Things to do with Bitcoin when you're dead

How to make sure your loved ones can still access your wealth without you.

Hey KF —

I have a question about what best practices are around succession planning with crypto (in case I die). My wife is a crypto n00b and does not really want to learn. I just want to make sure the funds are not lost if I die and that seed phrases can't get compromised if I'm alive. Are there some good best practices for planning for the worst?

— PA

First, I both recommend and request that you not die. I try to avoid offering explicit financial advice on Something Interesting but I will make an exception here: just don’t die. That will make managing your bitcoin stack radically easier.

Unfortunately, I am aware that in spite of my very good advice many people will choose to die anyway. If mortality is part of your financial plan, here are some things you should consider:

Don’t leave your loved ones a treasure hunt

Inheritance is a custody risk

How to share a secret

Keep it simple, keep it safe

Don’t leave your loved ones a treasure hunt

Visionary WWII codebreaker, genius mathematician and the grandfather of modern computer science Alan Turing was worried about the possibility of losing his wealth in the event of a German invasion of Britain — so he bought two silver bars (weighing a total of ~90 kg, worth roughly ~$98k today) and buried them a forest near Bletchley Park. After the war when he went to recover the silver he realized he could not break his own code for where it was buried. He never found the silver.

Obviously, everyone reading this post is several standard deviations smarter than the average investor — but none of us are Alan Turing. And even Turing wasn’t smart enough to avoid outsmarting himself! True self custody is a genuinely scary and difficult thing to do. Learning about Bitcoin (including learning to manage and custody bitcoin for yourself) is something everyone should do — but is not something you should force on someone you love, especially during a time of grief.

Don’t send your loved ones on a sidequest. There is no need to be overly clever and there is no upside to making things more complicated. If you bury your private key under a secret tree in Bletchley Park chances are the only legacy you will leave your heirs is a story about lost wealth. Don’t use your estate as an opportunity to flex how creative and interesting you are. Good estate planning should be boring.

Inheritance is a custody risk

People in bitcoin are touchy about how you choose to own and store Bitcoin. As I’ve written about before, I think the ideal custody strategy is a blend of different methods that have different risk profiles. Diversifying the ways you own bitcoin exposure lets you compartmentalize your risks: if something goes wrong, it only compromises part of your wealth rather than your whole stack.

That’s why in my opinion everyone should be doing at least some third-party custody through crypto exchange accounts, Bitcoin ETFs or professional custodians like Casa. That’s a controversial belief to some Bitcoiners, so if it seems counter-intuitive I encourage you to start with the post about the limits of self-custody. I’m not going to rehash those arguments in much detail here.

The reason that the seemingly benign advice to diversify your holding strategies is so controversial is because the history of Bitcoin is full of failed exchanges that lost user money. The risks associated with third-party custody are very real! But people tend to neglect the less-visible-but-no-less-serious risks of loss or theft in self-custody.

If the only thing you worry about is dishonest businesses and corrupt governments, then self-custody with a hardware wallet is the only tool you need. But a more complete picture of risk should include things like losing your seed phrase in a house fire or being targeted by a $5 wrench attack.1 One of the risks people don’t consider enough is the risk of dying unexpectedly and leaving your loved ones no ability to access your wealth without you.

Banks and ETFs excel at managing inheritance risk, so the more you are concerned about inheritance the more heavily you should rely on third-party custody solutions. Inheriting bitcoin held in an account at a crypto exchange or in shares of an ETF is by far the easiest way to posthumously transfer bitcoin wealth. Depending on your age, health and lifestyle you might reasonably decide to reduce your use of self-custody specifically to mitigate the transfer risk for your heirs.

On the other hand, for the same reason that everyone should hold at least some of their stack stored with third-parties for risk diversification, I also think that everyone should custody at least some bitcoin for themselves. So let’s talk about how to plan for inheritance and self custody! It’s the worst kind of Bitcoin inheritance but it is the most fun and exciting.

How to share a secret

To give someone your Bitcoin they need three things

They need awareness that your bitcoin exists (and belongs to them)

They need access to your private keys

They need to know how to use that information

People tend to plan for (2) but underestimate the importance of (1) and (3).

Step 1: Tell someone about your Bitcoin

Bitcoin has no knowledge of your passing and no ability to contact your loved ones. If you want someone to claim your bitcoin after your death, you will need to let them know that yourself. Don’t count on them to search through your laptop files for private keys or to recognize a hardware wallet if they find one in your belongings. That means you should tell someone about your Bitcoin, now, before you die. At a minimum you should tell the executor of your estate.2

You can choose to reveal these things after you die via pre-written or pre-recorded message, but doing that gives you no opportunity to clarify anything and gives your heirs no opportunity to ask any questions. If anything goes wrong with your attempt to sum everything up in one final message there is no Bitcoin support network that can help retrieve your coins. Better to explain something so important with a live conversation than a prewritten monologue.

Step 2: Plan how to store and retrieve your keys

Once you have told your heirs what to expect there really isn’t that much difference between making your private keys accessible to your heirs and making them accessible to your future self. That means most best practices for inheritance are also just best practices for cold storage generally. In my opinion this means:

Storing your private keys offline in a durable physical medium like metal

Keeping multiple redundant copies of those keys in case one is lost or damaged

Re-testing your ability to retrieve coins regularly, every ~year or so

How you choose to secure the keys themselves is a matter of personal judgement, but it is worth remembering that additional security does come at a trade-off for your heirs. Keeping your private key in a safety-deposit box or a home safe might be reasonable, burying it in Bletchley Park is probably not. You should think carefully about what kinds of hurdles your heirs (and future self) will be ready for.

As a simple example, you can choose to encrypt your private keys a secret passphrase. If you store the encrypted keys instead of the bare keys then someone who manages to steal your physical storage still won’t have access to your coin unless they *also* know your secret passphrase. That makes it harder for thieves to steal your coins — but it also adds more places that things can go wrong for your heirs.

Now they need your keys and your passphrase, as well as the knowledge of how to combine them. That’s trickier than it sounds, because they will also need access to the right tools to encrypt/unencrypt the keys and encryption techniques tend to be replaced over time. The tech that was commonplace when you set an address up may or may not still be commonplace by the time your heirs go to retrieve the bitcoin in it.

Step 3: Teach them how to use Bitcoin

Depending on the level of trust you have with your intended heir, this might be as simple as teaching them how you access your own storage. In this case I’m assuming you can trust your wife and the easiest answer is probably just to help her learn how to access your coins the same way you do, while you are around to teach her.3

If you don’t have that level of trust in your intended heir (such as if they are too young to be trusted with that much wealth) consider setting up a tutorial address with a smaller amount of bitcoin but secured in a similar way. You can teach them how to access coins consistently without exposing them to too much temptation and then later you can reveal additional address(es) with larger sums in your estate.

Don’t assume that if you’ve given someone a private key that you have given them bitcoin — if they need to ask someone else for help to actually use a private key you might as well send the key to that person directly. You can only meaningfully transfer bitcoin to someone who knows how to receive it. Otherwise you are just sending your bitcoin to whoever they trust.

Keep it simple, keep it safe

I have deliberately kept things very simple here because I think simplicity is the correct choice when you are optimizing for a loved one who is not a Bitcoin expert. There are theoretically other clever things that you could do with Bitcoin in service of custody and inheritance.

Most obviously, you could store your coins in a multi-signature arrangement where different coalitions of trusted keys could have different permissions over your funds.4 You could use nLockTime to create a kind of crude de-facto trust fund that paid out bitcoin over time, perhaps as a way of preventing your heirs from cashing out and selling everything all at once. You could use nLockTime and multi-signature together to cobble together a dead man’s switch to automatically transfer your bitcoin if you haven’t taken action in a certain amount of time. You could hide the location of your private key in a series of spooky riddles, each more difficult than the last. More things are possible than are actually practical.

If multi-signature storage is something you desire, I recommend working with a professional service like Casa.io. That is expensive, but if you have enough wealth to justify a multi-signature security arrangement you should be able to comfortably afford it. For any other fancy bitcoin machinery, I generally don’t think you should use them at all — at least not with any materially important part of your wealth. These techniques are still too new and experimental to be fully trusted yet. We don’t know all the ways they might go wrong.

Watch for businesses like Casa.io as an indicator of when functionality is stable enough to be trustworthy. The reason that Bitcoin custodians aren’t offering this functionality as a service today is because the security professionals (who are very good at reducing risk) can’t afford the insurance that the actuaries (who are very good at measuring risk) think the business requires. If the professionals don’t think the risk is worth it at commercial scale, it’s definitely not worth attempting for yourself. Separate your desire to do cool and interesting things with Bitcoin from your desire to provide for your loved ones after you are gone. Those are different goals.

I realize I haven’t said anything super groundbreaking here. Store your bitcoin thoughtfully and talk to your loved ones about how you do. Err on the side of simplicity and make sure you check regularly to confirm you (and your heirs) still have the access you expect. Teach your loved ones about Bitcoin while you are still around to answer their questions.

These are humble suggestions, but I also believe that simplicity is the approach that is most likely to ensure your wealth actually reaches your loved ones when the time comes. I promise your heirs will appreciate a straightforward legacy much more than an elaborate one.

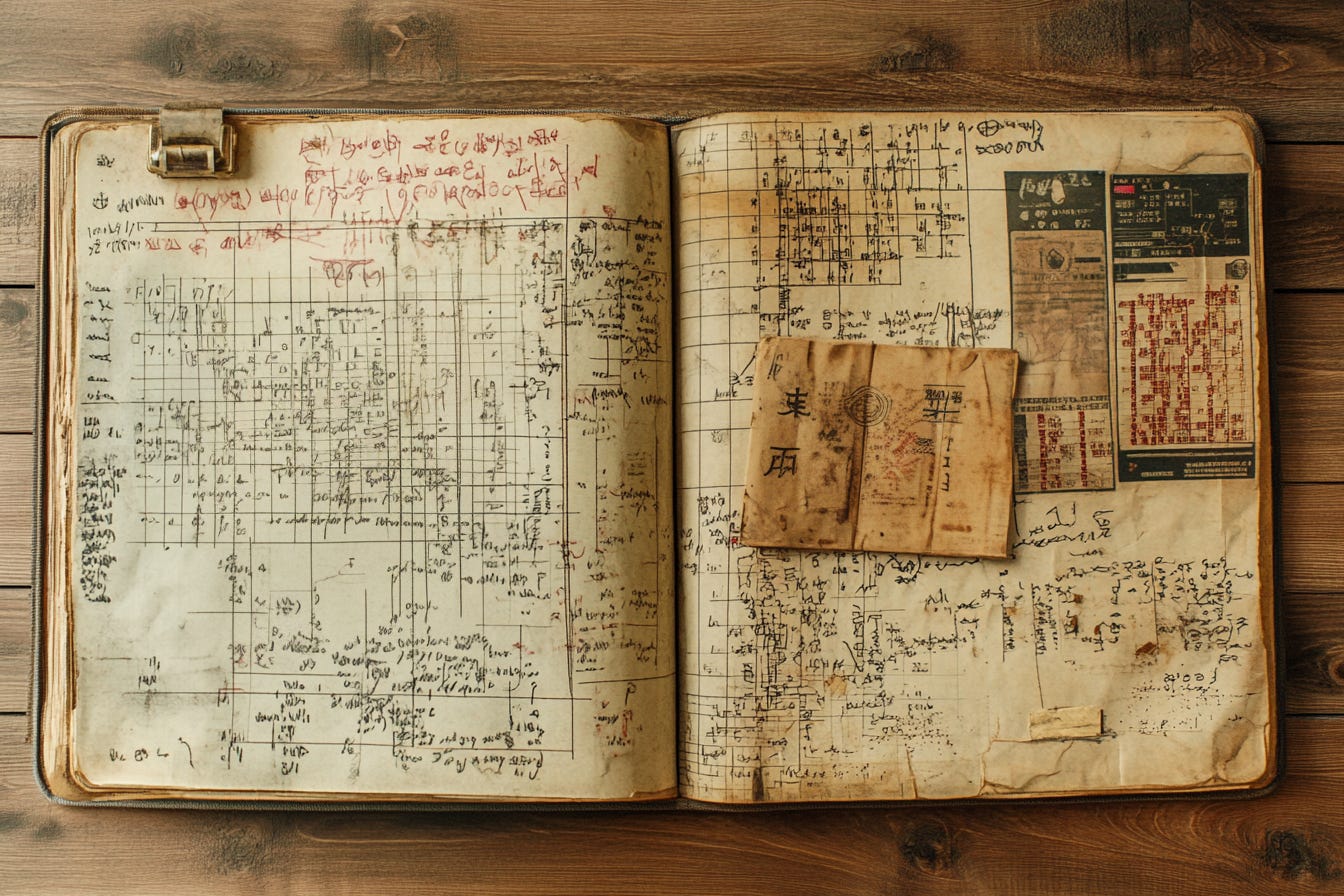

This is the spreadsheet I built decide my own risk profile / custody strategy.

If you have enough wealth to justify estate planning and you haven’t done it yet, you should do it now. If you don’t have enough wealth yet to justify forming an estate, you should probably be holding most of your bitcoin portfolio in Bitcoin ETFs. That will both solve your inheritance planning and has a much better overall risk profile for your wealth.

If your loved ones don’t want to learn about Bitcoin, that’s probably a sign that you should plan on moving whatever bitcoin you intend to leave them into a more beginner friendly vehicle like a Bitcoin ETF. Otherwise you are just setting them up for failure.

You should absolutely *not* split a single private key up into multiple pieces and store them separately, by the way. That might intuitively feel more secure but in practice attackers who know part of your private key can easily brute force guess the rest. Each additional bit provides twice as much protection as the previous one, so cutting your key in half doesn’t reduce your security by 2x it reduces it by a factor of 2^128. If any part of your private key has been compromised, the whole key has been compromised. To split your security across multiple locations, multi-signature is the technology you need.