¿Orange man, Orange coin, qué ves ahí?

Why Bitcoin's price surged in the aftermath of the 2024 Trump election

Inside this issue:

¿Orange man, Orange coin, qué ves ahí?

The median change vs the change in the median

¿Orange man, Orange coin, qué ves ahí?

On Nov 5th (the day of the US 2024 election) the price of Bitcoin was ~$68.3k/BTC. In the week following the election the price rocketed up ~36% to a high of ~$93.5k/BTC, well past the previous all time high of ~$74k/BTC. As of writing the price remains comfortably above previous levels at ~$88.7k/BTC.

The most obvious way to interpret this movement is that Trump positioned himself as the crypto-friendly candidate and he won. Trump attended Bitcoin conferences and went to Bitcoin bars. He raised money by selling NFT collections (twice) and a Bitcoin ordinals collection (once). He promised to start a Federal Strategic Bitcoin Reserve and to commute the sentence of Silk Road founder Ross Ulbricht. He criticized the SEC and pledged to make America "the crypto capital of the world."

Kamala Harris, by contrast, offered to "protect cryptocurrency investments" on a list of bullet points called the 'Opportunity Agenda for Black Men.'

So one fairly obvious reason that the price ticked up is that the Biden administration has been pretty openly hostile to the crypto industry and Trump is simply not. Trump doesn’t seem to particularly understand or care about Bitcoin (he sold the Casascius bitcoin he was gifted at the Bitcoin conference just before the election) but he does seem to be perfectly content to ally with the Bitcoin constituency.

I don’t think it’s just Trump though — I also think the election reshaped the political landscape around Bitcoin. Crypto was a relatively small part of the presidential campaign but it was a pretty large part of the campaign for Ohio Senate. Democratic incumbent Sherrod Brown lost the seat in part thanks to heavy campaigning against him by crypto-focused political action committees. Democrats are likely to walk away from this election feeling like they spent expensive political capital fighting the crypto industry and they have relatively little to show for it.

Trump has already pledged to fire SEC Chair and noted hand gesture enthusiast Gary Gensler "on day one" — but it’s not clear that he actually has the authority to do that. The president does have the authority to dismiss the Chair, but Gensler would still remain a commissioner until the end of his five year term on 2026 unless he resigned. Still, even diminishing Gensler’s influence without replacing him would represent significant relief for the crypto industry. I’ve written many times about how Gensler’s SEC has been a disaster for crypto and for America.

Gensler himself gave a speech yesterday in which he awkwardly defended his approach to crypto regulation, describing the industry as less that 0.25% of worldwide capital markets but also as "generally between five-and-seven percent of our overall enforcement efforts" which is not a great ratio even before you take into account the relentless court losses and the damage to the reputation of the SEC and to the administration as a whole.

An end to the Gensler era would be good for Bitcoin but it would be even better for DeFi, which is probably why Ethereum (ETH) and Solana (SOL) are up around ~30% and ~40% respectively over the same timeline. Regrettably the price of Dogecoin (DOGE) is up even more, around ~2.5x or so. Presumably this is because Elon Musk likes to manipulate the Dogecoin market and is now the head of a farcical government agency named the Department of Government Efficiency.1

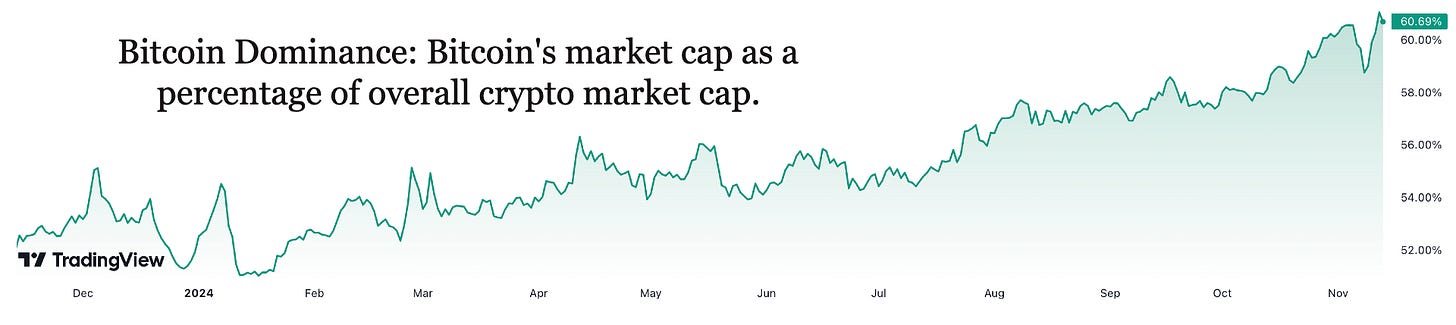

The rising tide hasn’t lifted all boats, though. Many smaller coins and tertiary networks are drying up in a flight to (relative) quality as crypto investors position themselves for the upcoming bull run. Bitcoin dominance (the size of the Bitcoin market cap relative to the size of crypto’s total market cap) has risen to almost 61%, the highest it has been since mid-2021.

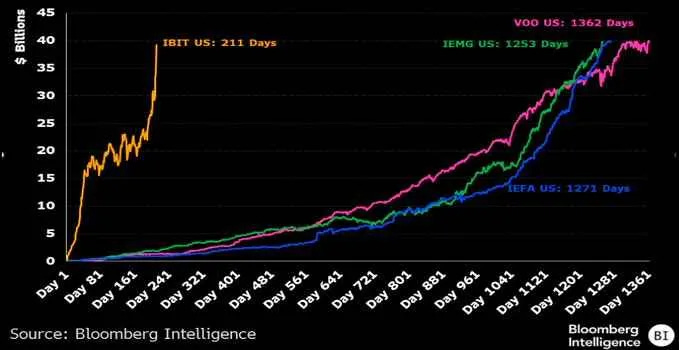

I attribute this to a few things: for one, it’s probably more fun to gamble on memecoins in a bear market. In a bear market Bitcoin is boring and memecoins are interesting, but during a bull market Bitcoin provides enough excitement on its own. But I don’t think this is a particularly important part of the explanation, because the majority of the money driving up the price of Bitcoin is actually coming in via the Bitcoin ETFs, not from crypto exchanges. Blackrock’s iShares ETF (IBIT) is the fastest growing ETF in history by an insane margin:

People say this kind of thing a lot, but I do think this bull run will be qualitatively different from previous bull markets. In my opinion most people encounter Bitcoin for the first time during a run up and they don’t buy in because they assume it is a bubble and they missed the moment. Then Bitcoin disappears from their attention for a few years during the bear market and when the next bull run returns they are surprised that Bitcoin hasn’t died or peaked. The second time people hear about Bitcoin they are much more likely to take it seriously.

At this point, almost everyone in the world has heard of Bitcoin. Believing that Bitcoin has value has gone from an extremely fringe position to a relatively commonplace opinion among bankers and CEOs. In the eyes of the public Bitcoin has quietly transitioned from a 'crazy person thing' to a 'rich person thing.' Buying into Bitcoin is also now much simpler — ETFs are a few clicks away in your existing brokerage account as opposed to requiring you to sign up for a new account with a crypto exchange and waiting a few days for KYC/identity verification.

During the last major bull run in 2021 the conventional wisdom was that Bitcoin was a bubble and confident skepticism was a very 'safe' opinion — but over time many of Bitcoin’s most prominent critics damaged their credibility by confidently predicting that Bitcoin would fail. The longer Bitcoin continues to exist and grow the more foolish those predictions start to look — and at this point the 'safe' opinion about Bitcoin is one of uncertainty rather than dismissiveness. That’s an enormous difference, because once you treat Bitcoin as a risky asset rather than an outright scam you have accepted that it has a role in a diversified portfolio.

The Trump administration is also a natural advertisement for Bitcoin’s intended purpose, both as a monetary hedge and as a check on state power. Trump has always chafed at Fed independence — he considered firing Fed Chairman Jay Powell over interest rates during his first term in 2018. That would have been illegal so his staff talked him out of it at the time, but it is unclear what that conflict will look like when it inevitably happens again. At a minimum it seems likely that Trump will pressure Powell to lower interest rates (and by implication mortgage rates) faster. One way or another the money printer will go brrr again.

Other things happening right now:

As you might imagine, there was a lot of discussion about my post analyzing the results of the presidential election. Some readers argued that my perspective was elitist and out of touch with legitimate voter concerns. To be honest, I haven’t really changed my mind about the median Trump voter. But one thing that did change my perspective was this post about wage growth under Biden. The author argues that although the change in median wages under Biden was positive the median change in wages was not — a subtle but critical distinction in terms of the impact on voters. He also argues that voters are more sensitive to change in income than to change in wages, so voters were likely also reacting to the expiry of COVID era subsidies. Voting for Trump in response to those pressures is still ignorant and self-destructive but at least this evidence suggests it was a response to genuine pain as opposed to entirely manufactured grievances.

Do you get it? DO YOU GET IT? So based. 🙄