[News] Ethereum hits new all time highs

Plus hedge funds are not short Bitcoin and what will Bitcoin do to wealth inequality?

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Ethereum prices reaches new all time highs

No, hedge funds are not short Bitcoin

Will Bitcoin make inequality worse? (reader submitted)

Ethereum is on a tear right now

Ethereum crossed it’s USD all time high this week ($1592 at time of writing):

There are a number of factors likely contributing to this run up. Reddit just announced a partnership with the Ethereum foundation, expanding their "community points" experiment. Considering the impact Reddit is having on markets at the moment that’s probably a pretty bullish development. Non-fungible tokens (NFTs) are experiencing a surge in attention as well with six-figure sales in NBA Topshots and Cryptopunks and the $10M launch of the new Hashmasks project (more on that below). Even the number of people searching for Ethereum on Google is at an all time high.

That surge of enthusiasm has come with a spike in congestion - Ethereum transaction fees are also the highest they’ve ever been, over >$10/transaction.

High fees are often presented as a criticism of a cryptocurrency but my take is the opposite - high fees mean that many people place a high value on transacting with the network. It also means that miner revenue and the percentage of miner revenue derived from transaction fees (as opposed to new coins) is at an all time high. Both very healthy developments for the network itself.

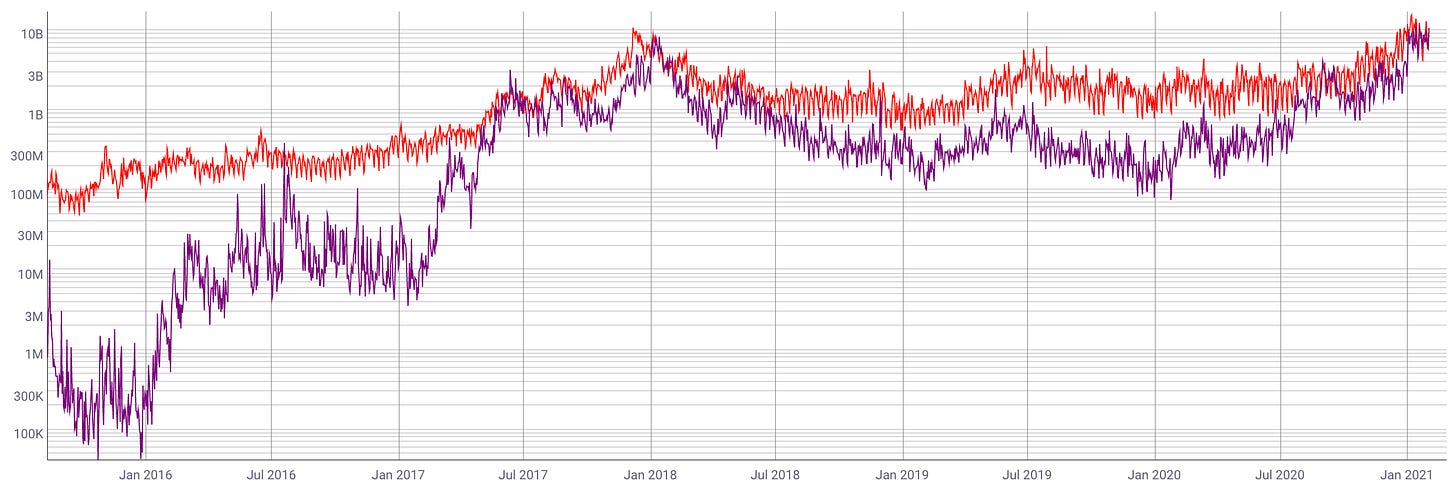

Ethereum’s transaction volume is also growing rapidly - occasionally you will hear claims that Ethereum’s transaction volume is larger than Bitcoin’s but to make that claim they need to include some subset of the transaction volumes of networks built on top of Ethereum and not just Ethereum itself. It’s true those networks provide material value to the Ethereum ecosystem, but they also can (and sometimes do) migrate to other competing networks so I don’t think it’s an apples-to-apples comparison. Still even at the base layer Ethereum is now clearing as much daily value as the Bitcoin network is:

Both Ethereum and Bitcoin’s volume rises in a bull market, but Ethereum’s seems to dip further in a bear market. This isn’t super surprising - bull markets are when all the experimentation happens and Ethereum is most useful/interesting/valuable when there are cool new things happening on it, as is happening now.

