Mark Cuban aboard the TITANic

Plus in El Salvador freedom is mandatory and the problem with mainstream crypto coverage.

In this issue:

Mark Cuban aboard the TITANic

Freedom whether you like it or not

The problem with Mainstream crypto coverage

Mark Cuban aboard the TITANic

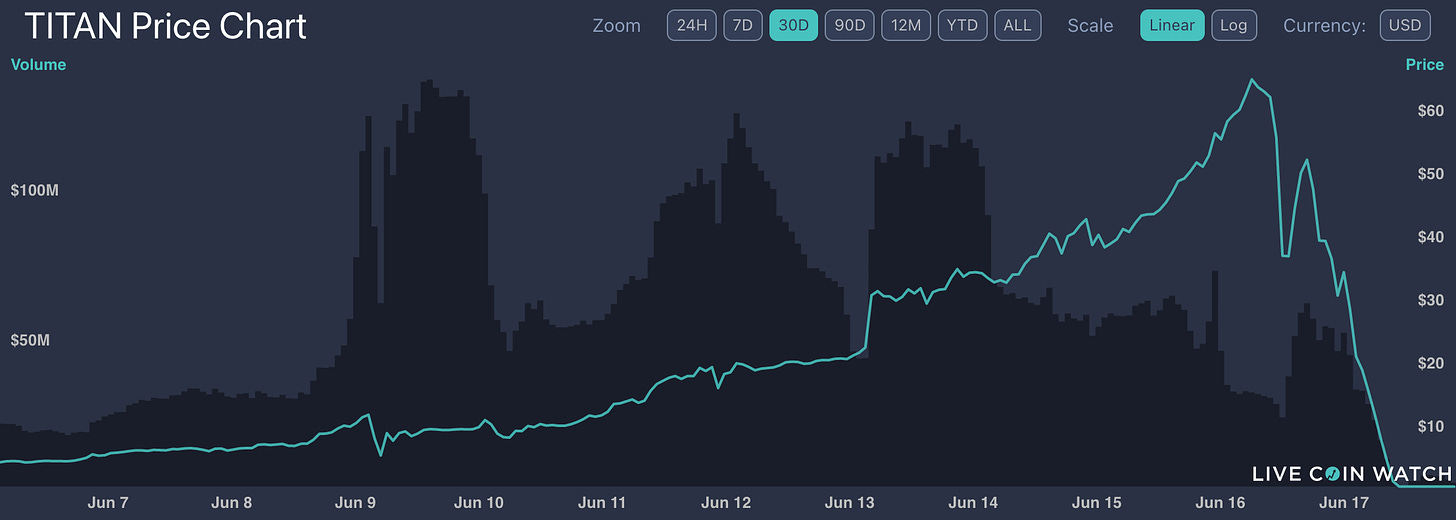

On Sunday Mark Cuban published a blog post about his explorations in DeFi with the observation that "valuing tokens is easier … than you think." He mentioned a handful of tokens he owned, most notably TITAN. On Wednesday TITAN dropped from $64 to $0 in a matter of hours. Valuing TITAN is now considerably easier! It’s worthless.1

In this case there was no clever hack or exploit that caused the collapse in price. TITAN is (or was) attempting to run a decentralized fractional reserve bank. What happened was basically a bank run.

TITAN customers could deposit another stablecoin (Coinbase’s USDC) and burn some TITAN to receive a token called IRON, which was meant to be pegged to $1. The smart contract then put the USDC to work in DeFi earning yield - paying TITAN holders an eye-popping 2-5% interest per day. If the price of IRON ever dropped the protocol would automatically mint more TITAN and use it to buy IRON, driving the price back up. In theory the supply of TITAN would expand and contract to automatically absorb the volatility from IRON and keep it pegged to $1.

Unfortunately when the price of TITAN fell on Wednesday, the market lost confidence that IRON would keep its peg. The result was a negative feedback loop - falling TITAN price panicked IRON holders who then sold their IRON below the peg, which triggered the smart contract to automatically create more TITAN and sell it for IRON, causing the price of TITAN to fall even more. (Other details about how prices were tracked by the system made the problem even worse.)

Everything about this collapse was predictable. Fractional reserve coins (e.g. NuBits, BasisCash, the Empty Set Dollar) have been launching (and failing) since 2018. As long as demand is rising they work great but they have no way to recover if the market loses confidence - so eventually they always collapse.

Mr Cuban is upset that he lost money and he feels it should be illegal.

"As a percentage of my crypto portfolio it was small. But it was enough that I was not happy about it. […] There should be regulation defining what a stablecoin is and what collateralization is acceptable. Should we require $1 in US currency for every dollar or define acceptable collateralization like US Treasuries? To be able to call itself a stablecoin [… it] should have to register.” -Mark Cuban

You can really feel his passion for the permissionless ideals of DeFi.

Freedom whether you like it or not

The consequences of El Salvador’s legal tender legislation are continuing to unfold. In 🇹🇿 Tanzania President Samia Sulhulu called for the central bank to begin preparing the country for accepting cryptocurrencies. Legislation establishing a legal framework for Bitcoin has been proposed in 🇲🇽 Mexico, 🇵🇾 Paraguay and 🇵🇦 Panama. Activists in 🇪🇹 Ethiopia started Project Mano to lobby the government to mine and hold Bitcoin as a means of escaping their country’s currency crisis. In America the Uniform Law Commission is drafting model legislation to make it easy for states to recognize Bitcoin as a legal foreign currency.

Criticism of the El Salvadoran law is also gathering momentum. The most controversial part of the law is Article #7:

Article 7. Every economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service.

Most legal tender laws (US laws included) only require the money in question be accepted for discharging debt and paying taxes. There is no legal requirement in America that businesses accept USD for spot purchases - it is entirely legal to run a Bitcoin-only business in America for example and refuse USD. Forced money rules are much rarer and more draconian - usually associated with propping up the failing currency of a corrupt government.

Defenders of the law point to Article #8:

Article 8. Without prejudice to the actions of the private sector, the State shall provide alternatives that allow the user to carry out transactions in bitcoin and have automatic and instant convertibility from bitcoin to USD if they wish. Furthermore, the State will promote the necessary training and mechanisms so that the population can access bitcoin transactions.

So merchants are obligated to accept bitcoin but the government promises to let you cash out into USD instantly with no price loss. That sounds great but there are a lot of subtleties still at play. For one thing a lot of El Salvadorans either have no internet access or limited mobile data plans with spotty coverage - so even connecting to the Bitcoin network is already a non-trivial challenge. Even in "Bitcoin Beach" in El Zonte where non-profits have been actively investing in the Bitcoin economy since 2019 physical cash is still the dominant medium of exchange.

For another it is simply not possible to guarantee automatic and instant convertibility from Bitcoin to USD. The government has established a $150M fund to buy bitcoin from El Salvadoran merchants but that doesn’t eliminate the price risk of Bitcoin it just transfers it from the merchant to the government. If the price of Bitcoin goes up the government will make money on the exchange but if it falls the taxpayer will be left holding the bill.

In fact by guaranteeing an exchange rate with no slippage El Salvador will likely attract the attention of money launderers who will be happy to use an El Salvadoran merchant to turn illicit Bitcoin funds into clean US dollars. Since running anti-money laundering / know-your-customer checks on every Bitcoin purchase is almost certainly infeasible, El Salvador will likely need to put strict limits on the size and frequency of Bitcoin transactions that merchants will be allowed to clear or risk running afoul of Financial Action Task Force (FATF) requirements.

All of these issues raise the obvious question of why the government is actually requiring merchants to accept Bitcoin as opposed to just allowing it. It is possible that the goal is simply to jump-start adoption, but it is also possible that the true motivation is to redirect the income of ordinary El Salvadorans into the hands of the government. In general El Salvadorans themselves are more worried than excited - a recent survey suggested ~90% of them did not want to hold or be paid in Bitcoin.

An especially pointed concern here is for the ~70% of El Salvadorans who are unbanked. If you have no bank account but still would prefer to hold USD instead of Bitcoin your only option is to keep your money in Tether. A sequence of events that ends with the government holding Bitcoin and the citizenry holding Tether would leave the entire country in a very precarious position.

Other things happening right now:

Sotheby’s is working with Sir Tim Berners-Lee to auction off a suite of code from the dawn of the World Wide Web as an NFT (along with some ancillary visualizations and a letter from Sir Tim. The code includes early implementations of HTML, HTTP and URIs.

If you’ve ever wondered why mainstream media coverage tends to be so hostile towards Bitcoin and cryptocurrencies generally, this video from Laura Shin is enlightening. Most traditional outlets have (understandable) conflict of interest policies that require that reporters not own assets they report on. That means the only people writing about Bitcoin in major publications are those who are willing to forgo owning any Bitcoin for themselves. In other words to qualify to write about Bitcoin for the mainstream media you need to either not understand Bitcoin or not believe in it.

Presented without comment:

Technically $0.0000000424/TITAN at time of writing.