Editor's Note: The World does not need a World Computer

Hey Friends -

Today is the second half of my "Flippening" post. Just like the first one it took about three times as long as a typical recent events post. There were some really interesting news stories that I missed to write this up but I do think it will be durable so hopefully it was worth the trade off. I plan to step back into more frequent, timely posts for the next few weeks.

This second post focused on the idea of investing in Ethereum as a proxy for investing in decentralized financed or web3. I can completely appreciate how compelling the analogy is: the cryptoeconomy is growing and you can own a piece of it! But the argument for why that value should accrue to ETH holders instead of whoever is actually building those businesses always reminds me of the business plan of the underpants gnomes from South Park:

Decentralized Uber is the example I chose partially because it was thrown around a great deal in the early days of pitching Ethereum but also partially because if you think decentralization is just generically useful it initially sounds obvious. Once you actually unpack what it means to decentralize Uber it is obviously a terrible idea. But that’s true of most things - most applications have no business being decentralized. Most users don’t even want decentralization! Being responsible for your own safety is alarming and sometimes painful.

I will probably lose some people who think I cheated by cherry-picking Uber but I would apply the same basic structure of argument (they should and will minimize use of decentralization) to any dApp currently flourishing on DeFi. They all have to make the same trade-offs. Uber is just much easier for ordinary people learning about the space to form intuitions about. I’m more focused on teaching the curious than re-persuading the already persuaded.

I didn’t go into some of the most interesting examples of price competition across different smart contract platforms because they aren’t so much dApps migrating to different platforms as being cloned onto different platforms forcing them to compete with mirror images of themselves. The economic implications are pretty similar but the explanation was just another layer of complexity in an already complex essay. It felt extraneous.

I also chose to avoid getting too much into the possibility that Layer 2 platforms built on top of Bitcoin will end up being serious Ethereum competitors. In theory I think such competition is possible but it has been slow to emerge and I’m not convinced any of the current competitors are ready to take Ethereum on yet. I decided it was easier to avoid the complexity. Even in answering a question about the Flippening I still think it makes more sense to evaluate investments on their own merits rather than comparing them to a specific nearby alternative.

I did mention Layer 2 on Ethereum in a footnote but I wish I had more space to go into that in more detail. Layer 2s are basically just groups of dApps teaming up to negotiate a discount. Ethereum is basically a decentralization wholesaler and L2s are just decentralization retail outlets. Arguing that Layer 2s will solve problems that exist on Layer 1 is ultimately circular but that circle can take a long time to walk. As with most of my deep dives I was at the GMail enforced length limit. I’ll probably need to do a follow up post about it at some point.

Discussing the ways Ethereum is centralized was also really difficult. I wanted to explain it as a generalized threat vector with clear examples, but I also didn’t want the article to become a laundry list of specific complaints, each of which required additional explanation and none of which were "decisive" in any sense.

In particular one area I wasn’t able to explore that might warrant a follow up later are the problems with Ethereum’s pre-mine. The structure of Ethereum’s launch sale meant that launched funds could be recycled - i.e. take the funds from early sales and use them to "buy" ETH from before the sale was over, diluting outside investors.

Fairness questions aside artificially inflating the share owned by the developer team is even more problematic with the promised shift to proof-of-stake, which essentially gives large shareholders complete control of the network. It is easy to assume that large holders of ETH have the best interests of the network at heart but they aren’t the only stakeholders that matter. It is frustratingly common for arguments in favor of Ethereum to switch from one interest group to another without acknowledging the fact their interests are not interchangeable.

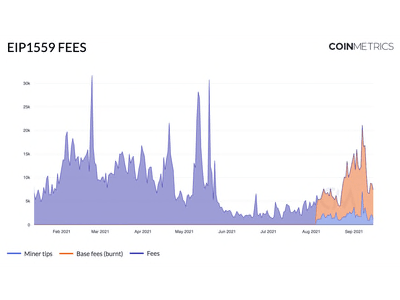

A good example is the recent EIP-1559 update, which burns some of the transaction fees rather than paying them to miners. Burning ETH reduces the total supply of Ethereum (good for ETH holders). But it also significantly lowers miner revenue (bad for miners) and eliminated periods of downtime when cheap transactions were possible (bad for ETH users). EIP-1559 is presented as "good for Ethereum" but really it is "good for ETH holders." Those things are not equivalent.

I suspect this half of the essay is the more challenging and controversial half. I was a little surprised that the first post didn’t cause any conflict - my proof of stake post drew a lot more ire. Now that it is finally written I plan to resume my usual pace of updates. I am also working on another video, a podcast episode and an NFT project - so stay tuned for more to come!

Thanks for reading. :)

KF