Can crypto survive quantum computing?

Also Elon Musk creates a party for gamblers at the Eiffel Tower

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Is Bitcoin ready for quantum computing? (reader submitted)

The wisdom of the crowd

Is Bitcoin ready for quantum computing?

“I'd be interested in the topic of quantum computing and risk of coin theft over time.” - CB

That was something I was really curious about, too!

First, the reason that people worry about crypto and quantum computing is because Bitcoin’s security (like almost all computer security in the world today) depends on the difficulty of factoring large prime numbers. Some proposed quantum algorithms (i.e. programs that can only run on quantum computers) that could solve these problems much more quickly than classical computers. So the fear is that once quantum computers are commercially viable Bitcoin’s security will be broken and coins will be stolen or artificially inflated.

You can read some more detailed math here and here if you are interested in the finer points, but the tl;dr is that if quantum computers were invented and widespread tomorrow it would make mining more competitive and it would re-using addresses unsafe but it would not invalidate the security model of Bitcoin. None of the existing quantum computing algorithms are threats today.

When / if a quantum algorithm is developed that actually does threaten those kinds of defenses it would be a widespread problem throughout the entire secure internet so you can bet that it would be mainstream news. But there are a couple things that can give us comfort about that scenario:

There will almost certainly be a long lead time between theoretical development and first prototype implementation and then another long lead time between first prototype implementation and actually scalable technology. Research into quantum computing began in the 1980s, Google was the first to declare they had actually used a quantum computer to solve a problem faster than a classical computer could have - in October of 2019. The problem they solved was generating random numbers. Stuff just doesn’t move as quickly in quantum computing as it does in mobile apps or social networks.

The most widely used encyrption algorithms today are not quantum-computing safe but there are known quantum-safe encryption techniques. They are clunky and more expensive (in memory and computation time) which is why they haven’t been deployed yet but they are available when needed.

So in sum if quantum computing threatens Bitcoin it will probably take a long time there are probably already known solutions and there are lots of other systems that will be motivated to develop defenses against any new threats that emerge. I personally don’t lose a lot of sleep over quantum computing and Bitcoin.

The wisdom of the crowd

This doesn’t really have anything to do with crypto so feel free to skip it, but it really entertained me. Signal Advance is a micro-cap medical supplies company incorporated in Texas that last filed financials with the SEC in 2016 when it boasted $180k in operating costs and $0 in revenue. Prior to last week it had never traded above $0.65/share and there have been no news releases or significant developments in their business. One thing that did happen to them is that Elon Musk tweeted this:

