Those who feed on the fallen

Plus the high price of cheap pizza and NFTs generate billions for creators

In this issue:

Those who feed on the fallen

Attestation and redemption

The high price of cheap pizza

Selling art is good for artists (🙀)

Those who feed on the fallen

The monumental aftermath of the Terra/Luna collapse is continuing to unfold. I first wrote about Terra/Luna back in March and then again last week immediately after the crash. I also wrote a longer form description of what happened and why for CoinTelegraph Magazine — you can find it here. Those posts go into what Terra/Luna was and why it failed — here we will focus a little more on what that failure means for the people involved and the crypto economy more generally.

First and most importantly I want to emphasize the human toll this took on ordinary people who lost money. TerraUSD (UST) was marketed as a risk-free place to save money, not as the exotic crypto-derivative it actually was.1 Some investors knew the risks and some should have known the risks, but many were just ordinary people who trusted someone’s advice about something they didn’t fully understand.

The Twitter account @FatManTerra has been surveying people who lost money and found the median investor lost ~$23k. That’s more than the average annual salary globally (and Terra was very much a global phenomenon). Around 1 in 4 of the investors surveyed had borrowed money to invest in Terra, believing it was safe. The enormous scale of this tragedy can make it feel inhuman, but those massive losses were carved from the life savings of real people:

There was also plenty of damage done to institutions and to the cryptoeconomy itself. Here is a long and detailed list of DeFi projects that experienced whiplash as the market unwound. Venture funds were also widely affected — Korean VC fund Hashed has lost ~$3.5B USD according to on-chain data. Delphi Ventures announced it had ~13% of its assets under management in Terra/Luna. Mike Novogratz of Galaxy Digital sent out a shareholder letter describing his now legendary Luna tattoo as "a constant reminder that venture investing requires humility." Indeed.

A strange thing about the Terra/Luna project is that it continues to have residual value even now. The developer community was large and active. A huge number of potential customers were onboarded into crypto. All the attention and curiosity trained on Terra right now is potential economic energy, waiting to be harvested. Like a dead whale falling to the ocean floor an entire ecosystem has emerged to scavenge whatever value remains from the wreckage.

The most obvious example of this are the various proposals to fork Terra and rebuild it somehow in the hopes of recapturing the pre-crash momentum.2 It isn’t at all obvious how you would do that, of course — even if you knew for sure how to build a version of Terra that is authentically self-sustaining and you could convince everyone you did, it still isn’t clear who you would include in the fork. Do people who sold at a loss on the way down get included? What about the people they sold to? These aren’t just abstract ethical riddles — how a new token is distributed will ultimately define how valid people perceive the resulting platform, and that perception of validity is what gives economic networks their power.

The belief people had (and still have) in Luna is powerful and easily abused. Right now some Luna holders are demonstrating their faith in the community by sending $LUNA tokens to a "burn address" posted by Do Kwon. Sending tokens to a burn address destroys them, which technically reduces the astronomic supply of $LUNA by some margin. Hundreds of millions of $LUNA have been destroyed — some in a gesture of solidarity and support for the community, others because of a rumor that the upcoming Terra fork will reward their sacrifice and their faith.3

Even grimmer the price of Luna has dropped so low that scammers have begun buying $LUNA and submitting fake proposals to the Terra governance forums that lead to phishing sites. Submitting Luna proposals is basically a cheap way to advertise to an audience you know is likely naive and desperate. Similar scam campaigns have been sending people messages inviting them to join fake Terra forks or to receive compensation for their UST losses.

The Terra community right now is like a crowd leaving a concert and wading through merchants offering overpriced water bottles and free mixtapes. The Terra show is over. But there is still money to be made from Terra fans.

Attestation and redemption

Since literally the second issue of Something Interesting I’ve been writing about the stablecoin Tether and the widespread fear that it is secretly insolvent. By now I’ve written about it dozens of times. Here is how I described it back in January 2021:

The way Tether works is surprisingly simple! You give your dollars (USD) to Tether Limited. Tether gives you the same number of Tether tokens (USDT). They promise not to lose your money, not to print unbacked Tether tokens and not to freeze or confiscate your accounts, even though technically the platform allows them to do any of those things. You in turn promise not to commit any money laundering or evade any banking regulations, even though technically the platform allows you to do any of those things. You might be wondering how you turn your USDT back into USD and the answer is you do not. That is not one of the services that Tether offers.

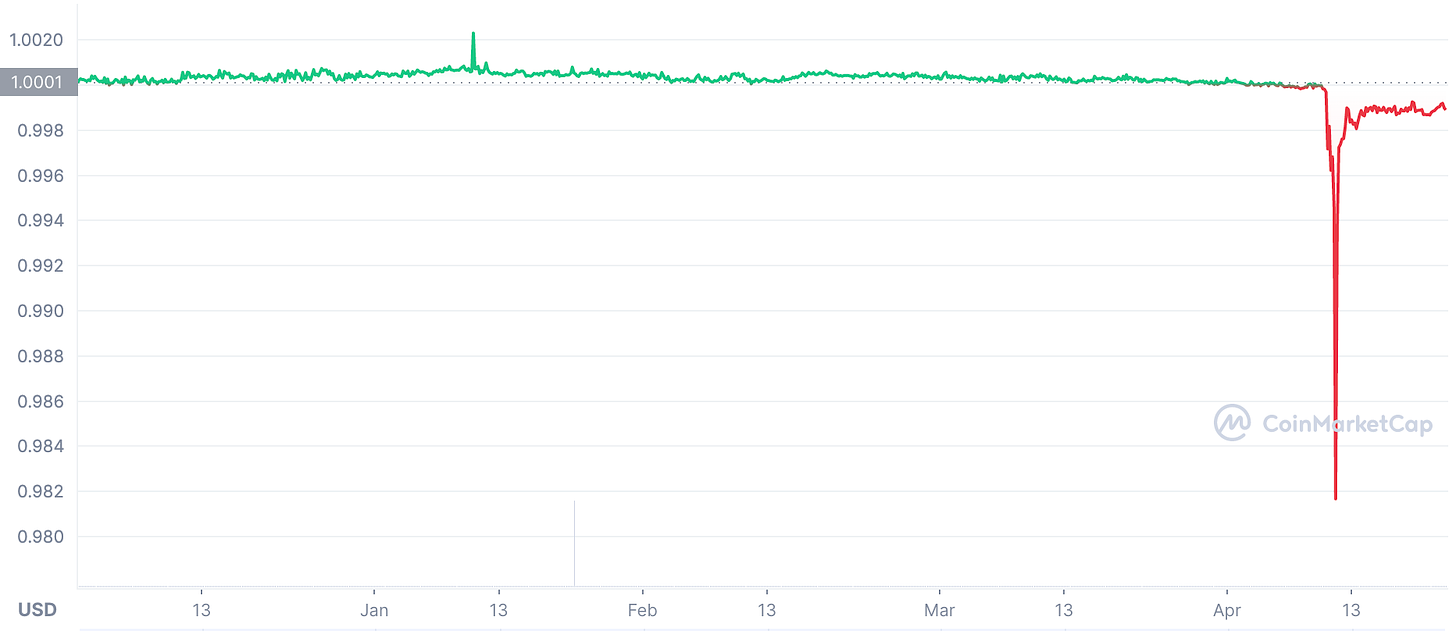

That is a slight oversimplification. You and I don’t qualify to redeem USDT for USD with Tether but there are partners who can. You can be reasonably sure that someone has the ability to redeem Tether tokens because in the wake of the Terra/Luna collapse, someone did. Around ~$10B Tether tokens were redeemed in the last week, reducing the total supply of Tether from ~$83B to ~$73B (~12%).

Depending on who you ask this is a story of strength (Tether was able to match $10B worth of redemptions at par without trouble) or a story of weakness (a bank run is starting on Tether and 12% of their liquid assets have already been drained). Investors have less appetite for stablecoins (the stablecoin market is down ~15% or so overall) but they might also have less appetite for Tether specifically. It’s hard to know.

