeks ago. The first Taproot signaling period has begun - you can watch miner signals at taproot.watch. At time of writing ~20% of blocks have signaled readiness, which means that there will not be enough support to lock in during this difficulty period. The client was released somewhat late because of all the debate, however, so it is not unexpected that many miners are taking their time rolling out. Things look promising for the next signaling window.

There is some evidence suggesting that Bitcoin mining is increasingly moving outside of China. The "China controls Bitcoin" narrative has never made sense but it is still encouraging to see hash power become more decentralized:

It is a shame that internet thing never worked out. It would have been perfect for blogging about the death of Bitcoin! (h/t reader DD)

In 2018 he compared it to trading "freshly harvested baby brains" so maybe his feelings are mellowing a bit?

In that Twitter thread alone there are clips of Bill Maher dismissing Twitch, camera phones, social networks and the possibility of a global pandemic. Someone should backtest counter-trading Bill Maher. Seems like it might be a profitable approach.

Vitalik has previously disclosed ownership of that address. It seems insane to me to keep ~$1B worth of crypto in a single address and advertise that you own it, but a lot of things in Ethereum seem insane to me.

Dogecoin as an investment actually is contrary to the interests of civilization.

Dominance is a pretty imperfect metric. Market cap does not tell you very much without knowing liquidity - but liquidity is impossible to observe directly so we all talk about market cap dominance anyway. Le mond - c’est terrible!