Chaos is a ladder

also transaction fees, Chinese hashpower and food for bulls

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

We take a moment to feed the bulls

Does China control Bitcoin? (reader submitted)

How is the cost to use Bitcoin changing? (reader submitted)

Bullish graphs for hungry bulls

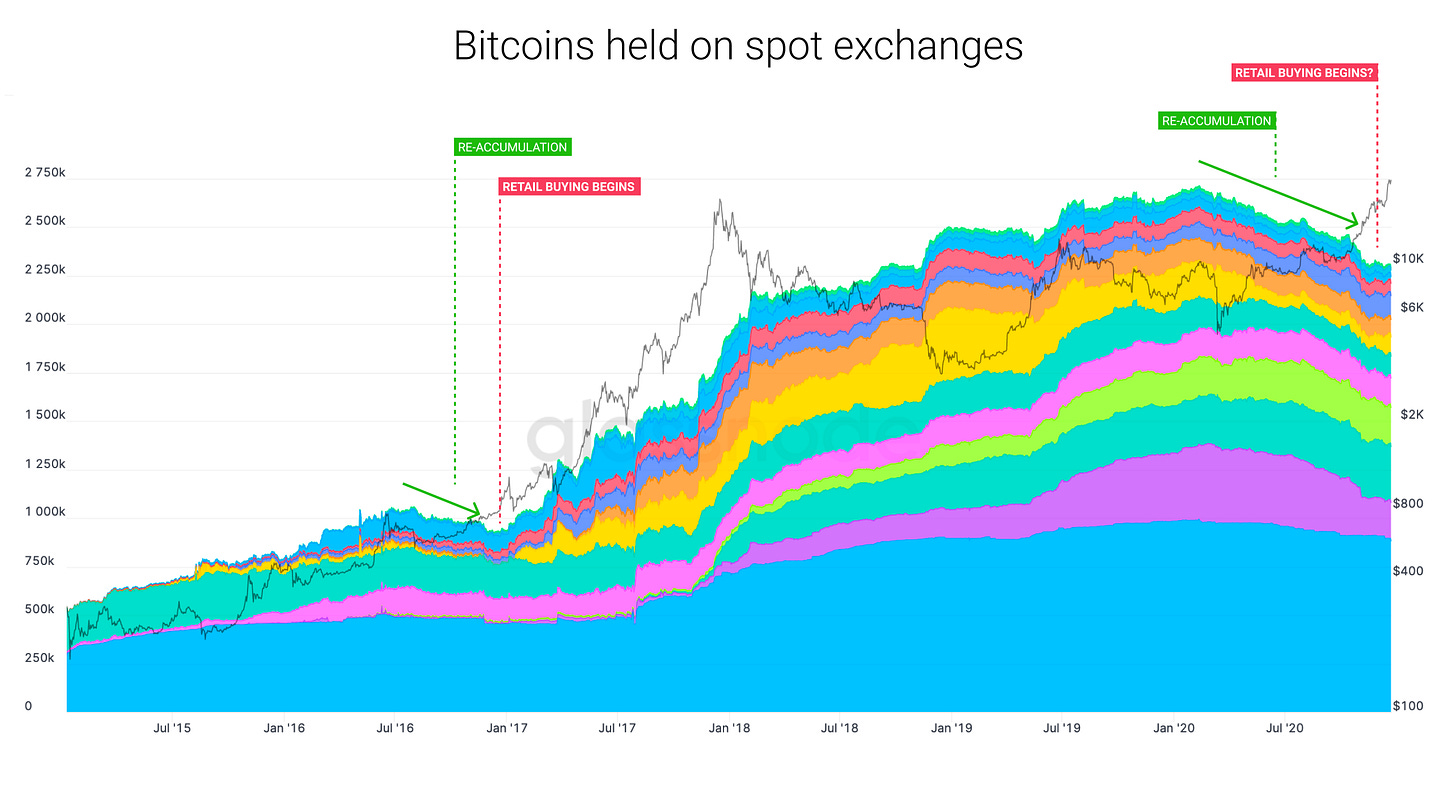

Early in a bull run coins are bought by longer term, more committed investors who tend to move their coins off exchange into cold-storage. Later in the bull run FOMO will bring more casual, short term investors who are more likely to keep their coins on exchanges (so they can sell them quickly). You could see this pattern in 2017 as a roughly ~6 month reaccumulation cycle where bitcoins were mostly leaving exchanges, followed by a few weeks of stable inventory and then a rapid growth in coins on exchange as excitement around the price peaked.

The same pattern is showing up now: we’ve just concluded a ~12 month reaccumulation cycle with steadily dropping inventory of bitcoin held on exchanges and have now entered into a stable period:

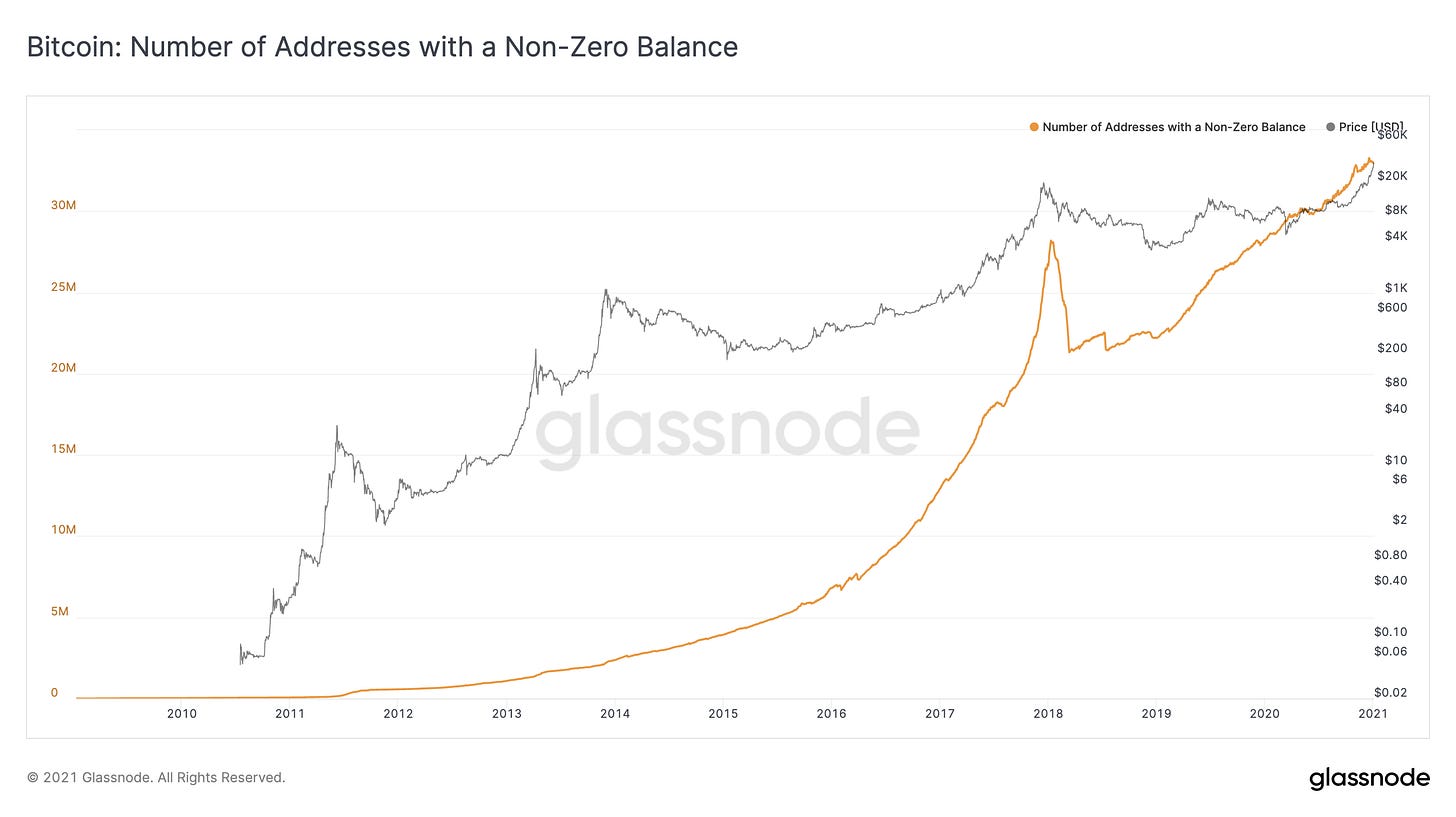

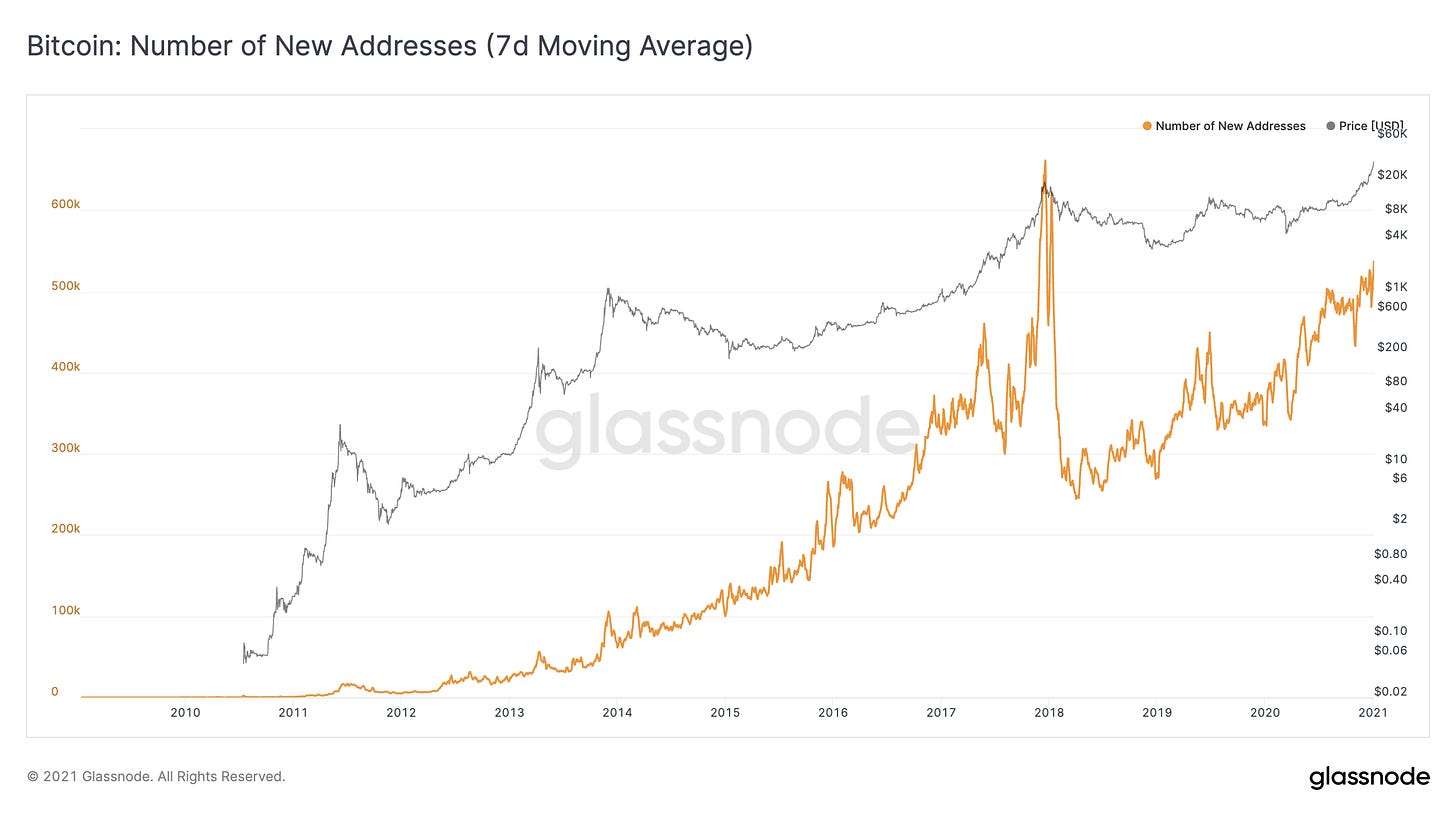

Coins leaving exchanges mean the buyers that have taken us up this far do not intend to sell their position anytime soon. A decent indicator that we are still early in the cycle for this bull run. We can also see steady growth in actual Bitcoin usage:

Nothing super unexpected or counterintuitive here but good confirmation that Bitcoin users are actually using Bitcoin. More people wanting to hold and transact in Bitcoin is the basic foundation behind every bullish argument.

Does China control Bitcoin?

“Does it matter that China controls >50% of hashpower?” -JR

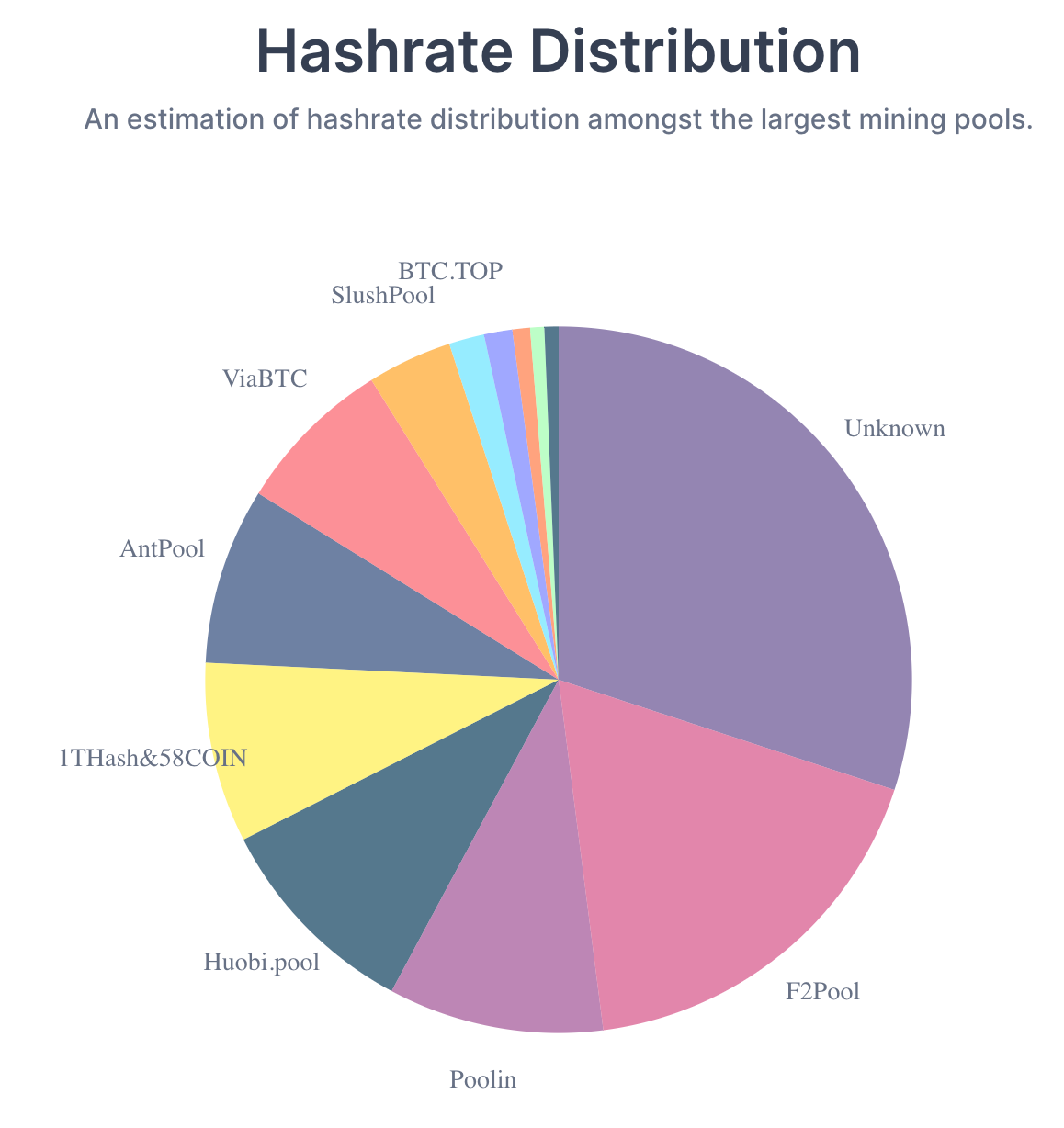

It is tough to know with true confidence who controls the computers that are mining Bitcoin. These days mining has gotten competitive enough that most individual mining rigs never actually find a block. A new, high end Bitcoin mining rig will cost in the thousands of dollars - so that’s an expensive lottery ticket. To smooth out this intense variance most Bitcoin miners aggregate their hashpower together into 'mining pools' that share the rewards they earn in proportion to how much hashpower each miner contributed. Some of the larger pools voluntarily sign the blocks they mine, but it’s not required by the ecosystem so many are left unmarked. This is the distribution from the last few days at time of writing:

Several of the largest (public) pools are based in China, which occasionally causes some concern about whether the Chinese Communist Party has undue influence over Bitcoin or might represent a threat to the security of the network. First some counterintuitive things to consider about the issue:

Mining pools don’t control their hashpower, the owners of mining equipment do. If they view the pool as misbehaving they can withdraw their hashpower and redirect it to a mining pool that is acting in their best interests. It’s not clear how much of their own hashpower the major mining pools actually control directly.

Mining pools don’t have to sign blocks and likely even the ones that do sign their blocks leave some unsigned to keep their true size obscured. If 'Unknown' was a mining pool they would be the largest mining pool by almost 2x. Likely many if not most of those blocks are actually being mined by pools that only partially disclose their presence.

So it’s quite difficult to know in practice who actually has how much control over the hashpower. The majority of Bitcoin mining equipment is made in China though and China also has an abundance of cheap hydroelectric energy, so it is reasonable to assume that the majority of Bitcoin mining is probably happening in China.

That isn’t necessarily a durable truth, though - Bitcoin mining will naturally gravitate to anywhere that cheap power is available so it will evolve alongside the changing energy landscape. Edge (a Bitcoin wallet company) has a good essay exploring trends in Bitcoin mining over time.

The good news is it doesn’t really matter a ton who the miners actually are, because what they are able to do is quite restricted. You can run a Bitcoin node yourself that lets you easily enforce the Bitcoin rules yourself and reject invalid updates from misbehaving miners. So no matter how much hashpower they have miners can’t create new coins and they can’t steal coins from anyone else. The only things miners can do within Bitcoin’s rules are ignore transactions or include them.

So even if a miner tried to censor your transactions they could exclude them from blocks they had found but they couldn’t stop any other miners from confirming your transaction and collecting the transaction fee for themselves. That miner could even be you, no one can stop you as long as the blocks you mine are valid.

So what can China do with their dominance in Bitcoin mining if the CCP turns hostile to Bitcoin? Probably the worst thing they could do is turn off all the mining equipment. Bitcoin only adjusts difficulty every 2016 blocks, so if there was a sudden sharp drop in hashpower it could greatly slow the network for a while. That would also simultaneously increase the reward for every other miner, so we would probably see a bunch of old mining rigs turned back on if that happened. They would also be turning enormous, profitable factories into giant warehouses of useless electronics, so I don’t see that as likely to happen.

The more common threat that people cite when worrying about China’s “control” of Bitcoin mining is a 51% attack where an attacker is in control of more than half of the total hashpower of the network and uses that control to rewrite recent history. There has never been a successful 51% attack on Bitcoin but it has happened to several smaller altcoins so it’s not a hypothetical consideration.

An attacker with dominant mining strength can indefinitely delay any transactions during the attack and they can potentially double-spend transactions like a kind of digital coin-on-a-string trick. They can’t steal your coins and they can’t make new coins for themselves. And since attacks like this are by definition quite expensive (you are paying for more hash rate than the rest of the network combined) they are difficult to sustain. If you are not an exchange accepting large cryptocurrency payments or a business that relies on constant rapid uptime, you probably wouldn’t even notice.

So to bring it back to the original question: we don’t know for sure that China has majority hashpower, but they probably do - it just doesn’t give them as much power as most people think.

The high price of freedom

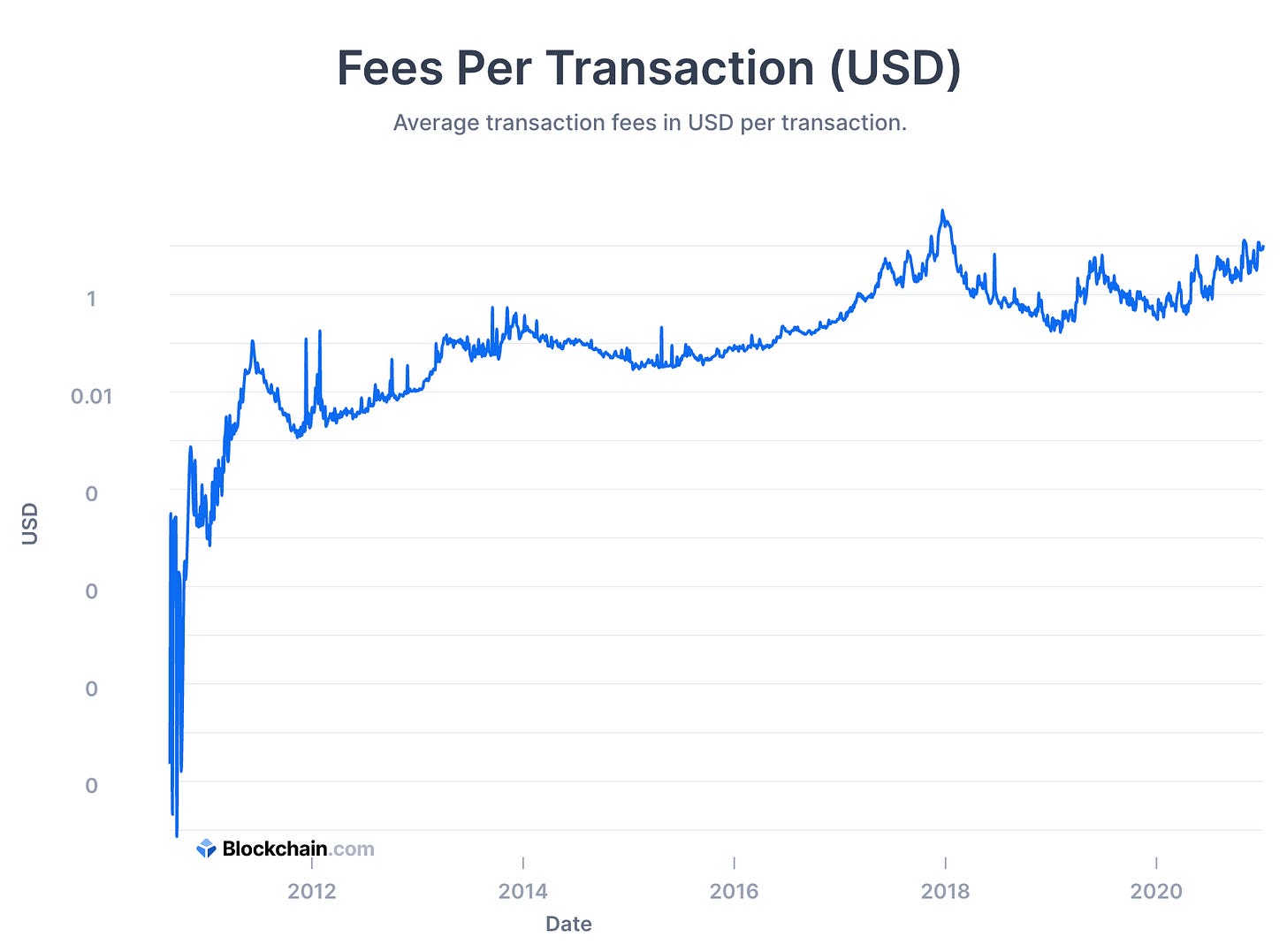

"I'd be curious to understand how you see bitcoin transaction costs evolving." -JH

When you send someone Bitcoin you create a transaction and then prove that it is authentic by signing it with your private key. Then you upload the transaction to any Bitcoin node on the network which will add it to the 'mempool' and relay it to the rest of the network. The mempool is a kind of waiting room for transactions that haven’t been confirmed by miners adding them into the blockchain yet. You can see some interesting visualizations of the process at mempool.space.

There are no rules about what order miners take transactions out of the mempool, but generally speaking miners are in it for the money and they usually confirm the transactions that would make them the most money. So to get your transaction out of the mempool and into the actual blockchain itself, you include a bribe to the miners called the 'transaction fee.' You can think of the mempool as a kind of auction where transactions are bidding for space on the next block. The more transactions there are trying to crowd into the same block, the higher the price to get in will be.

It’s hard to be precise about the exact cost of transacting on the Bitcoin network because it depends on a lot of variables. Transaction signatures can be different sizes depending on their complexity and larger transactions (in bytes, not in bitcoin) need to pay more to compensate miners for the extra space they take up. Depending on how urgently you want to confirm your transaction you might decide to put a high transaction fee (to get confirmed quickly) or a low transaction fee (if you’re willing to wait for a slow moment on the network) or perhaps even no fee at all hoping for an altruistic miner to pick it up for free. And whether a given fee is 'enough' will depend on how many people are trying to transact on the network at that moment.

As I am writing this a standard sized modern format transaction is averaging ~$1-2 in transaction fees. The actual average transaction fees (which includes lots of complex, older and badly structured transactions) have ranged from $2-12 over the last week. That’s pretty high but it is not as high as they got in the peak of the 2017 bull market, when the network was so clogged that the average fee was ~$54.

There was a lot of controversy around transaction fees at the time, resulting in several forks of Bitcoin and an exhausting amount of drama. Many of the more prominent altcoins launched on the premise that high fees would doom the Bitcoin network. To me this is like the old quip that nobody drives in New York because the traffic is too bad. High fees mean that people place high value on using the network. It’s not always convenient but it is healthy - when the block reward runs out those fees will be the only thing left to pay the miners for security.

So I do expect the price of transacting on the Bitcoin network to continue to rise. I don’t think we will ever see widespread coffee purchases on the blockchain directly. That’s OK though because I think Bitcoin is more useful as a high-value settlement network than as a competitor to Visa or Paypal. Smaller lightweight transactions should happen at higher layers, such as on the Lightning Network.

Other things happening right now:

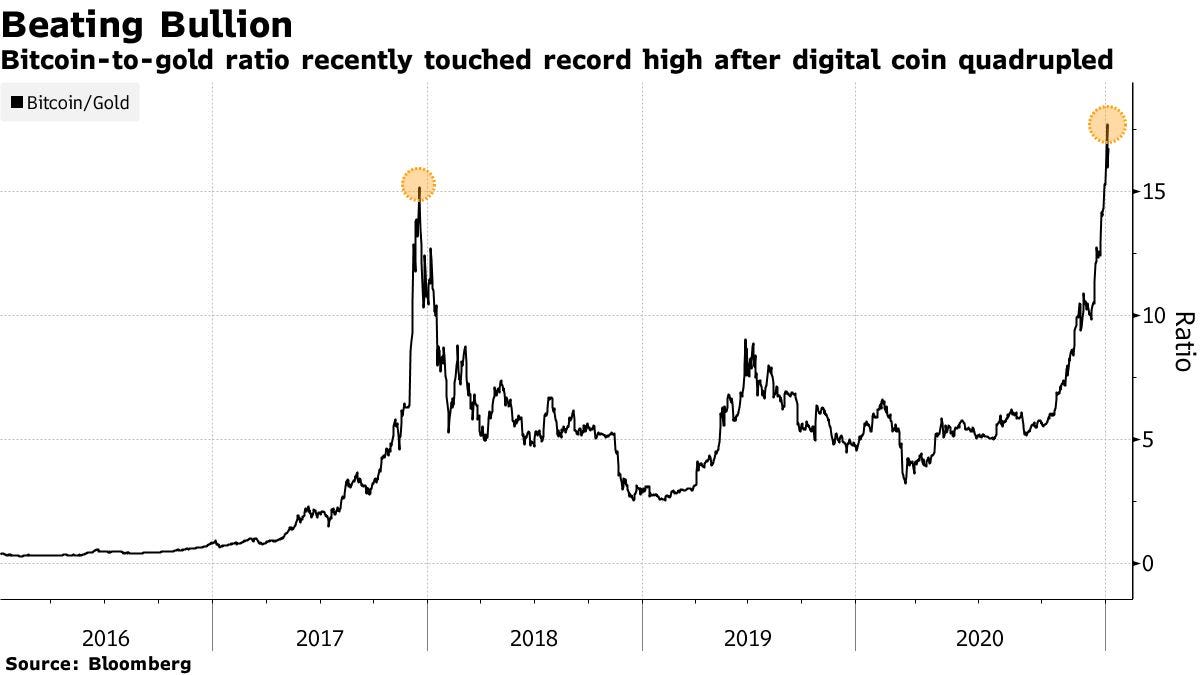

JPMorgan issued a statement that Bitcoin was successfully competing with gold in millennial portfolios and that if trends continued it implied a long term valuation of $146,000/btc. I personally think that estimate is low, but I agree that millennial portfolios will be the first to adopt Bitcoin in a serious way.

Bitcoin’s price in gold has reached an all time high:

The Office of the Comptroller of the Currency (a federal banking regulator) has issued a letter basically declaring that banks are allowed to use stablecoins to send/receive payments. The letter only mentions Bitcoin indirectly in a citation footnote, but the receptivity to blockchain tech is a good sign overall.

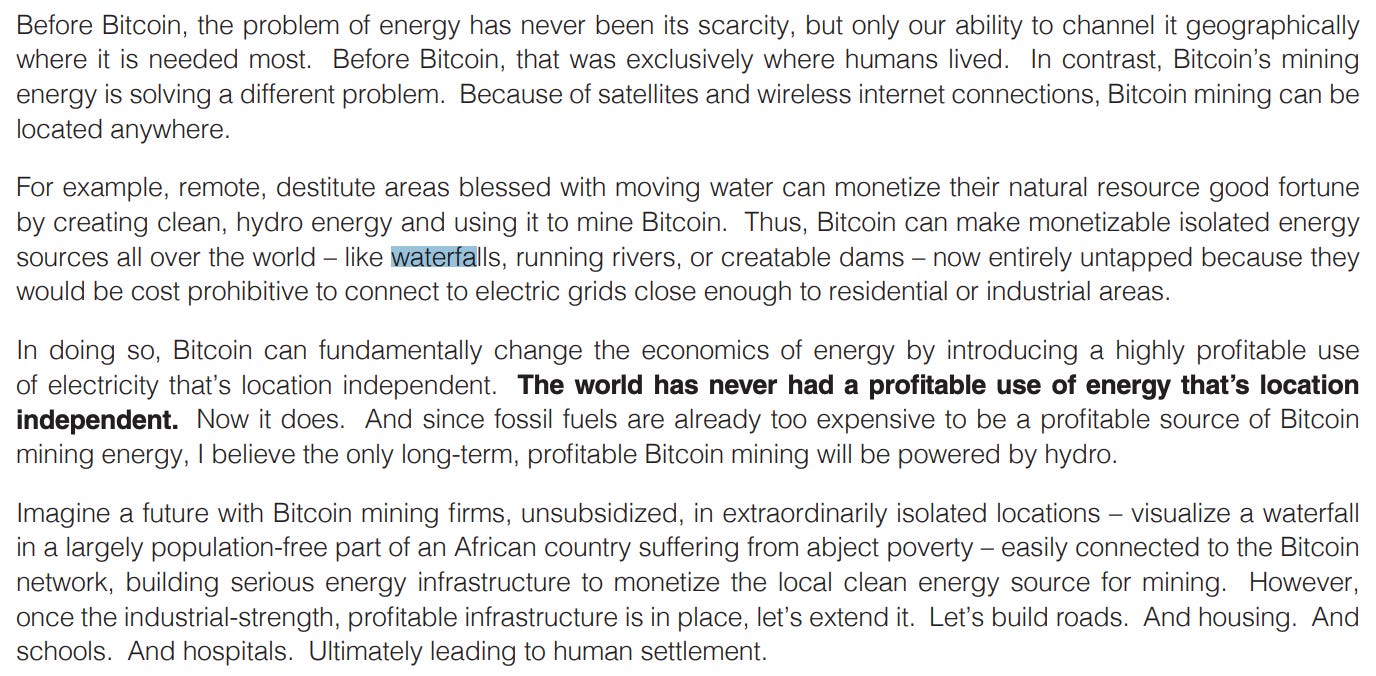

Stone Ridge Asset Management (a hedge fund that began holding Bitcoin in 2020) released a shareholder letter discussing their investment thesis in detail. I thought this particular snippet was worth highlighting given our recent discussion of Bitcoin and the energy market.

OB1 the founders of OpenBazaar (a decentralized marketplace somewhat akin to a darknet Etsy) have officially closed operations and will be shutting down the OpenBazaar infrastructure they had been running. OpenBazaar is OpenSource and could be run by anyone, but it seems unlikely anyone will bother.

If there isn’t enough volatility for you in Bitcoin itself, International Game Technology PLC (the world’s largest manufacturer of slot machines) has just filed a patent for integrating cryptocurrency directly into slot machines.

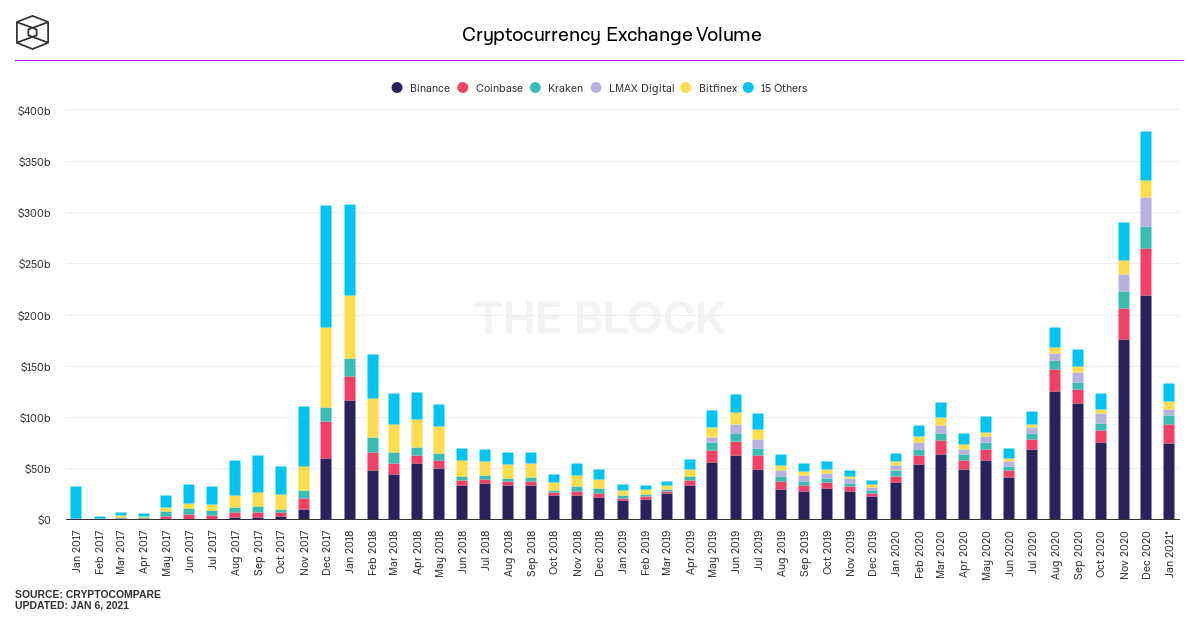

Cryptocurrency exchange volumes have already passed the 2017 peak:

Got a question on your mind? I’d love to hear it!