A brief history of people determined to be wrong

Plus who is actually buying NFTs and why are Bitcoin and stocks now moving together?

In this issue:

Bitcoin and equities are on the same ride

Stay safe out there friends!

Who is actually buying NFTs?

A brief history of people determined to be wrong

Bitcoin and equities are on the same ride

One of Bitcoin’s key selling points for investment portfolios has always been the idea that it was an uncorrelated asset - i.e. one that moved out of sync with stocks, bonds and other markets. The idea is that if the price of Bitcoin moves independently from the rest of your portfolio, then you can improve your risk-adjusted profit by including some Bitcoin in your investments, regardless of your opinion of Bitcoin. You don’t have to think it’s a promising investment - as long as you think its decorrelated it makes sense to own at least some.

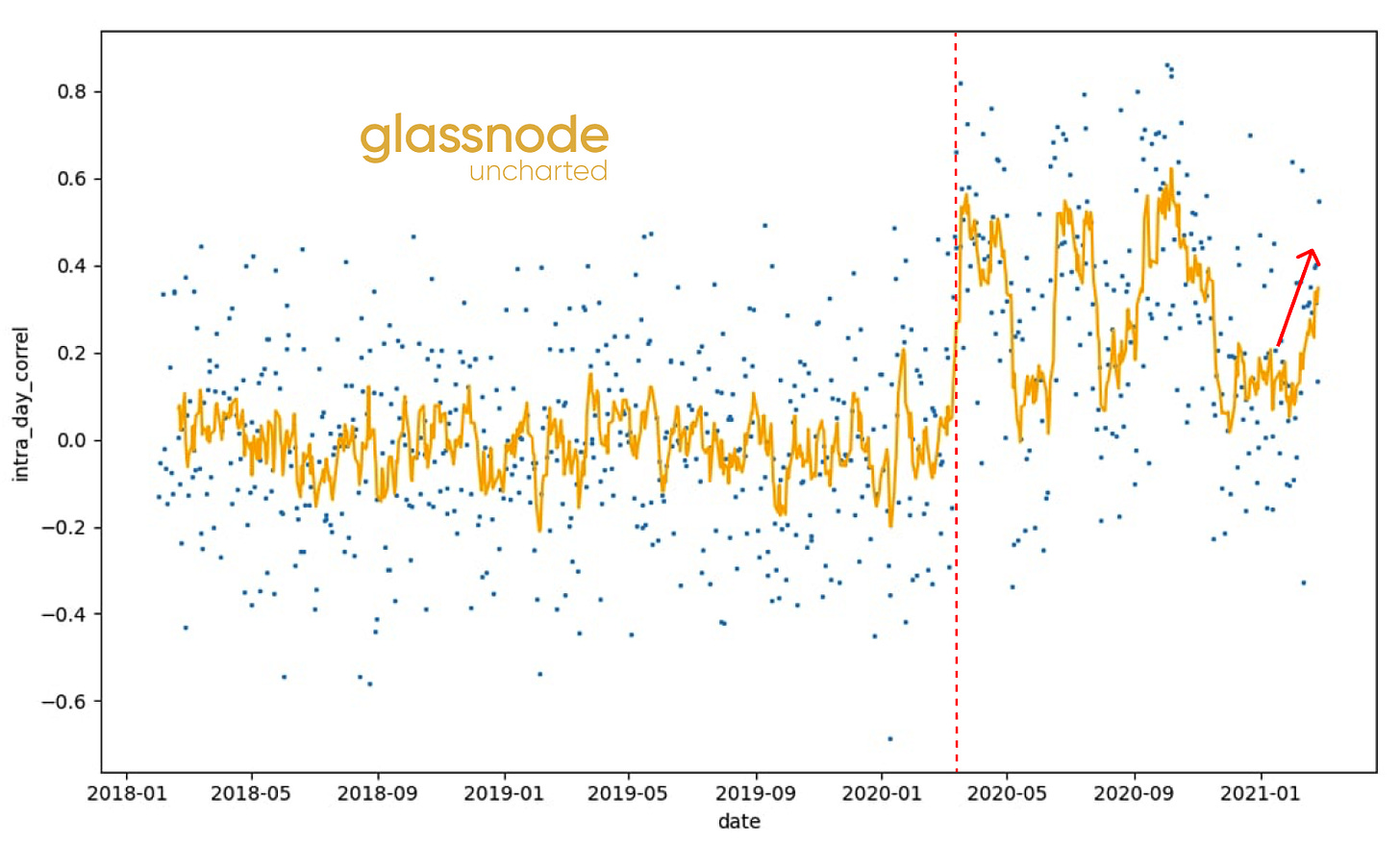

