Back in my day it was a simpler time

Plus the US government has de facto control of the Ethereum network.

Inside this issue:

Back in my day it was a simpler time (reader submitted)

Bitcoin is cleaning up coal waste in Pennsylvania

The US Government has de facto control of Ethereum

Back in my day it was a simpler time

"I just read Panic of the Apes and tripped over the lines "First, a reminder that I own a handful of Yuga Labs NFTs. I don’t consider them investments, I consider them souvenirs." I (and maybe other readers, especially those that came to crypto and nfts later) would love to hear about how you came to learn about crypto and NFTs. What was your mindset or what made you decide to buy in?

It's hard for me to imagine (as a buyer of more than a few NFTs and cryptocurrencies in late 2021 and 22) being in the space when punks were released? How was it different when the apes were released? What was the mood? Were most of the buyers in tech like yourself? How did you hear about BTC? about punks? apes? What would you say was the mix of speculators and those 'just in it for the tech'? How did that change between the punks and the apes?

As you and Something Interesting are moving forward into new work and possibly new perspectives I think it'd be interesting to read about a 'look back' and how you got started both with BTC and other crypto currencies and NFTs." — WC

What a lovely and thoughtful question — it is very easy after having made the leap into crypto to forget how things looked and felt from the outside. One of the strange and disorienting side-effects of how rapidly crypto is growing is that at any given time almost everyone in the industry is new! That means even relatively recent history needs to be repeated to be remembered. This is how entering into crypto and NFTs felt for me.

I first learned about Bitcoin extremely early on (2010, maybe?) from a coworker at Google but I immediately dismissed it because it was obviously impossible. Years later in 2013 when the FBI shut down the Silk Road I was surprised to learn that Bitcoin still existed and decided I should probably actually go read the whitepaper. I bought my first bitcoin in January of 2014, just before the collapse of Mt. Gox.

Specifically I bought a Casascius coin — the physical coins that often accompany mainstream media stories about Bitcoin so they have something to put in a photo.1 My reasoning was that even if Bitcoin collapsed it would still have a niche place in monetary history and so numismatists would probably still value the physical Casascius coin even if the bitcoin it held became worthless. The coin cost roughly ~2x the face value of the underlying bitcoin at the time.

It was the most ridiculous I had ever felt buying something up to that point and it was several days before I admitted buying it to my then-girlfriend-now-wife — but I also loved it and was excited to show it to anyone who visited. My first bitcoin was basically a goofy conversation object that I put on my curio shelf between the Klein bottle and the tungsten cubes.2

It wasn’t long before I was too attached to my Casascius coin for it to really work as a Bitcoin investment — I wanted to own some bitcoin that I could sell without having to damage an interesting piece of art. To figure out how much bitcoin I wanted to own I did a primitive version of the calculation I wrote about in my everyone should own Bitcoin insurance post.

In a world where Bitcoin is universally adopted you only need a very small amount of bitcoin which means if you own more than a very small amount of bitcoin you’re just being impatient. For most people (including myself) the right answer is to dollar cost average in for very small portion of their overall portfolio — and that’s what I did. I made small weekly purchases (and then eventually dialed back to monthly) over the next few years.

Buying Bitcoin regularly while the price slowly deflated felt awful. I constantly wondered whether I was an idiot. I stopped bringing Bitcoin up at parties. But I didn’t stop buying, because the argument still made sense to me. In retrospect 2014-2016 was a great time to be dollar cost averaging in but it didn’t feel that way at the time. A lot of us sincerely wondered if Bitcoin would ever be worth $1000/BTC again.

In the summer of 2014 Ethereum held it’s presale and I convinced my brother it wasn’t a good idea to participate. My concerns about the Ethereum approach remain relevant but in retrospect we obviously should have bought as much ETH as we could. My brother has graciously forgiven me. It’s tough to say how much my hesitation cost him since neither of us really believed in ETH and we almost certainly would have unloaded our positions shortly after the sale. It’s hard to make significant returns on investments where you lack conviction.

I found the ICO season of 2017-2018 embarrassing for the industry and was never remotely tempted to give anyone money for a slide deck full of promises even though it was a wildly popular thing to do. Watching VCs dump presale tokens onto naive retail investors left me with such a negative impression that years later I was slow to actually key into DeFi summer in 2020. Eventually I started paying more serious attention to what was being built on Ethereum but since I was still skeptical of the underlying platform I wasn’t tempted by any of the tokens built on top of it.

What I was tempted by was CryptoPunks. When the collection launched in 2017 I thought it was a genuinely interesting and cool new form of art. I have collected things since I was a kid and I immediately intuited the appeal of a digital collectible with the same scarcity properties of Bitcoin. I wanted one — but I still figured Ethereum was doomed so I decided I would wait for NFTs to come to Bitcoin.3

I stared with envy at CryptoPunks, but I didn’t buy one. Then in January of 2021 the Hashmasks project launched and I decided to participate in the mint, hoping to perhaps recapture what I had missed with the punks. I enjoyed the Hashmask mint and I still own two — but it only made me want a CryptoPunk more. Prices were rising and I worried that I might be priced out — or that I might lose my chance to buy a CryptoPunk that looked like me.

In February my lovely wife-and-editor told me I should just buy one and so I did. It felt very much like buying the Casascius coin — I worried at first that I would feel silly for having bought it but then was immediately glad to own it. Instead of going on my curio shelf with the Casascius coin I put the CryptoPunk on my Twitter profile, but the principle was basically the same. I didn’t buy my punk because I believed punks would go up in price — I bought because I was worried someone else would take the one that I wanted and just keep it.

Having played with the Hashmasks and bought my punk I didn’t feel the need to participate in a lot of the NFT collections that were minting at the time. I specifically did not care about the Bored Apes at first — a few friends were collecting them but they didn’t stand out to me at the time. I already owned my profile pic and I didn’t see any particular need to acquire multiple avatars. I wasn’t an art collector so I didn’t have any plans to become an NFT collector.

But the NFT culture at that moment was incredibly fun — it felt like a casino where the slots were malfunctioning and everyone was winning. And the coolest thing that everyone wanted to do with their winnings was trade up into high-status collections like punks and apes. I started to wonder if I was going to one day feel the same way about apes that I felt about punks and regret not having bought "my" ape when I had the chance. I finally decided to give into FOMO in July of 2021.

The entire year of 2021 was a relentless wave of free gifts and airdrops. Larva Labs gave every punk holder a Meebit, Yuga Labs gave every ape holder a dog, a mutant ape, an Otherside deed and some ApeCoin. There were free token airdrops of $LOOKS and $BOTTO and $ENS and many others. It felt like money was falling out of the sky and all you had to do was hop onto the right discord to learn where to look for it. It was obvious that time couldn’t last forever but it wasn’t obvious when it would stop. And then it did.

When the bear market caught up to NFTs and volume crashed ~97% the value of most NFTs crashed to zero and even the premier collection prices came down significantly from their peaks. The investment case for NFTs (which I always thought was weak) has gotten significantly worse. That was hard on the silly gambling NFTs that now litter my OpenSea 'hidden' folder but it didn’t change anything about the pieces that I bought because they were historically interesting and felt specific to me.

The last sizable NFT purchase that I made was an Azuki that I bought as a Valentine’s Day gift for my wife. I didn’t buy it because I thought the Azuki collection was underpriced and would likely appreciate in fair market value. I bought it because it was perfect for her!

To me there is a consistent through line from the appeal of Bitcoin to the appeal of NFTs — both require the same leap of faith about the value of digital scarcity. But for whatever reason it is empirically obvious that the overlap between Bitcoiners and NFT enthusiasts is quite small. I suspect that’s because of tribal loyalties created by the underlying competition between ETH and BTC.

I like collecting NFTs as digital trinkets and I do find entertainment in watching their trade value fluctuate. But I think it is important to distinguish between fun collectibles and actual investments — i.e. it’s OK to collect rare baseball cards but you probably shouldn’t do it with your retirement portfolio. NFTs and baseball cards are both interesting collectibles and terrible investments.

The right approach to crypto investing for almost everyone is just to buy a small amount of Bitcoin steadily over a long period of time. Most good investment strategies are kind of boring in practice.

Other things happening right now:

Bitcoin is cleaning up coal waste in Pennsylvania:

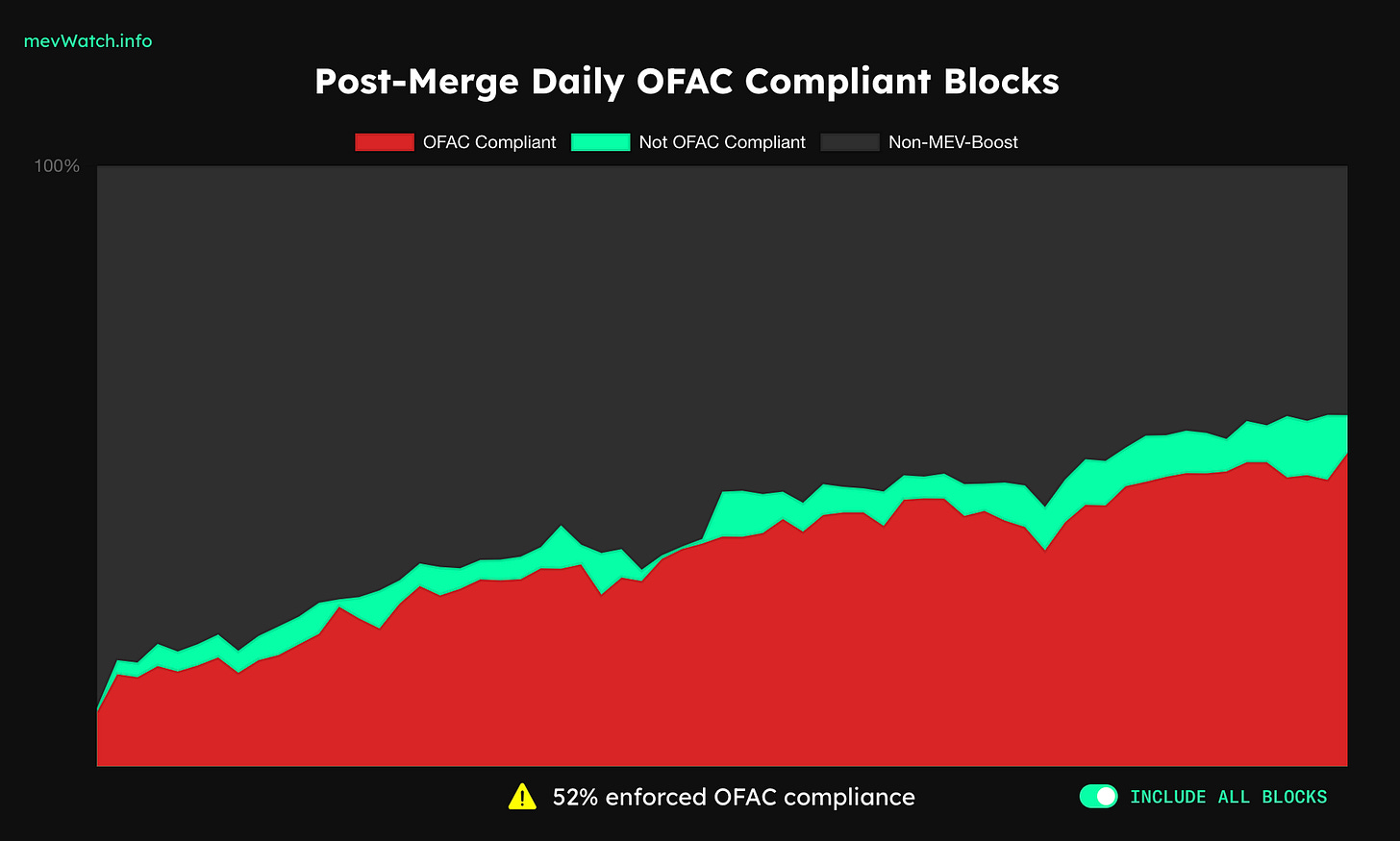

We’ve talked before about how the economics of MEV on Ethereum centralize the network: increasingly specialized skill is needed to extract the most potential value from block creation, which means more and more blocks are being created by a small group of specialists. Since those specialist companies are based in OFAC compliant territories the Ethereum blockchain is increasingly being dominated by OFAC compliant validators. At time of writing 53% of Ethereum blocks are OFAC compliant. If those validators decided to stop attesting to non-compliant blocks they would be evicted from the network. Arguably the US government has de facto control over Ethereum right now.

I really do have several tungsten cubes, which I promise I bought before it became a trend.

There are NFT systems that leverage Bitcoin (like Stacks or Counterparty) but they aren’t really native to Bitcoin in the sense that they each require an outside token (STX or XCP) to be fully operational. NFTs on Ethereum are truly native — you don’t need any additional tokens to make them work.