[Gamestop Saga - Part II] Robinhood sides with the Sheriff

A retrospective on GameStop, Wallstreetbets and what we can learn from the aftermath.

This is is the second in a series. If you haven’t already I recommend starting with the first post, Capital Uprising.

Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

If you haven’t already, start with part one: Capital Uprising.

Robinhood sides with the Sheriff

Nothing unites the people like a villain

GME refuses to die

The consequences so far

So what do we make illegal?

Robinhood sides with the Sheriff

When you trade stock on a modern exchange they do their best to pretend the transactions are instant but they are actually quite slow. Stocks trade on a T+2 day settlement window which means anything you buy today won’t actually clear until two days from now. The window of time between when you pay for a stock and when it actually arrives introduces some credit risk (maybe your exchange goes bankrupt before it clears) so exchanges deposit capital with their clearinghouse each day to cover that risk - similar to how margin accounts operate for retail traders.

This clearing risk is normally quite low, but it goes up when there is more volatility, more volume in a single ticker or when the volume is mostly buying or mostly selling. In the case of GME it was all three - more volatile, all focused in one stock and almost exclusively buying (at least among Robinhood’s userbase). Clearing risk was at extraordinary heights.

Higher risk means clearinghouses require a larger deposit - so in a sense if all of an exchange’s users decide to go long on a thin market they can spike the exchange’s clearinghouse deposit requirements - almost like a margin call. You can get a much more detailed explanation here. For Robinhood the movements on GME were so severe that their clearinghouse deposit requirements grew by a factor of ~10x.

That was the main reason exchanges were forced to limit trading in GME (and a handful of other similar stocks). Not necessarily a desire to protect hedge funds but a legal requirement to buffer the credit risk of an increasingly volatile market. Most exchanges chose to suspend trading entirely. Robinhood decided to suspend buying (which would further strain their capital requirements) but to continue to allow selling, reducing the burden on Robinhood but also letting hedge funds scoop up cheap shares while retail users were unable to compete.

To quote Douglas Adams:

"This made many people very angry and has been widely regarded as a bad move."

Not only did Robinhood’s choices mean the price could only move down it also showed everyone that the fix was in. There was no beating the house if they could change the rules in the middle of the game. The price of Gamestop’s stock collapsed 80% in a matter of hours:

Nothing unites a the people like a villain

America experienced a wave of refreshingly bipartisan fury about the abrupt shift in the market rules seemingly at the expense of small investors:

A class-action lawsuit was formed to capitalize on the outrage (as is tradition). Employees at Robinhood were understandably also frustrated with the company’s choices but no need to worry because Robinhood’s HR department is as polished and graceful as their PR department. Everyone was awarded $40 DoorDash gift cards. Very magnanimous!

Everyone is bleeding but GME refuses to die

I dragged my heels on publishing the second part of this series in part because I was hoping to wait until the dust settled so I could offer a conclusion to the story. But in spite of all the carnage above, r/wallstreetbets is still posting about GME and it is still trading above $50/share - much lower than peak but still ~10x where it was a few months ago. Short interest is down from ~140% of float to only ~40% - much lower but still an extremely high level of short interest for a stock. The battle drags on.

The consequences so far

I don’t know what you call it when you want to talk about the aftermath of something that hasn’t stopped happening yet. Simul-math? During-math? Maybe just math? The whole thing is very whelming. Anyway, this is what has happened so far.

First off, none of this worked out well for the hedge funds short GME:

There were hedge funds on both sides of the trade though, so there were winners too. A multi-billion dollar hedgefund named Senvest made ~$700M selling GameStop near the top. Another named Mudrick Capital made ~$200M from the surge in GameStop and the related surge in AMC.

It was overall probably a bad week for Robinhood. There was a lot of trading so they probably made a decent amount of money. But they also outraged their userbase, attracted the attention of regulators and ruined their Super Bowl ad. They had to shelve plans for an IPO and instead raise ~$3.4B from investors to cover their abrupt need for capital. Not great.

On the other hand this all worked out very well indeed for Robinhood’s main investor and largest customer (~40% of revenue) Citadel LLC. They buy and fulfill order flow for Robinhood so they made money on the volume of trading on the way up, knew exactly when to short to profit on the ride down and then were able to buy large stakes in both Melvin Capital and Robinhood very cheaply by offering the capital backstops they needed to survive. Win-win-win for Citadel.

The story is also mixed for the Redditors. u/DeepFuckingValue took at least ~$12M off the table so one way or another he ended up heavily in profit. On the other hand he left many more 10s of millions on the table when he stayed in the trade long after Robinhood froze trading. Now he may also lose his job as a financial wellness education director at MassMutual. A small price, I suppose, for greatness.

Some retail traders certainly got rekt but perhaps not as many as one might expect? There have been a smattering of posts on r/wallstreetbets. The NYTimes interviewed a few people who lost a few hundred dollars. If there are more tragic stories out there they haven’t surfaced. Thankfully it seems like most of the retail investors who played Gamestonk were using play money. In the end the role of the r/wallstreetbets community may have been less about raising the capital and more about creating the noise and attracting the attention.

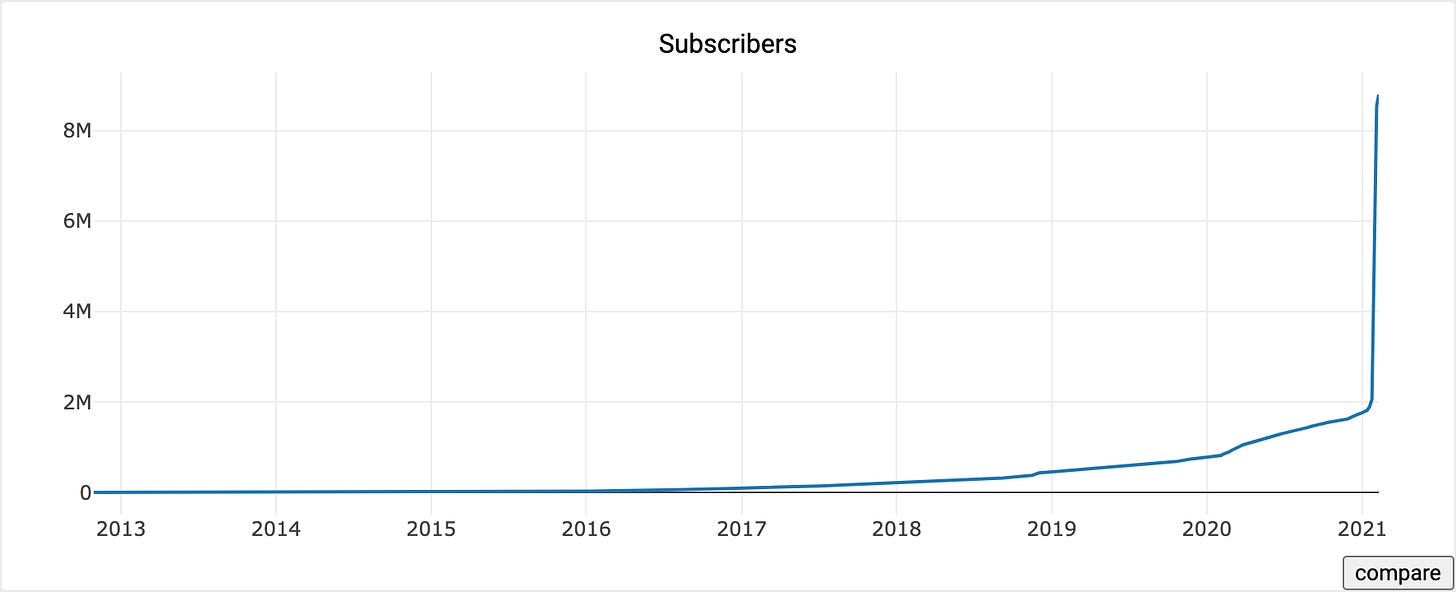

The community of r/wallstreetbets itself grew ~4x as all this unfolded:

Growth like this is a mixed bag for a small community. New members may not be familiar with or value the original culture - it is easy for the distinct flavor of a community to be washed away in such a wave. Not everyone joins with the best interests of the subreddit at heart either - undoubtedly some share of the new accounts were seeking to disrupt or dishearten the movement behind GME.

Then … it got weird. The original founder of r/wallstreetbets capitalized on the attention by selling the movie rights to his story in spite of the fact that he had been kicked out of the community around a year before any of this happened for attempting to monetize the subreddit.

Hearing about this a number of the retired moderators reactivated their old accounts and staged a coup, banning current mods and angling for their own movie deal. Moderating r/wallstreetbets had suddenly transformed from a thankless task to a precious business opportunity.

Drama ensued. Users and ousted mods rebelled and created protest posts and alternate subreddits - the details are in Jack’s thread above. Eventually Reddit intervened. The moderators attempting a coup were banned - but some of the current moderators had stirred up enough trouble in the process that Reddit banned them from being moderators as well. Only a fraction of the original moderator team remains and they oversee a community mostly composed of brand new citizens.

Imagine if your hometown quadrupled in size overnight and then fired and replaced most of the local government. It remains to be seen what will grow in its place but it will be qualitatively different from what it once was.

So what do we make illegal?

As boring as it is, I’m mostly inclined to agree with Joe here. Some people bought shares (possibly foolishly) and some sold shares (possibly foolishly). None of that is or should be illegal, even when it is ill-advised.

Shorting stocks is and should be legal, and so is encouraging other people to join you in your investment thesis - whether at an ideas dinner with hedge fund leaders, in an emoji laden post to r/wallstreetbets or as a billionaire being interviewed on CNBC. Payment for order flow is complicated but not intrinsically unethical. (Robinhood hid that they were selling order flow at first, which is obviously unethical, but it was the fraud not the business model that was bad.)

Perhaps we as a society should re-examine the implications of accredited investment, fee-free trading and capital margin requirements. There is always room to fine-tune the parameters.

The only real villain that I see in this story is Robinhood - the decision to halt buying and not selling strikes me as a violation of reasonable expectation of their users that was almost certainly motivated by a desire to shape the market for GameStop to their and possibly others’ advantages.

If you trade on GameStop, I would encourage you to migrate to another platform. And if you are one of the Congresspeople asking questions in the upcoming congressional hearing I would save my most pointed questions for the executives of Robinhood.