As the astute folks at the Uncharted Newsletter point out, until recently Bitcoin was decorrelated. But in the March 2020 market crash, Bitcoin fell along everything else. Since then correlation has been volatile but much higher. In other words, Bitcoin and stocks are moving together more than they ever have before:

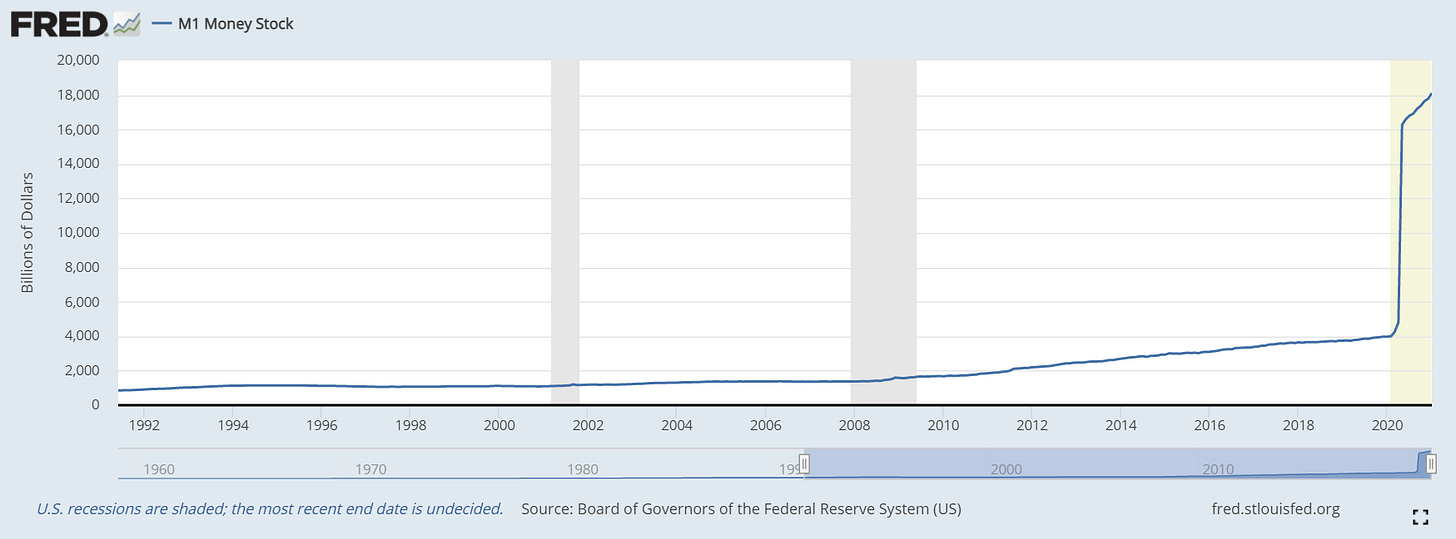

Something else happened in the spring of 2020, too. The $2.2 Trillion CARES act was passed, the largest stimulus in US history: ~10% of the total GDP. Anyway, here is a graph of the M1 money supply - loosely the number of dollars in the economy.

Editor’s Note: The big jump in M1 here is more complex than just "government prints dollars" - it actually has more to do with an accounting change and downstream consumer reaction to the government set interest rates. The Fed has a longer post about why it happened if you are curious. M2 is probably a more helpful graph to track, it tells largely the same story albeit much less dramatically.

The story is pretty straightforward: there are a lot more dollars, so it takes more dollars to buy the same number of Bitcoin or shares of the S&P 500. You can see the same thing happening in art/NFTs, collectibles like sports or trading cards, real estate and I’m sure any number of other asset classes. The story here isn’t about Bitcoin changing value, it is about the USD warping as a unit of measure. Dollars are losing value and it’s showing up in every asset class at once.

Stay safe out there, friends

“Did you see [URL redacted]? It's a bit wild to just send someone a bunch of money with the promise they will pay you back 5 fold. But I only own 0.04 btc right now, so might take the gamble to convert that to 0.2.” - recent conversation with a friend

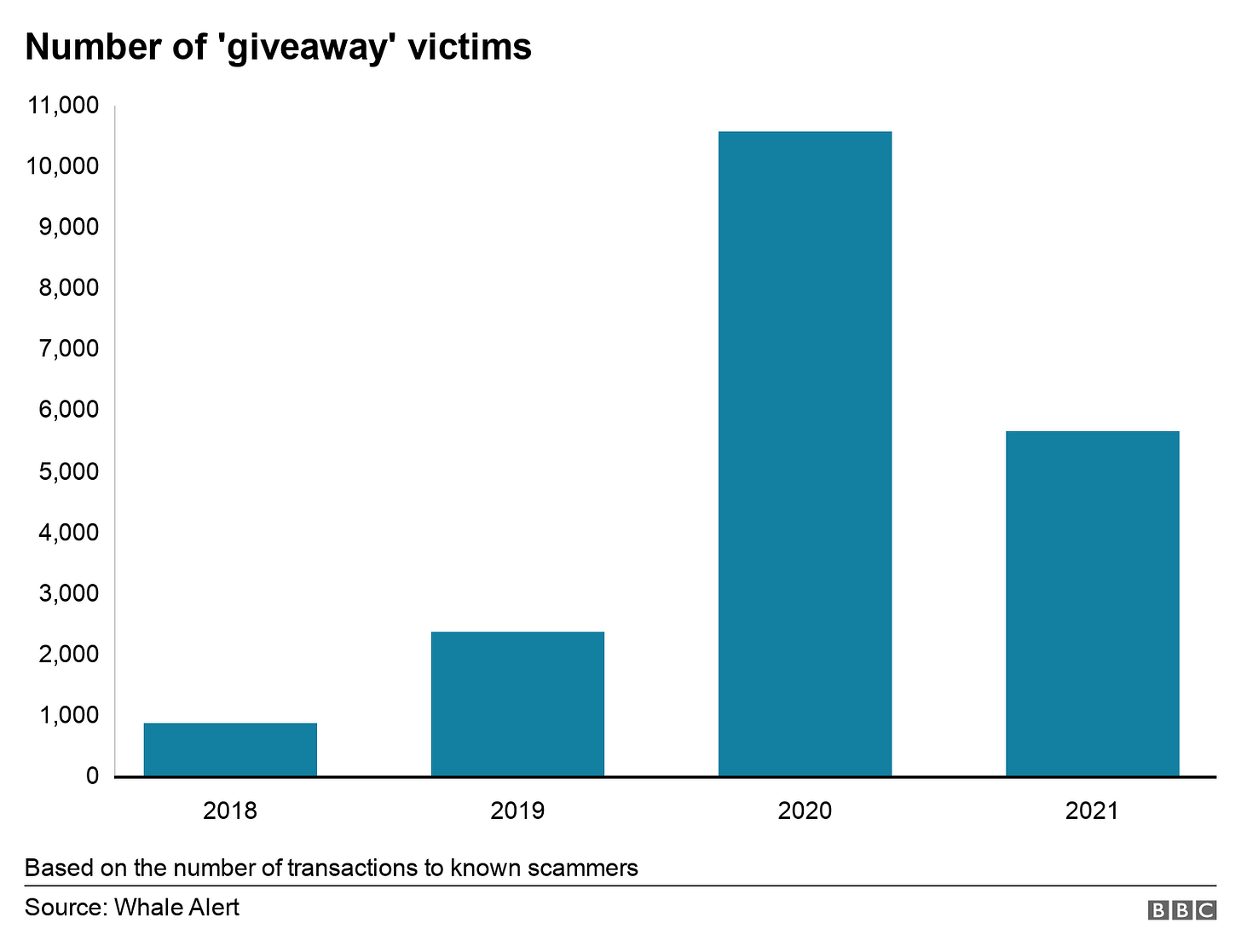

A depressingly common and effective scam is impersonating a prominent person or a respectable company in the crypto space and pretending to offer a "double your [BTC, ETH, whatever] by sending it here” promotion. Please don’t do that you will never get your money back. Unfortunately the growing number of new entrants to crypto also means there is a growing number of potential targets for the scam.

Anyone asking you to type in your private key, share your password or send them your Bitcoin should raise immediate red flags. Anyone promising to double your Bitcoin or to invest it for gains or make a profit through mining should also raise red flags. There is no such thing as a free lunch! If you are worried something looks too good to be true, you are almost certainly right. Stay safe.

Who is buying NFTs?

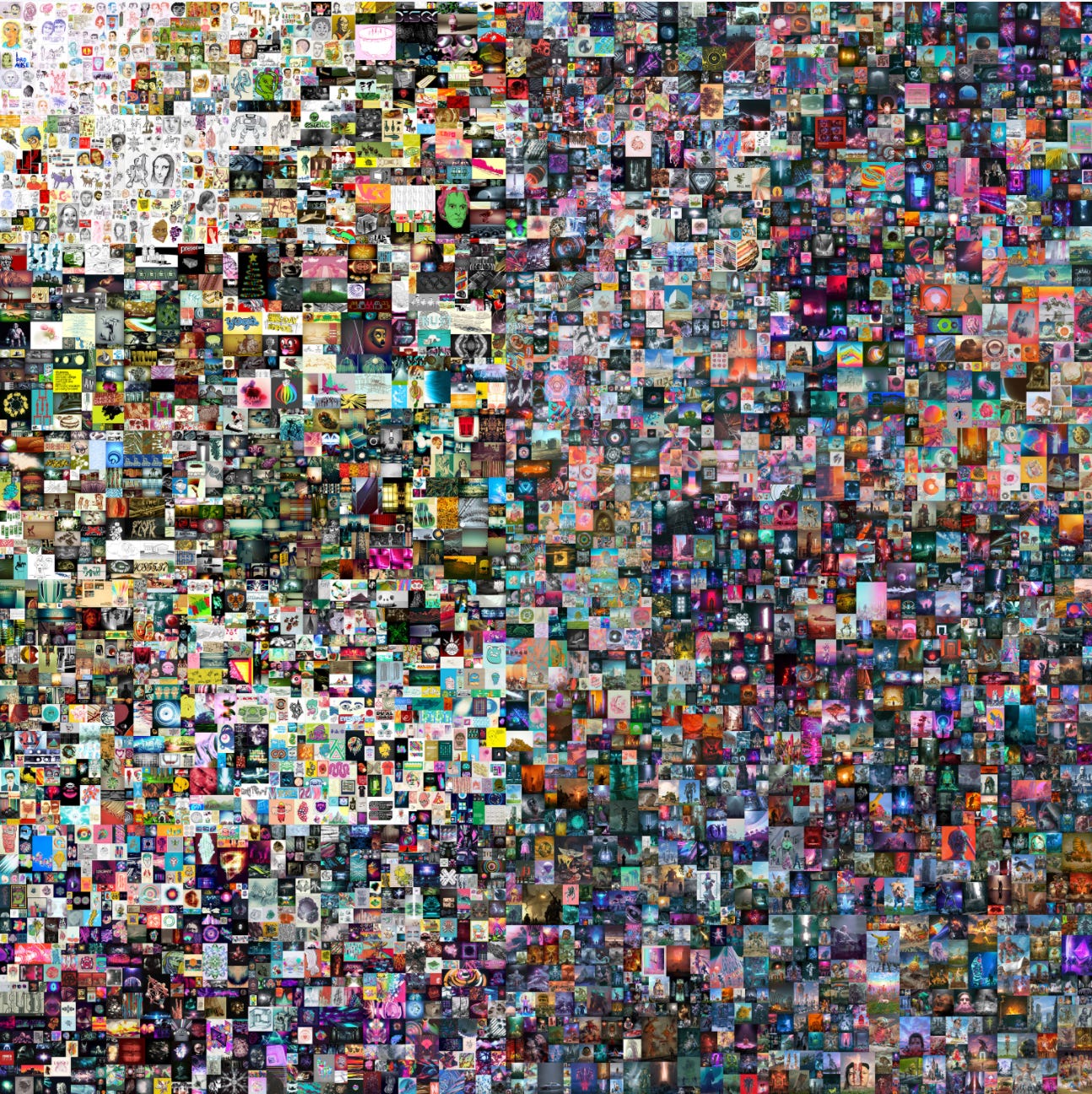

We talked last Thursday about the surge in NFT sales, culminating the digital artist beeple auctioning an NFT representing his first 5000 'everydays' for $69M. We showed you a copy of the work when it sold but just in case you only had a chance to enjoy the first few thousand here it is again:

$69M may seem like a lot for a digital work that anyone can copy and put into a newsletter but there are 5000 distinct images so maybe it helps to think of them as costing ~$14,000 apiece. It took beeple around 13.5 years to make them, so he effectively earned ~$5M/year. He is now the third highest paid living artist of all time.

The winner of the Christie’s auction was Metakovan, a pseudonymous crypto investor most known for having previously purchased a suite of 20 beeple works for $2.2M and founded a digital gallery that he sold fractional ownership stakes in using an ERC-20 token called B20. The price of B20 surged briefly on a rumor that Metakovan would be adding the everydays to the B20 collection but that doesn’t seem to be the case.

Some have argued that because Metakovan is already heavily invested in beeple art that his bids on the Christie’s auction shouldn’t be seen as valuing the art but instead as a kind of tape-painting to pump the value of his B20 holdings but I’m not so sure. For one thing, the $69M is about half the entire marketcap of B20 after the pump so its very difficult to see how Metakovan could get his money back from dumping B20. More importantly, Metakovan wasn’t the only one trying to buy at these prices.

Here is a video of Justin Sun (founder of Ethereum-clone Tron) attempting to outbid the winning bid but being prevented by some kind of error on the Christie’s website:

It’s hard to say what the final price would have been if the bidding had been allowed to continue - but it seems like $69M was, if anything, too low.

A brief history of people determined to be wrong

In the last issue (about Bitcoin and the Environment) I talked briefly about how Bitcoin’s value proposition is so complex and counter-intuitive that almost everyone initially rejects it. My own personal journey from laughing at Bitcoin to starting to understand it took a little under three years. Adam Back the inventor of Hashcash (which Bitcoin’s blockchain is based on) and CEO of Blockstream (the company that employs the most Bitcoin core developers) famously told Satoshi that Bitcoin couldn’t work. Nobody gets it on their first try.

For most people the cycle goes (1) reject Bitcoin as obviously absurd, (2) forget about Bitcoin for some time, (3) notice Bitcoin is still around and then (4) become either curious or angry. Some people become so frustrated that they start to build a sense of identity around rejecting Bitcoin, like gold magnate Peter Schiff:

That’s Peter Schiff’s actual son, by the way. He’s a big Bitcoin enthusiast.

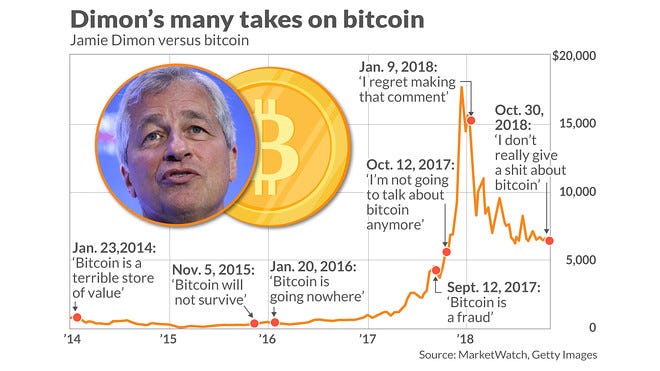

Peter isn’t alone in having been stuck in a loop criticizing Bitcoin for years as it continues to invalidate his worldview. Nouriel Roubini, Nassim Taleb, Paul Krugman and a number of other traditional economists have been visceral in their rejection of Bitcoin as a valid form of money. Warren Buffet famously called Bitcoin "rat poison squared." Jamie Dimon of JP Morgan Chase has had to walk back his comments on Bitcoin as JP Morgan has now launched a cryptocurrency exposure index and recommends ~1% of portfolios be kept in Bitcoin.

