The ironclad laws of physical reality

The efficiency, externalities and economics of proof-of-work vs proof-of-stake.

In this issue:

The ironclad laws of physical reality (reader submitted)

How to rebuild the court system in DeFi

Disney is making a Metaverse

The ironclad laws of physical reality

"You have a caveat in Proof of Stake will not save us where you say "There is a complex and nuanced discussion to be had about what the externalities of staked capital are in comparison to direct energy consumption - but unfortunately what advocates for proof-of-stake systems do more often is just pretend electricity is the only cost that really exists." The externalities of direct energy consumption to me feel extremely relevant and worth digging into, even if most people who do so do it in bad faith. Positive or negative, the externalities of PoW are large and, crucially, not really priced in at all. If we could measure and charge the true economic cost for energy, then I would be more unfalteringly excited about PoW. It is a happy coincidence that a lot of the cheapest energy in the world is renewable.

You mention the cost of staked capital. I'm not sure if you are arguing that it is an environmental cost, specifically, or an economic cost (in which case locked capital might even reduce energy usage vs if it could be used for investment or consumption?). I felt that was kind of punted on as well, with the rationale being that "the other side is dishonest." I agree people often distort reality, but I'd still like to better understand the reality they are distorting. The other thing I'm not sure you touched on (not in that article) is liquid staking. If stETH trades near the same price as ETH, does that reduce the capital cost to locking up my ETH? I can take out a loan against my stETH, for example, which I can't do with regular old staking. Is that relevant to the discussion?” - ZRW

First, I politely object to the characterization that I 'punted' on anything! Basically all of my posts (this one very much included) are at or even slightly past the length limit that GMail imposes for some reason. To add anything more I have to remove something else to make room — I have to keep a very tight scope and focus.

The point of Proof of Stake will not save us was not to make the case for proof-of-work but strictly to dismantle the bad arguments in favor of proof of stake. Pointing out that the people advocating for proof of stake are being dishonest wasn't a punt, it was the exact point of the essay! I've written many times elsewhere about the externalities of proof of work and why I think they are worth the cost. Can't fit everything into every post. 🙂

I do think it is interesting to investigate / examine the externalities of proof-of-work but I think it is a lot more complicated and subtle than most people bother to think through. For example you say "the externalities of PoW are large and, crucially, not really priced in at all" but that is a strong claim and I personally don't believe it!

Bitcoin mining itself produces no emissions or waste of any kind, is relatively quiet by heavy industry standards, takes up limited space, has no impact on the landscape or ecology around it and produces only a mild amount of entropic heat – and Bitcoin miners are so aggressive about closed systems to capture every piece of economic upside that many of them recapture that waste heat for use in things like hydroponic shrimp farms. The market is incredibly competitive and competitive markets are good at pricing things. Any remaining unpriced externalities in Bitcoin mining are in my opinion likely negligible.

I suspect what you are thinking of when you say there are unpriced externalities is the unpriced externalities of power production – and I agree that there are quite a few unpriced externalities in power generation. But attributing those externalities to Bitcoin is a category error. If I run a coal plant and I sell that energy to Bitcoin miners that doesn't mean Bitcoin mining caused the coal pollution. If Bitcoin disappeared I wouldn't stop burning coal – I would just sell the energy to someone else. My coal plant is not an externality of Bitcoin in any meaningful way. On the other hand if I have a natural gas flare that I replace with a Bitcoin mining site that only exists because of Bitcoin. That is an externality of proof-of-work: a positive one.

A lot of people operate under the fallacy that if a particular type of energy use is eliminated then overall energy use will go down – but that absolutely isn't true. The world did not stop producing energy because ETH switched to proof-of-stake. They just sold the electricity to someone else instead. Demand for energy is basically limitless, so the amount of energy we produce as a society is capped by our technological limits, not our use cases. We produce every drop of energy we can make cheaply and we spend every drop of energy we produce.

Any power generation that would happen in a world without Bitcoin isn't being caused by Bitcoin in any meaningful sense. Once we have decided to produce energy (along with whatever externalities that might entail) those externalities already exist, whether we use that energy to power old technologies or new ones. Banning a particular use of energy does nothing to reduce overall energy use. It does nothing to protect the environment. It is just a way of protecting incumbent industries from competition over the limited available pool of energy. The real way to understand the externalities of proof-of-work mining is not by asking "how much energy does proof-of-work mining use?" but rather "what activities are more profitable because proof-of-work mining exists?"

Viewed through that lens proof-of-work mining is an astonishingly green technology. The dedicated power that is generated exclusively for Bitcoin is almost entirely stranded methane and curtailed renewables and is almost certainly carbon negative. That's not a "happy coincidence" but rather an inherent property of what we mean by renewable! The second law of thermodynamics means there's no such a thing as a truly renewable energy source. We basically use the term "renewable" as a shorthand for "absurdly plentiful" which really just means "cheap."

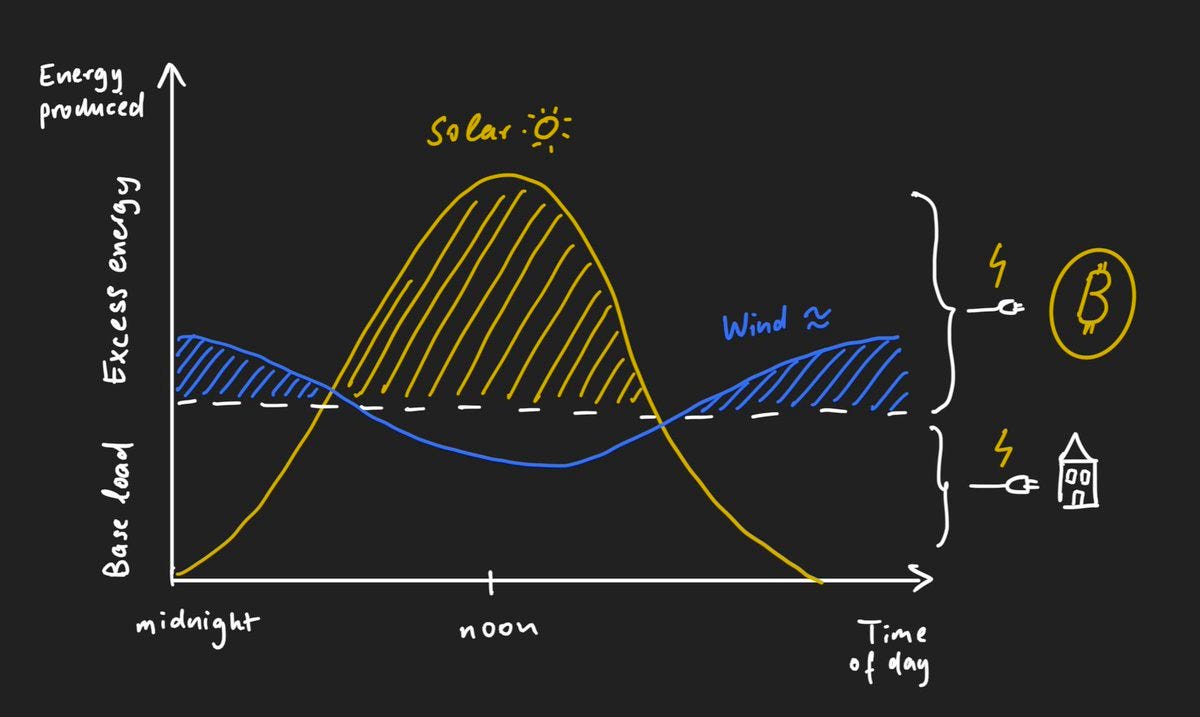

Fossil fuel energy is actually quite expensive per unit of energy – but it is extremely convenient because you can use the energy it produces wherever and whenever it is most useful. Renewable energy is by-definition cheap to produce but is often remote or available at inconvenient times. Fossil fuel is expensive but flexible, renewable energy is cheap but inflexible. Since proof-of-work miners are price sensitive but flexible about time and location they greatly improve the profitability of renewable energy and diminish the competitive advantages of fossil fuel. So it's not a coincidence or an accident of history that Bitcoin subsidizes renewable energy – it's an inevitable consequence of the design.

The energy externalities of Bitcoin are ludicrously positive which is why it is so frustrating to see people wringing their hands about it – but more thoughtful criticism of the environmental impact of mining is totally possible. For example Bitcoin doesn't just incentivize cheap energy production it also incentivizes the creation of a large number of what are essentially disposable computers. The environmental impact of producing Bitcoin mining rigs is waaaaaaaay more troubling than the environmental impact of running them. But almost nobody talks about that because energy use is easier to measure and graph and explain and so it makes better propaganda. Rhetoric that emphasizes proof-of-work energy use is more anti-Bitcoin than it is pro-Environment.

In my estimation the externalities of proof-of-work mining are as follows:

Providing a floor price on energy makes the economics more viable for renewable energy producers of all kinds: hydro, solar, wind, tidal, volcanic, geothermal and ocean thermal.

Being interruptible means bitcoin miners make power grids more stable/reliable

Being location agnostic means that miners can go on site to capture stranded energy like biowaste and flared methane

Being highly price-sensitive means that Bitcoin scavenges wasted power rather than displacing other forms of power use

Being powered by computation means that Bitcoin incentivizes the production of computer chips (and implicitly e-waste)

Now let's turn back to proof-of-stake! The basic gist of Proof of Stake will not save us is that securing a network always has a cost and that cost is measurable in dollars and payable in energy. That's a hard economic and physical reality. Proof of stake converts much of the cost into difficult to measure and complicated activities across many systems, which to the untrained eye can make those costs seem smaller. But they cannot be smaller unless the security of the network is also smaller. The economic value of the reward for validators is the security of the network which is the energy footprint it will implicitly consume. They are all the same metric. If you pay your miners $X they will spend $X worth of energy competing to win your $X reward – that's what it means to be a competitive market. Marginal revenue always equals marginal cost.

In proof-of-work this dynamic is obvious because of the difficulty adjustment. If miners become profitable then more miners join the network and difficulty adjusts until mining rewards are equal to the total amount being spent mining. But that economic reality is equally applicable to proof-of-stake: if you offer validators $X of rewards they will spend $X of energy competing over those rewards. The competition just manifests in more complicated ways, like MEV extraction or mining old staking keys for long-range attacks. Proof-of-stake does nothing to eliminate that energy consumption, it simply makes it fuzzier and harder to measure – like a child smearing the remaining vegetables around their plate to make it seem like they ate more. Only it's even worse because the same fuzziness that makes costs harder to measure makes competition less efficient which means some energy is wasted and the network is getting less total security per energy spent. So it's really more like burning all your receipts and pretending you have cut costs.

Proof-of-stake advocates almost always present locking capital up as "costless" which is frustrating and wrong. If staking capital didn't cost anything you wouldn't need to pay validators to do it. In reality of course staking capital has a societal cost, just as proof-of-work does. There is no such thing as a free lunch. The cost of staked capital is economic (in the sense that it can be measured in dollars) but it is also environmental in the sense that capital could have been deployed to solve any problem that matters to humanity. If you stake your wealth in Ethereum that wealth is not being used to fund art or culture or fight poverty or develop technology or fight climate change. By staking capital in ETH we have forgone some other thing that money could have done to improve the human condition.

Estimating the impact of staking on the allocation of capital is complex in the same way that it is complex to estimate the counterfactual of proof-of-work mining's presence on energy allocation. It would be unfair to characterize the impact of staking as being equivalent to the total capital it uses in the same way that it is unfair to characterize the impact of proof-of-work mining as synonymous with its total energy use. But it is equally unfair to characterize these costs as being negligible or non-existent, which proof-of-stake advocates routinely do. It is either dishonest or extremely shallow.

The presence of widespread liquid staking tokens changes the economics of staking somewhat but doesn't really change my underlying arguments. A widely used and adopted liquid staking token like cbETH or stETH makes it cheaper to move in and out of staking positions, which makes staking more attractive and would likely cause more total capital to be staked. That would raise the defense of the system but also the total cost – it's not clear to me that it would have an impact one way or the other on efficiency. I also think they have a natural centralizing tendency that is an existential threat to the security of the system, but that's a different question.

One thing liquid staking tokens don't let you do is double dip by staking your wealth and leveraging it for other things at the same time. Someone ultimately has to hold staked ETH in some form on their balance sheet for it to retain value and that person has taken on the opportunity cost of whatever else they could have done with their wealth. So if you take a loan out against your stETH to buy something then economically you have removed your wealth from the staking system and whoever accepted your stETH as collateral has provided the wealth that replaced it.

Staked ETH (in whatever form) can only hold value if someone is actually holding it and it can only defend the network if it is able to hold real value. There is no escaping the cost of securing the network – you can make it more complicated and spread it around, but you can't reduce it. Real wealth has to be spent to actually defend the network. Liquid staking tokens are interesting and impactful but don't change my basic concerns about proof-of-stake.

To summarize:

Any reasonable analysis of the environmental impact of a cryptocurrency network needs to (a) be counterfactual and (b) acknowledge the full range of costs. Even a cursory estimate of either of those things makes it obvious that proof-of-stake buys less network security at the cost of worse externalities than proof-of-work. It's slightly counter-intuitive but honestly most people would understand it just fine if there wasn't a relentless wave of bad faith argumentation pushing the opposite direction. They probably wouldn't even care! That's why there isn't an equally loud chorus crying out about the energy use of stable-diffusion or DALL-E. This argument isn't about the environment and it never was. It's just an unholy truce between people who are invested in proof-of-stake and people who hate Bitcoin.

Other things happening right now:

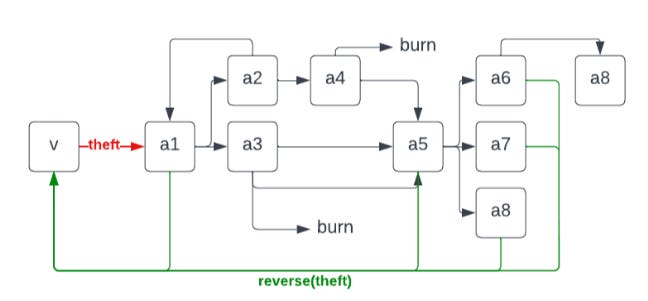

Here is a proposal to build reversible transactions on top of Ethereum. That’s a strange idea since irreversibility is the one of the basic value propositions of cryptocurrency transactions, but it’s possible to imagine use cases that benefit from delayed settlement *and* censorship resistance, like remittances to sanctioned nations where users still want fraud protection. The real question is whether a decentralized authority (like the "council of judges" proposed here) can ever be more trustworthy than traditional centralized authorities. Personally I think the internet abounds with examples of decentralized governing bodies that serve their users quite well: Reddit mods, Wikipedia editors, FOSS repositories. On the other hand, fraud detection is a really tangled problem. I’m not really convinced DeFi is ready to take it on yet.

Disney is seeking to hire a lawyer to "assist in performing due diligence for NFT, blockchain, third party marketplace and cloud provider projects, and negotiating and drafting complex agreements for those projects … on an aggressive and accelerated timeline." Disney has already released a handful of NFTs but is reportedly planning a Metaverse strategy — though CEO Bob Chapek has said, "We tend not to use the M word too often, because it has a lot of hair on it." I couldn’t agree more.