Thank you for your attention

Corruption destroys more wealth than it steals

Inside this issue:

Thank you for your attention

Front-running the Abyss

Why doesn’t Bitcoin act more like gold?

Thank you for your attention

On Friday afternoon, U.S. President (and America’s most popular pedophile) Donald Trump announced his intention to raise tariffs on Chinese imports another 100% on top of existing tariffs. Reopening the global war on trade for no particular reason1 surprised the market, knocking roughly 2.7% off the S&P 500, 2% off the Dow Jones and 3.5% off the Nasdaq 100.

Selling a U.S. stock is effectively buying U.S. dollars so normally a large equity sell-off would drive the value of the dollar up. In this case, though, the dollar dropped -0.7%, treasury yields rose,2 and the value of gold rose 1.5%. Investors lost confidence in U.S stocks and the U.S. dollar at the same time.

As with any serious change in economic and foreign policy, Trump made the announcement on his privately owned social media platform, Truth Social:

Trump prefers to make important policy announcements on Truth Social because those announcements are the only reason anyone remembers Truth Social at all. The White House has access to the most powerful media distribution channels in history but Trump prefers to use his F-tier social media site because everyone clicking on his post to understand incredibly important economic policy first has to click through a pop ad like this one (which is real):

This is what America has been reduced to. Matters of state and finance are gated behind interstitial ads for MyPillows and skin parasite creams. Obviously, that makes American policy announcements less dignified and less accessible … but it also gives our already ludicrously wealthy president a fraction of a penny every time someone tries to understand American economic policy. So, y’know. Trade-offs.

Front-running the Abyss

The tariff announcements also sent the crypto markets into a violent tailspin. Bitcoin fell almost 15% from ~$122k/BTC briefly down as low as $102k/BTC, before stabilizing somewhere around ~$112k/BTC at time of writing. The whiplash was worse for the altcoin market, which fell further and recovered less well. Across the entire crypto market ~$19B worth of investor capital was erased. That makes this the largest liquidation event in crypto history — destroying roughly six times as much wealth as the Covid and FTX crashes combined. Not … great?

Don’t worry! It wasn’t bad news for everyone. One lucky trader created a brand new account on a decentralized marketplace called Hyperliquid just in time to open nine figure shorts on BTC and ETH. They even managed to keep opening shorts up to the exact minute before the tariff announcement went public. Another trader was lucky enough to dump their World Liberty Financial Token ($WLFI) an hour before that! World Liberty Financial is the Trump family’s cryptocurrency investment company. Unfortunately there is no way of knowing who could have had a large stash of $WLFI tokens and prior knowledge of Trump’s upcoming tariff announcements.

These are just the trades that were made openly on decentralized markets. Presumably other (smarter) insiders did their insider trading on centralized exchanges where it wouldn’t be so embarrassingly obvious.

Collectively, Hyperliquid users lost ~$1.23B of wealth. More than 1000 wallets were completely liquidated and lost everything. More than 200 wallets lost over $1M. The user with the largest single liquidation lost ~$205M. The insider who traded against them collected only $192M in profit.

Numbers are hard to reason about, so I want to sit with that for a moment.

The median annual salary in America is ~$62k/year, before taxes. The liquidations on Hyperliquid alone destroyed the equivalent of almost 20 million years of ordinary salary. That’s like annihilating the annual income of everyone in New York (the state, not the city). Of course, that’s only the damage done to Hyperliquid traders — a relatively small part of the overall crypto markets, which are themselves tiny compared to traditional financial markets. The actual impact was many, many orders of magnitude larger than what we can measure here.

People die when the markets move like this. Some of them have already committed suicide after watching their net worth be destroyed in an instant. Some will die in the coming months and years because they can no longer afford health care or because they need to take on riskier work to make ends meet. Some will delay retirement, some will give up on getting a college degree. Some will lose their businesses, some will lose their homes. Many, many, many lives were ruined on Friday.

The economy is not a game.

Why doesn’t Bitcoin act more like gold?

A fair question to ask (and one people often ask after flash crashes like this one) is why doesn’t Bitcoin act more like gold? If Bitcoin is the ultimate store-of-value, why did the price of Bitcoin go down when the price of gold went up?

The simple answer is that Bitcoin is not (yet) a store of value. Right now Bitcoin is a proposition bet on whether it will one day become an important store of value. There are a lot of things that could still go wrong with that proposition, so Bitcoin is still a pretty high risk asset. When investors are scared they want to buy safety and sell risk, so when markets crash Bitcoin often crashes with them.

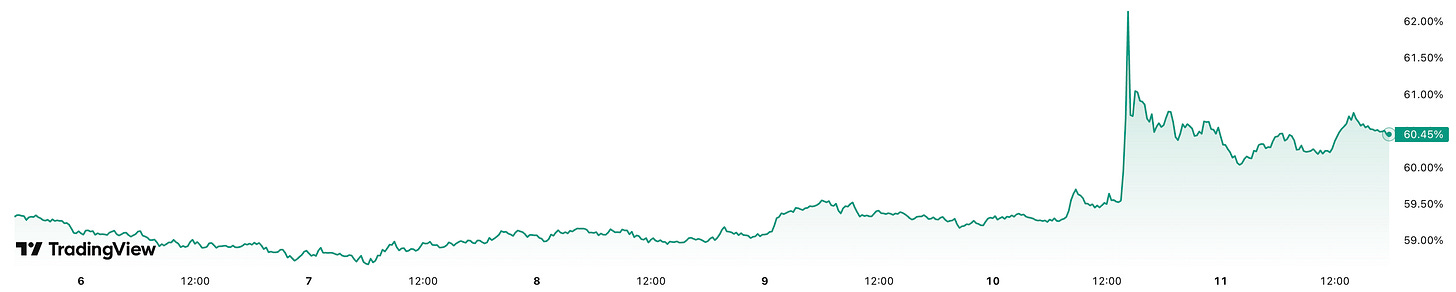

The slightly more complicated (but also more interesting) answer is that safety is a relative term. Compared to the S&P 500 Bitcoin is a risky asset, but compared to the long tail of altcoins it is a conservative investment. Traditional investors sell Bitcoin when they get nervous, but when crypto gamblers get nervous they sell their altcoins and buy Bitcoin instead. That’s why Bitcoin’s share of the overall crypto market cap (aka Bitcoin dominance) rose in the aftermath of the crash even as the price was dropping. Crypto investors were fleeing to the (relative) safety of Bitcoin.

Bitcoin acts simultaneously as a high-risk asset (for traditional investors) and a safe haven asset (for crypto investors).

Even some investors who consider Bitcoin a desirable safe haven asset may have been forced sellers on Friday. Bitcoin is an exceptionally deep and flexible source of liquidity and market crashes are when emergency liquidity is needed — whether to shore up positions or to take advantage of buying opportunities or whatever else. Bitcoin is emergency cash, so it’s not surprising to see people use (i.e. sell) Bitcoin during emergencies. Sometimes selling is actually spending.

Counterintuitively, I think this event was probably bullish for Bitcoin in the medium term and I think price will recover quickly and continue climbing from here. Normally a market is a mix of gamblers, momentum traders and believers, but the whiplash of liquidations wiped out all the gamblers and momentum traders in an instant. The only ones left holding Bitcoin are those who think it is worth more than the current price and can’t be easily scared out of their position. If they didn’t sell on Friday, they probably aren’t selling anytime soon.3

Traditional investors just saw Bitcoin survive a major market stress test and probably updated their assumptions about the natural “floor” price for bitcoin. Crypto investors just watched altcoin markets get torched and probably updated their assumptions about how much bitcoin they should own. Anyone who emptied their bitcoin stash for emergency liquidity will probably want to restock for future emergencies — and anyone else who noticed the value of that liquidity may decide to start acquiring an emergency bitcoin stash of their own.

The fact that Bitcoin just weathered a market-wide panic without ever falling below $100,000 is significant and frankly kind of astonishing. $100k/BTC is now a battle-tested floor price that the market will remember. That’s a sentence I could not have imagined writing when I started Something Interesting in 2020.

Theoretically this is in response to new Chinese export controls on rare earth minerals, but I seriously doubt Trump has strong policy opinions about ytterbium.

Bond yields go up when bond prices go down. Treasury yields going up means investors are demanding a higher rate of return for loaning funds to the U.S. government.

Friday was Bitcoin’s steepest ever one day price drop in history (-$20k/BTC), but for experienced Bitcoin investors the relative drop (-15%) wasn’t all that historically remarkable.

The most concise, data driven explanation I've read about the market crash. Thanks for the reporting!