Ironically, Tether itself has probably gotten stronger since the last time we wrote about it. Secondary effects aside, TerraUSD imploding eliminates Tether’s fastest growing competitor from the market. Rising interest rates mean that the revenue potential of assets under management is going up. And finally Tether (the company) just released a new attestation report giving a more up-to-date and detailed explanation of their finances. Since the last attestation they reduced holdings of risky commercial paper and increased holdings of US Treasuries.

Tether is still the least transparent of all the major collateralized stablecoins and has plenty of risk attached — but if you were comfortable storing your money in USDT last week you should probably still be comfortable today.

The high price of cheap pizza

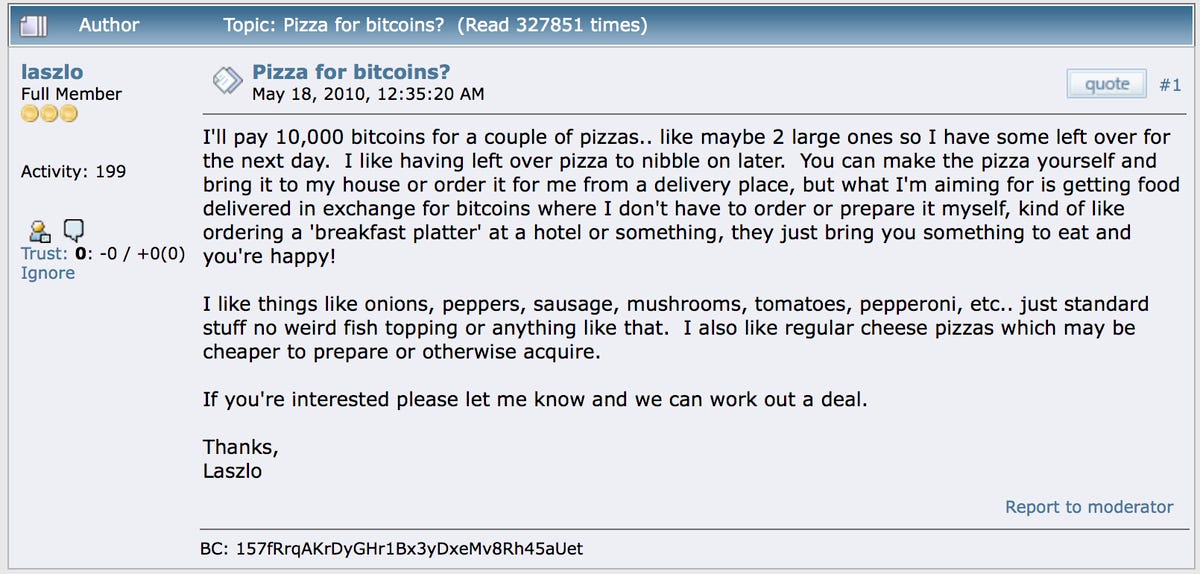

On Sunday May 22nd in 2010 Laszlo Hanyecz bought two Papa Johns pizzas for the (at the time) reasonable price of 10k BTC, now worth ~$300M. It is now an annual tradition to dunk on Hanyecz for his seemingly short-sighted purchase, but most don’t recall that the reason that Hanyecz had so much bitcoin lying around was because he had just invented GPU mining.

Many people (Satoshi included) were worried that one person having so many bitcoin would unbalance the network — so they chided Hanyecz to find ways to distribute his stash back into the ecosystem. Hanyecz wasn’t being short-sighted, he was reinvesting into the network to make sure it stayed healthy. He actually ended up buying 8 pizzas for ~40k bitcoin over the next few months.

Obviously the story "sophisticated developer jumpstarts Bitcoin ecosystem" is more complicated and less fun than the story "silly rube trades priceless Bitcoin for terrible pizza" which is why it gets less airtime. But it is still amusing how we remember this as the story of Laszlo Hanyecz (the man who traded bitcoin for pizza) and not the story of Jeremy Sturdivant (the man who traded pizza for bitcoin).

People tend to see Bitcoin Pizza day as a cautionary tale about why you shouldn’t buy things with Bitcoin — but it works equally well as an inspirational story about why you definitely should sell things for Bitcoin! Trading is symmetrical — for every winner there is a loser, and vice versa. Every story about a terrible trade is also the story of an excellent one. It just depends which perspective you take.

Other things happening right now:

Coinbase just announced a new semi-custodial wallet for web3. Traditional custodial wallets only allow you to send/receive crypto assets but they didn’t let you do any of the more interesting or exotic things in web3. With the new wallet/browser you can let Coinbase manage your private key (and help you recover it if you lose your password) and still use those keys to do arbitrary web3 things: staking, lending, DAO governance, NFT minting, etc. Brace yourself for more normies getting into DeFi.

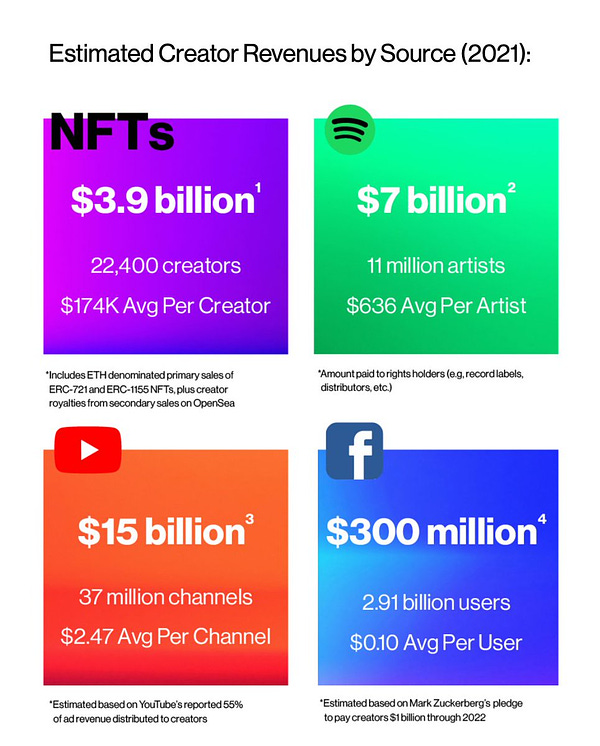

NFTs generated ~$4B in revenue for creators in 2021. Anyone arguing NFTs are bad for artists is either profoundly ignorant or acting in bad faith.

OpenSea just announced a major new exchange protocol called Seaport that supports trading arbitrary bundles of tokens, making conditional offers based on NFT traits or collections and some interesting, low-level gas optimizations. The result should be more liquidity in NFT markets with less competition for blockspace. It looks promising!

Here is an interesting set of analyses making the argument that the web3 developer community is uniquely global and growing less US-based over time. That is distinctly different from other open-source projects like Go or Linux, which are both heavily US based and relatively stable over time.

To celebrate their 10 year anniversary Coinbase put out a video montage of tweets going back to 2013 saying "Crypto is dead." It’s a cute bit, but the problem is using 'crypto' to refer to non-Bitcoin cryptocurrencies is a much more recent phenomenon. In 2013 the tweets that refer to crypto are referring to cryptography, not cryptocurrency. Actual cryptocurrency skeptics of the era were using the phrase "Bitcoin is dead" — but Coinbase’s business model is about selling Bitcoin alternatives, so their marketing is allergic to using the word Bitcoin, even when they are quoting someone else.

Presented without comment:

For example, Y-Combinator backed Stablegains accepted USD and USDC from customers and simply deposited them as UST into the Anchor protocol on Terra. Stablegains described itself as "15% interest, no surprises." After the crash of UST they frantically updated their marketing materials and terms-of-service.

As Terraform Labs points out, the "revival plan" is not literally a fork, but is actually a new chain with an airdrop to the existing community. The distinction is legitimate but I am absolutely not going to use the term "revival plan" to describe any of this.

Narrator: It won’t.