Five stories in six charts

Plus the end of the dollar and the rise of $1M Bitcoin

In this issue:

Five stories in six charts

Gradually, then suddenly …

Senator Warren is determined to be wrong

Five stories in six charts

1. Bitcoin is getting scarcer over time

First, an excellent animation from Wicked Smart Bitcoin showing a combined view of how the price marched up as Bitcoin itself became more scarce. Each section of the pie graph on the right represents the same number of blocks mined. With each halving new Bitcoin becomes scarcer.

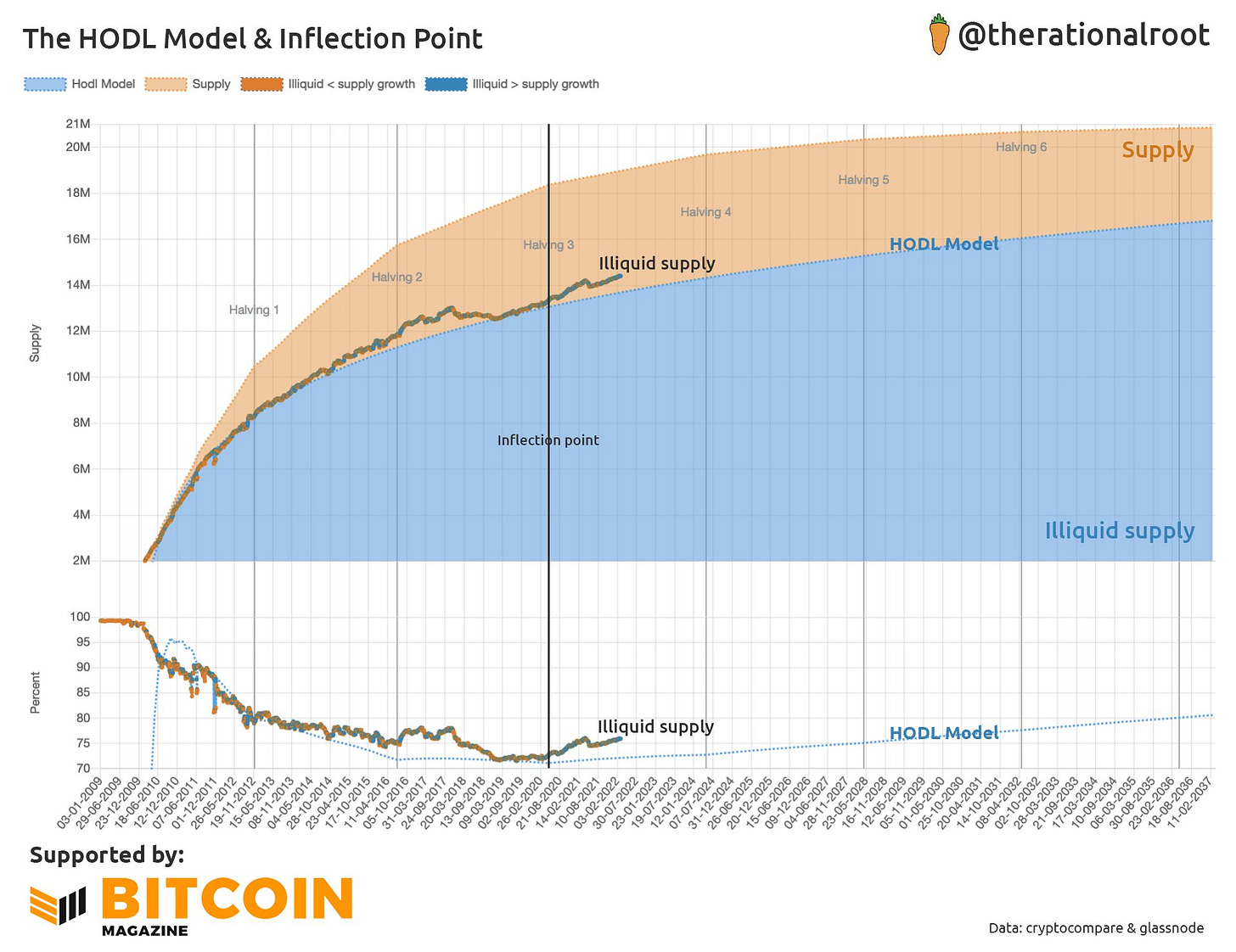

2. Investors are buying bitcoin faster than new bitcoin is created

@therationalroot has appeared in Something Interesting before — most recently in October with a spiraling price graph rotating around the four year halving cycle. His HODL model is based on projecting the growth in total supply of bitcoin and comparing it to the projected growth of 'illiquid bitcoin' i.e. bitcoin that has been held for >5 months1 and is unlikely to move again. Until recently more new liquid bitcoin was entering the market via mining than was being taken off the market by long term holders — but with the most recent halving (on 5/11/2020) that changed and long term holders are now acquiring bitcoin faster than the network can make it. Projecting those trends forward implies ~$100k/BTC by the end of 2024 and ~$1M/BTC by the end of 2028.

3. The conservative portfolio should have ~40% Bitcoin

Everyone knows that crypto has gone up a lot but everyone also knows that crypto is super volatile — so it is natural to assume that those who have gained a lot by investing in crypto are just lucky gamblers. But historically the price movements in crypto aren’t just volatile — they have also (until recently) been quite uncorrelated with other global markets.

That means even though crypto itself tends to have violent price swings including it in a portfolio can actually reduce risk and make it less volatile overall. The ratio of a portfolio’s return to risk is known as the Sharpe Ratio. The Sharpe Ratio is a rule of thumb that lets you compare investments across different risk profiles — different investors may have different risk preferences, but every investor should prefer a higher Sharpe Ratio.

According to an analysis from Grayscale Research adding Bitcoin to a traditional portfolio of 60/40 equity/bonds continues to reduce the risk/reward ratio until the Bitcoin position is at least 40% of the portfolio. Taken at face value that would imply that every value investor should have ~40% of their portfolio in Bitcoin regardless of their personal view on Bitcoin’s prospects. According to the same report current portfolio allocation today averages <2%.

4. Dollar cost averaging throughout history

It is easy to see how timing a perfect buy into Bitcoin is a perfect investment or why buying at the top is painful but it is harder to intuitively understand why dollar-cost averaging over time helps reduce that risk. Here Wicked Smart Bitcoin has another excellent animation showing exactly that.

The graphic starts with every day in Bitcoin history marked in green if a daily DCA investor would be in profit having started a daily purchase that day, or red if they would down. Then the next frame is the same but for two days of dollar cost averaging, then three days and so on through 1096 days, or ~3 years.

The fact that everyone who has been dollar cost averaging for 3 years is in profit is mostly just a way of saying that Bitcoin has gone up a lot in that time — but it is interesting to see how quickly the DCA strategy smooths entry timing risk.

5. NFT Markets are still small and insular

After Yuga Labs announced their acquisition of the CryptoPunks and Meebits IP earlier this month @degendata was curious about how much overlap their was between the two communities, so he created this fascinating visual showing the overlap between holders, or at least the overlap in wallets where the art is stored. Do you like this analysis, but wish it had ~10x as many dimensions? No problem.

Gradually, then suddenly …

We spoke last week about how Zoltan Pozsar (strategist at Credit Suisse) was predicting a new post-dollar global monetary regime. The next day Arthur Hayes (co-founder of Bitmex) wrote an interesting long-form analysis of what that might mean in a practical sense for gold, Bitcoin and the US dollar.

To summarize Hayes’ argument: when a country exports more than it imports that surplus trade value has to be stored somehow. Until recently by far the most common way to store that surplus trade value was to buy US Treasuries, which is why China is the largest holder of US debt (~$3-4T). China exports more than it imports and it stored the difference in USD liabilities. Other countries with large trade surpluses have had broadly similar strategies.

Now that the US and its allies have frozen Russia’s foreign reserves — countries like China are likely assessing how available their own reserves will be if they ever fall out of favor with the US government. They can’t easily sell their US Treasury position because that could crash the market and preemptively destroy their own wealth — but they can stop buying new debt and they can let the debt they hold slowly mature rather than rolling it over into new treasuries.

That trade surplus (~$0.9T annually) still has to go somewhere of course — in Hayes’ opinion it will move into gold as central banks around the world move to acquire (and custody) hard assets. At today’s prices that would mean central banks would need to buy ~480M oz every year, around ~4.2x total annual production of gold. So the first order impact would be a significant rise in the price of gold and increased pressure on the paper gold market to produce physically deliverable gold.

America’s new debt (i.e. our trade deficit + interest payments) also still has to go somewhere if foreign governments stop taking it. One option is to convince domestic buyers to step in, but motivating domestic buyers means paying them more (in the form of higher interest rates) which raises capital costs for domestic industries. That would mean less domestic investment and possibly a recession.

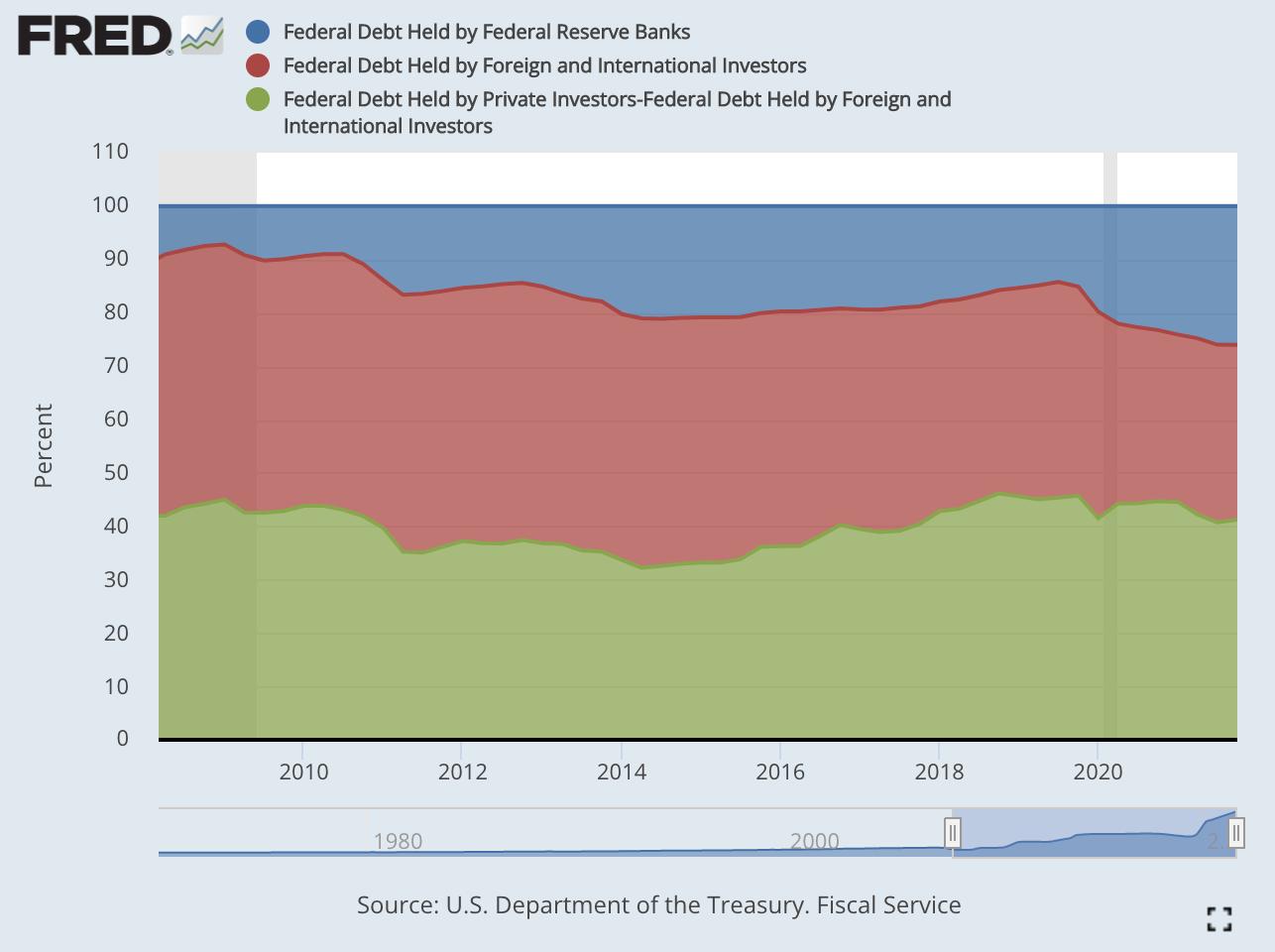

If America can’t sell debt to foreign buyers and doesn’t want to incentivize domestic buyers the only choice left is to "monetize the debt" by creating new money and using it to buy our own debt. That is the path that Hayes predicts: that America will continue to increase the money supply and the Federal Reserve will continue to own a larger and larger share of the Federal debt, as they have since 2008:

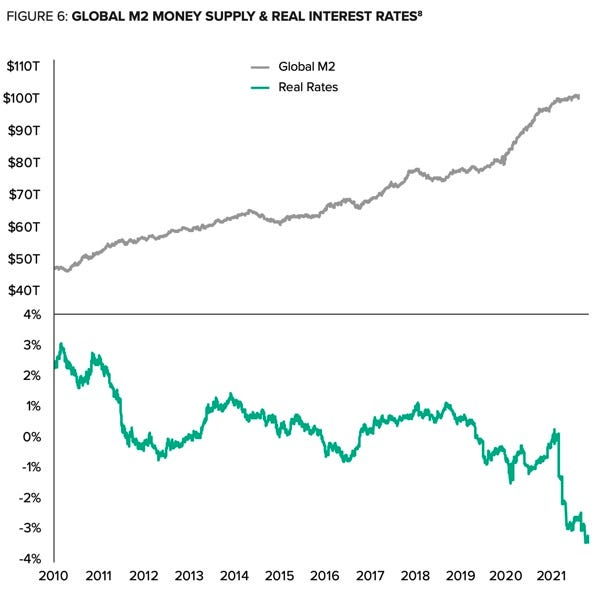

Increasing the supply of dollars increases the cost of holding dollars. You can see that pretty easily by comparing the total supply of money (M2) to the real interest rate — the more money is added to the economy, the cheaper it becomes to borrow / more expensive it becomes to lend:

It is against this backdrop of surging demand for gold and plummeting demand for USD that the dollar’s status as the global reserve currency will be tested. There is no obvious successor to the USD — China might have the economic strength to step into that role but it is has no interest in offering strong property rights to foreigners or enabling the free flow of capital. Rather than attempting to inherit the role of reserve currency China seems better prepared for a return to a gold standard, both strategically and philosophically.

Central banks who have the means and access to do so will turn to physical gold argues Hayes — but for smaller countries, companies and individuals managing custody of physical gold won’t be a practical option. Hayes argues the need for a more scalable alternative to gold will cause a phase-shift in how people value Bitcoin:

Bitcoin is currently tied at the hip with big tech risk assets […] the only way to break this correlation is a narrative shift on what makes Bitcoin valuable. A rip roaring bull market in gold in the face of rising nominal rates and global stagflation will break this relationship. As gold marches its way above $10,000, Bitcoin will march its way to $1,000,000.

As a rule, the only financial advice I offer is that subscribing to Something Interesting is a safe and virtuous way to dispose of unwanted excess fiat. But if you haven’t read my post about why everyone should have a Bitcoin insurance policy now might be a good time to check it out.

Other things happening right now:

Long time readers know I have tried to convince Senator Warren and other progressives to embrace Bitcoin many times, but sadly from the clip below it appears she is still not a reader. The main reason that Russian oligarchs can’t use cryptocurrency networks to smuggle $1B past the sanctions is because there isn’t enough liquidity to sell $1B worth of Bitcoin as you exit. If a Russian oligarch (or anyone else) decides to buy $1B worth of Bitcoin they will send Bitcoin’s price skyrocketing and they probably intend to keep the Bitcoin they paid an enormous premium for.

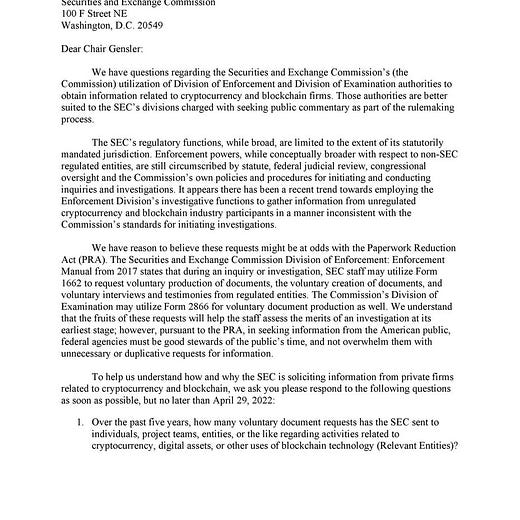

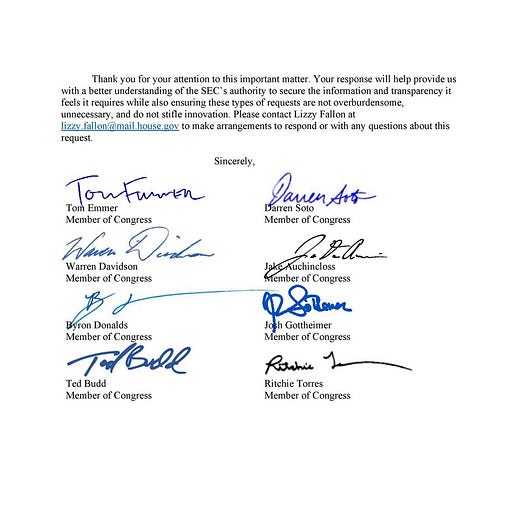

Representative Tom Emmer (R-MN) and seven other congresspeople from both parties signed a letter scolding the SEC for having an "overburdensome" regulatory approach to crypto and asking a series of pointed questions about the requests it is making of cryptocurrency companies.

That threshold isn’t arbitrary by the way — in observed practice coins that have stayed at their current address for >155 days (~5 months) are much less likely to move again.

Sharpe ratio is ratio of return to risk, not risk to return.