No, Bitcoin is not doomed (yet)

Plus how to lose $625M without flinching and Greenpeace works for Ripple now.

In this issue:

No, Bitcoin is not doomed (yet)

How to lose $625M without flinching

WAVES crash against the rocks of Alameda

No, Bitcoin is not doomed (yet)

"Transaction fees are supposed to rise to replace the block reward and pay for Bitcoin security, but fees are at all time lows … is Bitcoin doomed?" — Several readers

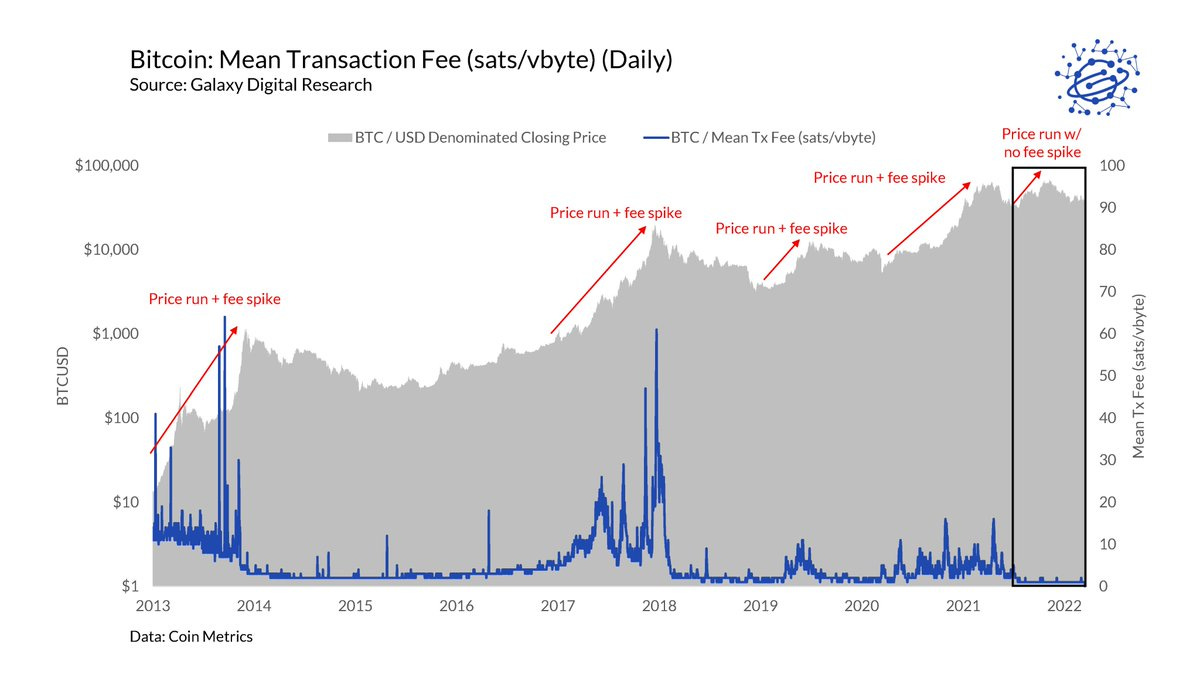

A lot of people on CryptoTwitter in the last few days have been discussing the graph above showing how Bitcoin transaction fees are at an all time low. Some people were celebrating cheap transactions while others (most notably @hasufl in this thread) argued this trend is an existential threat to Bitcoin that should worry us all. Several readers reached out to ask: is Bitcoin doomed? 🙀

First let’s start by saying that @hasufl is an incredible resource in the space exactly because he asks tough questions that others shy away from. He is on my list of quality skeptics — we don’t always come to the same conclusions but I always consider his thoughts worth reading carefully. Second I think the possibility of a transaction fee market not emerging is a real and serious threat. I listed failing transaction fee markets as my #1 and #2 biggest threats in my end-of-year article about ways Bitcoin might fail: This kills the coin. So this is a serious risk being discussed by an intelligent person acting in good faith. It’s worth taking seriously.

That being said I do think that @hasufl is premature in worrying about this today. The trend in transaction fees is unsustainable, but it is also not especially predictive. Fees are cheap today because we are discovering ways to use Bitcoin more cheaply (segwit, Lightning Network, e.g.) faster than we are adopting the network. But efficiency improvements will likely become rarer over time and adoption (if it happens at all) will presumably accelerate.

Both the supply and the demand of Bitcoin transactions are still evolving rapidly — projecting forward from today’s trends isn’t helpful. It is like pointing out that there is slack in a rope and then concluding the rope can never be pulled taut. As a simple example, consider stablecoins. One reason that fee pressure dropped on Bitcoin is because most stablecoin transactions moved to other networks. So to predict the long-term transaction fees on Bitcoin you would need to predict:

Will there be long-term demand for stablecoins?

Will stablecoins actually use blockchains or centralized servers?

What % of decentralized stablecoin transactions will be on Layer-1 vs Layer-2?

How will fee pressure from Layer-2 transactions accumulate into Layer-1?

What Layer-1 networks will still be competitive long term and what trade-offs will they make?

In short, variables on top of variables — and that’s just from one relatively straightforward example. I don’t think the long term fee market for Bitcoin is meaningfully knowable from today’s metrics. We don’t know how people will want to use Bitcoin and we don’t know the clever tactics they will invent to use it cheaply.

We also don’t know how much mining is necessary to secure the system or how much profit is necessary to motivate those miners. Maybe hobbyists will mine at a loss to heat their homes, or maybe nation states will mine at a loss to ensure access to the network as a matter of national security. Or maybe not.

A pragmatic reality in crypto-economic systems is that the only way to be sure they work is to observe them in practice. We only know Bitcoin is secure to the extent it has never been (successfully) attacked. We only know Bitcoin is sustainable to the extent that it has never failed. We have no real choice but to wait and see.

WAVES crash against the rocks of Alameda

WAVES is the equity token of a Russian algorithmic stablecoin called USDN. It is conceptually akin to Terra/Luna (which we talked about in March). One of the many strange side effects of the Russian invasion of Ukraine is that it caused some crypto investors to seek out the "Russian" version of various platforms — and one of the beneficiaries was WAVES, whose market cap rose ~6x in ~2 months. The team then borrowed against that growth in price to buy more WAVES and artificially drive the price up further. If you’re curious about the details, this thread is an excellent summary:

This kind of leverage based growth is a double edged sword — if your purchases are the only thing driving a price up then when you are eventually forced to sell you will drag the price down with you. There is no real market to catch you as you fall. Those prices are in some important sense not real — no one would pay them except you. The WAVES team probably knew that and was searching for a scapegoat to blame the inevitable fall on when WAVES founder Sasha Ivanov decided to accuse crypto trading firm Alameda Research of conspiring to short WAVES and spread FUD about it:

This proved to be a very, very foolish choice for a number of reasons. First, Alameda research is somewhat legendary and the obvious choice if you learn they are short an asset is to copy trade them. Second it actually looks like Alameda was not actually short WAVES but was instead in a market neutral set of trades trying to capture the high funding rates caused by WAVES leverage long demands:

So the main thing that Ivanov accomplished by accusing Alameda of a conspiracy to destabilize WAVES was to destabilize WAVES. The USDN stablecoin broke its $1 peg and has not been able to recover. The price of WAVES is down ~50% so far. If you think someone really rich and famously good at trading is betting against you, probably you should keep that belief to yourself. Even if you are wrong.

How to lose $625M without flinching

Axie Infinity is a play-to-earn Pokemon-like NFT battling game that started on Ethereum but eventually migrated to its own proprietary blockchain called the Ronin Network. To stay connected to the broader cryptocurrency ecosystem Ronin supported a bridge, which allows users to exchange out-of-network tokens (in this case Ethereum and USDC) for in-network tokens that could be later cashed out to reclaim the assets on their native network. Those assets were then secured by set of 9 trusted validator nodes.

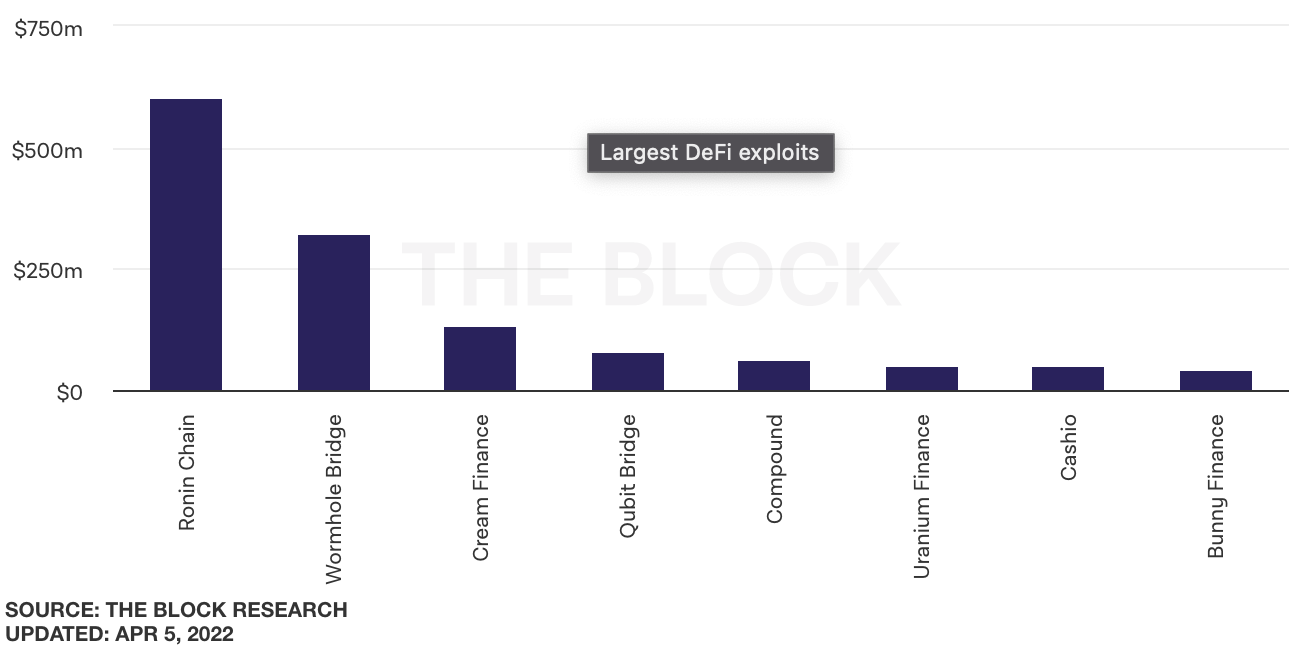

Unfortunately 4 of the 9 validator nodes were all controlled by Sky Mavis, the company behind Axie/Ronin. The attacker was able to compromise those nodes all at once along with one other validator, giving them a 5 of 9 majority and control of the system. It was as though they had the key to every vault — on Wednesday March 23rd simply emptied the bridge accounts of all 173,600 Ethereum and 25.5M USDC, collectively worth ~$625M at the time. That gives Ronin the dubious privilege of having suffered the largest DeFi hack of all time.

If this sounds familiar that’s because it is pretty similar to the Wormhole bridge attack that we wrote about in February. It’s also similar because venture capitalists have once again stepped in to cover the damages. Sky Mavis has announced they will absorb all user losses from the attack and Binance led a ~$150M financing round to help stabilize their balance sheet. Other than the temporary pause in withdrawals most users will likely never really notice the difference.

The size of the attack is interesting but not inherently embarrassing. What is embarrassing is that no one noticed the money was gone until 6 days later when a user tried withdrawing their money from the bridge and couldn’t. What is super embarrassing is that someone reported the attack 3 days later but the team told them to seek psychiatric help. Oops! Probably should have double-checked just in case.1

If you are a clever hacker who has just stolen a few hundred million dollars of assets from the Ronin bridge you might be tempted to add insult to injury by shorting the Ronin token on your favorite exchange. As soon as they notice all the missing money the price will crash and you’ll make money off all the money you made! Unless … no one notices. Then the price will keep going up. That would be bad. Your short would be liquidated before you got credit for your clever hack.

There isn’t any way to know whether this happened or not, of course. But we can watch the Ronin to USD price chart and wonder what the hacker must have felt as they watched the market climb right through their attack without noticing. In trading being right but too early is the same thing as being wrong.

Other things happening right now:

Vitalik Buterin (co-founder of Ethereum) posted an article on April 1st entitled "In defense of Bitcoin Maximalism." It’s a clever trick — Buterin is basically using April Fool’s to walk back his previous hardline anti-maximalist stance2 under the cover of satire. Now that Ethereum is faced with many competitors Buterin is suddenly more interested in cultivating platform loyalists. Laying the groundwork for that argument in an April Fool’s post lets him bury the hypocrisy under a facade of being both tongue-in-cheek and open-minded.

Greenpeace announced a multi-million dollar campaign to "change the code" of Bitcoin, funded principally by Ripple executive Chris Larsen. Changing Bitcoin’s code is of course free and effortless, anyone can fork the open source code base to do anything they like. What is difficult is convincing everyone who uses Bitcoin to use your knock-off Bitcoin instead. Ironically Greenpeace would have much more impact by using that money to fund renewable energy mining directly and compete to drive less efficient miners off the network.

Presented without comment:

In fairness to the team the person who reported the theft was assuming it was an inside job and was trying to blackmail the team. Still! If someone says they have damning evidence that you committed a crime, maybe look into it!

Vitalik actually coined the term 'Bitcoin maximalist' and it was meant to be derogatory.