No such thing as a free vault

The limits of (collaborative) custody

Inside this issue:

No such thing as a free vault

Magic: The Cardwashing

Gary Gensler’s impression of Taylor Swift

No such thing as a free vault

"I think your limits of self custody article could benefit from considering collaborative custody, not as an alternative to self-custody or custodians but as a *replacement* for them. I agree with you that a toy model that offers 2 options with tunable risk yields the conclusions you draw, but no analysis of bitcoin custody solutions is complete if it only considers self-custody vs. custodians.

Collaborative custody allows holders to balance responsibilities between themselves and their chosen key agents while avoiding single points of failure. Collaborative custody allows you to retain control over your bitcoin while gaining peace of mind that you're not entirely on your own. A robust market for collaborative custody creates a robust network of keys which is the ultimate long-term solution to bitcoin custody."

— Dhruv Bansal, Co-Founder & CSO of Unchained.com

For anyone who hasn’t read it already, the basic argument in the limits of self-custody is that no custody strategy is perfect and that a blend of different custody strategies is a better way to manage and reduce your overall custody risk:

Our first instinct with self-custody is to keep our entire portfolio in the safest available strategy, but we can do better. Storing all our Bitcoin in a single strategy is broadly analogous to investing our entire portfolio in a single promising asset. Since our goal when storing bitcoin is to minimize risk, it makes sense to lower our overall portfolio risk by storing our Bitcoin across several different strategies with different (i.e. uncorrelated) risks.

Diversifying like this reduces our risk in the same way that a diverse investment strategy reduces portfolio volatility — we sacrifice potential upside (some of our bitcoin is exposed to known/anticipated risks in less safe strategies) in exchange for greatly diminished downside risk (at least some of our bitcoin is always protected from unexpected risks in strategies seen as safe). For investors optimizing their custody strategy to minimize costs, minimizing downside risk makes sense.

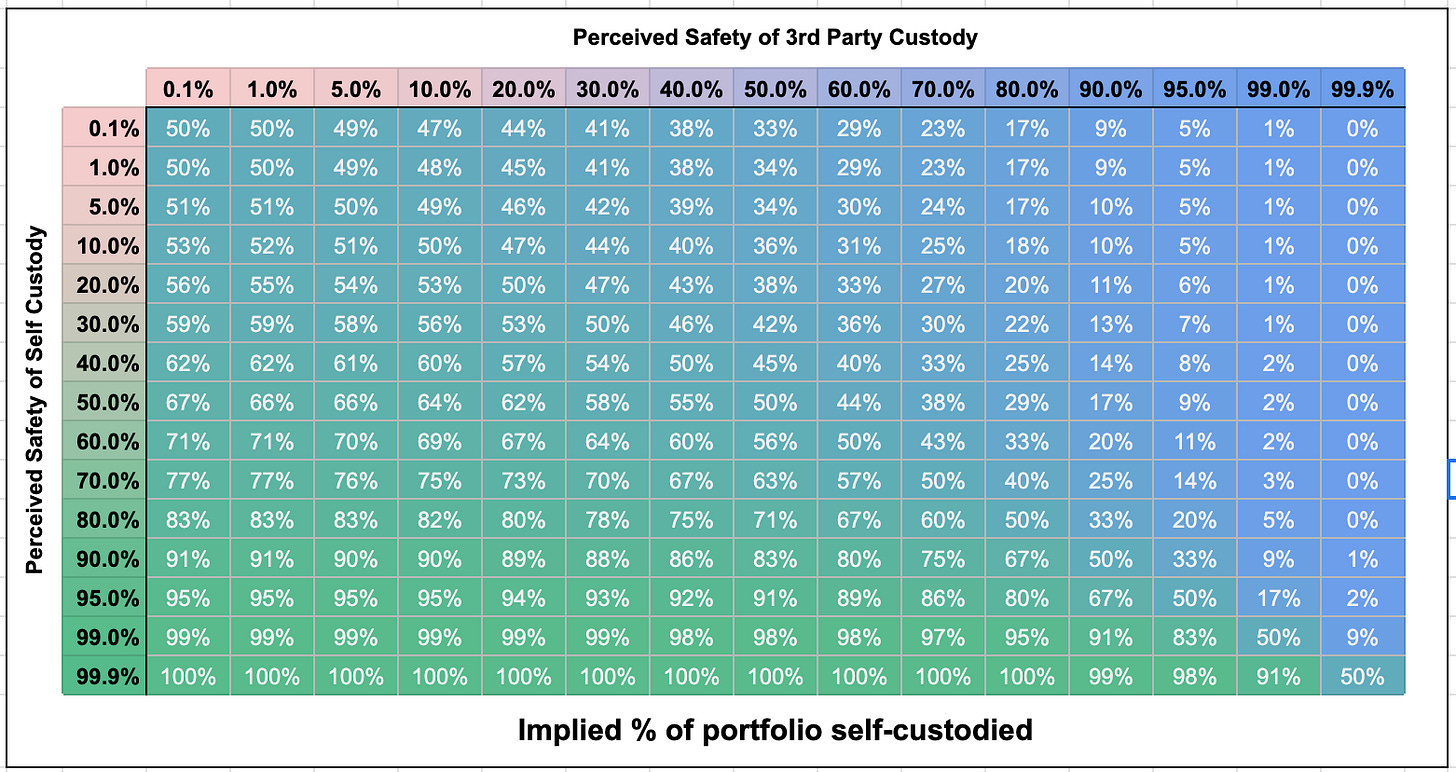

I also included a visual of what the 'optimal' portfolio allocation would be in a world where there are only two custody strategies and all risks result in 100% loss. My goal was to make it easy to see that even investors who are very confident in their ability to self-custody and very skeptical of third-party custody should still probably have a small portion of their portfolio stored that way as a disaster hedge. If an investor is ~99% confident in their ability to self custody and they think there’s a ~90% chance that a third-party custodian will rug them over the same window of time, they should probably store around ~9% of their portfolio in third-party custody:

Most of the feedback I get on the post is not very interesting but the most common (thoughtful) objection I’ve heard is that a two-option model of custody isn’t very realistic.1 Fair enough! It’s definitely true that there are a lot more than two ways to custody Bitcoin. But it’s also true that there are a lot more than two ways to invest your money and diversification is still good investment advice. The existence of more options doesn’t change my basic argument, which is that a blend of all the strategies will be better than any one strategy in isolation.

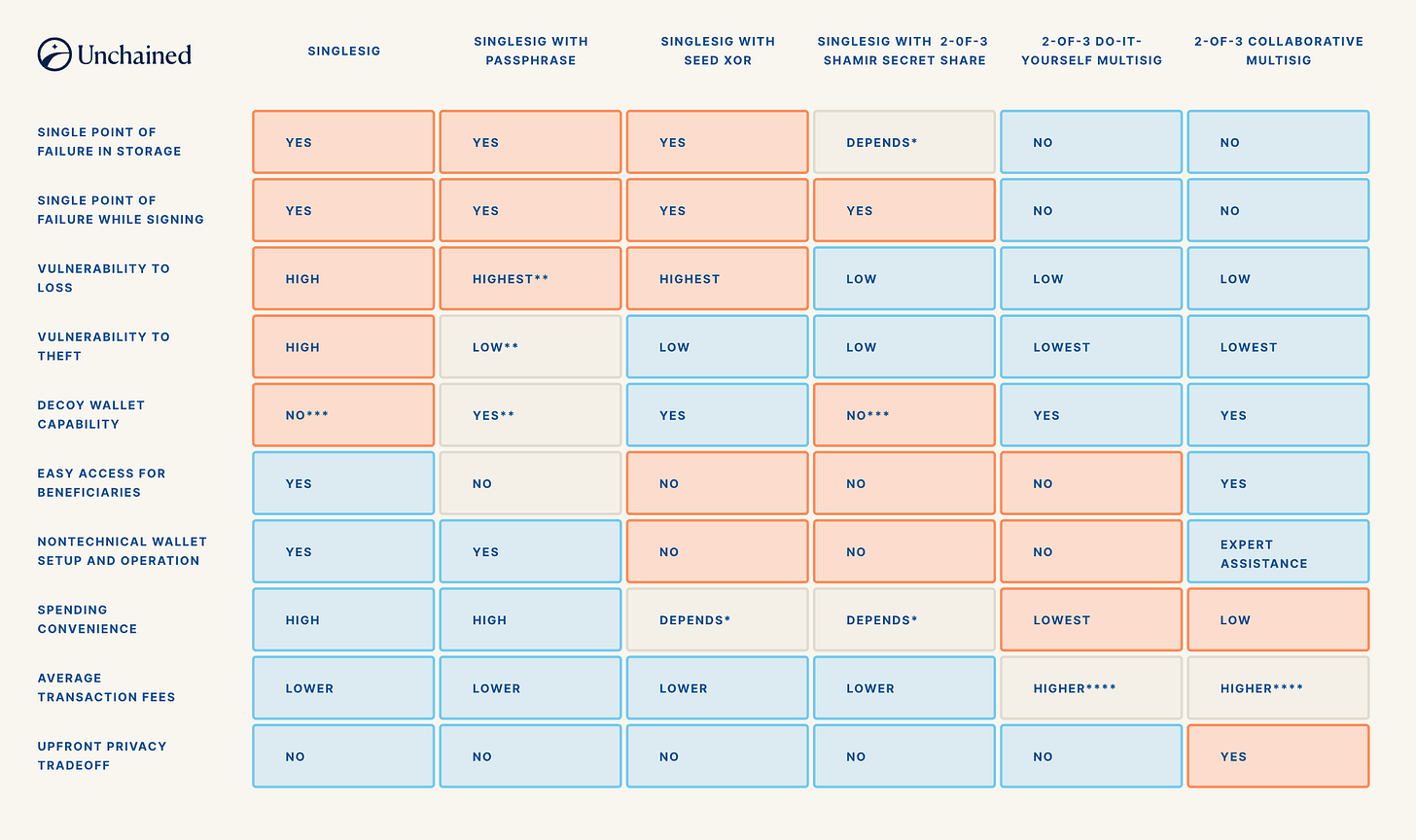

Unchained has an excellent graphic describing the pros/cons of some of the most common custody approaches today and I agree with the claims it makes:

It’s a good argument for the strengths of collaborative custody, but it also clearly shows why collaborative multisig is not strictly superior to other approaches. Transactions with a collaborative multisig are more complicated, the fees are higher and most importantly you lose all privacy with your co-signer.

If the risk of third-party custody that worries you is an FTX-like event where the company betrays you, 2 of 3 multisig leaves you perfectly safe. But if your primary worry is the government passing a law demanding that all bitcoiners surrender their bitcoin the way executive order 6102 did for gold, a collaborative custodian has the exact same risk profile as a traditional custodian.

Higher transaction fees are not an afterthought, either. Higher fees mean the minimum amount of wealth worth storing on chain is higher, too. The expense of transacting on-chain will push people into using custodial services for all but the largest transactions — and for many people they will be priced out entirely. There just isn’t enough blockspace for everyone to use it without sharing. You can play around with this model to reason about what long term transaction fees might cost, but it seems very likely they will be too expensive for ordinary people to afford even before we start factoring in additional complexity like collaborative multisig.

Collaborative custody is better at protecting against loss and theft, but it also raises costs and lowers privacy. It’s not a perfect replacement for self-custody (which is more private) or for third-party custody (which is cheaper). So from my perspective a rational investor should incorporate hybrid custody into their strategies, but it shouldn’t completely replace full self-custody or full third-party custody. Your money is still safest and easiest to use if you store it in multiple different ways.

Other things happening right now:

'Sam Altman backed private credit crypto lending fund targeting 5% bitcoin yield' is an incredibly cursed sentence, but here we are.

Here’s a fascinating little thread from @ZachXBT (a blockchain analyst who studies hacks/thefts/scams in crypto) showing how someone is trying to launder ~$25M worth of stolen crypto using high-end vintage Magic: the Gathering cards. Here’s a companion thread explaining a bit the market for vintage magic cards and what buying ~$25M worth of cards might have looked like.

Presented without comment:

It’s also true that treating every risk as a 100% loss is an oversimplification but nobody ever seems to object to that part. I made a more complicated spreadsheet that you can use to build a more sophisticated model of the threats of third-party and self-custody, if you are interested in exploring the implied custody strategy of more complicated risk profiles.