Crypto, huh! What is it good for? [reader question]

Is DeFi a nihilistic casino or the future of modern finance?

This [post about financial nihilism] seems antithetical to my understanding of your view of bitcoin (and gold), but maybe not completely opposed to how you view (or viewed) NFTs? I’m mostly curious how your views on crypto have evolved relative to where all this crypto/prediction market conversation seems to be headed. Other than bitcoin, is there anything “infrastructure-ish” that will remain/be net positive for society? — SL

Thanks for sharing! I would describe Neil Harounian’s post (The Speculation Engine: Financial Nihilism is a Good Thing) as "usefully wrong" — that is, I disagree with it completely but I appreciate how clearly it articulates a worldview I know is both widely and deeply held in the industry. The post isn’t long and it’s a light read, so I encourage anyone reading this to start there.

Inside this issue:

Fartcoin is not the future of finance

Crypto, huh! What is it good for?

Fartcoin is not the future of finance

Harounian starts his essay by arguing that the rising gamblification of everything is a healthy and rational response to a "system rigged against the average person". He cites rising home-ownership and undergrad education costs and concludes that "working hard, saving steadily, buying a home and building long-term security no longer feels realistic” which … is quite a leap!

I agree that the cost of home ownership is a genuine crisis — I’ve written about it before. But home ownership is not the only (or even the best) path to financial security and giving up on hard work and saving is not a financial strategy, it is an extremely damaging and pathetic strain of cope. Grown-ass adults need to confront the reality that capitalism is unfair without abandoning responsibility for doing what they can with what they have.

Of course the idea that gambling is smart isn’t really the point of Harounian’s thesis, it’s just a bit of light flattery for his presumed audience: gamblers.1 His real argument is that all this gambling is actually a necessary part of a grand restructuring of the entire financial industry. Just as railroad manias funded the railroads and the dot-com mania built the fiber networks, so too will the crypto manias build a new generation of financial infrastructure, on which we will all eventually depend.2

That kind of argument-by-analogy is at best a little glib. Are we meant to infer that overvaluing Pets.com was a critical step on the path to building nationwide fiber networks? Why? Harounian doesn’t say.

Rather than explain the causal link between speculation and productive investment he takes it for granted and uses it to paint the gamblers of the past (and by implication the present) as heroes and martyrs. But again … why? How does using leverage to long a three-day-old memecoin or buying short-term out-of-the-money Gamestop puts or betting the limit on a six-way-parlay help build the future of finance?

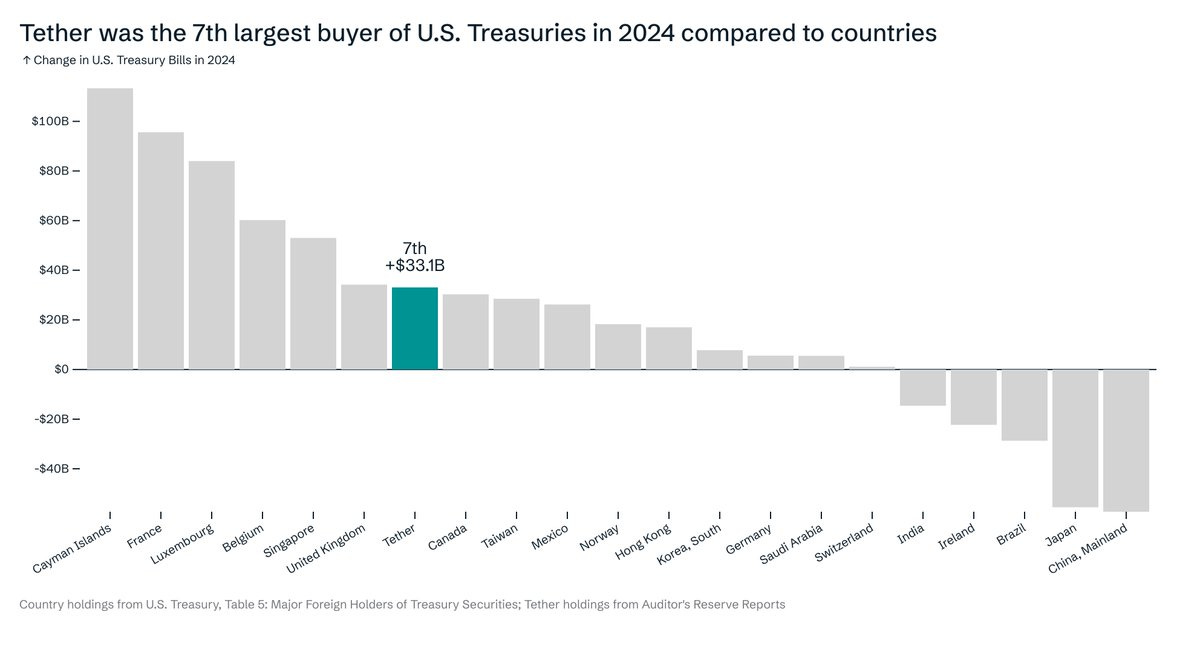

The only example of useful financial infrastructure that Harounian cites are stablecoins — and he is right that stablecoins are a radically transformative technology. But he is wrong to connect the growth of stablecoins to the speculation happening on pump.fun and other DeFi slot machines. Stablecoins are mostly a tool used by the global poor to access dollar-denominated banking services. The crypto casino is a rounding error compared to that market. Retail crypto speculation is not the reason it exists or has grown so quickly.

That’s what makes Harounian’s prediction that "every major GSIB (Global Systemically Important Bank) and Fintech will buy, build or partner with a crypto-native company [by 2035]" unintentionally funny. Stablecoins are the most jaw-droppingly profitable business in the history of the world. Banks have been competing to capture share in that emerging market for more than a decade already. Easy to miss if you are busy speculating on pumpfun memecoins.

Using speculative frenzy as a shorthand for socially useful investment is ridiculous. Labubu sales do not create critical infrastructure. Expensive Pokemon cards do not lower the cost of capital. Fartcoin and BONK do not signify the dawn of a radical new era of financial freedom. Sometimes people just get excited about things and the price of those things goes up.

Crypto, huh! What is it good for?

To get back to your original question, what infrastructure has crypto built that will both endure and be ~net positive for society? In my estimation we have accomplished three things of genuine and enduring value in crypto:

Bitcoin transforms the nature of long-term saving for the wealthy

Stablecoins transform the nature of short-term saving for the poor

Absolutely everything else in crypto I consider parasitic and destructive to the credibility of these three genuine value propositions. Consider how the speculative frenzies around monkey pictures3 annihilated the public reputation of NFTs — an absolutely wild outcome when you consider that NFTs are functionally a file type. Imagine if one of the early uses of .txt files had been so radioactively unpopular and cringe we had to invent a new naming convention for simple text files.

The casino that has grown on top of crypto is certainly interesting and at times perhaps even fun for some of the people who are playing, but it is very obviously value destructive as a whole. Pretending otherwise is either naive or disingenuous.

In this case I suspect a little of both.

Harounian runs a startup accelerator for crypto adjacent startups.

He also argues that "Tulip markets helped finance early Dutch capital systems" but I think that example is basically ahistorical, so we will politely ignore it. Dutch capital markets were well established by the time tulip markets emerged and the sudden surge in tulip prices was actually the result of a change in capital markets, not the other way around. It was not a huge historical incident and it did not create productive investments for anyone. The only reason we remember it at all is because of Calvinist propaganda.

Disclosure: I still own my monkey picture, I still like it, it is still (barely) in profit and I still consider it a terrible investment. I keep it as a souvenir of cryptohistory.

The distinction you draw between stablecoins serving the global poor versus retail speculation is crucial and gets overlooked constnatly. Framing memecoins as infrastructure-building feels like mistaking the strip mall for the roads that actually connect places. I'd add that the NFT reputation damage is a perfect case study in how hype cycles can completly destroy adoption timelines for genuinely useful tech.