$4B worth of NFTs

Plus there is always another ponzi and Bitcoin mining returns to China

In this issue:

There’s always another ponzi

When to sell your Bitcoin (reader submitted)

You don’t need a blockchain for that (reader submitted)

$4B worth of NFTs (reader submitted)

Bitcoin mining comes back to China

There’s always another ponzi

You might think that the colossal failure of Terra/Luna that we’ve been writing about for the last few issues would give people some pause before building or piling into crypto investment schemes but no, obviously not. That’s not how any of this works.

If anything ponzinomics seems to be a growth industry right now. Justin Sun of the Tron network is already defending his Terra-clone by saying he would "have taken care of the situation in a much more careful way" — no doubt a comfort to the ~$0.5B of holders of his algorithmic stablecoin USDD. On Solana meanwhile excitement is building around Stepn, a walk-to-earn exercise app that lets users buy NFT sneakers and use them to earn tokens that they can sell to new users looking to buy sneakers to earn tokens. Sound familiar?

Maybe that’s because you read my post in December about Hex/Ohm. If you didn’t, you should check it out! It’s probably my favorite piece of writing from last year. It’s about how Ohm and Hex are the same basic scam with different class aesthetics. On the day of that post OHM was trading at ~$440/OHM, it now sells for ~$21/OHM. HEX on the other hand has held up better, falling from ~$0.16/HEX to ~$.08/HEX, largely because of excitement around the supposed launch of PulseChain, Richard Heart’s upcoming new Ethereum competitor.

PulseChain is another L1 smart contract blockchain with a twist: Pulse will copy not just the functionality of Ethereum but the exact state of everything built on Ethereum at Pulse’s launch. So every project in the Ethereum DeFi ecosystem will automatically have a shadow-clone version of itself on Pulse. HEXicans believe that these hollow echoes of actual DeFi projects will automatically fill with value, apparently because they have never seen the Wikipedia page for cargo cult.

It’s worse than that though, because the smart contracts ported over to PulseChain won’t know they are empty shells with no one piloting the machinery. The Pulse version of dApps will trust price oracles that no one is maintaining, naive investors will buy worthless tokens thinking they’re getting a discount, predators will come out of the woodwork to exploit the inefficiencies of this half-living, half-dead monstrosity. People have invested >$1B into PulseChain so far. When it launches it won’t just collapse — it will explode.

When to sell your Bitcoin

"You’ve written a lot about your optimism about Bitcoin, but what are the biggest risks and/or failure scenarios for Bitcoin? What would have to happen for you to lose your faith in it and want to sell?" — RA

It’s a fair question! One of the only pieces of actual financial advice in all of Something Interesting is the repeated mantra that you should not invest more into Bitcoin than you can afford to lose. That’s because Bitcoin is a radical experiment! I don’t think it is going to implode the way Terra/Luna just did … but neither did the people who invested in Terra/Luna. Better to plan for the reality that we are learning how these systems operate as we operate them. Sometimes they blow up.

At the end of the year last year I wrote an essay called This kills the coin that counted down my top ten threats to Bitcoin (I also wrote a companion piece for paid subscribers estimating how serious those threats actually are). I plan to revisit this list from time to time and see if it merits updating, but skimming it over again now I think it’s still a pretty accurate description of where the risks are today.

You don’t need a blockchain for that

"Hey @knifefight I've heard a bit about soulbound tokens (SBTs) recently, and I feel like I'm missing something because I don't see the point. Can you shed some light on the concept?" — SO

Co-founder of Ethereum Vitalik Buterin just co-authored a paper called "Decentralized Society: Finding Web3’s soul" introducing the idea of what they call a 'soulbound token' or SBT. This Twitter thread is a reasonably good summary of the paper from someone who is a believer — I am personally deeply skeptical.

The idea is roughly that you could encode truths about you as a person onto the blockchain itself and then you would be able to leverage your reputation/resume in the DeFi economy. So everyone who graduates from Stanford gets a "Stanford Degree" SBT assigned to their address and everyone who wants to know if you graduated from Stanford can check your wallet for the degree. Or a landlord might give their tenants a "paid the rent" SBT token every month they can eventually use to demonstrate reliability to a bank when asking for a mortgage.

Encoding trust relationships and credentials in cryptographic signatures is a good idea with a lot of advantages if it became widespread — but you don’t need to store cryptographic signatures on a blockchain for them to be useful. Blockchains are extremely expensive solutions to the double-spend problem — they are just a tool that records when something has been spent so no one can spend it twice. If a token can’t be spent — it doesn’t need to be on a blockchain.

Stanford can cryptographically authenticate a degree and give graduates a copy of that signature. They can use that copy or make copies of their own, because nobody cares if a degree has been copied, they only care whether the original was authentic. It matters a lot who issued the degree and who earned it and it doesn’t matter at all who stored it or whether they made extra copies. Putting information on a blockchain is like carving it into a mountain. It makes that information more permanent, but it doesn’t make it more useful or trustworthy.1

$4B worth of NFTs

In the "Other things happening now" section of last post I linked to a Chris Dixon tweet about how NFT creators had made ~$4B in 2021, an average of ~$174k/creator, radically higher than comparable amounts on Spotify, YouTube or Facebook. Here’s the tweet again:

This got a lot of attention and some pushback from readers! Here are a few questions I got, paraphrased across several conversations:

"Sure the "average" artist made a lot but isn’t that just big outlier sales like beeple? Most normal artists probably aren’t making that much."

The famous record-breaking beeple sale was for ~$69M or around ~3.5% of the total revenue in the statistic above — or about ~$6k of the ~$174k/creator. The fact that a small number of headliner artists vastly out-earn the long tail of creators is true of almost every creative discipline, though. That’s not really unique to NFTs and it doesn’t undermine the comparison that Dixon is drawing between platforms.

"Isn’t this mostly just wash trading?"

The methodology counts revenue from initial sales and revenue from OpenSea royalties. You can technically always dismiss any trading in DeFi as wash trading because anyone can create an anonymous account and trade with themselves, there is no way to disprove it. I personally find the idea that artists would pay OpenSea 2.5% fees in order to fake secondary volume extremely unconvincing. I’ve never seen anyone make a good argument for why it would be profitable.

Minting is more nuanced — there probably is a good case to be made for buying the first few pieces in a mint from yourself in the same way a busker might throw some coins into a guitar case to encourage others to do the same. There isn’t a secondary fee to OpenSea for doing that — but for a lot of projects (especially large ones) the money from mint is not passed on wholesale to the developers as profit, a lot of it is dedicated to a community treasury.

So anyone seeking to “wash trade” a mint would need to (a) park the capital upfront through the entire minting cycle (the chain is transparent, so recycling funds would be visible) and (b) suffer whatever dilution the treasury takes from the dev team. These days that’s often >50%, so any volume that was "wash traded" would be extremely expensive. I seriously doubt it significantly inflated the statistic above.

"How are they counting creators? 22k seems pretty small."

OpenSea itself only has roughly ~1.6M active users. Traditional conventional wisdom in user-generated content is that users:creators are roughly 100:1, which implies ~16k creators. NFTs are still incredibly early. If I understand the methodology correctly they counted anyone who actually used an on-chain contract as a creator. That’s not beyond criticism but one advantage it has is that it counts the creators who actually spent money trying to create their NFTs. I think that’s a pretty decent proxy for how many creators are sincerely engaging with the medium.

Other things happening right now:

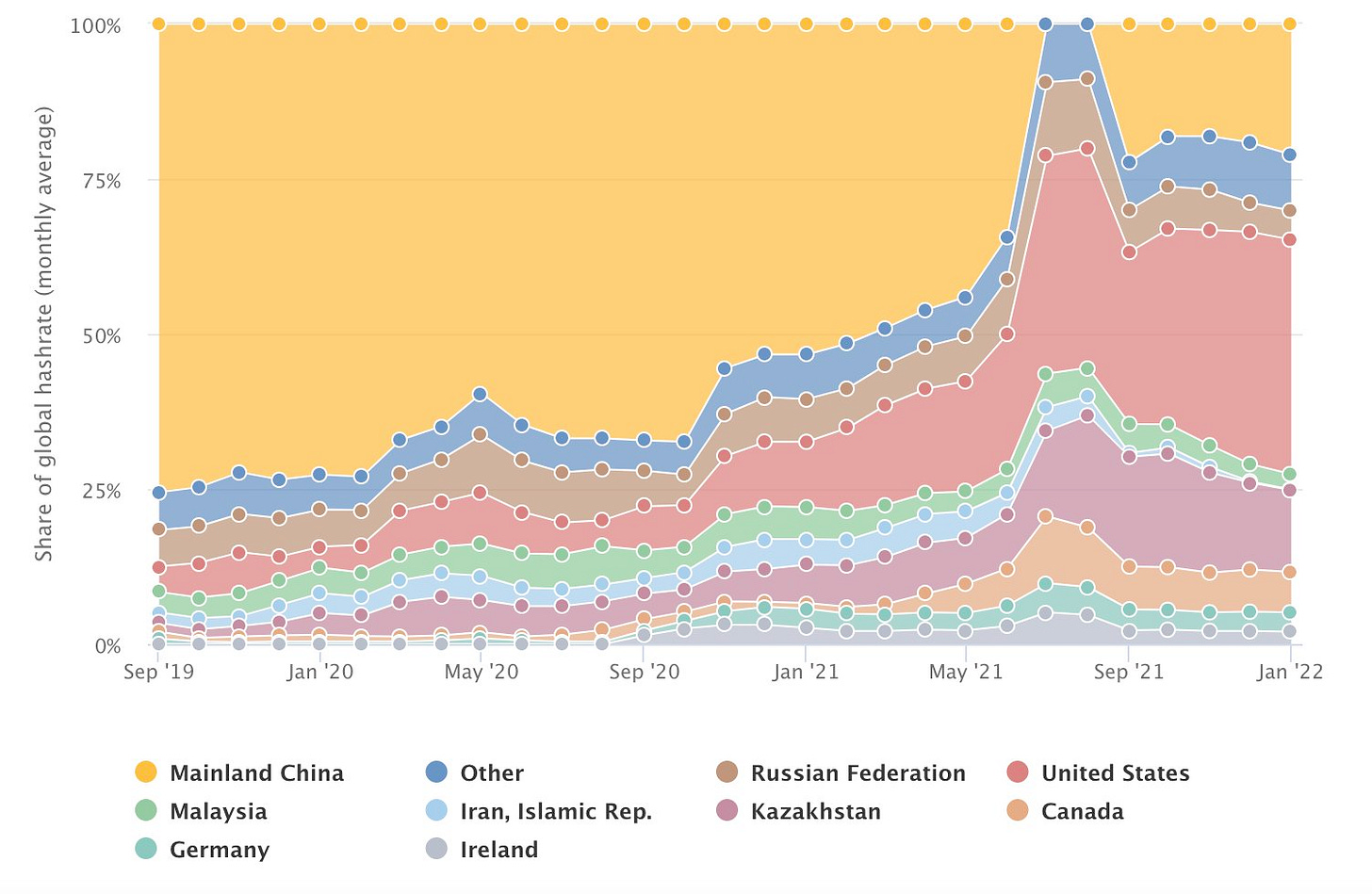

The Cambridge Bitcoin Electricity Consumption Index (CBECI) is the most reliable and objective overview of what we know about the Bitcoin mining network. They just released an update to their estimates of the geographic distribution of miners. Chinese mining dropped briefly to zero after the government banned mining, but underground mining seems to have resumed and Chinese miners now account for ~20% market share. The data does have limits — Germany and Ireland for example actually have very few Bitcoin miners locally but mostly show up as a result of miners who use VPNs.

Putting something on a blockchain does also timestamp it. You can obviously include a timestamp in the signature itself so if you trust the authority issuing the credential you don’t need the blockchain. Even an untrusted authority can also prove that a signature was made after a certain time by including information like a recent block number or that morning’s headlines. As far as I can tell the only reason to use the blockchain to timestamp a credential would be if you trusted the authority to issue credentials honestly but not to timestamp them honestly and you needed the ability to prove that credential had been issued before a particular date. I genuinely can’t think of a reason to do that, but maybe you can? Let me know.