Safe token go up, risky tokens go down

What the Federal Reserve is doing and what it means for crypto markets

In this issue:

Safe token go up, risky tokens go down

Jamie Dimon is gonna be so mad at Jamie Dimon

The history and significance of Bitcoin memes

Safe token go up, risky tokens go down

On Wednesday the suited priesthood of the Federal Reserve performed the ceremonial ritual announcing the new target Federal Funds rate: in this case 3-3.25%, a 75 bps hike from the last ritual. This was all widely expected and telegraphed in advance, so markets did the traditional thing and panicked:

Bitcoin also dropped ~9% in a three hour window (from ~$19.8k/BTC to ~$18.1k/BTC) and Ethereum dropped ~13% in the same time frame (from ~$1400/ETH to ~$1200/ETH), though both have recovered somewhat in the time since.

Part of the reason that markets seized up in response to the rate hike is because growth in rates has been explosive — this is the fifth rate hike this year and the third consecutive raise of 75bps. The last time rates were this high was in 2008 and the last time that they were hiked this quickly was in 1994. But another and probably more important reason for the reaction was in the messaging around the announcement, which emphasized the ongoing need to continue fighting inflation.1

"We have got to get inflation behind us. I wish there were a painless way to do that, there isn't. So, what we need to do is get rates up to the point where we're putting meaningful downward pressure on inflation, and that's what we're doing."

Short bursts of very high interest rates are not as economically significant as longer sustained periods of even moderately elevated interest rates because economically shaky entities can use the debt they acquired when it was cheap to survive until cheap debt is available again — a bit like surfacing to gulp for air in between waves. But if the era of cheap debt is durably gone, then enterprises that rely on cheap debt to survive will eventually collapse. Powell’s message here is clear: the water is rising. Rates will stay high until inflation is tamed.

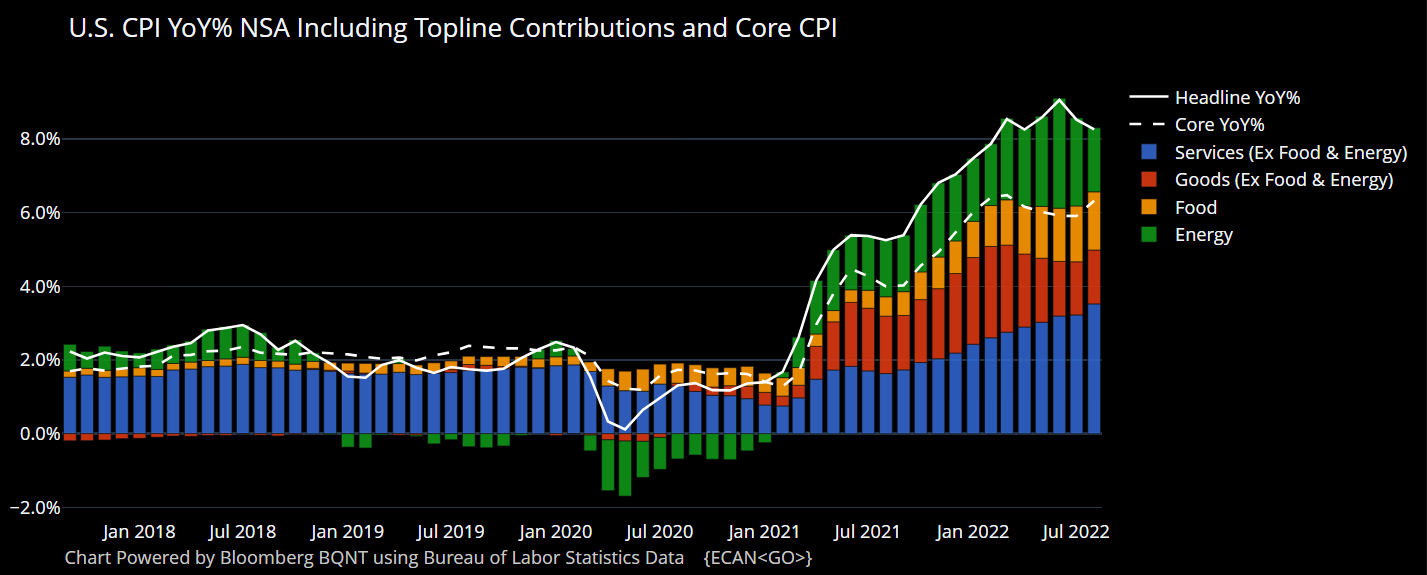

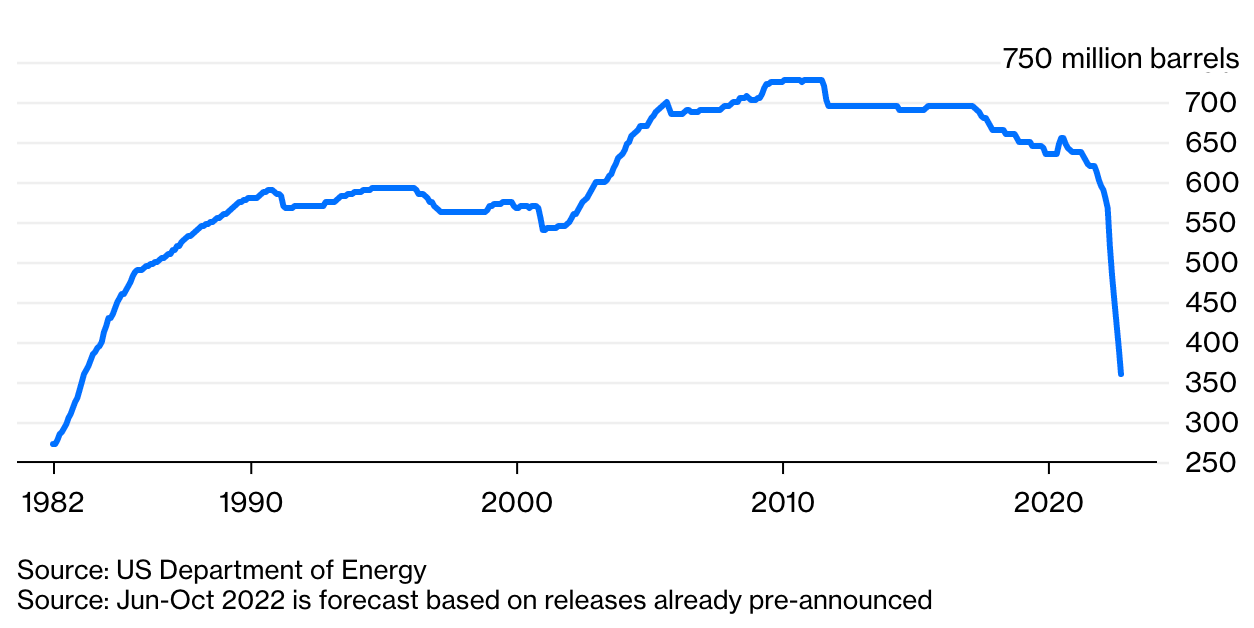

The year over year growth in the CPI has stabilized recently but is still ~8% or so, the highest recorded rate of inflation since the 1990s. Even worse, most of the improvements in the last few months have come from a drop in energy price growth (the green section in the graph above) — but energy prices are being suppressed by the release of oil from the Strategic Petroleum Reserve, and those supplies will not last all that much longer.

The only way to lower prices is to increase supply or reduce demand. Raising interest rates does not create more goods or services (i.e. increase supply) so the only way for it to lower prices is by reducing demand. That’s what Powell and the Fed are trying to accomplish: raising interest rates is just the means. The actual goal is to lower demand pressure by causing consumers to spend less money — a deliberately engineered micro-recession, like a controlled burn in an actively managed forest.

The way it works is this: when the Fed raises the benchmark rate that raises the short-term interest rates for U.S. Treasuries. Since everyone generally agrees the U.S. government is highly unlikely to default in debt denominated in a currency it can print more of, the yield on U.S. Treasuries is sometimes called the 'risk free' rate.2 The risk-free rate rising means all risky investments become worth less and some become worthless. High rates are hard on cryptocurrencies (because people are less willing to accept risk), hard on equity values (because corporate financing becomes more expensive) and hard on real estate (because higher interest rates mean more expensive mortgages and hence fewer buyers).

The destruction of asset values is not a side-effect, it is the intended purpose of raising interest rates. The goal is to destroy enough wealth that consumers and businesses feel less empowered to buy things. Once they stop buying things prices will go back down and the Fed can pivot back to lower interest rates — which they will absolutely have to do at some point.

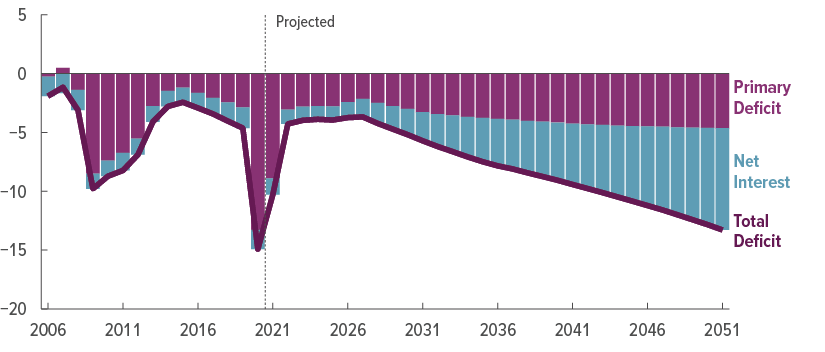

The average interest rate on the US national debt right now is ~1.6% and the interest payments were ~5% of the national budget in 2021. If the national debt rolls over at current interest rates (~4% or so) that would mean additional interest payments of roughly ~$550B or around ~2/3rds of the entire National Defense budget. The U.S. hasn’t run a government surplus since 2001, so presumably that extra expense would all end up rolled into the deficit and continue compounding. If interest rates on the national debt stay too high for too long the US risks running into a debt spiral.

So this is the paradox facing the Fed: they want to signal their steadfast commitment to keeping interest rates high (so that businesses actually adjust instead of just holding their breath) but everyone knows they eventually will have no choice but to back off and turn rates back down again. The market believes Powell is serious about keeping rates up in the short term but is equally convinced he will have no choice but to lower them again in the medium to long term.

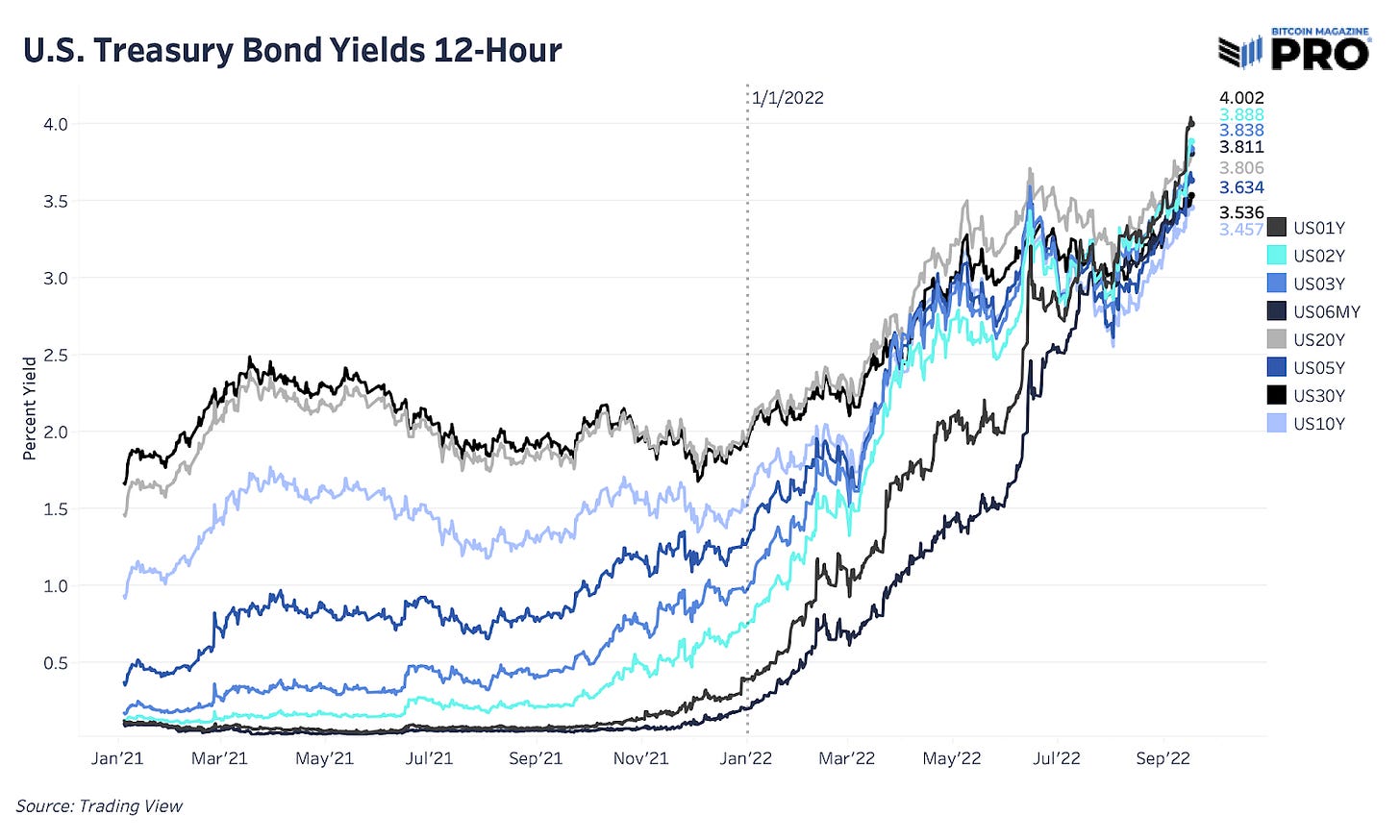

You can see the limits of the Fed’s influence by looking at the "yield curve" — basically the risk-free rates for different maturities. Traditionally a yield curve bends upwards — you get paid more for loaning capital for a longer period of time. Right now the US yield curve is inverted — meaning that short term debt (6m-3yr) is paying higher interest rates than long term debt (>3yrs).

Yield curve inversions are counterintuitive — it’s like a bank offering you a cheaper interest rate if you agree to pay your debt more slowly. But what it means is basically that the market does not believe the short term interest rates are sustainable. In the meantime, the Fed is paying USD holders quite handsomely to sit on their hands and take no risks, so it is probably a bad time to be holding risky assets.

Other things happening right now:

Jamie Dimon (CEO of JP Morgan) thinks cryptocurrencies are decentralized ponzi schemes. Someone should tell him about how J.P. Morgan invested $65 million in Ethereum conglomerate Consensys or how their Digital Assets Specialists report "no sign of crypto winter applying the brakes on institutional adoption." I bet Jamie Dimon is gonna be so mad when learns what Jamie Dimon has been up to!

Crypto exchange Kraken's CEO Jesse Powell is stepping down from his role at the exchange. Powell is a controversial leader so him stepping aside for someone less contentious could be a signal that Kraken is getting ready for an IPO.

Here is a lovely essay from Jameson Lopp about the history and importance of memes in maintaining the cultural Schelling power of Bitcoin.

We talked last week about the different types of inflation. The Fed has the power to increase or decrease the supply of money (i.e. monetary inflation) but is charged with the responsibility to keep consumer prices stable (i.e. price inflation). In this post I’m using inflation to refer to consumer price increases.

Risk free in this context means the yield has no risk, since the U.S. government can be counted on to pay it back. In other words, Treasuries are risk-free compared to just holding dollars. It doesn’t refer to the risk being taken by holding dollars as compared to any other currencies or assets.