Thanksgiving Leftovers

A collection of small stories I didn't find a place to put anywhere else

There was a few month stretch where I wasn’t posting regularly and my last few posts have been Big Topics so it’s been a while since I’ve had room for any of the smaller or sillier stories that usually show up in the Other things happening right now section.

So as a special Thanksgiving leftovers edition, here is a round up of all the miscellaneous and fun links from the last few months, a bit late and in no particular order. Enjoy!

Inside this issue:

Financial innovation at the Colorado DMV

Tether is (probably) more profitable than Mexico

The three different kinds of Paypal dollars

Why Bitcoin is not useful for criminals

Why Bitcoin is useful for criminals

Code is (not) law

A video of Hal Finney not being Satoshi

Bitcoin transaction history charted by age, by value and by USD price

A brief history of technology NOT bringing about the end of employment

Colorado:

The Colorado DMV now accepts Bitcoin for online payments and local news anchors are not impressed.

Stablecoins

According to their Q3 attestation the stablecoin Tether now holds ~$72.6B worth of U.S. Treasuries in its reserve. That is slightly more than the amount of U.S. Treasuries held by the Netherlands (~$72.3B) and slightly less than the amount held by Mexico (~$74B). Tether also only employs 125 people, so I suspect their operating costs are a bit lower than the operating cost of Mexico. I am not sure however as I have never operated Tether or the state of Mexico.