There are other ways people find themselves rejecting Bitcoin - another common one is to agree that Bitcoin is well intentioned but to declare it fundamentally flawed. Bitcoin developer Mike Hearn declared the Bitcoin experiment over in 2016 and sold all his coins at a price of around ~$400/btc. Roger Ver and Jihan Wu believed that they knew better than the market what Bitcoin should be and tried to force their vision on the market with Bitcoin Cash only to shatter the fortunes of Bitmain, which at the time was the world’s most profitable company.

Bitcoin is an experiment that hasn’t concluded yet and there is plenty of room for reasonable and intelligent skepticism - but people who confidently declare it a failure are being as dogmatic and unscientific as the Bitcoin shills. Don’t anchor your sense of self on your past investment decisions. Stay curious.

Leave yourself room to be surprised.

Other things happening right now:

This most recent drop happened shortly after a ~$1B transaction into a Gemini wallet caused an alert that triggered a lot of trading. A debate is unfolding on Twitter about whether that was legitimately a deposit to Bitcoin or whether it was just internal wallet management. Seems likely it wasn’t actually a deposit.

If the recent price action has you nervous, consider March 12 of last year - the worst single-day drop in the history of Bitcoin (so far).

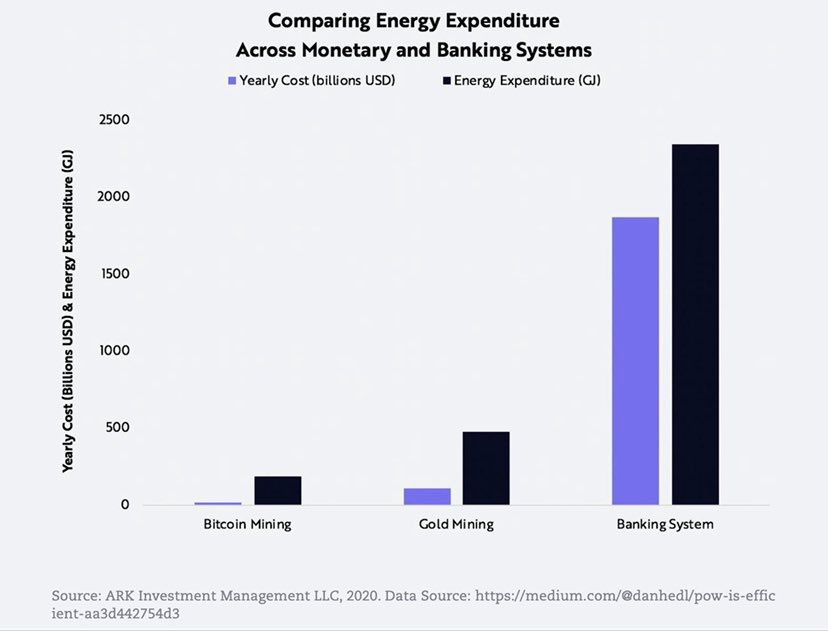

Another interesting take on the Bitcoin environmental debate we weighed in on last week. Dan Held in his essay POW is efficient did some estimations of the cost (both environmental and financial) comparing Bitcoin mining to gold mining and the traditional banking system. These estimates are pretty broad strokes (methodology is in the article) but they do a good job of putting the cost of running a sovereign currency in a more appropriate context than comparing Bitcoin to VISA or various nation-states.

The Oakland A’s are selling full season suites for 1 bitcoin. I don’t personally think merchants adopting Bitcoin as a means of payment is very interesting since they essentially just immediately resell your Bitcoin for you - but this is interesting because the actual price is being set in Bitcoin. If enough businesses set their prices in Bitcoin rather than dollars, Bitcoin won’t be volatile anymore. USD will be.

Presented without comment: