The subtle art of bribery

Plus Curve War is hell and the Super Bowl enters the Metaverse

In this issue:

Curve War is hell

The subtle art of bribery

The Super Bowl enters the Metaverse

Curve War is hell

“Knifefight! I've seen a few references to the Curve Wars ... question for you: wat is?” -TM

Strap in! This one is a bit complicated.

A lot of teams and projects in DeFi use stablecoins — cryptoassets whose value is meant to be pegged to something else, usually a US dollar. There are a lot of different kinds of stablecoins and they get used in a lot of different ways. Anyone moving between DeFi projects may need to trade one stablecoin for another as they do. Curve Finance is a marketplace for buying and selling stablecoins — sort of the DeFi equivalent of a currency exchange booth at an airport.

To run a market for stablecoins you need market makers — traders who are willing to buy from sellers at a small discount and sell to buyers at a small premium. Market makers create the liquidity that opinionated traders need and then charge a small cut for the convenience. In DeFi these market makers are often called "liquidity providers" (LPs) and since more liquidity makes for a better market they are often paid handsomely for their service.1

Curve pays its liquidity providers in two ways. First, they earn a small cut of trading fees that happen on their trading pair — encouraging capital to provide liquidity to the active markets that most need it. But they also earn a 'bonus' reward set by the contract, which lets Curve subsidize new markets to jumpstart their liquidity. This bonus reward is paid in the native Curve token, CRV.

An example will probably help: let’s say you want to provide liquidity for the USDC/DAI pair. You would deposit $100 USDC and $100 DAI into the USDC/DAI liquidity pool. Every time someone wants to buy DAI with USDC you will earn a small amount of USDC. Every time someone wants to buy USDC with DAI you will earn a small amount of DAI. And Curve itself will reward you with some extra CRV for your services in making Curve markets more liquid.

One thing you can do with your new CRV is sell it and treat it as revenue but another thing you can do is lock it into the Curve contract itself in what is called "vote escrow." Vote escrowed CRV (veCRV) is paid a percentage yield that gets larger the longer you stake — but even more importantly veCRV determines the votes for how CRV rewards will be distributed across different liquidity markets. So if you lock up your CRV you can vote to increase the rewards for the USDC/DAI market where you happen to be offering liquidity.

Highly liquid markets are useful for Curve — but they are also useful for the stablecoin projects themselves. So MakerDAO (the project behind the DAI stablecoin) benefits when the DAI markets are heavily rewarded and attract lots of liquidity providers. They benefit so much in fact that it might even make sense for them to buy and lock CRV just so they can vote to direct the CRV rewards to the DAI markets.

Since there is only a finite number of CRV rewards, increasing rewards for DAI liquidity providers will always come at the expense of the rewards for liquidity providers for other trading pairs. That is what the Curve wars are: DeFi projects jockeying for voting power on Curve so they can direct CRV rewards to their markets and keep their tokens liquid / easy to trade.

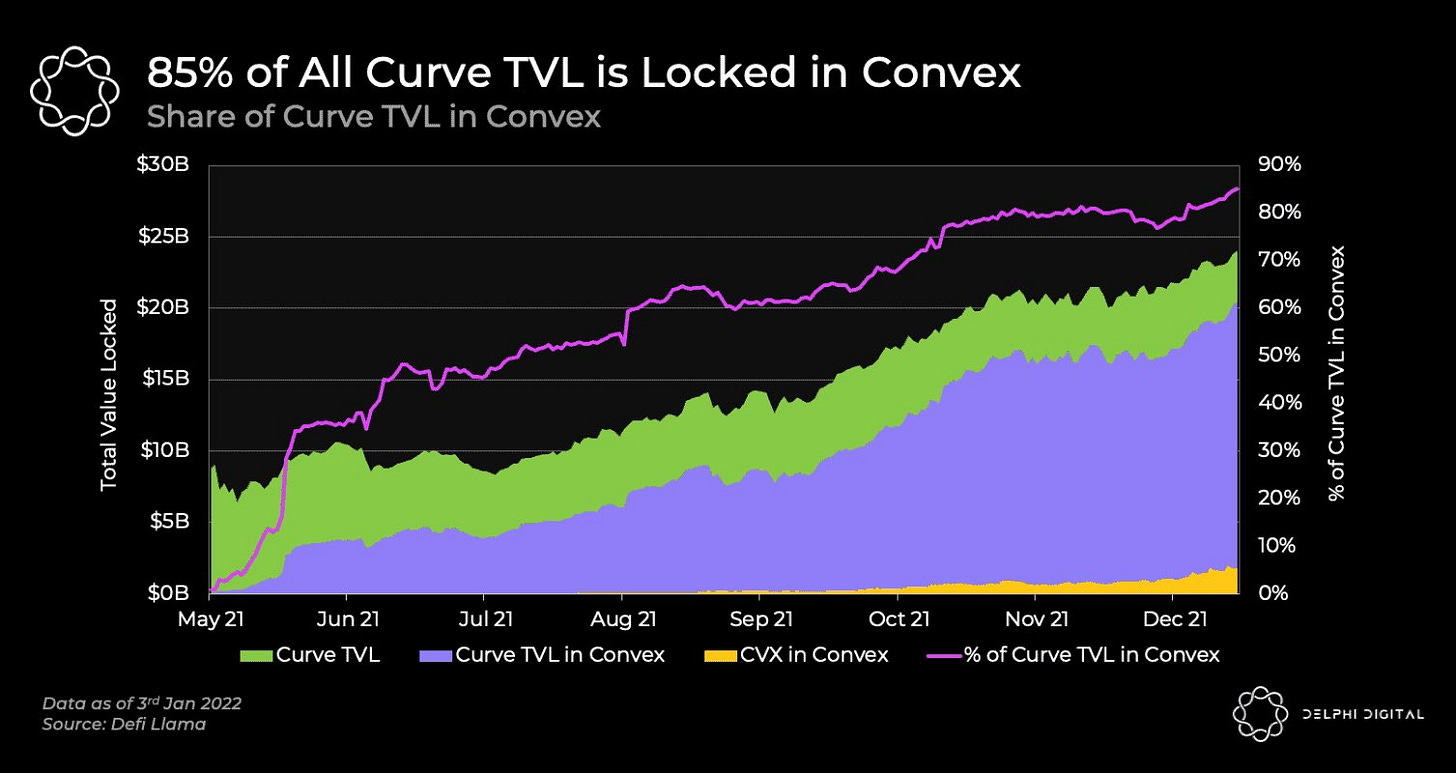

The stakes are quite high. Curve is the second largest project on Ethereum by total value of capital (~$14.4B) and the third largest project (Convex.Finance, ~$12B) is built entirely on top of Curve as a way to concentrate and monetize the voting power of veCRV. Convex owns just under half of all veCRV and manages around ~87% of the liquidity on the Curve platform.

If you want to start a new stablecoin (and many projects in DeFi do for various reasons) you will want your stablecoin to be easy to trade, which means you want a liquid market, which means you want to attract liquidity providers. Historically you would pay those liquidity providers yourself directly — but it may make more sense to outsource that task by paying Curve or Convex holders to acquire liquidity for you. If that turns out to be true the real winner of the Curve Wars will be Curve itself.2

The subtle art of bribery

"I’d be interested in your take on acquiring users through airdrops/high-APY single sided staking/etc. I can see argument that it's web3's version of customer acquisition costs (CAC), but seems hard to differentiate between lasting users and mercenary capital." — AS

In my glory days as a PM that led teams in charge of experimentation and testing, I was very fond of citing Goodhart’s Law, which states that if you try to optimize too directly for a metric you will end up ruining it. When there is too much incentive to move a metric people will (consciously or unconsciously) find ways to game that metric and moving it will stop being meaningful.

For example, the British wanted to reduce the cobra population in India so they offered a reward for dead cobras — such a valuable reward that enterprising Indians began breeding cobras themselves so they could turn them in. By paying to increase the metric "number of dead snakes" the British had made "number of dead snakes" no longer a useful way to measure progress on controlling the snake population. They were trying to incentivize the killing of cobras but what they were actually incentivizing was the production of cobra bodies.

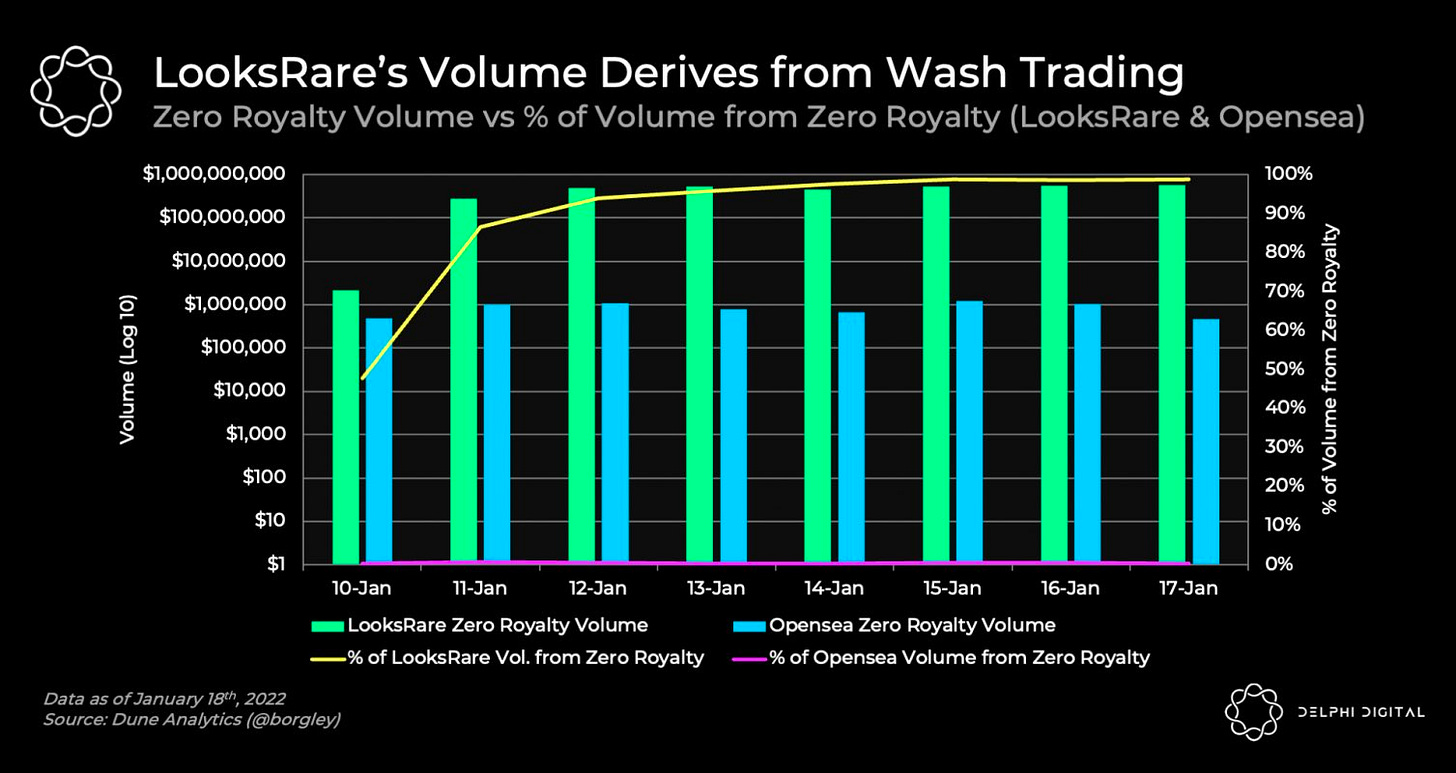

Many new DeFi/crypto projects bootstrap their networks by offering incentives to encourage adoption — consider the recent launch of LOOKS by the LooksRare NFT marketplace. Looks offers several kinds of incentives: it rewards trading, staking the LOOKS token directly or providing liquidity on the ETH/LOOKS trading pair.

The graph at the top of this section is Goodhart’s law in action: LooksRare is paying people to trade on their platform and so people are trading … with themselves. Some have argued that this wash-trading is good for the platform because it creates fees for users who are staking their LOOKS, but I don’t buy it. You could subsidize stakers directly without giving the wash traders a cut. In my opinion this particular incentive system is broken and being exploited. LooksRare is buying dead cobras.

In contrast the rewards for liquidity providers make a lot more sense to me. Users providing liquidity may be mercenary, but they make the LOOKS token more liquid either way. They don’t have to be sincere to be useful. Subsidizing liquidity makes it harder to understand how liquid the market actually is, but measuring liquidity is probably less important than maximizing it.

The trick to distinguishing between the two is to scrutinize carefully what you are actually buying. Using the network token to reward behavior is a powerful tool — but you have to be sure you are buying behavior you actually want.

Other things happening now:

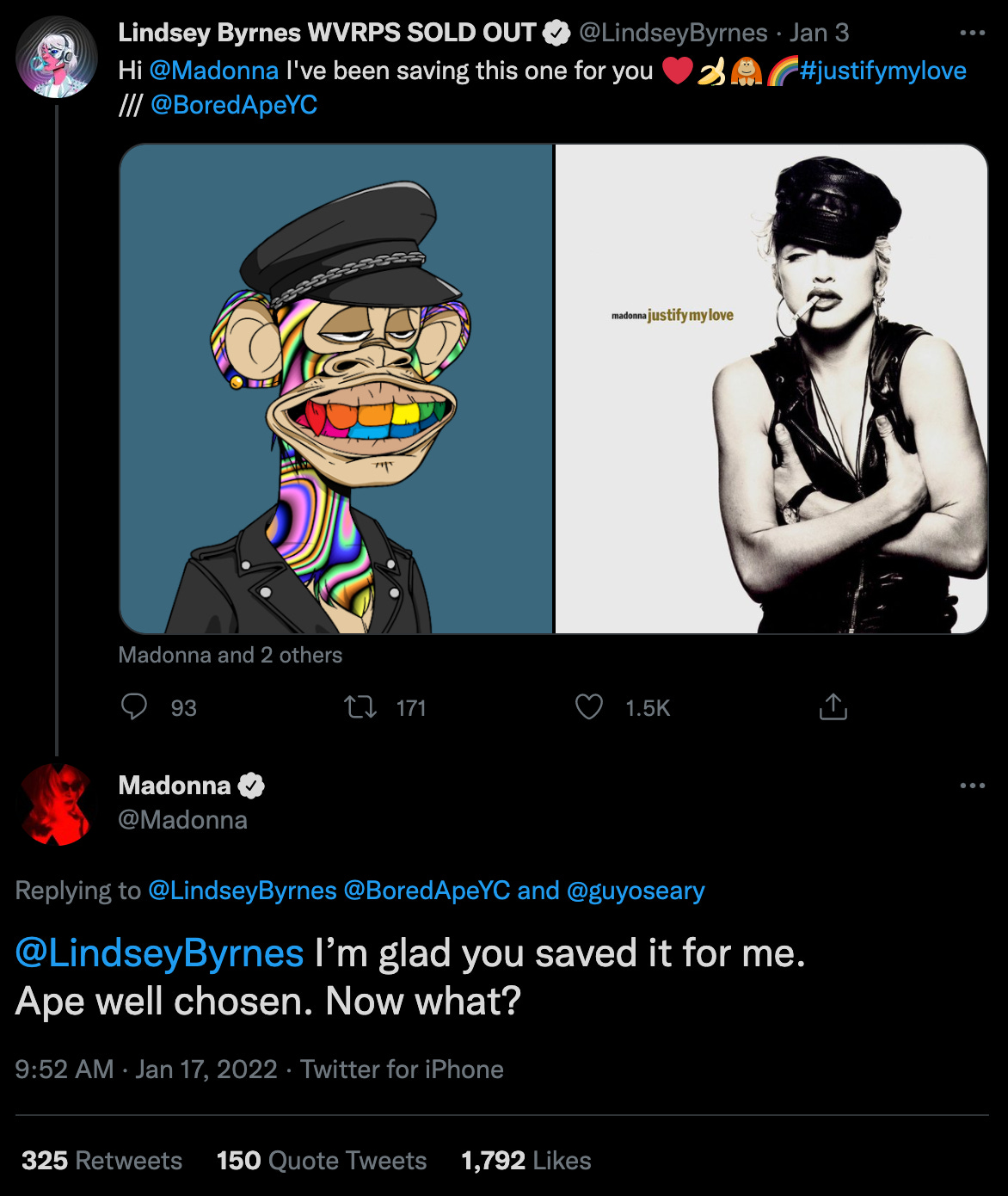

In a footnote a few issues ago we mentioned a trend of matching Bored Apes to potential celebrity owners, including an example of a particularly apt one for Madonna. Turns out Madonna agrees:

On Sunday January 16th the NounsDAO voted 75-1 to approve a governance proposal from the Budweiser corporation. In exchange for a free Noun (a pixelated NFT avatar worth around 68 ETH / ~$211k right now) Budweiser agreed to wear the Noun as their Twitter avatar and feature it in a Super Bowl ad.3 At least one Super Bowl ad featuring an NFT is now confirmed. It seems likely it won’t be the only one.

An internet collective raised and spent €2.66M buying a rare original of the concept art book for Alejandro Jodorowsky’s failed attempt to make an adaptation of Frank Herbert’s masterpiece. They appear to have genuinely believed owning a copy of the physical book gave them the rights to make a derivative animated series. Having since been ridiculed all over the internet they decided to pivot to "developing their own independent IP."

It is interesting to watch Bukele position himself and his policies to appeal to the international crypto community rather than towards his own electorate. I’m assuming the average El Salvadoran wouldn’t even recognize the phrase DGAF. It suggests he doesn’t feel very accountable to them.

This should be obvious but just in case, if you find that the enslavement and genocide of millions of people is below your line then redraw your fucking line.

Presented without comment:

Profit calculation for providing liquidity is complicated because you need to maintain an even balance between the assets in your portfolio, which functionally means you are always selling the winning asset to buy more of the losing asset. This is colloquially known as "impermanent loss" which I think is an unhelpful description, but no one consulted me. The tl;dr is that liquidity provision is most profitable when the assets you are providing liquidity for don’t move too far apart in relative value. The details are beyond the scope of this post but you can find a handy calculator for estimating impermanent loss here.

The Curve Wars are predicated on the idea that Curve controls the majority of stablecoin liquidity, which may not actually be true. Over the last six months the price of CRV has gone up but the share of the stablecoin swap market controlled by Curve has gone down. In practice Curve may not end up being the final battleground for stablecoin liquidity.

Budweiser also plans to release a collection of NFTs that will have governance rights over how the Budweiser Noun votes in NounsDAO proposals. One can only imagine how opinionated the average Budweiser fan is about NounsDAO governance proposals.