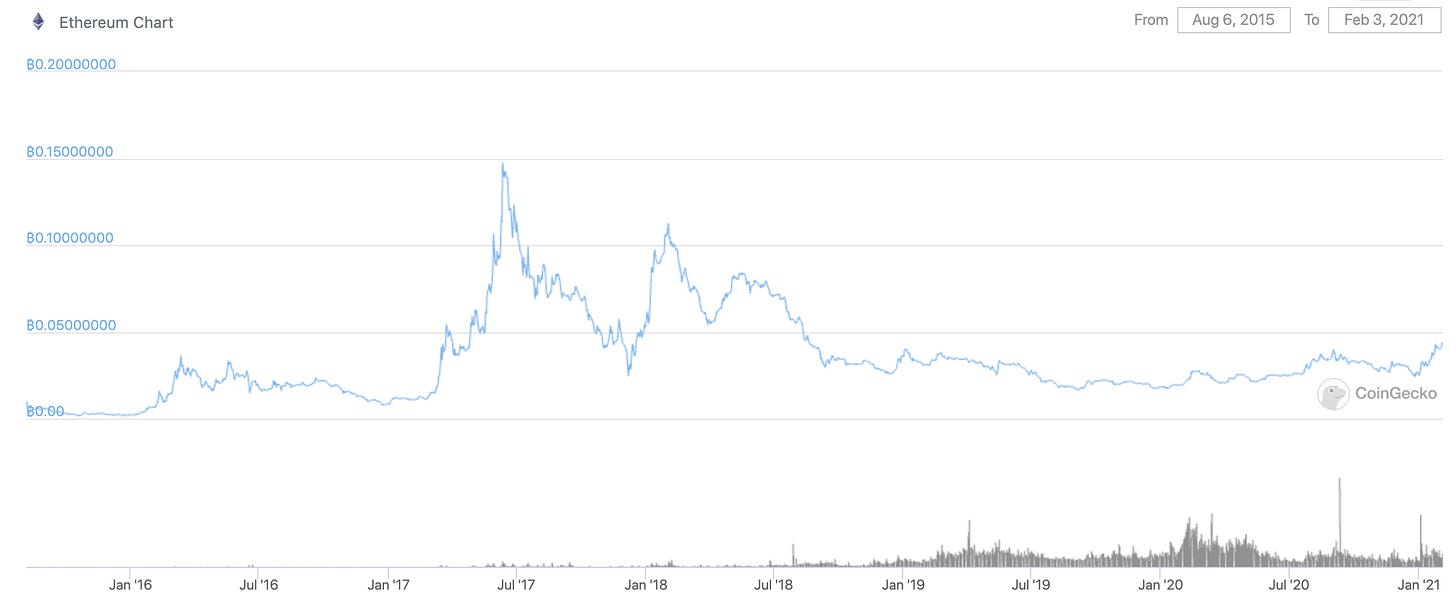

Still it is worth watching the BTC/ETH chart to separate out the market’s excitement for cryptocurrency generally from their excitement about Ethereum specifically. By that metric things have ticked up for Ethereum but are still far from the all time high during the height of the 2017 bubble.

On the other hand, last night Grayscale Investments acquired ~$76M worth of ETH (they acquired ~$600k worth of Bitcoin in the same window). Grayscale you’ll recall runs a family of investment funds that essentially act as traditional equity wrappers around crypto products. Buying at this scale suggests there is probably real institutional demand interested in holding exposure to Ethereum.

