NFTs are dead, long live NFTs

Plus Minecraft bans NFTs and Gamestop does a whoopsiedoodle

Taking into account the feedback from the last reader survey, I’m trying a new format where I bundle specific topics like NFT news or market analyses into dedicated posts so people can read or skip them as they like. By definition those posts will probably have a lower open rate (since some readers will just skip them entirely) so I’ll be looking for other signals to understand if they are useful/interesting! If you like this format/approach, let me know or better yet share this post with a friend or two! 🙂

In this issue:

NFTs are dead, long live NFTs

Metaverse and Meatspace

Minecraft bans NFTs

Gamestop does a whoopsiedoodle

NFTs are dead, long live NFTs

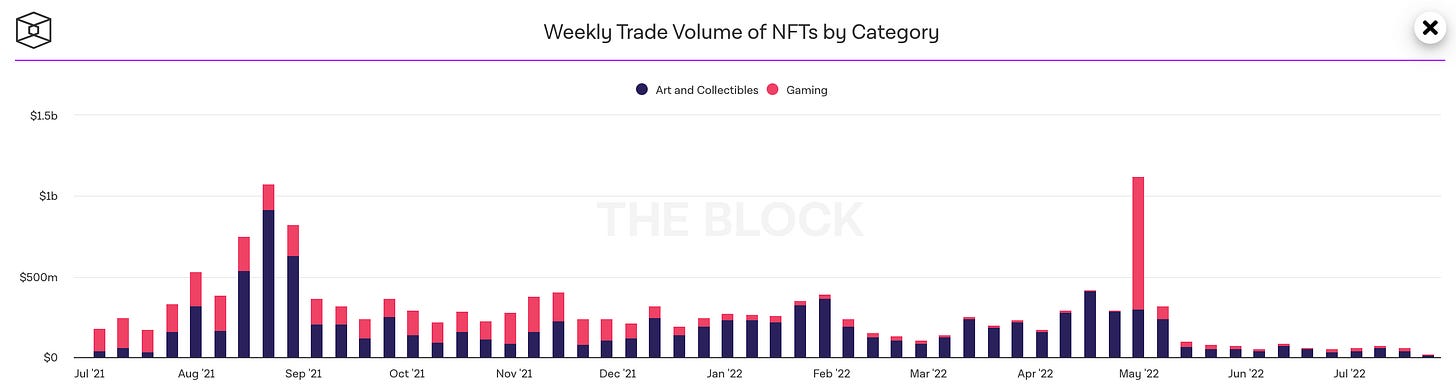

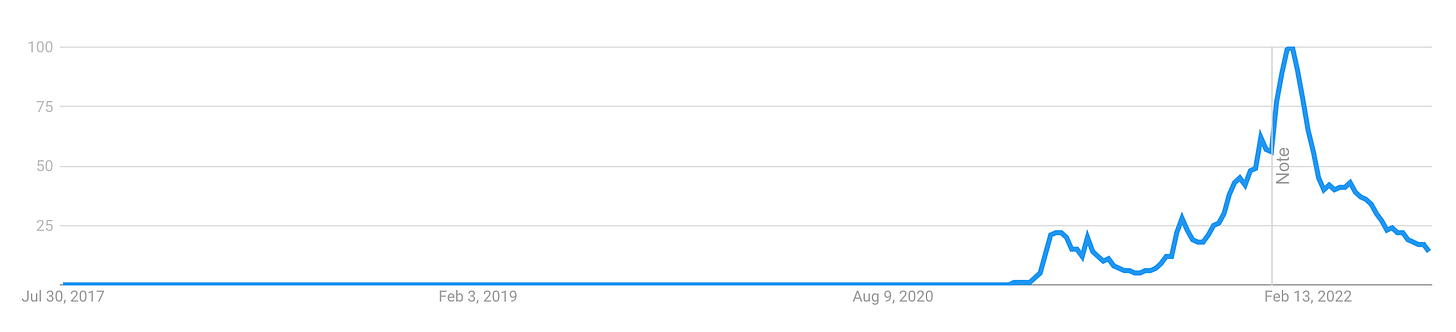

Following the enormous peak in May of this year (the Otherside land sale) NFT trading volume off an absolute cliff. At peak in August of last year there were more than >$1B worth of NFTs traded in a single week. Even after that bubble was over the majority of the year saw weekly trading volumes around ~$400-800M. In the second half of May and beyond volumes have been dramatically lower, with last week being the lowest total trade volume (~$75M) since February 2021. According to Google Trends mainstream interest in NFTs peaked in January and has fallen since:

This trend is pretty distinct from the public’s interest in crypto generally, which has stayed roughly stable over the last two years. Compare Google search interest in Bitcoin (red), Ethereum (yellow) and NFTs (blue) over that same window:

It seems clear that the initial wave of exuberance over NFTs is over and the public backlash against NFTs has muted the interest and excitement. A lot of pundits are looking at charts like those above and predicting the death of NFTs. I think that would be a mistake.

First, prices have fallen a lot less precipitously than volume and search interest, at least among the expensive, high-profile collections. The price of Bored Apes for example peaked at $400k just before the Otherside mint but stabilized after the initial drop and have not been continuing to fall. You can tell a similar story with most of the other major collections: fewer buyers, but stubborn sellers.

That can make for some dramatic mismatches — at time of writing The Eternal Pump by Dmitri Cherniak for example has a floor price of 330 ETH (~$524k) and an open bid of 15 ETH (~$26k) meaning that prospective buyers and prospective sellers disagree about the current value of the collection by a factor of ~22x.1

Something that I am not sure the market has fully internalized, however, is that the value of an NFT collection is not set by the average market participants’ opinion but is defined by the least committed owner. A small band of committed owners can and have been keeping the floor prices astonishingly high even as the broader tide of demand has receded.

Assuming that this isn’t the end of NFTs (and I don’t think it is) then each subsequent market cycle NFTs will look more familiar and less outlandish. Like Bitcoin itself NFTs benefit from the Lindy Effect — the longer they are around the less likely they are to go away and hence the more interesting they become. The idea that only crypto nerds want NFTs may one day sound as quaint and naive as thinking only drug dealers use cell phones or comparing the internet to a fax machine.

Metaverse and Meatspace

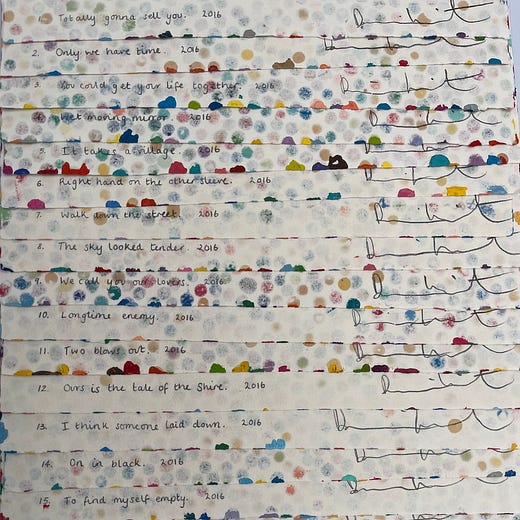

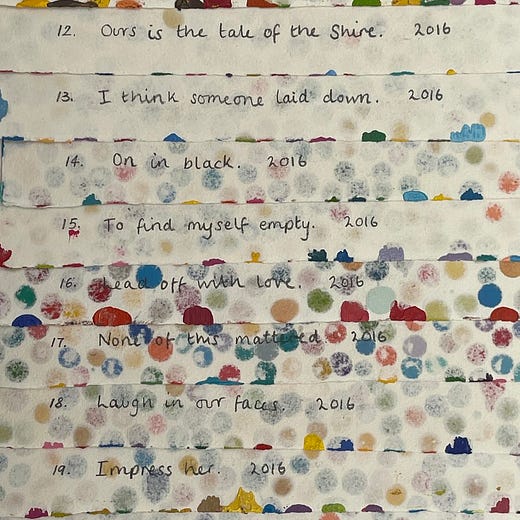

English pop artist Damien Hirst’s first NFT Project The Currency has concluded.2 Hirst made 10,000 individual spot paintings and sold 10,000 corresponding NFTs.

Owners of the NFTs had a choice of either keeping the token or burning it in exchange for the corresponding physical painting. At the end of the first year (which closed on the 27th) Hirst pledged to burn the physical paintings associated with any unredeemed tokens. The Currency asked collectors which they valued more — the physical object, or the digital history?

5,149 paintings were claimed from the 9000 tokens held by collectors, implying the majority of collectors (~60%) still preferred the painting to the token. Hirst elected to keep his 1000 pieces as NFTs and burn the originals.

Other projects are exploring the bridge between physical and digital in other ways. Conceptual artist Shl0ms blew up a Lamborghini, scanned the resulting debris and released 3D scans of the car fragments as NFTs. The Azuki project airdropped a physical jacket to their holders in the form of tokens that changed color once the jacket has been claimed. Americana Technologies is working on NFC chips that would embed NFTs into physical luxury goods.

Pairing a real world object with an NFT might sound redundant but there are actually a lot of use cases where that could make sense. Imagine an NFT paired with an expensive sneaker — people who wanted to buy and sell that sneaker could use a service to put the token and the payment into escrow and then release them when the physical sneaker is delivered to the purchaser. Buyers avoid counterfeits, sellers avoid payment fraud, creators can charge royalties on secondary transactions.

NFTs also allow creators to reward their supporters without needing to know who they are, such as how Hirst airdropped a second NFT to holders of The Currency shortly after the claim window for physical paintings first opened. They allow creators to give early access, exclusive content or additional privileges to patrons of previous projects. They allow collectors to incorporate their physical possessions into their digital identities: profile pictures, metaverse avatars, etc.

In a sense pairing NFTs with real world merchandise allows physical markets to benefit from the advantages of digital markets and vice versa. I think we will continue to see more of it.

Minecraft bans NFTs

On July 20th Minecraft announced a formal policy banning NFTs from any in-game content. Minecraft is the best selling video game of all time (~238M copies sold) and has an elaborate set of rules governing the enormous and complicated secondary economy that has grown on top of it. Their reasons for not wanting to support NFTs (they can’t ensure a good user experience and they don’t want people to be ripped off) are completely reasonable given their position and how new the NFT market is. Interestingly, Tim Sweeney, the CEO of Epic Games (which owns Fortnite) has made it clear they are taking the opposite approach:

Other things happening right now:

Gamestop is selling a 9/11 NFT for $46 is probably not a sentence that should ever have been needed and yet here we are.

LimeWire (best known for helping college kids steal music around the turn of the century) is now back and all about NFTs apparently.

On July 14th OpenSea announced they were laying off 20% of their staff. That’s similar in scale to recent the layoffs at several other crypto exchanges.

The open offer metric isn’t quite as useful in high-priced NFT collections because you do need to have at least that much wETH available in your wallet to make the offer, so it is expensive to leave large bids open for long windows. One assumes the true bid price for pieces from The Eternal Pump collection is actually somewhat higher.