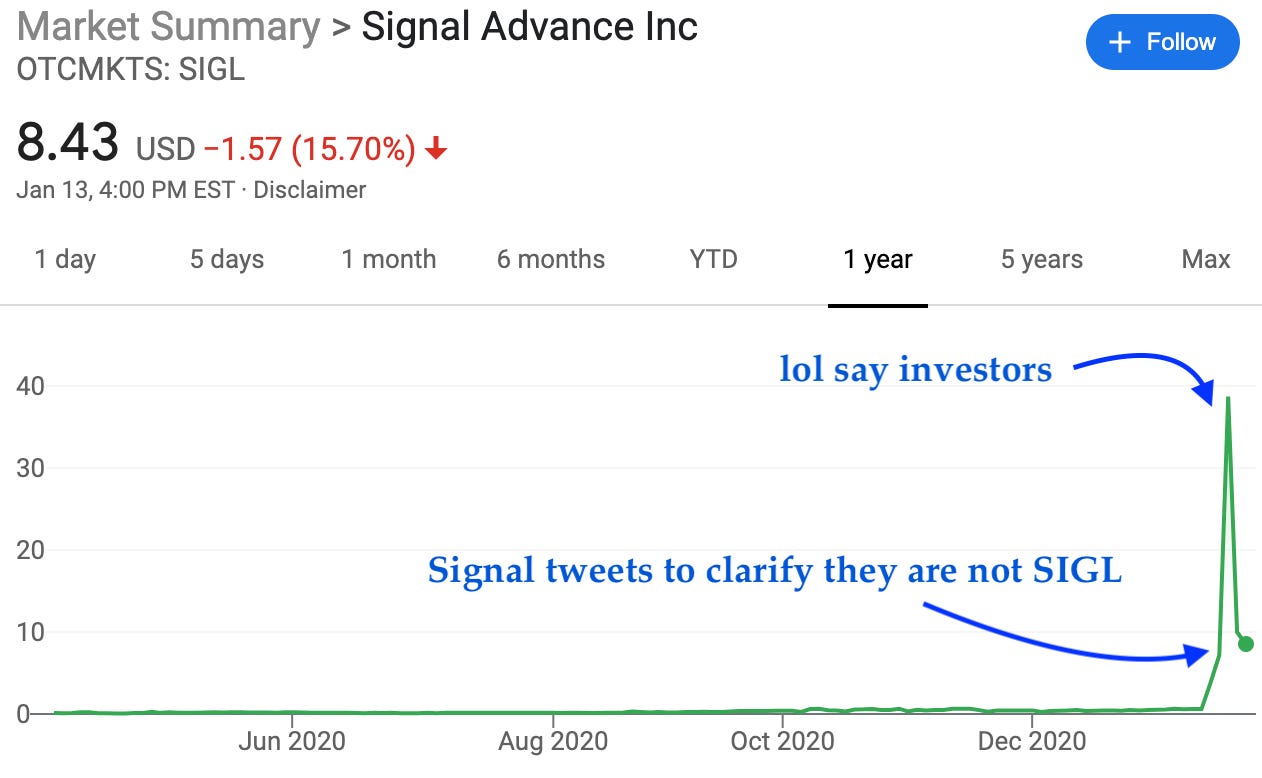

Elon was of course talking about the encrypted messaging app Signal and was presumably unaware of the Texas firm. But if you were one of Elon’s let’s say enthusiastic followers and you went right to Robinhood and typed "Signal" and bought the first thing you saw, the result was this:

Elon Musk liked the tweet, CNBC did a segment on it, lots of financial articles were written and the CEO of Signal Advance was quoted saying: “We strongly recommend people do their due diligence and always invest with care.”

And then this happened:

SIGL traded as high as $38.7/share (an implied valuation well over $3B) before dropping down again. Presumably this was the echo of all the momentum traders on Robinhood and similar platforms who are searching for 'quickest growing stock' and then piling in behind it without being curious about the underlying asset. Even now at time of writing SIGL is trading at $13.60 so if you bought SIGL based on Musks’ tweet you are still up ~22x. At a certain point maybe the idiots were right?

Matt Levine of Bloomberg sums this up really well in Money Stuff:

Last year I might have thought: “It is rational to knowingly buy the wrong stock if you think that other people will unwittingly buy it and you can dump it on them.” After Signal Advance’s three days of huge gains, I would remove that condition. You rationally buy the wrong Signal knowing that other people will rationally buy the wrong Signal, and other people do the same, and the reliance on ignorance drops away and you are all just playing a sort of gambling game with each other. You all keep buying Signal Advance at higher and higher prices, hoping to sell it to each other at even higher prices; eventually some people are left holding the bag but lots of others have taken a nice profit and had a lot of fun. Signal Advance as a company is irrelevant to all of this; it is just a gambling token […] I suspect that the Elon Musk tweet didn’t really confuse anyone; it just provided a point to coordinate around. “Hahaha let’s trade this word that Elon Musk tweeted, that’ll be fun,” is a plausible thought process.

The technical term for the "point to coordinate around" that Levine talks about at the end there is a Schelling Point. It basically means anything that people can use to coordinate without needing to directly communicate with each other. If you are trying to guess when/where you were supposed to meet with someone in Paris, the Eiffel Tower at noon is a much better guess than 2:23pm at 10 Rue du Nil. Elon Musk’s tweet was like an Eiffel Tower that a bunch of gamblers all independently decided to meet at. The reasons didn’t really matter, just that everyone knew where to go.

Other things happening right now

The Bitcoin Fund, an aptly named Canadian Bitcoin exchange traded fund (ETF) is now officially managing $1B dollars of assets! Don’t get too excited, they mean Canadian dollars. Sorry, eh.

We’ve talked about Tether before in Something Interesting so I thought folks might be interested in this Granger causality analysis by btconometrics. The math I leave to you to assess but he makes the statistical argument that Bitcoin price rises cause increases in Tether supply not the other way around.

YouTube creator Ali Spagnola was given a bitcoin by a fan several years ago when it was ~$50 and remembered to check on it in the recent run up. You really can’t buy this kind of PR:

The mayor of Miami claims to be considering moving some of the city treasury into Bitcoin. Seems more likely that this is empty posturing but it’s still interesting to see a politician see Bitcoin as a positive thing to posture about: