You can't secure a blockchain with flowers

Plus the outrageous leverage in traditional finance and the colorful legacy of John McAfee

In this issue:

Why can't blockchains do something useful? (reader submitted)

The outrageous leverage of traditional finance

Who will eat John McAfee’s dick now?

Why can’t blockchains do something useful?

“It seems like a lot of the complaints about Bitcoin boil down to the idea that proof-of-work is wasting energy. Wouldn’t it be better if we could secure the blockchain by doing something useful like folding proteins or planting trees?” - Lots of readers

Bitcoin is a deeply counterintuitive idea and there are a number of places where it is fairly common for people to get tripped up as they learn about the space. One really natural starting point is to ask: we are paying miners to do something pointless. What if we paid them to do something useful? Wouldn’t that be better?

The subtle misconception at the base of this line of reasoning is the idea that proof of work is arbitrary and can be arbitrarily replaced. But Bitcoin mining isn’t arbitrary at all - it has a very precise and specific purpose: it forces miners to prove they are committed to defending the network by sacrificing real resources. The security of a blockchain is the difference between how profitable it is to attack it and how profitable it is to defend it. Bitcoin is expensive to attack (because you have to sacrifice real resources) but profitable to defend (because you get paid bitcoin).

The problem with "work" that has a useful side-effect is that any side-effect produces value for an attacker subsidizes the attack and therefore undermines security of the network. The only activity that creates security for the network is activity that is costly for attackers but not for defenders. Even that is not enough, though - any 'work' that secures a blockchain has to accomplish at least four things:

It needs to be costly to perform, so miners are committed to the network.

It needs to be cheap to verify, so anyone can easily confirm miner’s work.

It needs to be impossible for attackers to resell outside the system, so that defenders are rewarded and attackers are punished.

It needs to scale predictably in difficulty, so the network can adjust the amount of work required as the population of miners grows or shrinks.

Adding a fifth requirement like "it needs to cause [X] to happen as a side effect" is much more difficult than it seems because it is actually already difficult to design a mining process that satisfies the first four requirements, as Bitcoin does.

It would be nice to have a network secured by planting trees. That would be costly for miners (1) and it does scale well in difficulty (4) but it is not cheap to verify at all (2) and attackers could definitely resell the value of planted trees to subsidize an attack (3).

It would be nice to have a network that was secured by folding proteins. That would be costly for miners (1) and it could be implemented in a way to limit miner’s ability to resell their work (3). Unfortunately it is not especially cheap to verify (2) and is basically impossible to predictably scale in difficulty (4).

So why can’t blockchains do something useful? The good news is they can! They can secure a cryptocurrency. They just can’t do two things at once.

The outrageous leverage of traditional finance

Let’s suppose you are a wild-eyed denizen of r/wallstreetbets and you are keen to make a high-risk/high-reward wager on the stock of Gamestop ($GME). You deposit $1 to use as margin to trade with and you take a 100x leverage long position - you are now holding $100 worth of Gamestop stock.

If the price of $GME falls 1% the stock you hold will now only be worth $99 and the exchange will sell it and use your collateral to close out the position. But that example assumes that the exchange can close your position out in time - what if the stock isn’t just falling but plummeting and by the time your exchange can close your position it ends up selling for only $90. Who is liable for that extra $9 of loss?

In traditional finance the answer is that you do. Trading on traditional exchanges means agreeing to unlimited liability - you are pledging your entire net worth against any trades you make. If you lose more money than you put up as margin the exchange will send lawyers to let you know how much they are owed.

Leverage on a crypto exchange works differently. Crypto exchanges operate with a limited liability model. Traders are only liable up to the margin they have deposited and losses beyond that are socialized in various ways.1 Winning traders can only win as much as losing traders lose and no more.

Former Bitmex CEO and current man-awaiting-trial Arthur Hayes wrote an interesting and accessible essay about how profound a difference that is by comparing the Great Financial Crisis of 2008 to the collapse of Mt Gox in 2013. Both were of similar scale to their respective economies (the GFC wiped out ~6% of the global GDP, MtGox "lost" ~7% of all Bitcoin), but the GFC required massive unprecedented bailouts and there was no bailout for MtGox.

Traditional banks have transmissible risks, so a risk to individual banks was a risk to the banking system at large. The banking system is how the majority of money is transacted, which meant a threat to the banking system is a threat to the currency itself. The government had no choice but to enact an unprecedented bailout to keep failing banks alive so that money could still flow through the economy. The risk was incurred by traders and banks, but the cost was ultimately paid by taxpayers.

Crypto exchanges have limited liability and no lender of last resort - so when MtGox collapsed it did not present a systemic risk to other exchanges and even if all exchanges simultaneously became insolvent the network itself would continue to enable the transfer of money. Thus there was no authority that needed to or even could issue a bailout for MtGox - and no bailout ever came. All the costs of the collapse were paid for by those who took the risks: MtGox and the traders on MtGox.

