Bitcoin is the fastest currency in human history

Anyone who told you Bitcoin was slow was selling you something

Bitcoin is often criticized as being "too slow" to compete with either traditional payment networks (like Visa) or alternative cryptocurrencies (like ETH). That’s a strange complaint because Bitcoin is the fastest money to ever exist without exception. Nothing else even comes close. Satoshi is pointing at the moon and people who complain about transactions-per-second or confirmation times are staring at his finger.

In this issue:

Credit cards are actually very slow

Buying a coffee vs buying a house

Speed is security and security is speed

There is no faster Bitcoin

Credit cards are actually very slow

When we paid for things using physical tokens like dollar bills or gold coins payments were simple and atomic. You proved to the merchant that you would pay by paying them, and after you gave them the money they had it. It was a simpler time.

Physical money is great for small payments to local merchants but it breaks down for larger payments in a more globally interconnected economy. Moving physical cash over long distances is slow, dangerous and expensive. Modern payment systems like credit cards evolved to overcome those limitations — but they make more complicated trade-offs as a result.

If you think the Visa network is a fast way to pay for coffee it is because you are picturing the act of buying coffee, not the act of selling it. For the consumer a credit card transaction is nearly instantaneous but for the merchant it is decidedly not. Merchants are usually paid by payment processors in batch settlements overnight and for credit card transactions the threat of chargebacks lingers for much longer. The part of credit card payments that is fast isn’t the payment — it’s the credit.

The point at which the promises of money becomes actual money is called settlement. When you see someone describing Bitcoin as slower than Visa it is because they are confusing initiating a payment (which happens more or less instantaneously on both networks) and settling the payment (which happens in less than 10 minutes for most Bitcoin payments and typically happens overnight for credit card payments).

Buying a coffee versus buying a house

Small payments often appear instant because merchants are willing to eat the risk of a chargeback to make things more convenient for consumers. People buy more coffee when coffee is convenient, so coffee merchants endure the inconvenience of overnight payment and the risk of chargebacks to make their coffee convenient for consumers. When payments are larger the risk rises and the illusion of convenience becomes too expensive to maintain.

That’s why property sales are typically done through escrow services and take several days to complete. Unlike a coffee merchant a property seller is only willing to give up their deed/key when payment has been assured. That’s the service that escrow companies are offering: settlement finality. Certainty that the payment has been received and won’t be revoked as soon as the product is delivered. That’s the same service the Bitcoin blockchain offers more cheaply and effectively.

Larger payments create more friction than smaller payments because they create more risk and require stronger safeguards. Those safeguards lower risk but they also slow things down. Small payments look instant because they don’t matter — they are small enough for debt to move quickly and money to eventually catch up. Large payments tell you what the actual speed of moving money is. As anyone who has ever bought or sold a house can tell you — it’s surprisingly slow!

Speed is security and security is speed

Every payment has some probability of failing. With traditional cash the risk is accepting counterfeit money or having money stolen in transit. With credit cards the risk is a chargeback dispute. With bank payments the risk is government intervention and seizure. With Bitcoin the risk is a double-spend attack or a blockchain re-org. These risks tend to go down over time but they never go away entirely.

In that sense no payment is ever completely final — finality is a spectrum of risk, not a binary state. A payment is "final" when the recipient decides the risk of it failing is too small to be worth considering anymore. That’s a function of both their risk tolerance and the size of the payment. A "fast" payment network is one that eliminates the risk of payment failures as quickly as possible.

Transactions with low payment risk are difficult to reverse — in other words the "fastest" payment network is the one that is the most difficult to rewrite. In that sense debit cards are faster than credit cards because they are spending actual money instead of debt, which makes it more difficult to demand a payment back. That’s why we use wire transfers to buy houses instead of credit cards — they are a much faster way to be certain the money will stay where it was sent.

So how fast is Bitcoin? The payment risk in Bitcoin is that an attacker will use mining power to rewrite Bitcoin’s history without your payment in it — like traveling back in time to prevent your payment from ever happening at all. That’s possible to do in Bitcoin but it is also staggeringly expensive — each additional block miners generate produces ~¼ million USD worth of security (at current Bitcoin prices) and new blocks are added on average every ten minutes.

A wire transfer for $100k would take 1-5 business days and most credit cards won’t support a payment of $100k at all — but a $100k Bitcoin payment will be secure within less than 5 minutes on average. Bitcoin can secure >$1B payments (and it has). The reason it can do that is because it adds security / removes payment risk incredibly quickly compared to any other form of payment that has ever existed.

There is no faster Bitcoin

People misunderstand Visa as faster than Bitcoin because as consumers we are rarely exposed to settlement/finality, so we don’t have good intuitions about what fast payments actually mean. A lot of competing cryptocurrencies take advantage of that same basic misunderstanding to market themselves as faster than Bitcoin.

Litecoin, for example, is designed to produce blocks ~4x faster than Bitcoin — but blocks don’t actually provide security by themselves. Security is provided by the amount of work that miners put into mining the block and hence the amount of work an attacker would need to put into replacing it. Dividing that work into four times as many blocks is like dividing $1 into four quarters and calling it a raise.

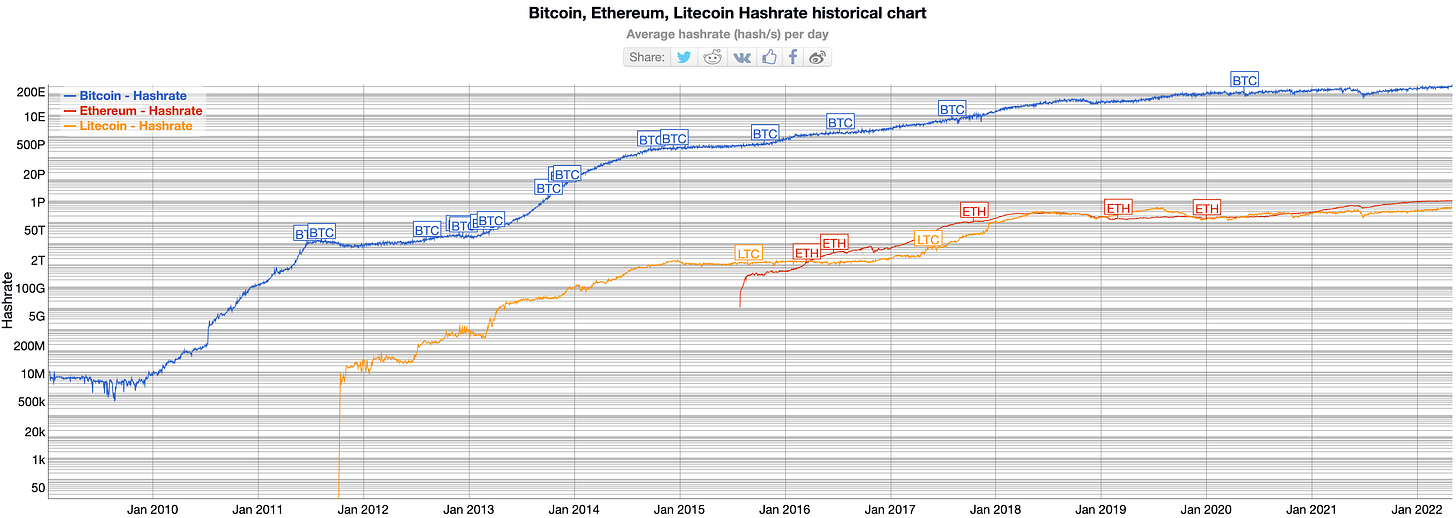

The correct way to compare how fast cryptocurrency networks secure payments is to ask how much computational power miners are investing into those networks over the same period of time. The chart below compares the network security1 of Litecoin (yellow), Ethereum (red) and Bitcoin (blue) over time:

Many newer competing cryptocurrencies take advantage of people’s confusion and unit bias to complicate the system of checkpoints that secure the network to make them harder to compare, but you don’t need to scrutinize the machinery to understand the broad conclusion: the Bitcoin network is the most secure network because the most computational power has been spent to secure it.

Bitcoin is and has always been the most expensive network to reverse and hence the fastest network to deliver finality. It spans physical distance faster than money, reaches finality faster than escrow, offers security faster than other cryptocurrencies and can scale to much larger payments than credit networks.

Bitcoin is the fastest currency in human history. Nothing else even comes close.

This chart compares hashrate. Another valid and interesting comparison is miner revenue, which is much more equitable between Bitcoin and Ethereum. Ethereum miners are paid similarly to Bitcoin miners but create much less hashrate in part because running an Ethereum validation node is more expensive in other ways but also because Ethereum is actively planning to retire proof-of-work miners and migrate to a proof-of-stake system. That gives Bitcoin miners longer time horizons for their return on investment. The Bitcoin network can effectively buy security more cheaply by entering into a longer term contract.