No, hedge funds are not short Bitcoin

In the wake of Reddit investors putting the fear of god into short positions everywhere some folks are using charts like these to imply that there are vulnerable hedge funds short Bitcoin as well:

This is a great example of how looking at only one part of a trade can leave you with a very flawed impression. In all likelihood these hedge funds are not actually short Bitcoin but participating in what is called a basis trade.

When demand for Bitcoin is high and traders are anticipating a bull run it creates a gap between the price in the futures market and the price in the spot market. Deep pocketed players like hedge funds can arbitrage this price premium away by buying bitcoin cheaply on the spot market, selling short into the premium on the futures market and pocketing the difference without taking any position on the price of Bitcoin itself.

Nothing to see here, really.

Does Bitcoin make inequality worse?

“Are you worried about the inequality in Bitcoin? Will it make people reluctant to buy in? Governments more willing to stop it? Does the bull case for Bitcoin make inequality worse along the way?” - MS

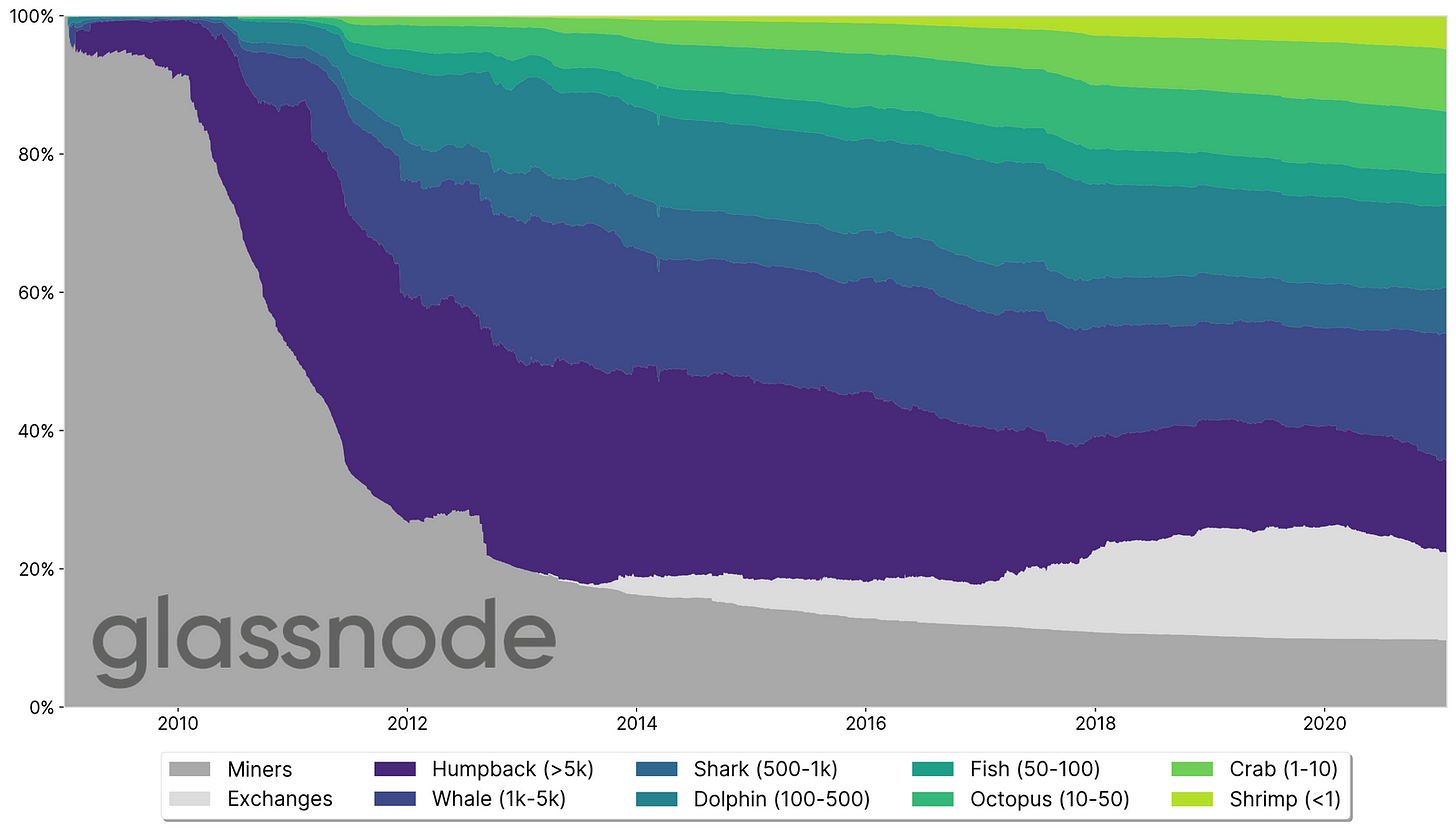

The most common way that I see this topic come up is misunderstandings like this one where someone naïvely assumes that each address on the Bitcoin network corresponds to one person and then uses the distribution of coins across addresses to make claims about the inequality of Bitcoin as a system. This has been going on for a long time! Back in 2015 I wrote this on Quora:

It's hard to infer the actual concentration of wealth in the Bitcoin economy from the concentration of unspent tx outputs at various addresses. Most users of Bitcoin spread their wealth across multiple addresses (either explicitly, such as keeping some in cold storage and some in a hot wallet) or implicitly (by using a hierarchical deterministic "HD" wallet, which automatically tracks all your change addresses and masks the complexity of the underlying accounts from the users). Moreover a lot of the most concentrated addresses don't represent wealthy individuals but rather aggregate stores of Bitcoin held by multiple parties, such as the cold storage accounts of exchanges, darknet markets, GBTC, etc etc. So the graphs above suggest a very unequal wealth distribution, but they don't actually tell us very much about how distributed or concentrated Bitcoin wealth actually is in the real world.

So if someone tells you that the inequality in Bitcoin is known, make sure they aren’t just taking addresses at face value to make that claim. It’s also naïve to take inequality in the Bitcoin system today as a useful indicator of what inequality would look like in Bitcoin after widespread adoption. At one point in history literally every Bitcoin in existence was held by one person - inequality in the system has been steadily and consistently dropping ever since. We don’t know what the equilibrium will be.

That said I do think the underlying question of what we think the impact of Bitcoin adoption would be on inequality has merit. My intuition is that adopting Bitcoin will inevitably be chaotic and that chaos is bad for the poor - so in the short term I would expect adopting Bitcoin to increase inequality. Not so much because of Bitcoin itself but because rapid economic change is always hardest on those with the least.

In a world where Bitcoin adoption has already taken place, however, I think Bitcoin would be a powerful force for equality. Most government funding in the world today is done through currency debasement - which is a cruelly regressive tax. The rich can secure their wealth in equity or real estate or other assets. Those who keep the majority of their net worth in bank accounts and are paid in dollars not stock options are the ones who shoulder the burden of the debts paid off with the printing press. Forcing all government funding to be done via explicit taxation would, I think, be good for inequality. Eventually.

Other things happening right now:

Willy Woo puts Bitcoin’s growth so far into perspective:

We’ve talked before about using Bitcoin mining units to eliminate natural gas flares. Here is a company called Giga Energy, actually doing that in Texas:

TheHashmasks are a new family of NFT art pieces that sold out at auction last week for a collective ~$10M worth of ETH. Hashmasks are procedurally generated avatars that can be named (or renamed) by their users. Hashmask #1 (named Trump) sold for 99ETH before the reveal. Since the reveal Hashmask #9939 (of 16384) has since been sold for 420 ETH (~$630k at the time). It was titled nice at time of sale, but has since been re-titled to sex. Nice.

Presented without comment: