Inside this issue:

Ripple, huh! What is it good for? (Absolutely nothing)

Wait, shouldn’t that be illegal?

Comparing AAPLs and orange groves

The SEC is hammering at screws

Ripple! What is it good for? (Absolutely nothing)

To the best of my ability to search the Something Interesting archives1 the first and only time I spoke in any detail about Ripple/XRP was in The First 10 cryptocurrencies you meet back in March of 2021. Here’s what I said at the time:

Ripple is the name of both a cryptocurrency (XRP) and a company (Ripple Labs). When Ripple created XRP they kept ~60% of it, and the majority of Ripple’s income comes from selling XRP. Ripple would like very much for you to think of XRP as a naturally occurring commodity they discovered in the wild rather than unregistered securities they created to sell. The SEC does not agree and is currently suing Ripple Labs.

On Thursday judge Analisa Torres of the Southern District of New York (SDNY) issued a preliminary ruling in that lawsuit (SEC vs. Ripple Labs et al). If you are curious for slightly more detail about XRP itself you can read my old post but understanding XRP is not important for understanding this ruling or for leading a meaningful and fulfilling life. The ruling in this case is interesting, meaningful and important — but Ripple itself is not.

There are only a few things you need to know about Ripple/XRP:

XRP is a real token in the sense that it really does exist. You can buy it and trade it and hold it yourself if you are so inclined. The token works as advertised.

XRP is not a real token in the sense that it has no practical purpose. It is not required to operate the technology developed by Ripple Labs and there is no naturally occuring demand to use it.

The only people who own XRP are those trying to speculate on Ripple Labs by treating XRP as a proxy for equity and Ripple’s founders, investors, employees and partners — all of whom want to sell to that first group.

In other words, XRP only exists to create exit liquidity for insiders. It’s entire purpose is to transfer wealth from retail investors to Ripple Labs and the people and organizations Ripple Labs wants to pay.

Wait, shouldn’t that be illegal?

I mean … probably? A lot of people think so. The SEC certainly did when it brought the lawsuit. But the problem I and others have been warning about is that whether you think cryptocurrencies are a menace to society or a boon, they just do not fit well into our existing laws. The SEC should be in charge of helping well-intentioned companies comply with securities regulation but in the case of crypto they have simply refused to do so. Instead the SEC has focused exclusively on enforcement without explanation seemingly in an attempt to suppress the entire industry.

Deliberately cultivating ambiguity probably did discourage a lot of good-faith participation, but it didn’t stop everyone — and it left a lot of room open for eventual interpretation by the courts. The SEC is probably regretting that now.

In their lawsuit against Ripple Labs the SEC argued that the XRP token was an illegal security, meaning the initial sale of XRP was an illegal securities offering and every subsequent trade in XRP was an illegal securities exchange. Judge Torres rejected that argument and ruled that while Ripple’s initial XRP sales were securities the XRP token (at least in isolation) was not a security:

"XRP, as a digital token, is not in and of itself a ‘contract, transaction[,] or scheme’ that embodies the Howey requirements of an investment contract." — Judge Torres

Comparing AAPLs and orange groves

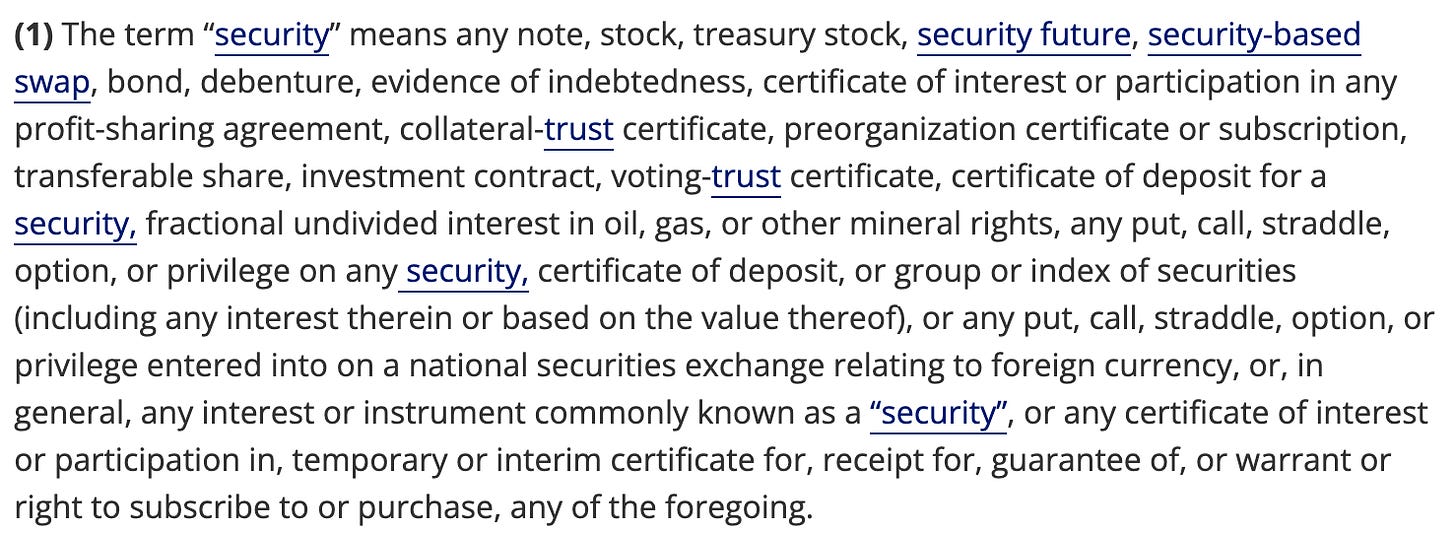

To understand why Judge Torres ruled that XRP is not a security we’ll need to unpack at least a little about what a security is2 — which is going to make the last post about the metaphysics of artistic value look straightforward and sensible by comparison. First off, the word 'security' is a legal catch-all term designed to encompass basically any financial instrument. You don’t actually have to read this whole list, just let it wash over you:

XRP looks a bit like stock if you squint and intuitively a lot of people assume it should be legally equivalent, but on careful examination it is pretty clearly not stock. You can’t vote with it, it doesn’t come with any special rights or privileges. Ripple Labs has traditional equity — XRP is something else. Most of this ruling is about what that something else is and whether it is a security. In particular, whether XRP fits into the broadest category of security: an investment contract.

Investment contracts are interesting because they can be legally inferred with or without any agreement by the parties involved. That makes sense — if you could skirt securities laws just by deciding not to formalize your agreements they wouldn’t be very useful laws. The government decides when something is a security contract (and investor protection rules apply) in more or less the same way the government decides when something is a motor vehicle (and vehicular safety laws apply).

Investment contracts are generally understood through the lens of the 1946 Supreme Court case SEC vs W. J. Howey Co, which roughly outlines a four part test that defines an investment contract as any agreement involving (a) an investment of money (b) in a common enterprise (c) in the expectation of profit from (d) the efforts of others. Not all securities are investment contracts (obviously, or the list above would be shorter) but in many ways they are the broadest category and represent the outer limits of the SEC’s domain of authority.

W.J. Howey was a real estate developer selling contracts to manage Florida orange groves. He argued that he was selling land, oranges and services — not securities. The court ruled that the collective package represented an investment contract because the buyers were (a) investing money into (b) a common enterprise (c) hoping to profit from (d) the efforts of others. The oranges, the trees they grew on and the land the groves were planted on were not investment contracts — but the contract governing the land management and the profit sharing was.

The question in this case was whether any of the things Ripple Labs had done met the Howey criteria and thus could be considered investment contracts. Judge Torres ruled that the initial sale to investors were investment contracts: investors had given Ripple Labs money with the expectation Ripple would use that money in a common enterprise designed to create profits.

But she also ruled that Ripple had not created an investment contract when giving XRP to employees and partners (because they had not invested money) or when they had sold XRP on the open market (because buyers on exchanges had no reasonable expectation their money was going into a common enterprise). Those transactions did not meet the Howey test and so did not create an implicit investment contract. Ripple had violated securities laws — but XRP itself was not a security.

It feels like XRP should be a security of some kind but it honestly makes sense that the tokens themselves are not investment contracts. Contracts are a claim on whoever has committed to them — they don’t exist outside of the entities they obligate. If Ripple Labs ceased to exist then any contracts binding Ripple Labs would stop existing as well. But recall that one of the only things you need to know about XRP is that it legitimately does exist.

In a world where Ripple Labs had disappeared XRP would almost certainly be worthless (like Chuck E. Cheese tokens in a world where Chuck E. Cheese went bankrupt) but they wouldn’t stop existing. You could make an investment contract using XRP and/or Chuck E. Cheese tokens but the contract wouldn’t be embedded in the tokens themselves. Selling tokens isn’t automatically an exchange of securities.

That’s a counter-intuitive result because it places a higher protective burden on the initial sales to informed institutional insiders than it does on later sales to uninformed retail investors — the opposite of how investor protections should work. But the court is just acknowledging the shortcomings of the law as it stands today: we have special rules and protections in place for investment contracts — but XRP is not an investment contract, so those rules don’t apply.

This isn’t a good outcome, in the sense that XRP is worthless trash and Ripple Labs should not be allowed to dump trash on an unsuspecting public. But that doesn’t mean the ruling is a flawed decision or that it will be overturned. American courts exist to interpret the law, not to author it. The responsibility for creating a sensible legal framework for cryptocurrency belongs to Congress and (to a lesser extent) the SEC. Instead they have chosen to avoid that responsibility in the vain hope that cryptocurrency would give up and go away on its own. As a result Ripple VCs enjoyed full state protection and retail XRP investors were hung out to dry.

The SEC is hammering at screws

Judge Torres’ ruling is not as flimsy as SEC-stans are hoping but to be clear this is a summary partial judgement from a single district court, not the binding law of the land. The precedent it creates is not universal and could still be overturned on appeal. Judge Torres’ conclusion that the Howey Test is not met without a literal exchange of money is novel and may not be sustained — implying that Ripple may still have violated securities laws when it paid employees/partners in XRP or when it sold XRP on public exchanges. Even if nothing changes it remains very bad news for Ripple Labs who was still found to have committed serious securities violations.

But taken at face value the ruling is incredibly good news for exchanges since it pretty clearly indicates that secondary trading of tokens is not inherently a security exchange. Coinbase stock jumped ~20% on the announcement and they (along with several other exchanges) immediately moved to relist XRP for trading. It’s also an optimistic legal signal for any cryptocurrency project the SEC might have considered an illegal security which — other than Bitcoin — was all of them.

It is still very possible this ruling will be overturned on appeal — but a new result won’t necessarily satisfy anyone disappointed today. The problem is we need a meaningful framework to define exactly what a cryptocurrency token is at various stages of development/decentralization and what kinds of responsibilities should exist for anyone creating/distributing/trading them.

Trying to regulate cryptocurrency using legislation from the 1940s is like grabbing a hammer and declaring that screws are just nails that refuse to comply. We need our leaders to meaningfully engage with this new technology instead of pretending existing securities regulations are already sufficient. Until we acknowledge the need for new rules to address this new possibility space we will be trapped in an endless debate where one side blames pegs for being square while the other complains how the holes are too round.

Standard caveats apply: I am not a lawyer and this is not legal advice. Don’t get your legal advice from newsletters with Rick & Morty memes.