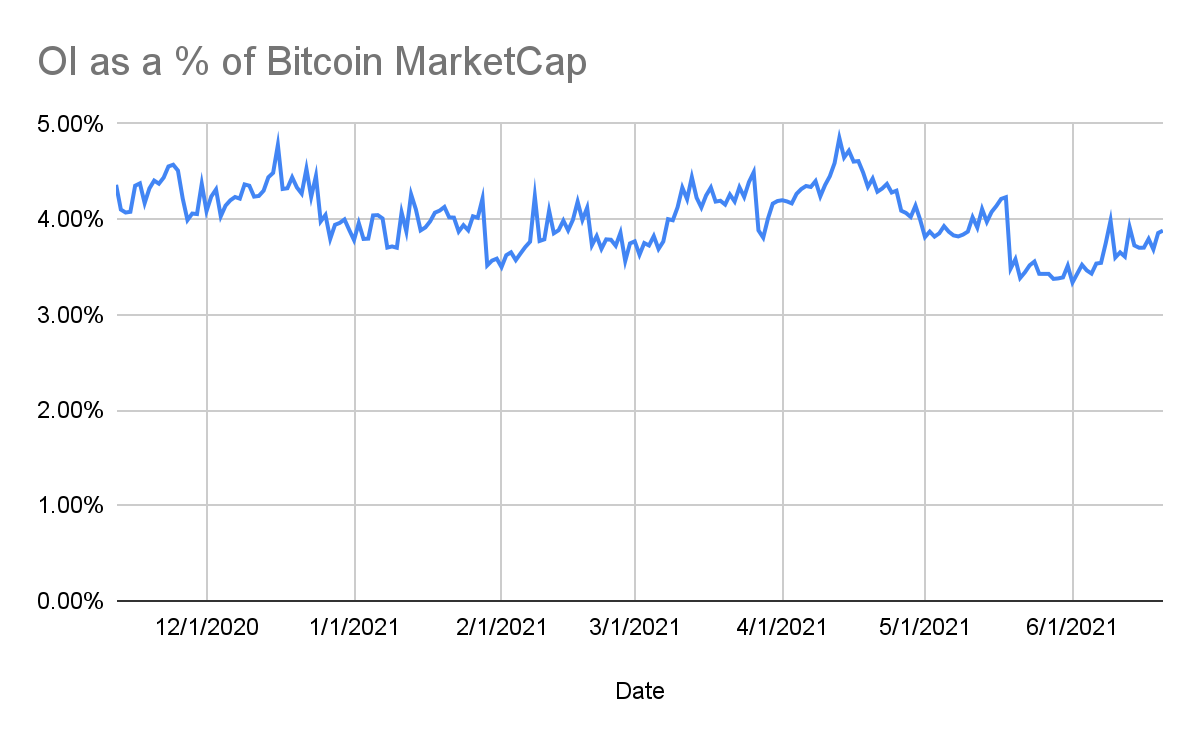

The fact that traders bear more of the risk of their own trading in the crypto markets leads to the counterintuitive fact that there is actually drastically less leverage in the crypto market than in traditional finance. Open interest in Bitcoin is <5% of market cap which means the leveraged derivative market is trivial - even if we assume zero margin (i.e. infinite leverage) that would make the Bitcoin market overall something like ~1.05x levered.

By comparison according to Hayes the ten largest commercial banks average ~14.04x leverage between them and the world’s top central banks average a staggering ~96.35x leverage. When those leveraged trades fail governments step in and create new money to cover the losses - specifically they covered the mortgaged-backed liabilities of the banks but not the actual mortgages of the citizens.

Traditional banking is like going to the casino with a buddy who keeps all their winnings but demands you split your chips with them whenever they bust.

Other things happening right now:

We’ve talked before about New York’s recent attempt to pass a moratorium on Bitcoin mining and its comprehensive but also restrictive regulatory approach to cryptocurrency (aka the "Bitlicense"). Not every New York politician feels the same way, however - current leading New York City mayoral candidate Eric Adams has made competing to attract Bitcoin businesses part of his platform. It’s not clear exactly what tactical steps he might be proposing, but it is interesting to see the rhetoric switch to seeing Bitcoin as an economic opportunity.

On Friday President Bukele of El Salvador presented the government’s new Bitcoin wallet and announced a $30 airdrop to anyone who chooses to install it. Bitcoin starts to look a lot more practical when compared to spending two hours riding a bus and an hour waiting in line:

Outsized personality and software tycoon John McAfee was found dead in a Barcelona prison on Wednesday morning of an apparent suicide. Before his death he heavily implied that if he ever committed suicide it would be a cover up because he had been murdered. Given his love of chaos my default assumption is he would do that even if he was planning to commit suicide. McAfee was in jail for tax evasion and had just been approved for extradition to the United States. He was most famous in Bitcoin circles for his … confident … price predictions.

Most notably winning trades are closed at the bankruptcy price of losing trades and are taxed to create a community insurance fund to cover excess losses.