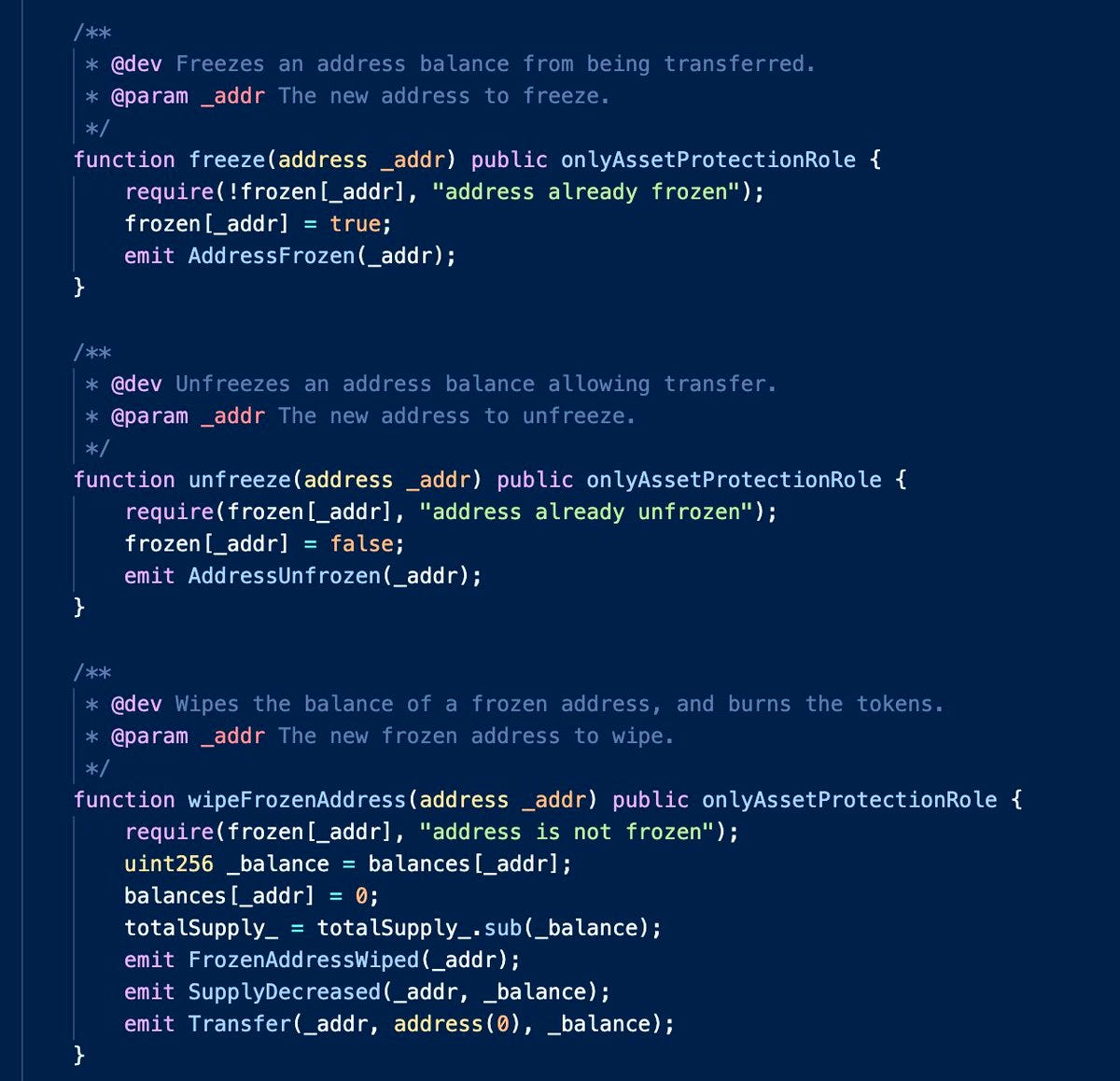

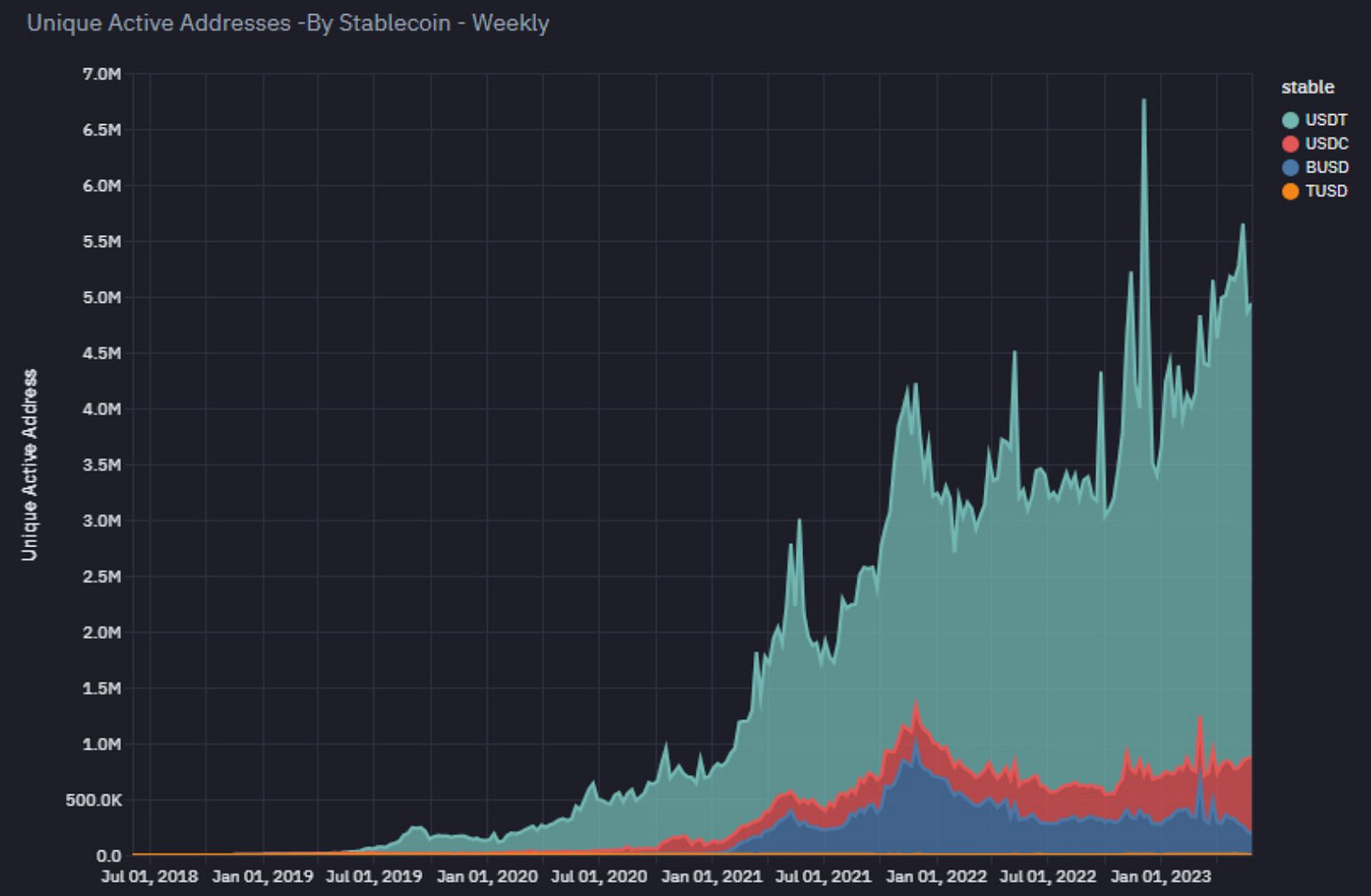

Paypal must have gotten jealous of Tether’s free money printing machine because they just launched their own stablecoin, an ERC-20 token on Ethereum called PyUSD. If you’re keeping score at home that means there are now three different types of dollars a Paypal customer can hold: Paypal, PyUSD and Paypal savings. Ironically of the three types of Paypal dollars the PyUSD token has the best transparency, asset backing and the most senior debt claims. It also keeps the traditional Paypal feature of being able to unilaterally freeze or delete your money. Decentralization is neat!

Crimes:

Here is a fascinating thread describing a massive Bitcoin money-laundering ring and the law enforcement operation that infiltrated it and eventually shut it down. This is an interesting example of how Bitcoin is not actually an ideal currency for criminals: the largest clients of this service were hackers who had collected a Bitcoin ransom but needed to convert it into a less traceable currency like USD in order to spend it. The most interesting detail to me was how criminals used the serial numbers of paper money as a way of discreetly revealing/confirming each other’s identities without saying anything incriminating.

On the other hand, Bitcoin absolutely can be useful to criminals. In Venezuela the government recently sent troops in to regain control of the Tocorón prison, where the Tren de Aragua gang had taken over the facilities. When they arrived they found a functioning Bitcoin mine. Mining is the best way to buy perfectly anonymous bitcoin, which I personally think is part of why the hashrate has continued to climb steadily throughout the bear market: buyers that pay a premium for truly anonymous bitcoin are probably actually using the network for censorship resistance, rather than just speculating on its future value.

