Something Interesting is bamboozle free

But it is made in a facility which processes bamboozles and may contain trace amounts

Happy Genesis Block Day! Today we are answering a few of the reader questions that came in during the break. Next post we will resume normal news coverage.

In this issue:

Why doesn’t Bitcoin just tax holders? (reader submitted)

Does quantum computing kill the coin? (reader submitted)

Does an EMP blast kill the coin? (reader submitted)

Does taxation kill the coin? (reader submitted)

Something Interesting is bamboozle free (reader submitted)

Why doesn’t Bitcoin just tax holders?

“You talked about how the block reward might run out before Bitcoin has a fee market but I don’t think it even takes that 140 years. It suffices that price increases don’t match the halving rate. So far it has more than doubled every four years but if you assume it eventually doesn’t, what follows? The txn fees were conceived b/c the value was initially conceived as a medium of exchange. If it was conceived as more of a settlement layer / store of value, then perhaps the appropriate thing to tax was wealth not payments? Kind of scales linearly with the utility that one derives?” — IS

Satoshi actually always anticipated that the network would be expensive to use. Some people were confused by the phrase "electronic cash" in the Bitcoin whitepaper, but Satoshi meant cash as in bearer instrument not cash as an retail payment system. I don’t think Satoshi ever used the phrase ‘settlement layer’ but the idea that Bitcoin is principally a store of value is as old as Bitcoin itself. That’s why the Genesis block references the banking bailouts instead of PayPal fees. Bitcoin has always been a tool for saving, not for spending.

It is very possible that Bitcoin dies as the block reward starts to fade out (I consider it the greatest threat to Bitcoin) and you are right that it might not take 140 years. It isn’t necessarily the case that the price has to grow faster than the block reward shrinks though — it’s entirely possible that we are overpaying for security today. The network may end up settling into an equilibrium with a lower hashrate than we have today but high enough to protect the network.

It’s pretty common that people propose (or predict) that Bitcoin adopt a tax on holders, usually by making the block reward permanent and removing the 21M limit on the total supply of Bitcoin. Creating new Bitcoin dilutes the share of ownership of all holders and is functionally a tax you could use to pay miners for protection. I don’t personally think Bitcoin will ever compromise on the 21M limit even if that turns out to be fatal to the network.

The basic purpose of Bitcoin is to enforce perfect scarcity and the set of people using Bitcoin are the set of people who value that feature. It would be much easier to start a new network with a different monetary policy than it would be to convince Bitcoiners to change Bitcoin. You can even launch the new network as a fork so that everyone starts with an equivalent balance to what they controlled on the Bitcoin network.

Even on a new network there are a few problems I see with an inflation tax:

The network can only buy security with [token] but the price of security is set in [electricity] and the network does not know the ratio of [electricity/token].

The amount of security a network needs is determined by the attacker, so even if the price of security was known it still wouldn’t be clear how much to buy.

Even if the perfect tax rate was knowable it still wouldn’t be predictable because it would change as a result of changes to the outside economy.

Building a decentralized monetary policy means rallying a community of people who all agree on the answer to those questions and I find that hard to imagine. If it was easy to build widespread consensus about monetary policy central banks wouldn’t be controversial and Bitcoin would never have been invented.

If you have a widely accepted method of calculating the "right" inflation rate, why not just operate a central bank? It’s cheaper than a blockchain.

Does quantum computing kill the coin?

“Thanks, this was a really good post. Another risk I think about sometimes is quantum computers. Is that anywhere in your worry space?” — TM

It isn’t very high on my list of worries, to be honest. I wrote about quantum computing a bit in the early days of Something Interesting but the tl;dr is:

We don’t know a way yet to use quantum computers to break the kind of encryption Bitcoin uses.

There will likely be a long window between theoretical discovery of how an attack would work and a practical implementation of that attack.

There are already known quantum-safe encryption methods that Bitcoin can upgrade to when it becomes necessary.

That’s why quantum computing didn’t make my list of threats to Bitcoin.

Does an EMP blast kill the coin?

“Could [China] be contemplating a future without Bitcoin, brought about by a concerted attack using weapons based on EMP technology? Many articles have discussed diverse potential threats to Bitcoin, but so far I've not seen any evaluation of potential threats to Bitcoin resulting from a global EMP attack. Is this a real possibility?” — KG [link]

An electromagnetic pulse (EMP) is a surge of electromagnetic energy that (among other things) damages electronics and the power grid. They happen naturally around phenomena like lightning strikes — but they can be caused artificially as well. In theory you could imagine a weapon of war designed to cause an enormous EMP that would disrupt the target’s electronic equipment and take down their power grid.

I don’t know enough about the technology to hazard any guesses about whether weaponizing EMPs is actually a realistic strategy or not, but I don’t think it would be a very effective way to fight the Bitcoin network. EMPs have a physical location and the Bitcoin network does not. To attack the Bitcoin network you would need to attack everywhere at once — including within your own borders. Effectively you need to destroy the internet itself.

That’s a lot of collateral damage if your goal is just to fight Bitcoin. It would be like fixing a termite infestation by burning down your house. You could do a lot of serious harm to the network by EMP-ing large miners with known locations — but even then the Bitcoin network would probably be able to stagger on with off-grid generators and satellite connections. The damage to Bitcoin from an EMP attack would be serious but probably not fatal. The damage to civilization would be much worse.

Does taxation kill the coin?

"I’m confused. Isn’t the easiest way to kill Bitcoin just to tax it? We already have equities. Why not treat Bitcoin like equity and tax every transaction on the appreciated value? If Bitcoin has a fixed value and USD is always depreciating, wouldn’t every Bitcoin transaction create tax friction backed by the force of the IRS?" — AY

Actually that’s how cryptocurrency is already taxed today! The IRS considers Bitcoin and other cryptocurrencies property, meaning that profits are taxed in much the same way that profits from equities or real estate are taxed. The difference between the value of Bitcoin when you bought it and the value of Bitcoin when you spent it is considered capital gains (or losses) and is taxed accordingly.

Those taxes definitely create friction for Bitcoin as a payment network, but Bitcoin isn’t a great retail payment tool anyway — even without taxes it is expensive and complicated. Where Bitcoin really excels is as a vehicle for long-term savings, which isn’t particularly hindered by capital gains taxing — or at least no more so than any other long term investment.

You could imagine more draconian tax measures designed to be explicitly punitive, but they are all just softer versions of outlawing Bitcoin entirely. If the tax code becomes too onerous for people to comply with some people will stop using Bitcoin — but some people will stop paying taxes. If you could eradicate something by making it illegal the government would have won the war on drugs.

Something Interesting is bamboozle free

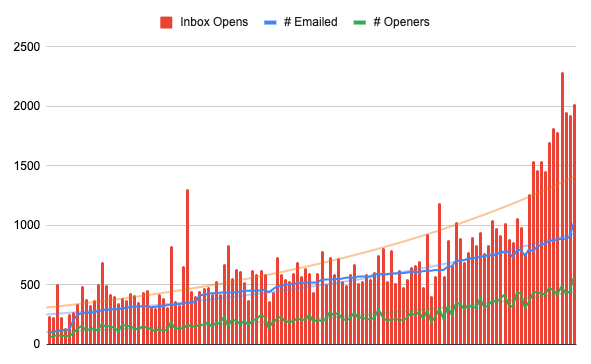

"Your chart confuses me. You said the newsletter goes out to >1k people but it seems like you are emailing <1k and somehow it is being opened by more?” — MF

No bamboozles! The chart was of all posts leading up to the state-of-the-newsletter post but did not show the audience for the state-of-the-newsletter post itself. Since the Cointelegraph syndication happened between that post and the one before it there were a lot of new subscribers — enough to cross that satisfying four digit threshold right before the new year!

The state of the newsletter post went out to 1020 people and was read by 561 of them who each opened the article an average of 3.6 times. Above is a more up-to-date graph, but it is of course also already obsolete. Today’s post went out to >1.1k readers. The march of history sweeps ever forward!

Other things happening right now:

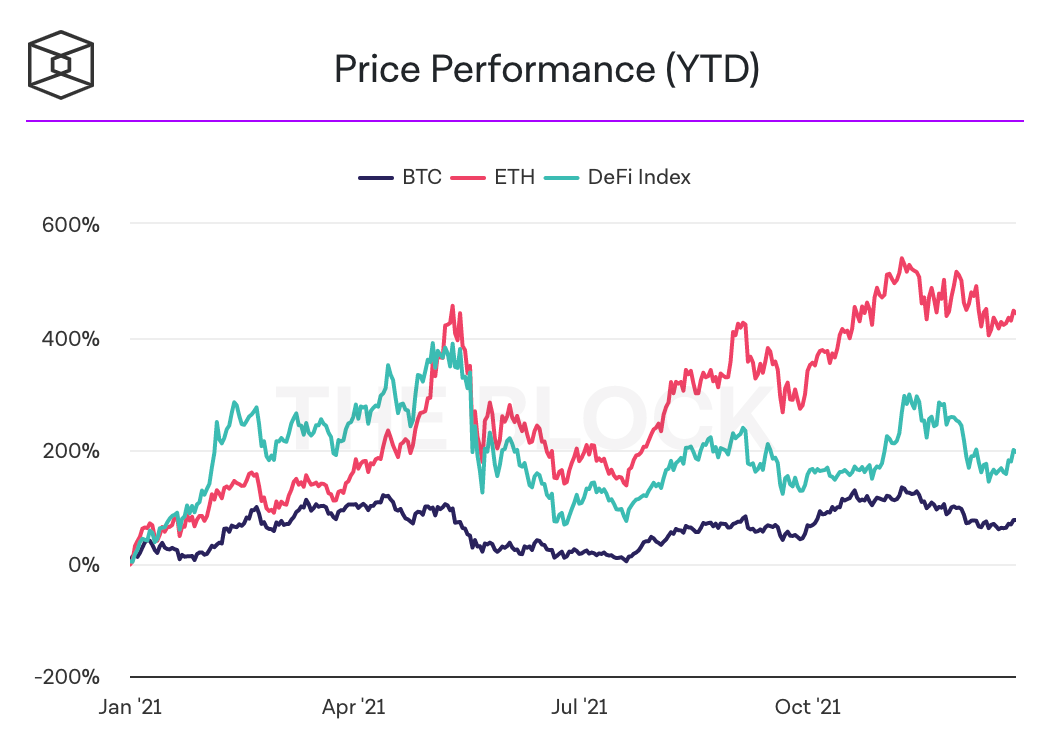

In retrospect it turns out that native ETH was the right 2021 crypto investment, assuming you don’t have a natural talent for timing dog coins or buying monkey jpegs. By comparison the S&P 500 index rose ~28% in 2021.

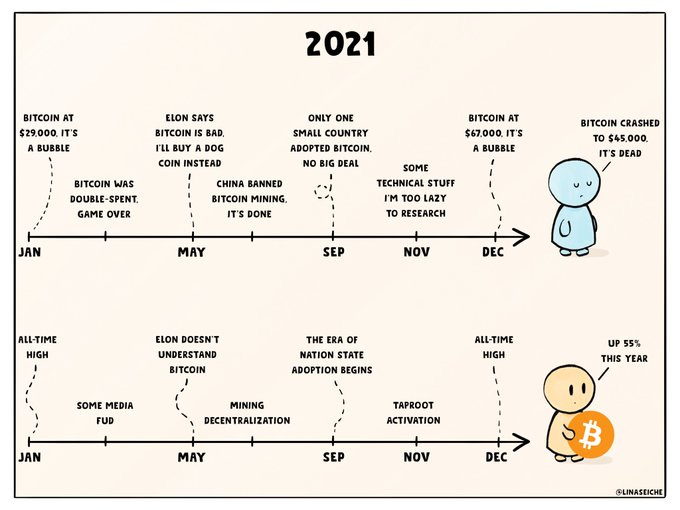

Presented without comment: