Inside this issue:

Ok, maybe panic a little

The murder of Terra/Luna

A city made of pure Bitcoin

DJ Pauly D on inflation

OK, maybe panic a little

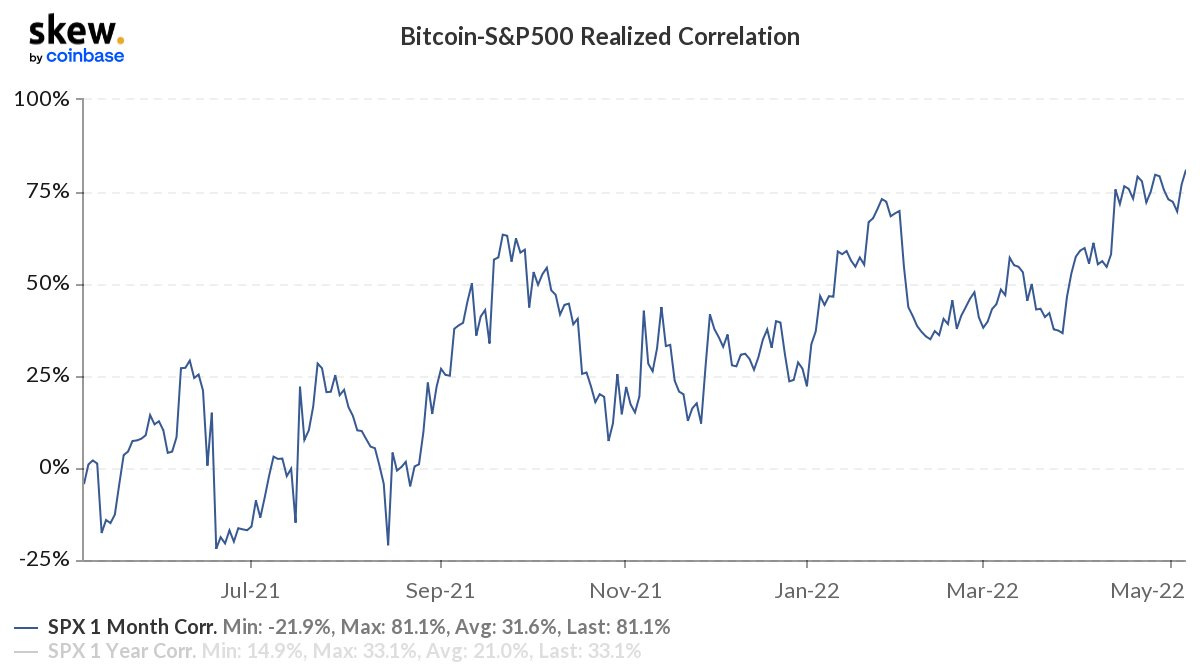

Bitcoin is now in its sixth consecutive week of downward price movement, the longest stretch of consecutive weekly closes in the red since 2014. Yesterday the price scraped briefly below $30k/BTC before recovering — at time of writing the price of Bitcoin is ~$31k/BTC. There are a lot of reasons for the price movements (we’ll get into one of the more interesting stories below) but the basic backdrop of everything is the chart above — my personal pick for the ugliest graph in crypto right now.

The story above is a grim one for Bitcoin. Historically Bitcoin’s returns were basically uncorrelated to the rest of the market — but since the start of the pandemic Bitcoin has increasingly been rising and falling right alongside the S&P 500. That’s bad news for Bitcoin for two reasons:

First, one of the strongest arguments for investing in Bitcoin (especially at the institutional scale) was how Bitcoin’s returns were uncorrelated with the rest of the market. Modern portfolio theory says that adding an uncorrelated asset to an existing portfolio lowers risk (or if you prefer, improves return for the same level of risk). Investors who bought Bitcoin for portfolio diversification are likely not very satisfied to watch it perform like a tech stock instead of digital gold.

More generally though this is not a good time to be performing like a tech stock. The Fed is fairly openly talking about taming inflation by reducing demand — which is fancy econospeak for deliberately causing a recession to keep prices down. That’s likely to be hard on all kinds of asset prices, especially high-risk, high-return investments generally. Here is the last year’s performance for the ARK Innovation ETF, Cathie Wood’s disruption-focused managed fund:

In short, Bitcoin is not acting like an inflation hedge and the assets it is acting like are in a tailspin. I try not to make price predictions in Something Interesting but it does seem like it’s probably going to get worse before it gets better? This drop has been painful but by historical standards it could still get much worse:

A drop of the same severity that we saw in 2015, 2018 and 2020 would start to stabilize somewhere around ~$8-10k/BTC. I don't actually think it will go that low, but I do think it could get worse from here.

The murder of Terra/Luna

We talked a bit back in March about algorithmic stablecoin pair Terra/Luna. Terra (UST) is a stablecoin that attempts to peg its value to the dollar and Luna is the equity token the algorithm uses to maintain that value. In other words, Terra’s value is backed by demand for Luna and Luna’s value is supported by demand for Terra. Here’s what I said about it at the time:

The trouble with this arrangement (and with algorithmic stablecoins generally) is that people tend to lose faith in the deposits (Terra) and the collateral (Luna) at the same time. When you most need the value of Luna to prop up the value of Terra they may both be collapsing — like offering panicking customers in a bank run shares in the failing bank instead of cash.

An oversimplified but not unreasonable mental model of Terra/Luna is that it is a ponzi scheme with the express goal of becoming too big to fail. Founder Do Kwon’s strategy was to use Luna profits to build up such an enormous defense of Bitcoin reserves that the idea of UST losing its peg becomes unthinkable:

In addition to buying an arsenal of Bitcoin to defend the peg Kwon also formed a liquidity alliance with several other major stablecoins as part of the Curve Wars (which we’ve also written about before). Liquidity battles on Curve are their own complicated beast we don’t have time to get into here, but a simple mental model is that the more liquidity a market has the harder it is to move the price. Since the goal of a stablecoin is to have a price that doesn’t move at all they need deeply liquid markets to hold their price in place.

The Luna Foundation Group (LFG) withdrew a significant portion of the liquidity they had deployed in UST markets to redeploy them in this new liquidity alliance — and within minutes an attacker took advantage of the lowered defenses to sell enough UST to clear out all the remaining liquidity on Curve and cause UST to lose its peg to the dollar. That forced the LFG to sell some of their newly acquired Bitcoin to defend the UST peg:

Turning Bitcoin’s largest recent buyer into a forced seller is likely part of what drove Bitcoin’s abrupt collapse below $30k — presumably the attacker took advantage by shorting Bitcoin before attacking the UST peg.1 The price of UST briefly fell to ~$0.61 to the dollar. Binance halted withdrawals for both Terra and Luna. Some Uniswap UST markets froze up entirely due to the lack of liquidity. Terra deposits on the native Anchor protocol have dropped by more than ~$4B so far and are still dropping.

As of writing UST is trading around ~$0.48,2 which students of math will recognize as noticeably less than $1. Stablecoins have lost their peg and recovered before but it seems likely this blow will be fatal. Luna is <$1 from down from highs well over $120 and still collapsing. Tens of billions of dollars of wealth have been obliterated, mostly from small, retail investors.

The history of cryptocurrency is littered with the corpses of failed algorithmic stablecoin projects. If you are thinking about starting an algorithmic stablecoin, please don’t. Here’s a catchy little tune to help you remember:

Other things happening right now:

Forbes finance columnist William Baldwin (whom I’ve chatted with before) just published a trad-fi focused article about how to invest in Bitcoin that quotes me casting some shade on the non-Bitcoin ways to get Bitcoin price exposure. Baldwin’s audience is mostly fund managers so the article is a very pragmatic one but Baldwin has a lightly acerbic tone that I find quite entertaining.

The government of Argentina and the International Monetary Fund (IMF) have agreed to Argentina’s 22nd bailout, this time for ~$45B. As part of the agreement the IMF has demanded that Argentina “discourage the use of cryptocurrencies with a view to preventing money laundering, informality, and disintermediation … to further safeguard financial stability.” Cryptocurrency is quite popular in Argentina, possibly because since joining the IMF in 1956 the government has needed a fresh bailout every ~3 years. Annual inflation in Argentina right now is around ~55%.

President of El Salvador Nayib Bukele has released more details about his plan to build a thriving metropolis where the streets are paved with Bitcoin:

Presented without comment:

This wasn't an especially hidden attack — here is a thread laying out the basic mechanics of how it could work as far back as last November. Here are a few interesting hypothetical stories about how the attack might have worked and how profitable it might have been.

Fun fact, when I started writing this draft UST was still trading at $.92 and the title was still the 'attempted' murder of Terra/Luna. 😬