More Americans own Bitcoin than live in California

Plus Vitalik rug pulls the dog coins and Bitcoin survives the Elonquake

In this issue:

Oh Elon not this again

Vitalik rug pulls the dog coins

Oh Elon not this again

Part time CEO and casual plagiarist Elon Musk decided to wade back into the cryptocurrency markets on Wednesday by announcing that Tesla would be suspending acceptance Bitcoin payments out of concern for the environmental costs of Bitcoin mining. Price immediately dropped ~10% from ~$52.7k/BTC to ~$47.7k/BTC before recovering somewhat to ~$51k/BTC at time of writing.

Here is the complete statement:

It is hard to know where to begin here. Is the implication meant to be that Musk invested billions into Bitcoin last month but only just now got around to Googling it? I assume the plan is also to stop selling electric cars to China - after all it's the same coal powering the same grid.

We’ve talked before about the environmental impact of Bitcoin and I’m sure we will again but just to review the carbon footprint of Bitcoin does not scale with the number of transactions on Bitcoin, it scales with the value of Bitcoin. In other words Tesla’s approach here makes no sense regardless of how you feel about Bitcoin. Continuing to hold billions of dollars worth of Bitcoin on their books is worth much, much more to Bitcoin miners than the transaction fees from a few measly Tesla purchases.

To be clear I also think the environmental argument being made here is weak - the power that Bitcoin consumes is ~40% renewable and growing and is ~1/4th the energy use of American clothes dryers. Bitcoin also uses non-rival energy, which means energy that would otherwise be wasted - like vented natural gas from oil mining. The largest Bitcoin mining company in North America is carbon neutral. Bitcoin also subsidizes renewable development and is vastly cleaner than the alternative. But even if you start with the assumption that Bitcoin mining is an environmental catastrophe and must be stopped, Tesla’s approach here is backwards.

Musk alludes to "other cryptocurrencies that use <1% of Bitcoin’s energy/transaction" but doesn’t specify which ones. Energy/transaction as we talked about above does not actually make sense - so it is difficult to know for sure what currencies he could mean. One obvious candidate is Ethereum which has been noisily beginning a transition to proof-of-stake validation in part out of perceived environmental benefits.1

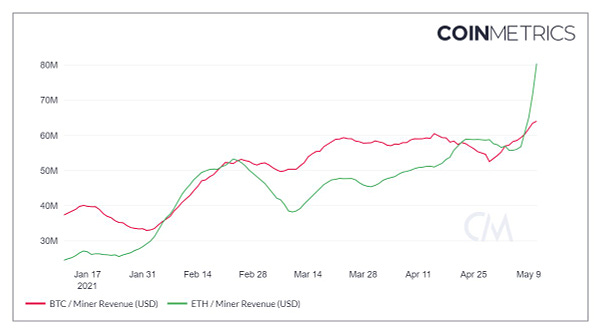

That would be funny if it were true, since Ethereum’s miner rewards have actually recently been larger than Bitcoin’s. Technically Ethereum is the larger consumer of energy at the moment, though it doesn’t get as much coverage.

Perhaps Musk was referring to Dogecoin, as in his last tweet where he polled his followers about whether Tesla should accept DOGE:

That would also be funny, since Dogecoin is also a proof-of-work cryptocurrency with a less efficient hardware network. It only uses less energy than Bitcoin because fewer people are using it (so far). It is going to be a bummer when Musk realizes that. Maybe he can derive some comfort from this conversation from a simpler time:

Vitalik rug pulls the dog coins

We talked last week a bit about Uniswap, the largest of a handful of decentralized exchanges known as DEXs. Decentralized exchanges (DEXs) are like centralized exchanges (CEXs) in that you can use them to buy and sell various tokens. They are unlike CEXs in that no one decides which tokens get listed - anyone can create a market for any coin they like. Convincing a CEX to bother listing you used to be one of the biggest struggles for new tokens, but with a DEX there is no one to convince.

So let’s suppose I create a new token called scamcoin and then award myself 100% of the total supply in exchange for my hard work. I can create a market for scamcoin on Uniswap by depositing some (or all) of my scamcoin along with a more established token I want to trade it against, like ETH. Doing that creates what is called a liquidity pool or an automatic market maker - kind of like opening up a virtual shop offering to buy and sell scamcoin.

Then I can use that market to buy some scamcoin from myself, driving the price up and creating the illusion of demand. Crypto investors are discerning so I’ll need a whitepaper and a Discord server so they know scamcoin is legit. Now my new token has a liquid market, a thriving community and a sharply rising price. Scamcoin is going to the moon! 🚀🚀🚀2

As soon as enough naive investors have bought enough of my scamcoin I can just withdraw all of the ETH from the liquidity pool. Since there are probably no other market makers that will drive the price of scamcoin to zero but I will have all of my ETH as well as the ETH of new investors and they will at least have their scamcoin tokens as a souvenir. Variations of this scam happen often enough in crypto it has a name: a rug pull.

In the months following Dogecoin’s climb a family of dog-themed coins sprang up pitching themselves as successors to the Doge throne: Shiba Inu coin (SHIB), Dogelon Mars (ELON), Akita Inu (AKITA), etc, etc. These new tokens wanted the liquidity of a market on uniswap but they didn’t want potential investors to be scared off by the risk of a rug pull - so they came up with an innovative gimmick. They created the liquidity pool, but then gave control of that pool to Vitalik Buterin (founder of Ethereum).

The idea here was two-fold: (1) Vitalik is well known and respected in the community so he probably wouldn’t want to be associated with a rug pull and (2) he is already rich enough he probably wouldn’t be tempted. Ooops?

On Wednesday, Vitalik withdrew liquidity and sold or donated his gifted tokens. Collectively he donated ~$64M worth of ETH and enormous nominal sums of tokens - theoretically worth more than ~$1B although good luck finding someone to sell them to. Vitalik donated to an India Covid Relief Fund, Gitcoin, Givewell, the Methuselah foundation, the Machine Intelligence Research Institute and Charter Cities.

Maybe Vitalik did it for charity or maybe for the billion-dollar tax shelter. Maybe he wanted to warn future memecoins not to leverage his reputation. Maybe he wanted to end the wave of dog tokens to ease congestion and lower fees for Ethereum. Or maybe Vitalik just woke up this morning and chose violence.

At time of writing SHIB is down ~30%, AKITA is down ~36% and ELON is down ~66%. Nature is healing.

Other things happening right now:

It looks like I will need to record an addendum to the first episode of the podcast. The gamblers were right - Hertz stock is going to pay out for shareholders:

CNBC tried to pullquote their way around it but if you listen to the full clip it is clear that Druckenmiller thinks Bitcoin has already won the competition for best money and that Ethereum is only just beginning to compete for smart contracts:

A survey by the New York Digital Investment Group (NYDIG) showed that ~46M Americans (or ~14% of the population) own Bitcoin today. That is more Americans than live in California and a large enough share of the vote that it will be difficult for responsive democracies to meaningfully oppose.

This is a phenomenal visual metaphor for consensus mechanisms:

I am personally of the opinion that the environmental impact of Proof-of-Stake is obfuscated but not actually reduced.

Narrator: It wasn’t.