Bitcoin is a machine that eats pollution

Plus the fastest way up is slowly and Mt Gox releases an NFT

In this issue:

Hello friends! Thank you all for reading my thoughts and sending me yours. I wanted to share a bit of personal news: my family is expecting the arrival of our second daughter and our induction is scheduled for tonight! That probably means that my publication rate will be a little erratic over the next few weeks. You will probably also see more rough edges than usual since my lovely wife is also the Something Interesting Editor-in-Chief and the first line of defense against my bad habits as an author. In the meantime I respectfully ask that everyone hold off on any significant cryptocurrency news or developments for a month or two while I get my feet under me again. Thank you and wish us luck!

The fastest way up is slowly

Bitcoin is a machine that eats pollution

A "healthy" regulatory environment

The fastest way up is slowly

For the last two weeks or so the price of Bitcoin has been climbing steadily, rising around ~26% from ~$38k/BTC to ~$48k/BTC at time of writing. Part of the price movement is because of the broader macroeconomic response to sanctions and war and part is because Terra’s LFG acquired ~0.5B BTC earlier this month — but in my opinion the majority of the story is simpler. The price is going up because the supply is going down. The ratio of coins held by long-term-holders (i.e. addresses that have a long history of acquiring and not spending) has been growing since early last year:

It’s not rocket science. The more bitcoin held by people who don’t want to sell the less bitcoin there will be available for sale. Price goes up. What is interesting is that this particular movement up is using way less leverage and driven way more by spot. During the January 2021 run from ~$30k → ~$60k traders were at times paying annualized interest rates >100% to go long with leverage and ~70% were using Bitcoin as collateral. Today the equivalent traders are paying ~1.7% annually and ~38% of them are using Bitcoin as collateral.

In other words this particular bull run is driven by savers more than speculators. That makes it less explosive but it probably makes it less fragile, too.

Bitcoin is a machine that eats pollution

This week oil and gas conglomerate ExxonMobil announced plans to expand a program where it used Bitcoin mining to reduce emissions. They are doing that by using Bitcoin mining to eliminate flaring — the practice of burning unwanted natural gas produced as a side effect of oil mining. We’ve talked a number of times before about flaring and why Bitcoin mining is uniquely suited to help avoid it.

Obviously when it is profitable and convenient oil companies will sell the natural gas they produce mining oil — but oil is often mined in remote locations and difficult terrain, so it is usually not convenient or profitable to bring the natural gas to market. But it is much cheaper and easier to bring Bitcoin mining machinery to the oil site than to build a pipeline — which means oil companies like Exxon can use natural gas to mine Bitcoin instead of simply flaring it.

That means the energy is used instead of wasted, but more importantly the emissions from Bitcoin mining are much, much cleaner than the emissions from flaring. Both flaring and using natural gas produce carbon dioxide but flaring (which is often inefficient and incomplete) can also release methane and NOx into the atmosphere as well. Methane damages the ozone layer and NOx contributes to acid rain. That’s why Exxon is part of the World Bank’s “Zero Routine Flaring by 2030” initiative.

In other words Bitcoin is a machine that eats pollution and prints money — and this is a significant commercial validation that it really works. ExxonMobil is not virtue signalling — their tests have shown that mining Bitcoin alongside mining oil will reduce emissions and improve the bottom line. In a sensible world we would all be celebrating a tool that makes environmentalism profitable.

Alas we are not in a sensible world. Instead we are in a world where we are all cursed to watch the NYTimes write the same foolish op-ed quoting the same disingenuous source over and over and over until they have ground their journalistic reputation into so much dust beneath their heels.

Imagine if a single Bitcoin transaction actually did require 2000 kilowatt-hours of electricity? The average Bitcoin transaction yesterday cost $1.75 USD. If it cost 73 days of American household energy use to process a transaction, transactions would cost about that much (~$270 using this estimate). Transactions don’t cost that much because they don’t use that much energy. The energy use of Bitcoin has nothing to do with the number of transactions on it and there is really no excuse for the NYTimes to be making that mistake. There are plenty of resources explaining why it doesn’t work that way. They should subscribe to my newsletter.

A "healthy" regulatory environment

In the clip above Treasury Secretary Janet Yellen both admitted skepticism and acknowledged the benefits of cryptocurrency, ultimately saying that the president’s executive order was a call to create "a regulatory environment in which healthy innovation can thrive."1

It’s a nice thought! Meanwhile the EU is considering legislation that would functionally make self-custody wallets illegal and the SEC released 200+ pages of new regulatory definitions designed to expand their regulatory scope to include all of DeFi without ever actually mentioning it directly. The trouble with these regulatory efforts is not just that they are heavy handed and wrong. It is also that they are fundamentally inscrutable and difficult to parse.

Regulators shouldn’t be adversarial to the industry they are regulating — the goal should be to guide companies into compliance as well as enforce it. Being deliberately obtuse about the actual intentions of the rules makes it harder for companies to adhere to those rules effectively. It is a strategy for maximizing punishment, not a strategy for minimizing misbehavior.

Other things happening right now:

The London Bullion Metal Association (LBMA) has announced plans to launch a database for tracking and identifying gold bars to help fight counterfeiting and smugglers. If only there was some kind of digital gold already? That would be pretty convenient.

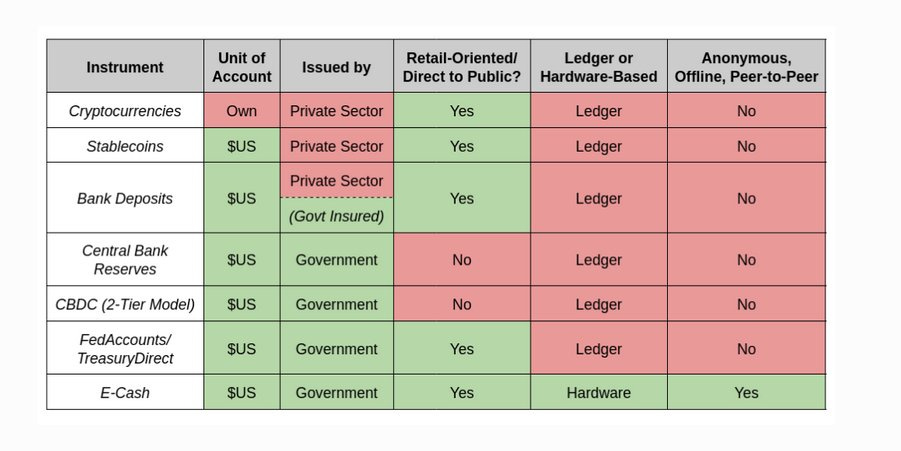

A group of Democratic Congresspeople just announced a proposal for the Fed to release a hardware-based "e-cash" that would emulate the experience (including privacy) of physical cash. It is an interesting proposal though I expect it is politically non-viable! JP Koning has an good graphic below2 showing how the e-cash proposal fits in with various other CBDC and CBDC-like technologies:

We’ve talked several times recently about the Western decision to sanction Russia’s foreign currency reserves in response to the invasion of Ukraine, and how it raises questions about the dollar’s role as the global reserve currency. Here is Putin himself making the case that countries will move their reserves away from "inside money" and towards hard commodities. Putin is an accomplished liar so don’t take him literally but it is interesting to see what arguments he thinks will be the most effective.

Mark Karpelès, former CEO of the infamous Mt Gox just announced a free NFT available to anyone who had a Mt Gox account between 2010 and 2014.

Andrew Ross Sorkin opens the question with a reference to how Russian Gas Society Pavel Zevalny hinted at the possibility of Russia accepting Bitcoin payments for oil / gas exports, but I personally think that was more an afterthought than a serious proposal.

Note that I disagree with Koning’s assessment of cryptocurrencies but consider him a worthy skeptic in the space.