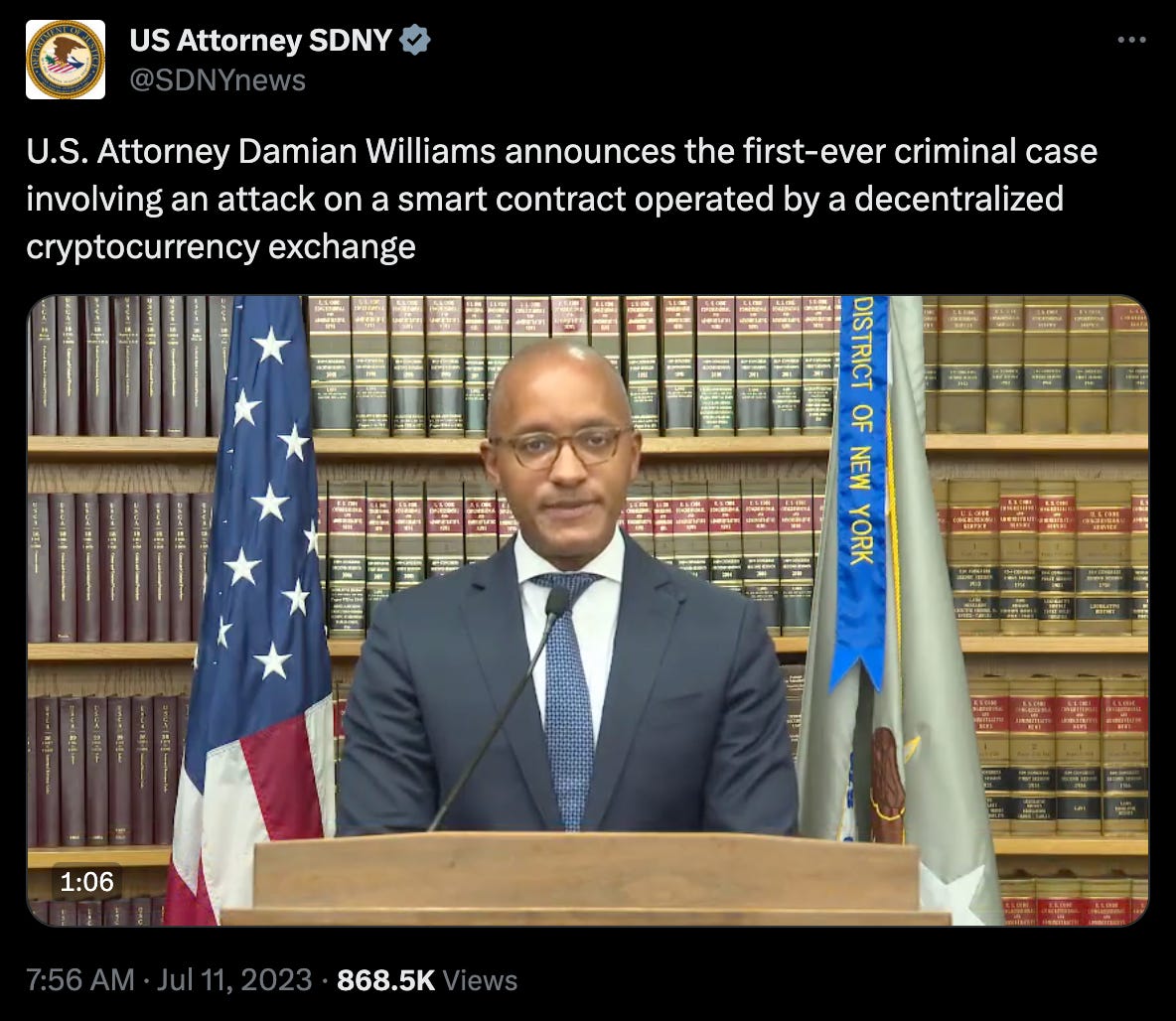

The US Attorney of SDNY announced the first ever criminal case for attacking a smart contract, charging Shakeeb Ahmed with money laundering and wire fraud for using spoof accounts to manipulate price on a decentralized exchange. What is notable about this case is that Ahmed is not accused of hacking the smart contract in a traditional sense, but instead of using it in a way that was not intended by the developers. The code allowed it! But the law does not.

Ancient Bitcoin History:

Here is a very cool video of Hal Finney describing a zero knowledge proof scheme in a talk back in 1998. Unfortunately, here also is a very convincing argument from Jameson Lopp that Hal Finney was probably not Satoshi Nakamoto.

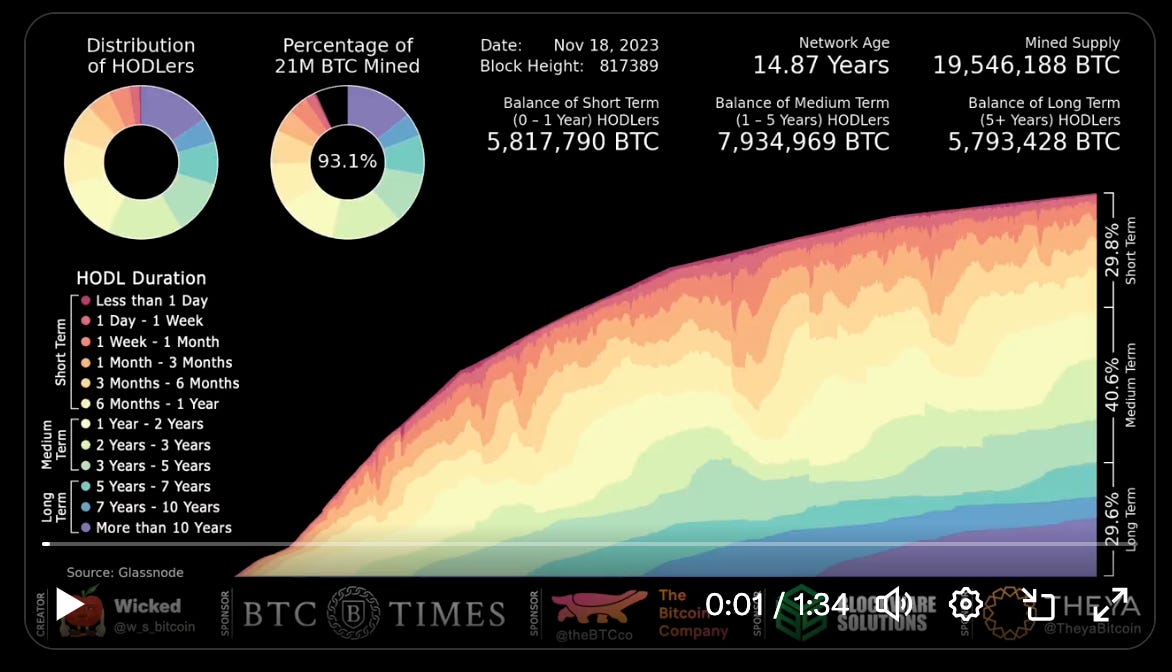

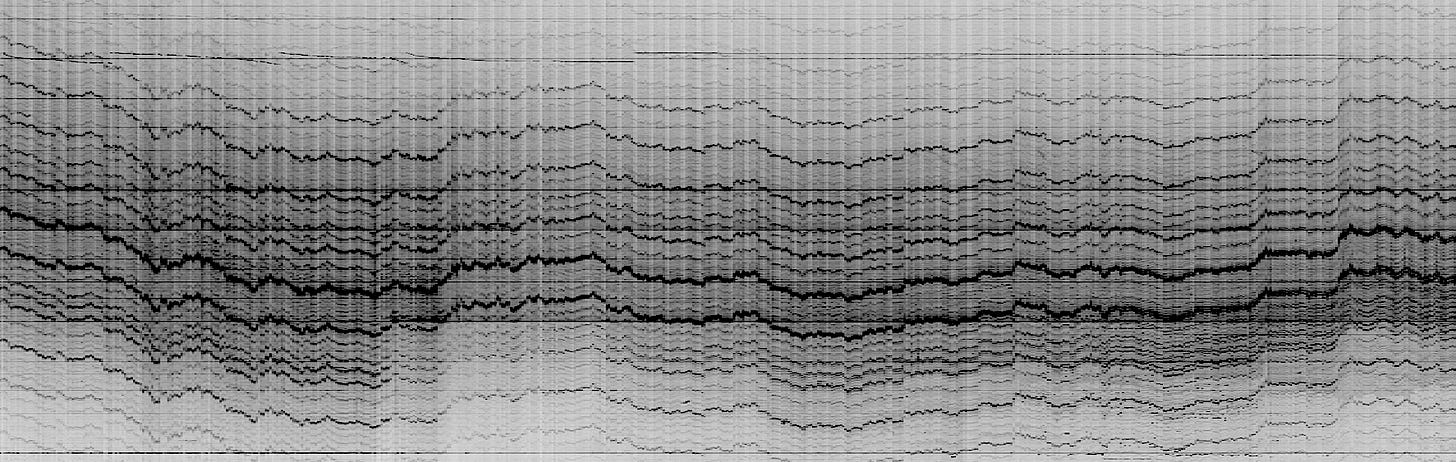

The proportion of Bitcoin held by long term holders continues to reach new all time highs. Roughly 70% of the available supply of Bitcoin has been held for more than a year. Here’s a cool animation showing the accumulating sedimentary layers of long held Bitcoin transactions as they aged over time.

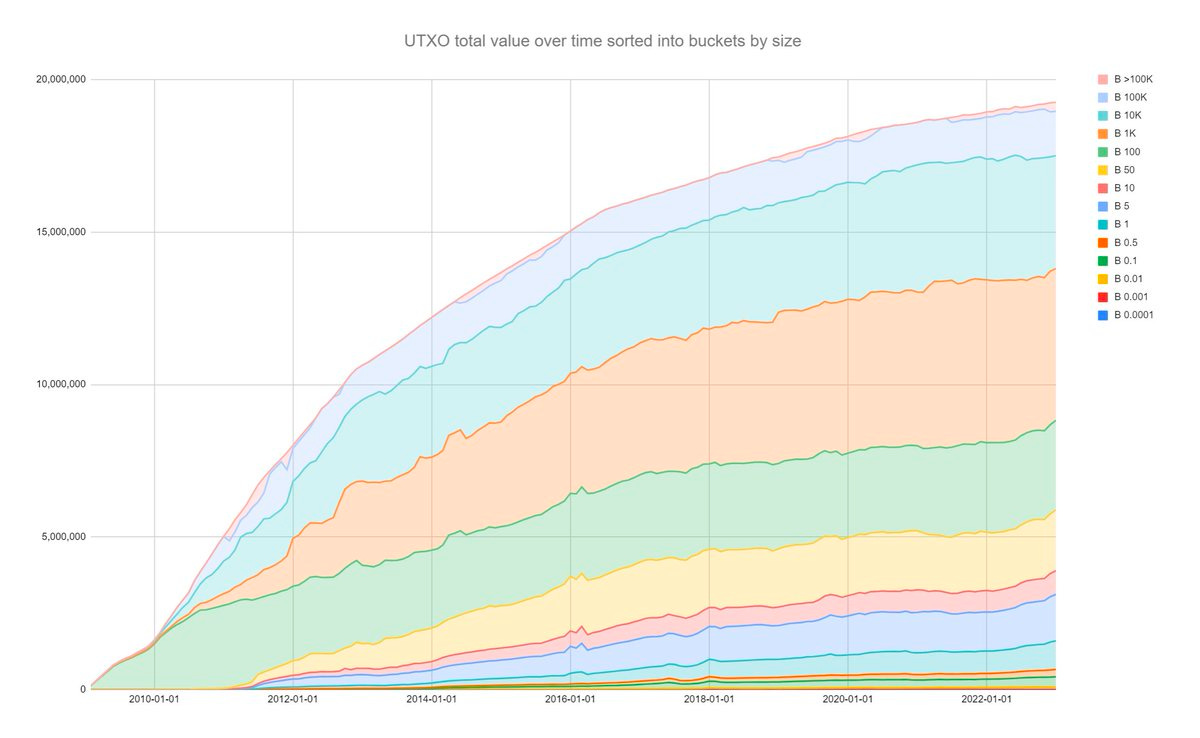

Another interesting historical view of Bitcoin transactions, this time grouped by size rather than by age. Until ~2011 (i.e. before Bitcoin had a traded price anywhere) by far the most common unit was 100 BTC (~$3.8M by today’s prices). Presumably it wasn’t even worth bothering to even make a transaction for less.

UTXOracle.py is a clever technique for inferring the historical price of Bitcoin only using on-chain activity by taking advantage of the fact that people tend to cluster their payments into round numbers in USD terms. In other words, people are much more likely to send $10 or $100 worth of Bitcoin than they are to send $13.42 and $107.81 worth of Bitcoin — so if you see lots of transactions for a particular (seemingly arbitrary) quantity of Bitcoin, that quantity is probably some natural round number when measured in the USD price. This signal is too slow and potentially open to manipulation to build a price oracle around, but it is probably roughly how future economic archeologists of the will infer the commercial value of early Bitcoin transactions. History math!

Other stuff besides crypto:

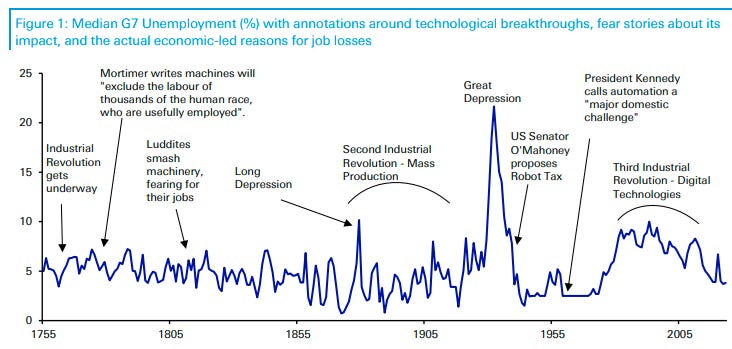

A brief history of technology NOT bringing about the end of employment: