[News] Gamestop 🚀🤝🚀 Bitcoin

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Bitcoin Marketwatch: food for Bulls, food for Bears

Billionaires join the Gamestop insanity (non crypto)

Bitcoin Marketwatch: food for Bulls, food for Bears

Coins continue to flow off of exchanges and into high value wallets:

Consumer interest is starting to pick up in markets with less stable currency:

Bitcoin’s aSOPR (which we’ve talked about before) has adjusted back down to baseline. You can read more details here if you are curious but basically aSOPR tries to approximate how much "unrealized profit" is in the market. When the number goes high it means that most coins can be sold at a profit, suggesting that the price may be overheating. Now that it has reset most coins are neutral profit or would need to be sold at a slight loss. Given the medium to long term bullishness in the market right now it seems unlikely that people will be excited to sell more at a loss. So perhaps the movement down has slowed for a bit.

On the other hand, it’s not necessarily traders collecting profits that have caused this leg down. Much of the sell pressure seems to be coming from F2Pool, the largest known Bitcoin mining collective. The graphs here do a good job of showing how Bitcoin’s price started dropping around the same time bitcoin started moving from F2Pool wallets to exchange wallets (presumably to sell):

It’s not totally clear what is motivating this particular move on F2Pool’s part, so it’s hard to know whether or when it will stop. If the coins keep moving into the hands of long term accumulators though it will eventually prove bullish.

The nihilists have taken the wheel

Loyal readers who have been with the newsletter since Saturday will recall how we explored the story of Gamestop, a business whose stock price rose ~1600% in a matter of days when r/wallstreetbets went to war with short sellers. They managed to drive the stock up to $65/share! What a cartoonishly high price, we all thought. Hahaha! Anyway, this is the price at time of writing:

That tiny little spike on the left is the $65 spike we talked about on Saturday. It was a simpler time. Tuesday Gamestop was the most heavily traded security in the world:

This is taking a serious toll on the hedge funds that are in the short position - shorts lost a collective 1.6B over the day. Melvin Capital management is a $12.5B hedge fund that was one of the top performing funds in the last year until this move - now they have had to call in a backstop of $2.75B in cash from Citadel LLC and Point72 Asset Management to stabilize their position. Both Melvin and Citron (the other major hedge fund short GME) have announced that they closed their positions at significant loss, although it’s not clear if that is actually true.

The party got turnt up yesterday when the goofy billionaires arrived:

Over the course of the day the circuit breaker had to be pulled on the stock nine separate times in a failed bid to calm volatility. Elon Musk stepped in to settle things down with his own level-headed commentary:

Recall that Elon Musk can spike a stock by accident with his tweets, so who knows what the power of a clear and unmistakable rallying cry might be. Melvin Capital famously and publicly shorted Tesla stock for years but I'm sure that has nothing to do with Elon's enthusiasm for this trade.

So is it market manipulation? Grassroots activism? I don’t know. What it definitely is not is the sign of a healthy well functioning economy.

Other things happening now:

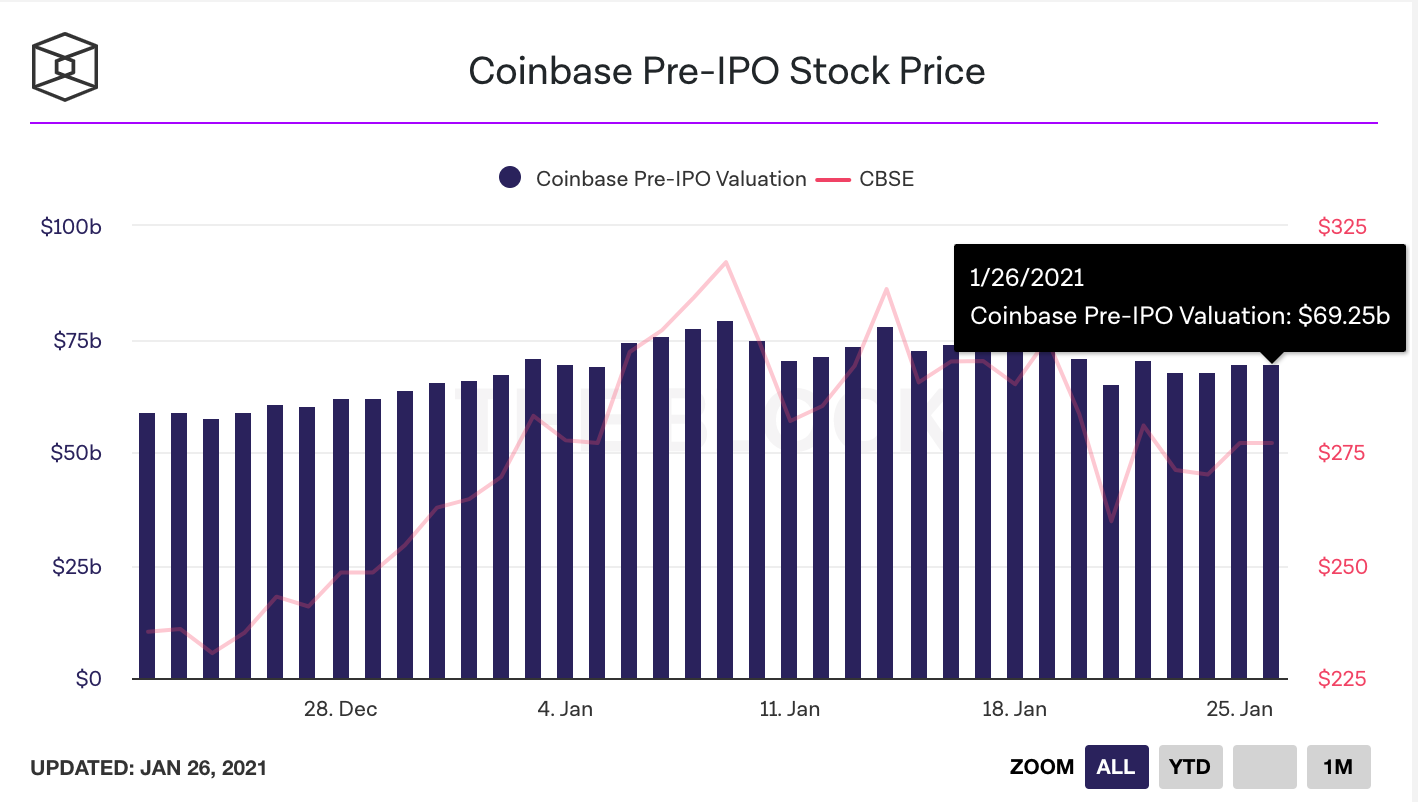

Coinbase’s IPO is trading at an effective valuation of ~$70B at the moment. To put that number in context, the NYSE was purchased for ~$8B in 2012. The Nasdaq currently has a valuation of ~$23B. A valuation of ~$70B likely implies Coinbase is more valuable than every other exchange in the world combined. That might be a bit bullish even for me.

The endowment funds of some of America’s largest universities have been acquiring Bitcoin from Coinbase for the last year and a half:

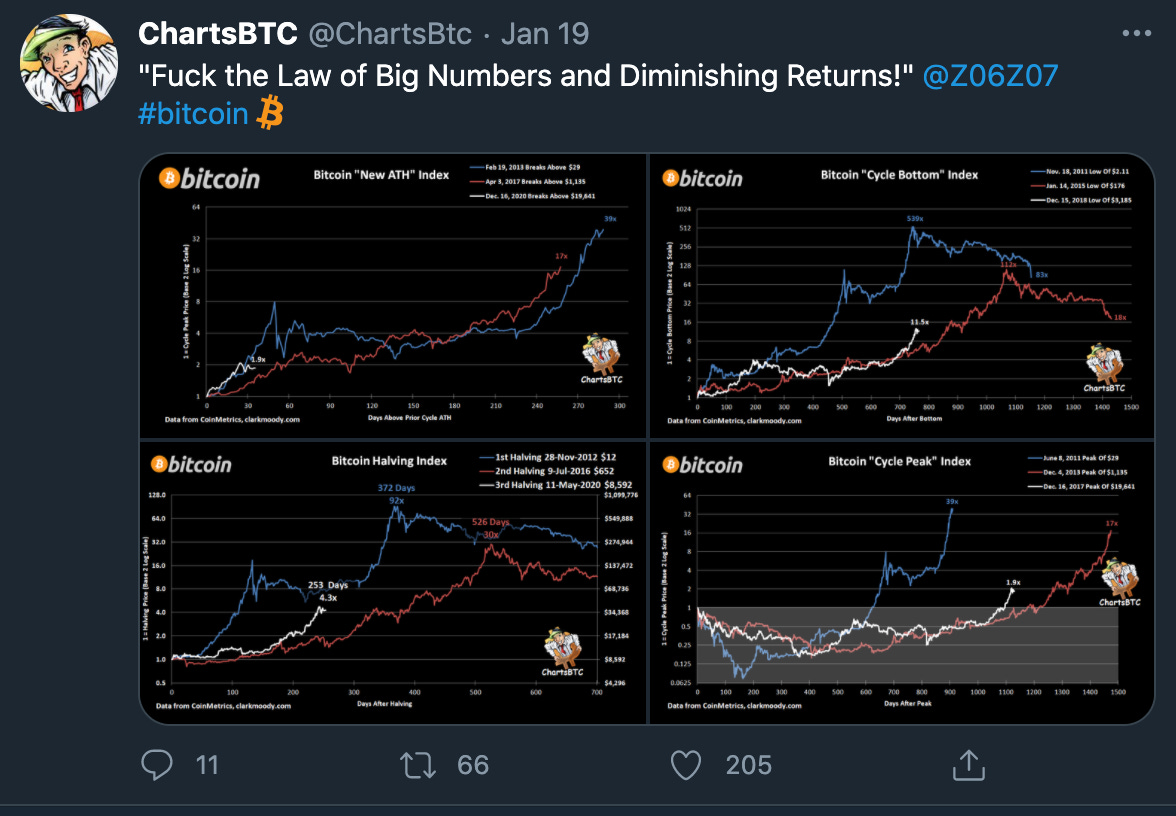

If you are a believer in the cyclical theory that Bitcoin has reliable bubbles that happen at regular intervals, there are a couple of places where you could anchor this cycle: previous all time highs, previous lows between peaks, halving cycles, etc. They pretty much all imply the same thing - it still looks early:

Presented without comment: