The SEC is acting in bad faith

Gary Gensler is the wet, lingering fart ruining the elevator for everyone

Inside this issue:

The two kinds of crypto crime (Reader submitted)

The SEC is completely full of shit

You can’t ban crypto you can only exile yourself

Entropy is just a cognitive illusion

Can you point me to a couple good articles that discuss the SEC and crypto issues. Is it a matter of what defines a security and within purview of the SEC? How will this impact the future of crypto? — HF

The two kinds of crypto crime

On Monday June 5th the SEC charged Binance.US, BAM trading services and Binance founder/CEO Changpeng Zhao (better known as CZ) with a raft of 13 securities violations. The SEC charges are full of colorful evidence and damning quotes, most notably the Binance global Chief Compliance Officer complaining to a colleague: "we are operating as a fking unlicensed securities exchange in the USA bro."1

The next morning the SEC charged Coinbase with operating as an unregistered securities exchange, broker and clearing agency. Ten different state agencies (AL, CA, IL, KY, MD, VT, NJ, SC, WA, AND WI) also coordinated to deliver simultaneous show cause orders2 accusing Coinbase of trading unregistered securities.3

The market did a big frowny-face. ☹️

The obvious intention of doing this in such tight coordination is to lump all these actions together in public perception. That’s extremely suspect because the charges might sound similar to a person unfamiliar with the details but they are extremely different in kind and character.

Coinbase is accused of operating an exchange for unregistered securities and the SEC is demanding they delist those securities and pay a fine. Binance is accused of the same but also accused of lying to investors, misappropriating customer funds, deliberately bypassing risk/fraud protections and trading directly against their own users for profit. The SEC is seeking to dissolve Binance and CZ himself may end up facing jail time. Whatever you think of either case, they are not equivalent.

The Binance charges are more serious but they are also (to me at least) less interesting. Using customer funds to secretly trade against them is obviously illegal and equally obviously should be illegal. No one is interested in defending Binance’s (alleged) behavior, which is why the SEC lead with the dramatic case against Binance and not the dry process violations of Coinbase.

The SEC would prefer to focus attention on the former, mainly because …

The SEC is completely full of shit

Charging Coinbase and Binance with listing unregistered securities sort of implies that they should have known better — but in fact the SEC has very deliberately refused to clarify which crypto assets are securities and which are commodities in spite of years of pressure from the industry. Coinbase itself is actively suing the SEC for the regulatory clarity they have refused to offer. The two SEC lawsuits aren’t even consistent with each other: of the 19 assets specifically mentioned only 8 are listed in both lawsuits:

In the past the SEC has clarified that Bitcoin is a commodity but guidance around other assets has been extremely sparse and often conflicting. Reasonable people can disagree on how to categorize Ethereum. For example, here is current SEC Chair Gary Gensler back at a Bloomberg conference in 2018 arguing that over 70% of the crypto market (BTC, ETC, LTC, BCH) were *not* securities:

Contrast that with current SEC Chair Gary Gensler who argued while teaching a course on cryptocurrencies at MIT in 2018 that Ethereum was a security, at least at the time of the initial launch:

Both of those Gary Genslers have a refreshing amount of clarity compared to the current SEC Chair Gary Gensler who testified before congress in 2023 and explicitly refused to answer whether Ethereum should be considered a security or not:

The regulatory confusion here is not an accident, it is a strategy. Gensler is fond of suggesting that crypto projects should "just come in and register" but in reality it is often not at all clear who could even perform that registration — which is why Robinhood is delisting several of the tokens mentioned (SOL, ADA, MATIC) even though it is a licensed securities exchange.

The entire point of a cryptocurrency project is to remove central points of authority and provide neutral infrastructure beyond anyone’s control. Demanding that crypto assets register with the SEC is deliberately creating a Catch-22: any useful project would be unable to comply and any project able to comply would not be useful. "Come in and register" is a fundamentally dishonest argument meant to disguise the true intent: to make crypto as an asset class de facto illegal.

You can’t ban crypto you can only exile yourself

The easiest way to read these and other recent administration actions (e.g. the proposed ~30% tax on cryptocurrency mining) is as a signal of general government hostility towards crypto as an industry and an asset class. By making compliance difficult and expensive perhaps they hope to discourage companies from participating at all, starving the crypto markets of liquidity and perhaps killing them entirely. But it is also entirely possible that rather than strangling the crypto market these measures only succeed in driving them off-shore and beyond the reach of US regulators.

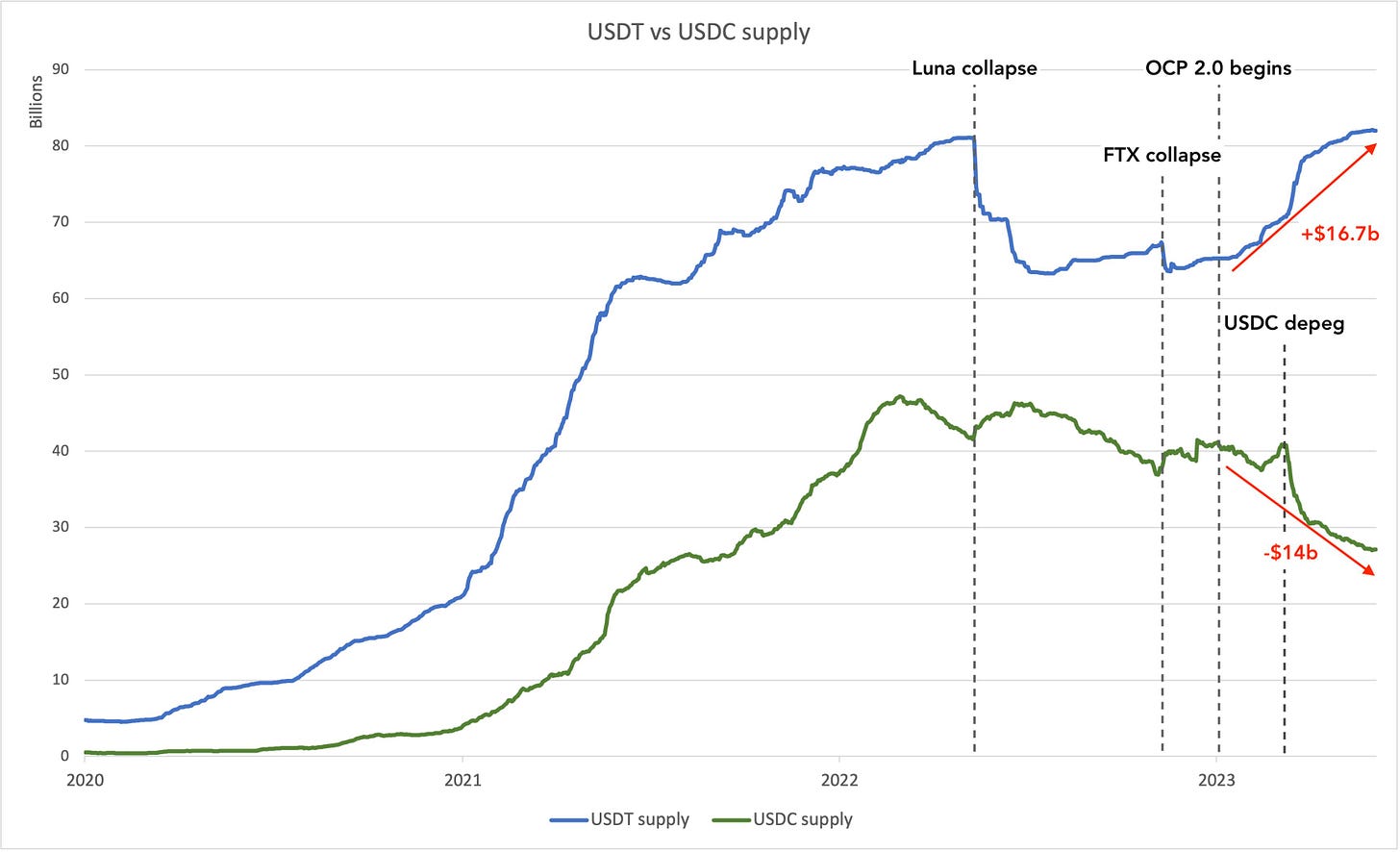

Stablecoin users for example don’t seem to be abandoning stablecoins, rather they seem to be abandoning Circle’s US based stablecoin (USDC) in favor of the off-shore and much less tightly regulated Tether (USDT).

Not exactly a win for investor protection.

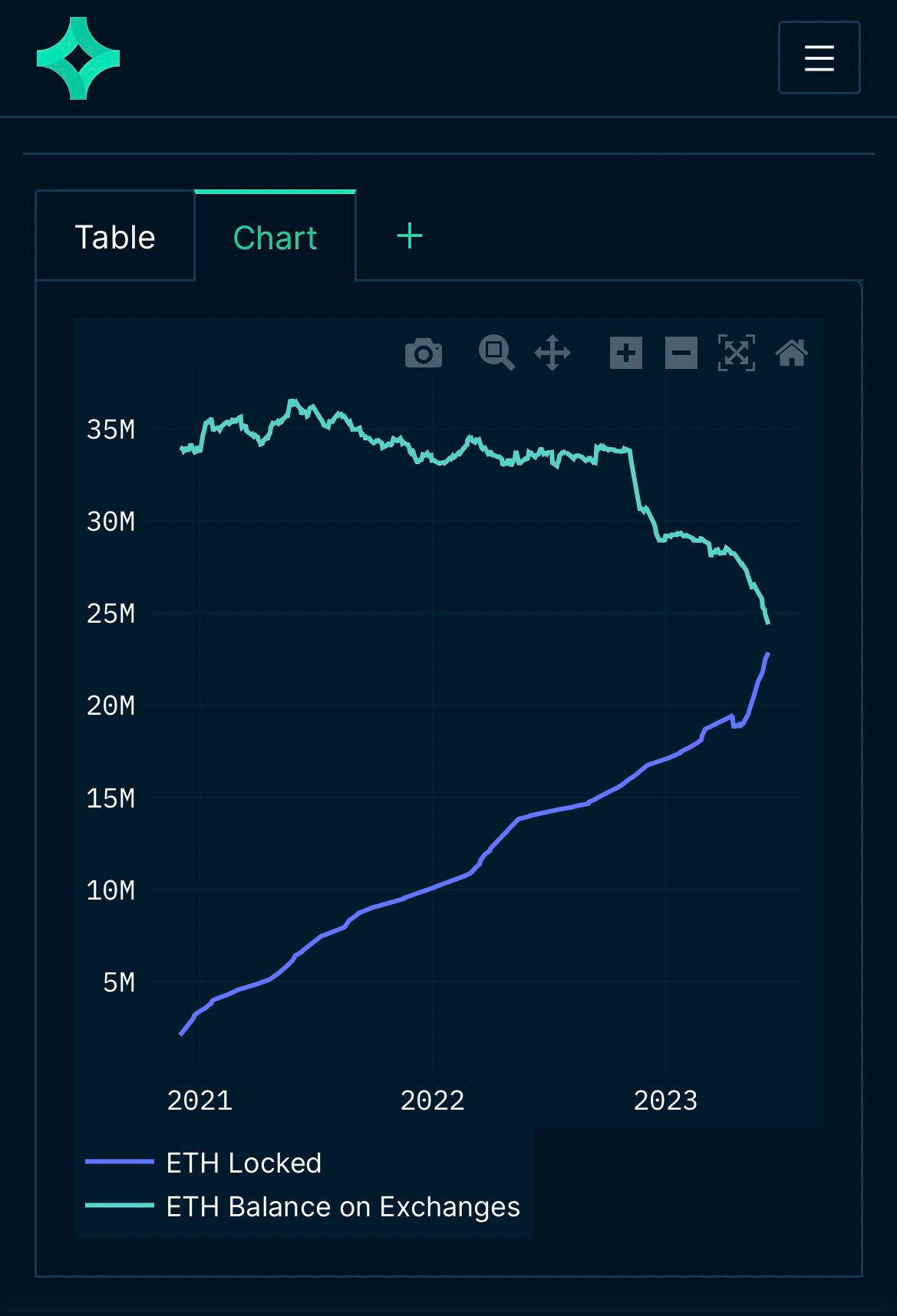

Much of the Coinbase/Binance lawsuits focused specifically on offering staking as a service for ETH (and other crypto assets). But discouraging exchanges from offering staking services didn’t discourage users from staking their ETH — they simply moved their balances off exchanges and staked in other ways:

A lot of other countries have a much saner approach to crypto. Canada, for example, has reasonably comprehensive rules for how crypto exchanges can be compliant. Europe passed the MiCA framework which isn’t flawless but is a legitimate attempt to provide regulatory clarity for crypto as an asset class. The UK is actively campaigning to be seen as a friendly home for the crypto industry. The US is the only country with the hubris to believe it can unilaterally will crypto out of existence.

Other things happening right now:

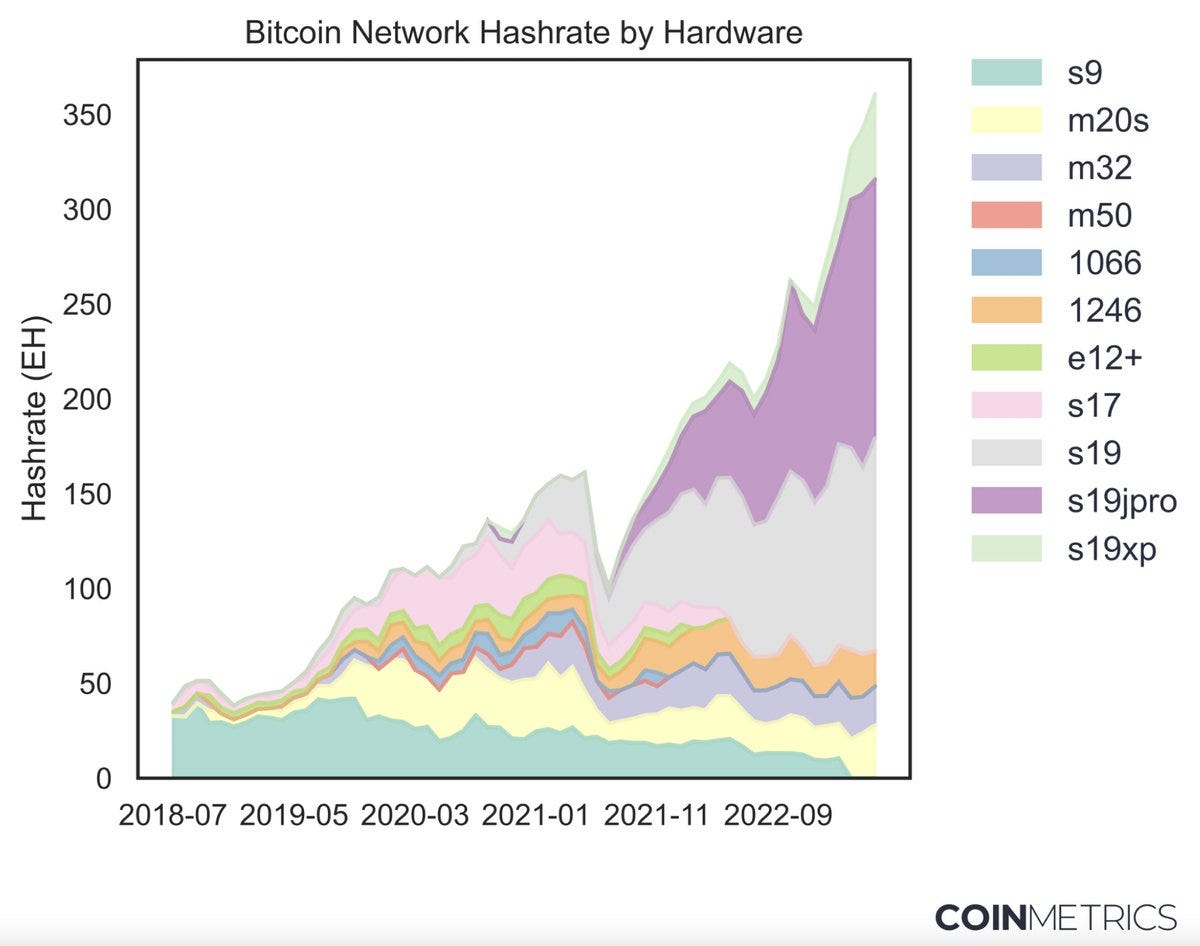

An exciting new methodology from Coin Metrics for inferring the hardware used to mine Bitcoin will radically improve estimates of Bitcoin’s power usage, energy efficiency and hardware lifecycles.

Feeling glum about the heat death of the universe? Worry not, friend! Perhaps entropy is actually just a cognitive illusion!

Look, Something Interesting is not a criminal advice column and I am absolutely not a lawyer but if you ever find yourself violating or thinking about violating securities law you should probably not be talking about it in a recorded chat. Especially if your title contains the words 'Chief Compliance Officer.' It’s this kind of lack of attention to detail that makes our industry look unprofessional in front of the grown-up criminals of traditional finance.

In an astonishing coincidence, someone took out a large short position in Coinbase just before the SEC action was announced. What a stroke of good luck!

An 'order to show cause' is basically the judicial equivalent of a parent making a stern face and saying "Explain yourself!" to a naughty child.