Bitcoiners need the Guillotine

Plus real Bitcoin transactions will never be cheap. Stop trying.

In this issue:

Bitcoiners need the Guillotine

Free as in Freedom is not Free as in Beer

Bitcoiners need the Guillotine

Scottish Enlightenment philosopher and economist David Hume (1711-1776) in his seminal work A Treatise of Human Nature described (among other things) the is/ought problem, colloquially known as Hume’s guillotine. Hume pointed out that nothing we know about what is true tells us anything about what ought to be true and nothing we know about what ought to be true tells us anything about what is true. The world of objective fact and the world of moral truth are entirely separate.

Hume’s guillotine is a rule-of-thumb for reasoning about the world, a bit like Occam’s razor or the less famous but IMHO more interesting Hanlon’s razor. It is a way of cutting apart two similar but distinct threads of thinking that become tangled when they are allowed to intertwine. An argument where one side argues about what is true and the other side argues about what ought to be true is a useless argument. Those people are talking past each other.

More importantly, the guillotine is a tool for helping us distance ourselves from our own biases. We tend to let what we think ought to be true distort our understanding of what is true — we tend to assume that which is true is good (naturalistic fallacy) and that which is good is true (wishful thinking).

I wish Bitcoiners were more familiar with and more liberal about applying Hume’s guillotine to their own reasoning. An increasingly cultish sub-tribe of Bitcoiners have been patrolling the space enforcing orthodoxy to the point where even extremely mild takes like "some people will prefer to pay someone else to custody their bitcoin" are treated as dangerous wrongthink. Some Bitcoiners are so radically devoted to self-custody they assume that anyone who points out the mere existence of other perspectives is an enemy of the cause. I wrote a post myself a few weeks ago about the limits of self custody and multiple people reached out to my CEO (some publicly) to make sure he was completely certain I could really be trusted.1

The creation and enforcement of Bitcoin dogma does not advance Bitcoin — to be honest it isn’t even really about Bitcoin. Already mission creep has expanded the maxi mandate from simply promoting sound money to opposing perceived cultural enemies like NFT enthusiasts or fractional reserve banks. Many of its loudest advocates share a host of completely unrelated interests: gun culture, classical art, climate skepticism, carnivore diets, the practice of Christianity.

None of these things have anything to do with Bitcoin. Bitcoin is not a religion and collective faith is not a useful way to understand it. Bitcoin is adversarial technology. It lives firmly on the 'is' side of Hume’s guillotine. It absolutely does not know or care what it 'ought' to be. The self-appointed high priests of Bitcoin orthodoxy are not representative of who uses it or what it is useful for. They are co-opting the language of Bitcoin to artificially elevate their own importance.

The battle for the future of Bitcoin is not happening on Twitter and the most important players in that battle are not Twitter warriors. Being the first to adopt a technology does not make you the best equipped to predict its future. Loving Bitcoin is not the same as understanding it.

On that note …

Free as in Freedom is not Free as in Beer

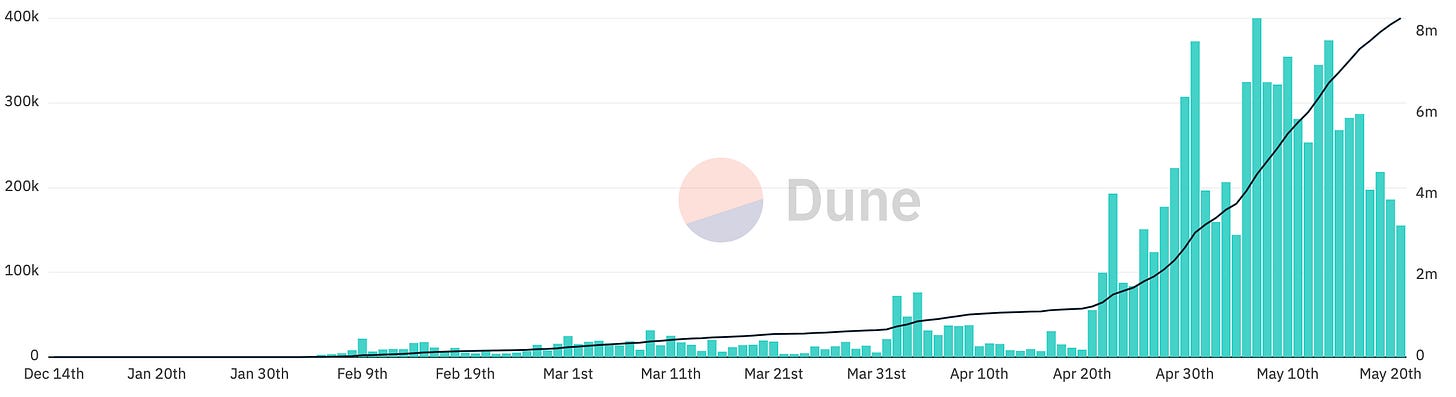

Back in February I wrote a bit about ordinal inscriptions, the nascent Bitcoin-native NFT protocol that was seeing a surge of attention and controversy at the time. Ordinal inscriptions are controversial in part because NFTs are generally controversial (which is dumb) and in part because they compete with other Bitcoin transactions for blockspace and drive up the fees required to use the network. Since then ordinal usage has continued to grow:

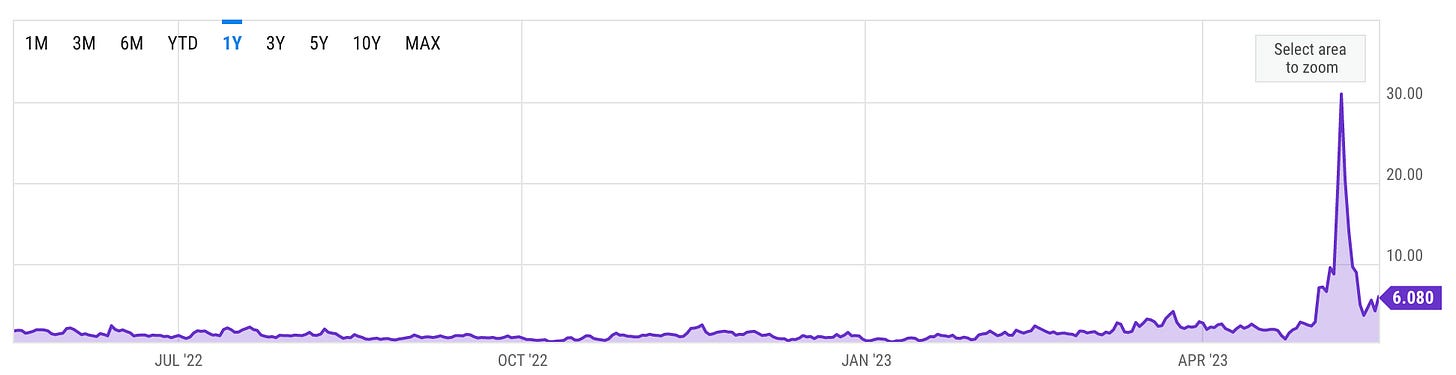

As of writing ordinal transactions have spent ~$39M on transaction fees. In fact on May 7th Block #788695 became the first block in Bitcoin history that paid the miner more in transaction fees (6.7 BTC) than in block rewards (6.25 BTC). Average transaction fees were the highest (in USD) that they have been since the bubble in 2021 when bitcoin was trading for ~$69k/BTC.2

The main reason for this spike in transaction fees is the launch of several "BRC-20"3 tokens that used inscriptions to create meme-coins on Bitcoin. Good news: Bitcoin finally found product market fit! Bad news: the killer use case for Bitcoin turned out to be shitcoins after all. Life comes at you fast.

BRC-20 tokens are an objectively silly thing to spend Bitcoin on, but then again so is pizza or alpaca socks or conference tickets or anything else. Spending bitcoin on anything is foolish — Bitcoin is for saving. People who complain that ordinals and shitcoins are crowding out "legitimate" use of the network are no different from the big-blockers in 2017 who complained that small blocks and spam transactions were crowding out retail users. Every time the fees rise someone objects that fees ought to be lower. They need to study the guillotine.

Transaction fees will necessarily rise because blockspace is unbelievably precious and expensive. To pay for a Bitcoin transaction is to pay literally everyone to remember that transaction for literally forever. The blockchain is the most permanent recorded memory in the history of civilization and it adds only ~0.5M records or so per day. That’s roughly enough room for everyone on Earth to add one new transaction every ~35.6 years, not accounting for the new population growth in that time. If Bitcoin is widely adopted, blockspace will be incredibly scarce. The shocking thing is not that transaction fees will rise but that they were ever this cheap to begin with.

Transaction fees will also necessarily rise because today they are subsidized by the block reward and the block reward is going away. In the long run transaction fee levels and network value are necessarily linked: either fees rise to pay for the security needed or network value drops until it falls under the level that fees can secure. As the network subsidy for mining disappears, transactions fees will need to rise to motivate miners to keep providing finality. There is no free lunch.

If you believe in the value of decentralization it is easy to see why you would want everyone to have access to it. But if you understand how decentralization works it is also easy to see why that will never be possible. The math simply does not allow it. Even in a world of hyperbitcoinization, true self-custody will remain an extraordinary privilege that most people will never be able to afford. This is a descriptive statement, not a proscriptive one. The cost of decentralization is like the force of gravity, it is neither good nor evil, it simply is. It exists on the other side of the guillotine.

The lure of cheap transactions is strong. The latest iteration of this hope in Bitcoin is the idea that the Lightning Network will scale to allow everyone use the Bitcoin network cheaply. To be clear, I am a huge believer in the Lightning Network. It is part of my work at Blockstream and I’ve written about my belief in its potential. But Lightning lowers the cost of using Bitcoin — that’s not quite the same thing as making Bitcoin cheap to use.

Opening and closing a Lightning channel both require on-chain transactions today, which means that as on-chain transactions become prohibitively expensive opening new channels will become prohibitively expensive as well. There are proposals to make more channels more cheaply/scalably (i.e. channel factories) but since every proposal depends on an on-chain anchor transaction every channel will need to be purchased/leased somehow from someone able to afford the original transaction.

Even setting aside the cost of opening and closing channels are not cost-free to maintain. Nodes must be actively online to receive payments and watch their counterparties for misbehavior. Users must either perfectly balance their [sent|received] payments or occasionally pay a liquidity service provider to rebalance their channels so they can keep [sending|receiving] payments. Most importantly the bitcoin needed to secure Lightning channel capacity is necessarily online and not in cold storage.

The marginal cost of individual Lightning transactions is very small, but the total cost of creating, using and maintaining a Lightning channel is actually quite high — especially as the price of bitcoin and L1 blockspace inevitably rises. Advertising the Lightning Network as cheap and good for small transactions / retail users is like telling everyone to launch their own satellites for cheaper mobile internet.

Lightning channels are more like expensive high-speed railways than cheap personal vehicles. They will radically lower the cost of transportation — but it doesn’t make sense for everyone to build their own tracks. Channels will only make sense for those who benefit enough from streamlining their payment flow to justify the (ongoing) cost of maintaining a channel. For the majority of individual people that trade off simply won’t make sense. For most people even owning bitcoin in the first place will be a privilege of significant luxury.

This is a descriptive prediction, not a proscriptive one. I’m not trying to defend the natural cost of decentralization as good, but I do think understanding it is useful. Anyone trying to understand an adversarial, economic system will need Hume’s guillotine. Reasoning about the future of Bitcoin requires a clear separation between hope and belief. Otherwise we’re just manifesting.

Regrettably, as long time readers already know I definitely cannot be trusted. Hopefully some kind of shadowy figure will invent some form of cryptographic technology that is good at minimizing the need for trust.

In general mining rewards are measured in USD because the security that mining provides to the network is a function of the purchasing power of miner rewards, not the nominal quantity of tokens they receive.

ERC-20 tokens are named that way because it was the 20th technical standard submitted to the Ethereum Request for Comment (ERC) process. BRC-20 tokens are named that way because the creators wanted people to think "ERC-20 only for Bitcoin." There is no Bitcoin Request for Comment process and there are no BRCs 1-19. It is the equivalent of naming your product with a lowercase i at the front so people associate it with Apple.